Good enterprise homeowners are exploring a brand new world of financing past the financial institution foyer. Personal credit score lenders and various monetary firms make entry to capital a extra frictionless expertise, with sooner choices, extra versatile necessities, and funding options tailor-made to trendy enterprise wants.

An alternate enterprise mortgage could be a highly effective answer, particularly in case you’re a part of the 46% of companies looking for capital for development and growth.

Let’s check out the highest eight various enterprise lenders, discover what kind of lending merchandise can be found, and stroll via the steps you’ll be able to take to use for various enterprise financing.

What’s various financing?

Different financing opens doorways that conventional banks usually maintain locked. These progressive lenders present all of the funding options you’d count on, plus inventive choices like money circulate financing and specialised packages designed round how your enterprise truly operates, not simply the way it seems on paper.

In comparison with banks, various lenders supply extra environment friendly underwriting processes, sooner funding instances, and looser eligibility necessities.

Nonetheless, these less-restrictive {qualifications} create a dangerous state of affairs for the lender, so they might impose increased rates of interest. For instance, the rate of interest on a enterprise line of credit score ranges from 8% to 60% or increased.

You should use various financing for practically any enterprise goal, from masking every day bills and stocking up on stock to upgrading gear and increasing your enterprise. Refinancing a enterprise mortgage with various financing can be helpful while you wish to borrow further funds or safe higher phrases.

Different enterprise lending at a look

Whether or not you’re in search of a small short-term mortgage or want funding for a big capital expenditure, there are numerous various enterprise financing choices. Here’s a fast have a look at eight of the highest various lenders:

| Lender | Finest for | Max mortgage quantity | Time period size | Minimal rate of interest |

| Nationwide Enterprise Capital | Advisor service | $10M | As much as 10 years | 12% |

| Bluevine | Traces of credit score | $250,000 | As much as 12 months | 7.8%

*for a 6-month time period |

| OnDeck | Brief-term wants | $250,000 | As much as 24 months | 27.3% |

| Fundbox | Newer companies | $150,000 | 12-24 weeks | 4.99%

*for a 12-week time period |

| Lendio | Evaluating lenders | $2M | As much as 10 years | 8.49% |

| Prosper | Beneath-average credit score | $3 million | As much as 5 years | Not disclosed |

| Fora Monetary | Excessive-revenue companies | $1.5M | As much as 18 months | 1.11 issue charge |

| Fundera | Quick funding | $5M | As much as 7 years | Varies |

Finest various enterprise funding

Discovering the most effective various enterprise mortgage in your firm is essential. Every lender has their very own eligibility necessities, time period limits, funding pace, and extra. Let’s have a look at the highest eight various lenders and their enterprise funding options.

1. Nationwide Enterprise Capital

- Finest for: Advisor service

- Max mortgage quantity: $10M

- Beginning rate of interest: 12%

- Time period size: As much as 10 years

- Trustpilot score: 5 stars

As a non-public credit score lender, Nationwide Enterprise Capital presents a number of lending choices from loans and features of credit score to money circulate financing and asset-based lending. We pair every applicant with a enterprise advisor who works to acquire the most effective funding presents for you thru direct lending.

With a 90% approval charge, Nationwide Enterprise Capital helps all companies no matter credit score, income, or time spent in enterprise. Maybe that’s why we’ve an ideal five-star score from Trustpilot.

| Professionals | Cons |

| • Loans as much as $10 million • Rates of interest beginning at 6% • Personalised financing steerage • Quick funding • No tax returns required |

• Rates of interest and phrases fluctuate • Not designed for startups |

2. Bluevine

- Finest for: Traces of credit score

- Max mortgage quantity: $500K for time period loans and $250K for credit score traces

- Beginning rate of interest: 7.8% for a 6-month time period

- Time period size: As much as 12 months

- Trustpilot score: 4.3 stars

Bluevine is a business-focused lender that provides numerous companies, from loans and features of credit score to bank cards and checking accounts. One software qualifies you for each Bluevine enterprise traces of credit score and partner-issued enterprise loans. The draw back is that mortgage values max out at $500,000, and also you’ll have a most of two years to pay it again.

| Professionals | Cons |

| • A number of funding choices • One software for all merchandise • Charge reductions for checking account holders |

• $500,000 max mortgage worth • Brief-term lengths • Financing will not be accessible to companies in Nevada, North Dakota, or South Dakota |

3. OnDeck

- Finest for: Brief-term wants

- Max mortgage quantity: $250K mortgage, $100K credit score line

- Beginning rate of interest: 27.3%

- Time period size: As much as 2 years

- Trustpilot score: 4.6 stars

Quick funding is what OnDeck is thought for, with same-day funding on loans and prompt entry on enterprise traces of credit score. Nonetheless, this comfort comes at a number of prices. For one, OnDeck has excessive APRs, decrease borrowing quantities, and a considerable origination price. Moreover, OnDeck’s companies are autonomous and don’t embrace the help or experience of an actual advisor.

| Professionals | Cons |

| • Get prompt entry when permitted for a credit score line • Similar-day funding on enterprise loans • Fast software course of |

• Common mortgage APRs of 57.9% • $250,000 max mortgage quantity • Requires 1+ years in enterprise |

4. Fundbox

- Finest for: new companies

- Max mortgage quantity: $150K line of credit score

- Beginning rate of interest: 4.99% for 12 weeks, 6.99% for twenty-four weeks

- Time period size: As much as 6 months

- Trustpilot score: 4.7 stars

Fundbox presents a line of credit score that’s best for newer companies. The minimal income requirement is just $30K yearly, and the minimal time in enterprise is simply three months.

