Your online business is rising quick; new purchasers are approaching board, and also you’re touchdown greater contracts extra typically. However managing money stream whenever you’re increasing that shortly is an actual problem, particularly when development alternatives require instant capital. Taking out the best sort of enterprise loans provides you the liquidity it’s essential to transfer the enterprise ahead so you’ll be able to reap the benefits of revenue alternatives right this moment.

Learn on to study 11 enterprise mortgage varieties, how they work, an instance of them in motion, and the way to decide on the best one on your firm’s development plan.

1. Quick-term enterprise loans

Finest for: Companies that want quick entry to capital to reap the benefits of time-sensitive alternatives or meet pressing prices.

Quick-term financing offers a lump sum of capital that you simply repay over three months to 1.5 years, plus curiosity and charges. You may select between:

- Mounted rates of interest: These are fastened month-to-month funds that stay the identical all through the time period.

- Variable rates of interest: Your repayments rise when common rates of interest improve and fall after they lower.

Use case: A restaurant chain CEO spots a main location in an up-and-coming metropolis middle, however the landlord desires a non-refundable deposit of $120,000 inside 30 days.

The chain desires to borrow $300,000 to safe the positioning and pay for a complete fit-out. Quick-term financing is good on this state of affairs as a result of lenders typically pay out inside 24 to 72 hours. As soon as the brand new restaurant opens, the corporate will repay the mortgage from the income the restaurant generates.

| Professionals | Cons |

|---|---|

| • Entry capital in 24 to 72 hours to maneuver shortly on time-sensitive alternatives • Most short-term choices don’t require collateral • Cheaper than enterprise bank cards |

• Quick-term loans are likely to have larger rates of interest than long-term choices • Borrowing limits are normally decrease than with long-term loans • Repayments can put stress in your money stream throughout quieter intervals |

2. Lengthy-term enterprise loans

Finest for: Bigger investments that take time to indicate a return, like funding main development or shopping for one other enterprise.

Companies use long-term enterprise loans to entry bigger quantities of capital that they repay over three to 10 years, typically longer. To safe these loans, lenders normally ask for collateral, resembling autos, gear, or different belongings, like investments.

These offers take longer to rearrange, and chances are you’ll want to offer an in depth marketing strategy, together with substantial documentation. Lengthy-term financing fits each small enterprise house owners and established firms seeking to spend money on strategic development as a result of it offers decrease month-to-month funds and prolonged reimbursement intervals that protect money stream.

Use case: A medical gadget producer in Texas desires to purchase a rival firm with robust recurring contracts and a patented product line in North Carolina, the place the sector is booming.

They borrow $4M over 15 years to finish the deal. The increase in gross sales and their bigger market share cowl the repayments as the corporate continues to develop.

| Professionals | Cons |

|---|---|

| • Pay decrease rates of interest than short-term funding • Make repayments extra inexpensive by spreading the associated fee over a long run • Fund giant purchases with out draining your capital reserves |

• These loans take longer to rearrange and contain extra paperwork • They’re more durable to qualify for, as lenders normally require each robust credit score and collateral • The overall curiosity value is usually larger because of the longer reimbursement time period |

3. Gear loans

Finest for: Shopping for autos, know-how, or equipment with out draining working capital

Companies can use gear financing to purchase bodily and stuck belongings, like autos, manufacturing equipment, workplace gear, or industrial kitchen gear. Lenders like these offers as a result of the gear acts as collateral, which lowers their threat.

That normally means higher charges and sooner lender approval, particularly if the asset has an extended helpful life and holds its worth over a long run.

Use case: A development firm desires to tackle a sequence of earthworks contracts however doesn’t need to dip into reserves to cowl a $200,000 excavator. As a substitute, they take out an gear mortgage.

The machine pays for itself by means of the income it generates on these jobs whereas defending working capital to cowl enterprise bills like payroll, gas, and supplies. As soon as the corporate has cleared the stability, the asset stays on the stability sheet.

| Professionals | Cons |

|---|---|

| • The asset covers its personal prices on the roles it permits • Gear financing is less complicated to qualify for than unsecured enterprise loans • There’s no requirement to offer private or enterprise collateral |

• Gear loans can solely be used on tangible, business-related purchases • The lender can repossess the asset when you miss your repayments • You’ll must consider upkeep and insurance coverage charges, which push the associated fee up |

4. Money stream financing

Finest for: Corporations that have money stream fluctuations brought on by occasions like seasonal dips or sudden bills

Money stream financing helps companies prioritize development constantly to keep away from letting go of alternatives throughout slower intervals. As a substitute of assessing your belongings, lenders take a look at your gross sales historical past, revenue margins, and ahead projections to find out how a lot you’ll be able to borrow.

