My end-of-week morning practice WFH reads:

• Why Individuals Can’t Purchase the World’s Finest Electrical Automobile: You’ve most likely heard of BYD. A middling participant within the auto business only a few years in the past, the Chinese language electrical car producer BYD surpassed Tesla final yr to develop into the world’s top-selling E.V. model and is anticipated to drag even with the world’s largest carmakers, Toyota and Volkswagen, by 2030. But most Individuals have by no means even seen a BYD and doubtless received’t anytime quickly. (New York Occasions)

• Substack Is Having a Second—Once more. However Time Is Working Out: Whereas star reporters proceed to flock to Substack, subscription fatigue is just getting worse. (Wired) see additionally The Actual Drawback With Bluesky: The platform has extra customers than ever. So why does it really feel so empty? (Slate)

• This early-warning signal is telling the inventory market {that a} recession is extra doubtless: If you happen to’re like many U.S. customers, you’re extra fearful now about cash. (Marketwatch)

• Prepared to actually tackle Schwab and Merrill Lynch, Vanguard quantifies ‘significant’ worth that monetary advisors ship ‘past portfolio efficiency’ in code shift: “Our findings exhibit that monetary recommendation presents vital worth past conventional portfolio development and monetary planning interventions,” the report states. “The peace of thoughts and time financial savings that purchasers expertise ought to be integral measures when assessing the worth of monetary recommendation, as a result of they will improve purchasers’ high quality of life,” the report concludes. (RIABiz)

• Why We Assume Solely Others Get It Incorrect: The introspection phantasm is the mistaken perception that our inner reasoning is a dependable, clear window into all of the elements shaping our judgments. (The Important Thinker)

• The paradox of Trump’s tariff coverage: The excellent news for American customers and companies is that potential value shocks and different disruptions from an all-out world commerce conflict stay at bay — and Wall Road is taking this complicated panorama in stride. The unhealthy information is it’s hardly the sort of coverage panorama conducive to corporations making long-term investments. (Axios)

• 9 Classes from the World’s Oldest Folks (Blue Zone Knowledge): Common Individuals live 10-15 years lower than individuals in different developed nations. That’s a stunning discovering, however what’s driving it? (Peter H. Diamandis)

• Welcome to the immigration industrial complicated: Funding for ICE is about to skyrocket beneath Trump’s Large Lovely Invoice. (Washington Publish) see additionally Trump loves ICE. Its Workforce Has By no means Been So Depressing. A “mission not possible” deportation marketing campaign has left many staff burned out and morally conflicted. (The Atlantic)

• Did Shakespeare Write Hamlet Whereas He Was Stoned? Sam Kelly Explores the Potential Affect of Hashish on the Bard’s Prolific Literary Output. (Literary Hub)

• They Name Him ‘Large Dumper.’ He’s Crushing House Runs Like Babe Ruth. Seattle catcher Cal Raleigh stays on a historic tear coming into a showdown in New York towards the Yankees and Aaron Decide. (Wall Road Journal)

Make sure to try our Masters in Enterprise subsequent week with Richard Bernstein, founding father of RBA. The agency focuses on Macro tendencies, and manages (or advises on) $15.7B AUM. Beforehand, he was Chief Funding Strategist at Merrill Lynch from 1988-2009. Bernstein was named to Institutional Investor’s “All-America Analysis Crew” 18X, and inducted into the Institutional Investor “Corridor of Fame.”

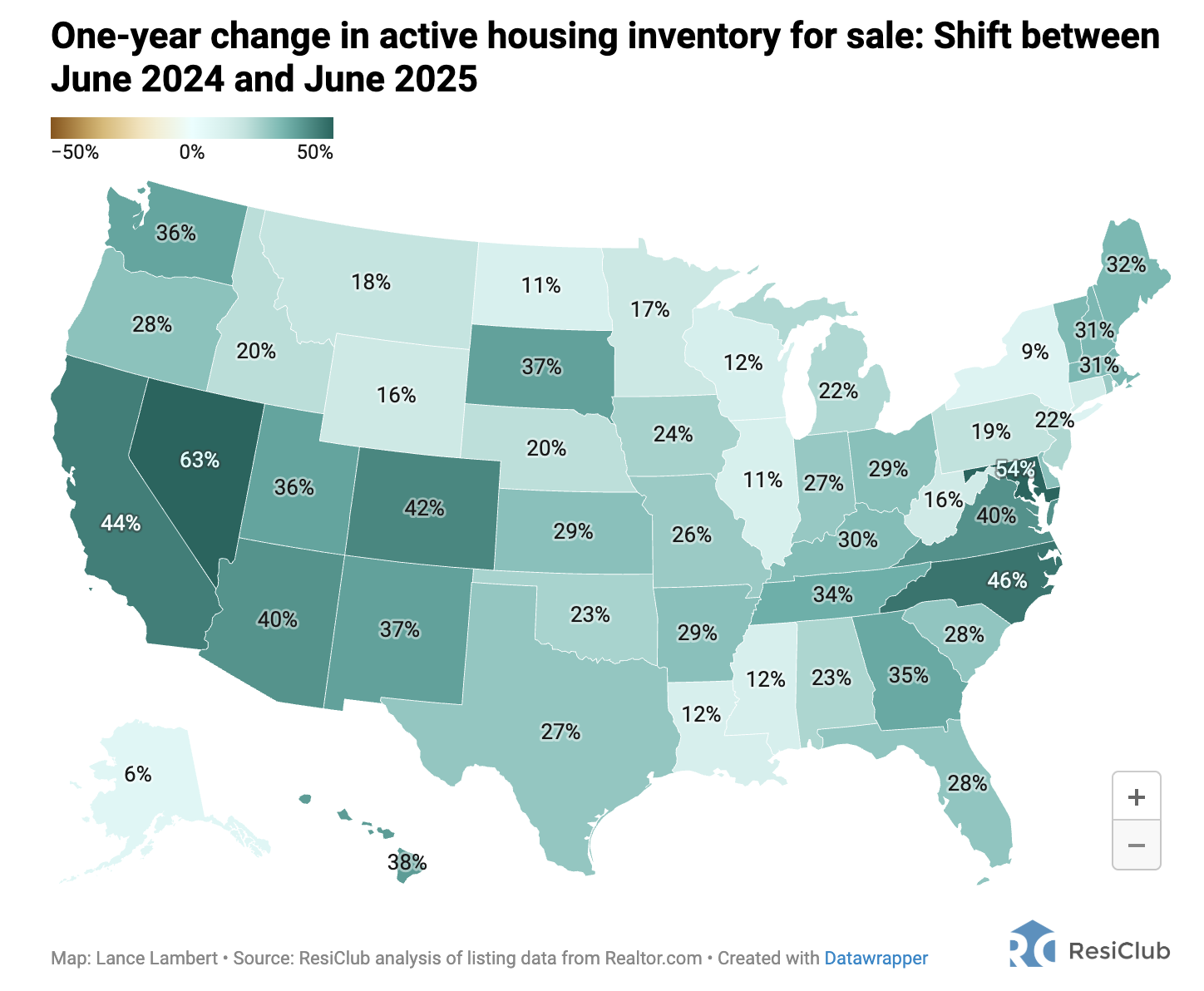

These states are seeing the largest housing market stock shift

Supply: Quick Firm

Join our reads-only mailing listing right here.