With one of these short-term enterprise mortgage, your repayments modify along with your earnings, rising when revenues are up and falling after they’re down.

Use case: A Miami Seaside retailer expects a lot decrease footfall in January and February after the vacation vacationer season ends, however they know gross sales will bounce again in March when spring breakers and early summer season guests arrive. Nonetheless, they don’t need to fall behind on funds to resort put on suppliers or threat dropping their prime Lincoln Highway or Ocean Drive lease phrases.

Money stream financing helps them maintain onto their working capital through the seasonal lull – protecting excessive South Seaside hire, sustaining swimwear and resort style stock, and retaining bilingual gross sales workers – then pay down the mortgage sooner as soon as the spring tourism surge begins.

| Professionals | Cons |

|---|---|

| • Borrow primarily based on the energy of your gross sales, not how a lot your belongings are price • Get a lump sum to cowl the prices of scaling your enterprise |

• If income restoration is gradual, it takes longer to clear the power • Charges are usually larger than different sorts of financing |

5. Bridge loans

Finest for: Corporations needing short-term capital to cowl a niche in funding

Bridge loans let firms transfer forward with their plans when the funding they want isn’t prepared but however is on its approach. That could possibly be a industrial mortgage, gear financing, or incoming investor capital.

When the funds arrive from the everlasting financing supply, the corporate pays off the bridge mortgage in full, finishing the momentary funding cycle.

Bridge loans do include trade-offs to contemplate. Rates of interest are sometimes a lot larger than conventional financing, and there are normally extra charges on prime of the principal quantity. Nonetheless, the pace of approval and extra flexibility these loans present give a enterprise the respiratory room it must act shortly on time-sensitive alternatives.

It’s necessary to notice that mortgage phrases are very brief, not often exceeding 12 months, making them unsuitable for long-term financing wants.

Use case: A tech firm getting ready for an IPO would possibly want $1M to cowl authorized prices, regulatory filings, and investor roadshows. They take out a bridge mortgage to fund the upfront prices, then repay it in full when the IPO closes and the capital lands of their account.

| Professionals | Cons |

|---|---|

| • Get quick entry to capital when time is of the essence • Used to cowl varied enterprise wants, as bridge lenders are usually very versatile • Plug the hole in capital when you wait on your funds to land |

• Rates of interest are larger than with conventional loans • You’ll want a transparent and credible exit technique to be accredited • Bridge loans aren’t appropriate for ongoing or long-term enterprise wants |

6. Enterprise traces of credit score

Finest for: Companies wanting versatile, repeat entry to funding with out reapplying each time

A enterprise line of credit score shares lots in frequent with a enterprise bank card. Each have a restrict (the utmost quantity you’ll be able to borrow) and a stability (how a lot you’ve really borrowed). You pay curiosity solely on the funds you employ, and whenever you make a reimbursement, you get entry to these funds once more.

You resolve how a lot and whenever you pay again, topic to a minimal month-to-month fee. It’s a versatile technique to handle short-term money stream or act on sudden alternatives. It’s additionally a preferred different to stock financing.

Use case: An e-commerce platform attracts $200,000 from its credit score line to guide pay-per-click adverts and top off on the objects its CRM forecasts will probably be its greatest sellers through the vacation season.

When gross sales are available, the corporate pays down the road of credit score partly or in full and reuse the funds on the following large push. It’s quick and repeatable.

| Professionals | Cons |

|---|---|

| • Entry pre-approved capital whenever you want it • Pay curiosity solely on the quantity you draw, not your complete credit score restrict • Use for short-term investments that supply a quick return |

• Could be more durable to qualify for than an ordinary small enterprise mortgage • Corporations might grow to be depending on their credit score line in the event that they don’t observe good money stream administration • You’ll must repay the total stability by a set date or reapply for an extension if the road isn’t revolving |

7. Bill factoring

Finest for: Corporations that need to convert unpaid buyer invoices into capital immediately

Bill factoring is likely one of the hottest small enterprise financing choices for B2B firms. The factoring firm buys your excellent invoices and pays you a sure share (as much as 95%) of their worth. When your buyer pays, you get the rest minus the factoring price.

Every buyer goes by means of a credit score approval course of the place the factoring firm evaluates their creditworthiness and fee historical past. Authorized clients are assigned a credit score restrict that determines how a lot of their invoices may be factored.

Use case: A commerce counter makes use of bill factoring to supply 30-day phrases to builders and subcontractors. This offers clients time to finish the job, receives a commission, and settle the bill. For the commerce counter, one of these enterprise financing means they’ve the capital they should restock and canopy instant bills like payroll and hire.

| Professionals | Cons |

|---|---|

| • Flip excellent invoices into working capital inside 24 hours • Keep away from including debt to your stability sheet |

• Factoring charges cut back your revenue margin on every bill • You solely obtain fee when a job is absolutely full, not at earlier venture milestones • Factoring solely works with B2B clients who move the issue’s credit score checks |

8. Development enterprise loans

Finest for: Contractors, subcontractors, and suppliers

Development enterprise loans give contractors the capital they should transfer on a job earlier than the consumer’s fee is available in. You should utilize the funding to pay your crew, purchase supplies, rent subs, or maintain work progressing whenever you’re ready for fee.

Some lenders fund initiatives up entrance, whereas others launch the capital at outlined milestones, matching the tempo of your drawdowns to the tempo of the venture.

Use case: California is spending $180B on infrastructure within the subsequent 10 years. Let’s say a civil engineering firm wins a brand new $1.5M contract however wants $300,000 up entrance to cowl supplies, preliminary staffing, and website mobilization on electrifying a part of the brand new high-speed railroad.

The California Excessive-Velocity Rail Authority (CHSRA) can pay the primary bill 45 days after work begins. The contractor can fill that hole with a mortgage, so that they have the capital they should get underway with out dipping into their working capital.

| Professionals | Cons |

|---|---|

| • Cowl upfront contract, labor, and materials prices earlier than clients pay yo • Select between a one-time lump sum or milestone-based payouts • Protect working capital accessible to cowl sudden venture prices |

• Repayments might start earlier than the venture is full • You would possibly hit vital money stream points when you exceed your contingency finances • Some lenders solely provide funding to bonded contractors |

9. Manufacturing financing

Finest for: Producers that must scale their manufacturing, improve their gear, or purchase uncooked supplies in very giant portions

With manufacturing financing, like a manufacturing mortgage, you may get the capital it’s essential to improve capability and enhance effectivity. You may also purchase the brand new equipment, rent the skilled workers you want, and fulfill giant orders earlier than your clients pay you.

You’ve gotten a number of enterprise mortgage choices, together with time period loans, gear financing, or traces of credit score, relying on what you’re funding.

Use case: A producer within the booming dental 3D printing market secures distribution offers with a number of giant dental labs. To satisfy demand, they want extra skilled personnel and extra printers to deal with the brand new quantity.

Additionally they need to purchase resin in bulk to extend their revenue margin per unit. Manufacturing finance provides them the capital to scale output shortly, enhance turnaround instances, and maintain their present clients on schedule.

| Professionals | Cons |

|---|---|

| • Pay for capital bills that gas long-term development • Meet rising demand with out utilizing day-to-day working capital • Use funds to rent workers, buy gear, or increase manufacturing |

• Lenders typically require detailed forecasts and enterprise plans, so count on a drawn-out software course of • Your repayments might begin earlier than you start to obtain income from clients • Some loans might require collateral or a private assure, relying on the kind and measurement |

10. Subordinated debt loans

Finest for: Companies with a senior mortgage in place needing additional capital to develop, however don’t need to refinance or hand over fairness

Subordinated debt is debt that’s beneath your present mortgage on a stability sheet. You retain your present debt (the senior debt) and add a second mortgage behind it. If something goes improper, your senior lender will get paid first.

For that motive, the subordinated lender costs extra. It’s an efficient approach of elevating capital with out refinancing your unique mortgage or handing over a part of your organization.

Use case: A wholesale distributor desires to open a second website to service a brand new grocery chain contract. Nonetheless, there’s already a senior mortgage on their present facility, and the lender gained’t lengthen phrases or lend extra. To avoid this, they increase $750,000 in subordinated debt. This retains their standing with the senior lender intact whereas unlocking new capital to develop.

| Professionals | Cons |

|---|---|

| • Add additional capital to your account with out breaching the phrases of your present mortgage • Keep away from giving up shares or fairness in your organization • Increase funding even after reaching your senior debt restrict |

• Costlier than senior debt • Could be onerous to qualify for one of these funding, particularly if your enterprise or credit score rating isn’t robust • Some offers might embrace an fairness kicker, that means you may nonetheless find yourself giving up a few of your shares |

11. Small Enterprise Administration (SBA) loans

Finest for: Enterprise house owners with average or adverse credit

The U.S. Small Enterprise Administration backs the SBA mortgage program. You entry enterprise financing by means of establishments like banks, credit score unions, or on-line lenders that may in any other case reject your software due to your credit score rating.

| Professionals | Cons |

|---|---|

| • Entry funding when mainstream lenders gained’t work with you • Use for working capital, refinancing debt, property purchases, and extra • Get favorable rates of interest on some SBA-backed mortgage varieties |

• The appliance-to-payout timeline can stretch to 120 days or extra • The method entails full financials, private ensures, and an in depth marketing strategy • You’ll nonetheless want a fairly robust credit score profile to qualify |

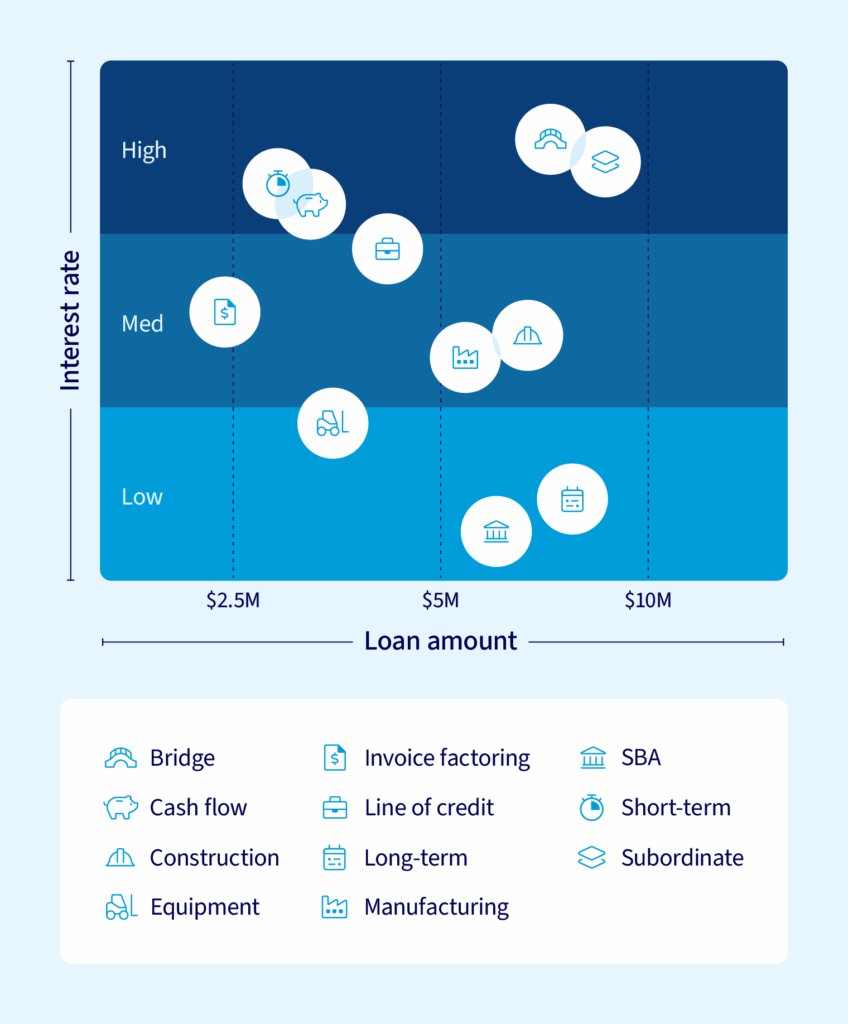

Key variations between these mortgage varieties

Totally different loans unlock totally different alternatives. Not each choice will fit your wants, and a few will not be accessible due to your credit score rating.

Under, examine every of the mortgage varieties from our overview above that can assist you resolve which one is perhaps best for you:

| Mortgage Kind | Rate of interest | Compensation schedule | Collateral | Finest for | |

|---|---|---|---|---|---|

| Quick-term mortgage | As much as $10M / 3–36 months | Increased | Weekly or month-to-month | Usually unsecured or backed by private assure | Pressing prices, one-off alternatives, deposit deadlines |

| Lengthy-term mortgage | As much as $10M / 5–20 years | Decrease | Month-to-month or quarterly | Vital collateral typically required | Property purchases, acquisitions, large-scale growth |

| Enterprise gear mortgage | As much as $10M / 3–10 years | Decrease | Month-to-month – matched to gear lifespan | The gear you’re shopping for or leasing | Shopping for autos, equipment, or specialised know-how |

| Money stream financing | As much as $10M / 6–18 months | Increased | Day by day or weekly – adjusts with earnings | Primarily based on enterprise income, not belongings | Overlaying gaps throughout seasonal dips or gradual receivables |

| Bridge mortgage | As much as $10M / 1–6 months | Excessive | Lump sum on maturity | Might require belongings or be unsecured | Shopping for time earlier than long-term funding or delayed fee arrives |

| Line of credit score | $50K–$1M+ / Revolving (ongoing entry) | Increased | Versatile – draw and repay as wanted | Primarily based on enterprise historical past and financials | Stock builds, advertising spend, managing cyclical money stream |

| Bill financing | As much as $10M / Phrases: 30–90 days | Charges usually 1%–5% of bill worth | Buyer pays factoring firm instantly | Invoices function collateral | Turning unpaid B2B invoices into fast-access working capital |

| Development mortgage | As much as $10M / 6 months to three years (project-based) | Varies | Usually tied to milestones or month-to-month drawdowns | Could also be tied to contracts or secured with belongings | Upfront venture prices – labor, permits, supplies |

| Manufacturing financing | As much as $10M / 1–7 years | Average to low, relying on construction | Month-to-month or milestone-based | Varies – gear, invoices, contracts | Increasing capability, bulk supplies, or investing in automation |

| Subordinated debt | As much as $10M / 2–5 years | Excessive | Structured repayments, typically with covenants | Usually unsecured, typically private assure | Elevating capital beneath an present senior mortgage with out refinancing |

| SBA mortgage (7a / 504) | $50K–$5M / 7–25 years | Low to medium | Month-to-month – lengthy reimbursement phrases | Might require property, belongings, or private assure | Actual property, growth, associate buyouts, or refinancing high-cost debt |

Ideas for choosing the proper enterprise mortgage

It’s simple to discover a lender. What’s more durable is deciding whether or not the finance package deal they’re providing suits your monetary state of affairs and future enterprise development plans.

The best selection provides you respiratory area and protects your working capital. The improper one pulls an excessive amount of capital out of your checking account and makes managing your enterprise funds daily lots more durable.

Right here’s how one can examine you’re making use of for one of the best mortgage for your enterprise:

- Mortgage sort: Go for a mortgage with a time period that both far exceeds the asset’s lifespan or concludes earlier than an affordable return is achieved.

- Mortgage measurement: Verify and double-check that the mortgage quantity you need is correct. Don’t go for too little as a result of getting extra from the identical lender six months later is a problem.

- Mortgage phrases: Look previous the rates of interest and examine the T&Cs for different costs, resembling origination charges and prepayment penalties. Ask for the total reimbursement schedule, not simply the month-to-month quantity.

- Mortgage disbursements and repayments: Know for sure how a lot you’re getting and when. Additionally, pay attention to how typically you’ll be making repayments and examine that it gained’t trigger money stream issues.

Don’t take the primary provide if it doesn’t make sense. Ask your accountant to examine for pink flags, and base how a lot you’ll be able to afford in your quiet months, not your busy months, as a result of that’ll shield you from shortfalls.

Entry the funding to fulfill your wants with Nationwide Enterprise Capital

Getting a enterprise mortgage solves an issue, and it opens a door on the identical time. The important thing for companies is choosing the choice that presents the best upside and the bottom draw back. Making the best selection relies on understanding what you want, whenever you want it, and the worth of the chance value. Performed proper, enterprise financing is a worthwhile alternative, not a burden.

Nationwide Enterprise Capital is a key development associate for 1000’s of American firms. Whether or not they want a short-term mortgage or manufacturing financing, our lending specialists work to assist them discover the best package deal for his or her firm.

We’re a market chief in funding $100K-$10M+ transactions and have secured over $2.5B+ for purchasers. Full our digital software kind and let’s get you funded.