Sadly, the compensation interval maxes out at six months, making Fundbox an honest answer when constructing credit score however a poor lender selection in the long run.

| Professionals | Cons |

| • Low eligibility necessities • Quick approval choice • No early compensation penalties |

• Solely traces of credit score can be found • Compensation durations are quick • Curiosity charged weekly |

5. Lendio

- Finest for: Evaluating lenders

- Max mortgage quantity: $2M

- Beginning rate of interest: 8.49%

- Time period size: As much as 10 years

- Trustpilot score: 4.7 stars

Whereas the rate of interest you obtain will depend on your distinctive scenario, Lendio has cheap beginning charges for every product they assist. Accounts receivable financing begins at 3%, enterprise traces of credit score begin at 8%, and time period loans begin at 6%. Nonetheless, you’ll want no less than $8,000 in month-to-month income and nice credit score to qualify for these charges.

| Professionals | Cons |

| • Low beginning rates of interest • Loans as much as $7M • A big number of funding choices |

• $8K month-to-month income minimal requirement • No direct loans or traces of credit score |

6. Prosper

- Finest for: Companies with below-average credit score

- Max mortgage quantity: $3M

- Beginning rate of interest: Not disclosed

- Time period size: As much as 5 years

- Trustpilot score: 4.5 stars

Prosper is a client lending and investing platform that provides enterprise financing via BusinessLoans.com. Financing merchandise embrace loans, traces of credit score, bill factoring, and extra. BusinessLoans.com has no minimal credit score rating, and you may get a mortgage for as little as $5,000, making it a good selection for enterprise homeowners who don’t have nice credit score.

The draw back is that there’s little or no transparency, and also you gained’t have entry to any data till after you fill out a full software.

| Professionals | Cons |

| • Mortgage values as much as $3M • No said credit score necessities |

• Lack of transparency • Enterprise merchandise aren’t via Prosper |

7. Fora Monetary

- Finest for: Excessive-revenue companies

- Max mortgage quantity: $1.5M

- Beginning rate of interest: 1.11 issue charge

- Time period size: As much as 18 months

- Trustpilot score: 4.5 stars

Fora Monetary is a direct lender that provides enterprise loans and features of credit score as much as $1.5M. With a $20K/month income requirement, Fora Monetary is finest for bigger, well-established companies and might not be the most effective useful resource for small companies.

| Professionals | Cons |

| • Borrow as much as $1.5M • Direct lender • Gives prepayment reductions |

• $20K/month income requirement • Restricted to enterprise loans and features of credit score |

8. Fundera

- Finest for: Quick funding

- Max mortgage quantity: $5M

- Beginning rate of interest: Varies

- Time period size: As much as 7 years

- Trustpilot score: 4.3 stars

Fundera is a division of NerdWallet that provides a wide range of enterprise financing merchandise, from traces of credit score to money circulate financing. While you fill out an software, you’re assigned an advisor who works with you to search out the most effective enterprise financing options. Whereas an advisor could be useful, it comes at the price of transparency.

| Professionals | Cons |

| • Borrow as much as $5M • A number of funding choices can be found • An advisor guides you thru the method |

• No transparency on APRs • Lack of management over the method |

Conventional lending vs. various lending: Prime variations

Getting a enterprise mortgage via a standard lender versus another lender seems very completely different. All the things from eligibility necessities and mortgage quantities to funding pace is completely different. Right here’s an outline of the variations you’ll be able to count on when selecting between another and a standard lender.

| Conventional lending | Different lending | |

| {Qualifications} | Strict necessities, together with an excellent credit score rating and a number of years in enterprise | Decrease credit score, income, and time in enterprise necessities |

| Mortgage quantities | Massive loans, usually $1 million plus | Often smaller mortgage quantities beginning at $100,000 |

| Funding pace | Gradual, usually taking weeks and even months to obtain funds | Fast turnaround, together with same-day funding |

| Funding varieties | Loans and features of credit score | Versatile choices together with loans, traces of credit score, bill factoring, gear financing, and extra |

Sorts of various enterprise lending

Firms can leverage a wide range of various lending choices to develop their enterprise. Let’s check out a few of the hottest various funding choices.

Money circulate financing

With money circulate financing, your compensation schedule strikes with your enterprise rhythm. Lenders advance capital primarily based in your income historical past and projections, then accumulate compensation as a small share of your every day or weekly gross sales, creating a versatile funding answer that higher fits your wants.

Time period loans

Time period loans are what most individuals consider once they hear “enterprise loans.” You obtain funds in a one-time, lump-sum fee that you simply’ll repay over a preset time period. Whereas conventional lenders supply time period loans, various lenders supply a wider vary of time period loans, like stock financing and microloans (small loans with quick compensation durations).

Enterprise traces of credit score

A enterprise line of credit score is without doubt one of the hottest alternate options to a standard time period mortgage. As soon as you identify a enterprise line of credit score, you’ll be able to draw funds as wanted. And also you’ll solely pay curiosity on the quantity borrowed, not the full credit score line. Plus, as you repay what you’ve borrowed, that complete is added again to your accessible credit score line.

Tools financing

Tools financing is a manner so that you can break down a large gear buy into extra manageable funds. Different lenders for small companies have a tendency to hold increased gear financing rates of interest than conventional banks, however there are only a few restrictions on the kinds of gear you’ll be able to finance.

Bill factoring

Bill factoring is a short-term enterprise financing possibility that permits you to leverage your current invoices. You’ll be able to promote these invoices to a third get together firm that collects fee immediately out of your clients. Bill factoring instantly offers you entry to capital as a substitute of ready in your clients to pay.

Professionals and cons of different enterprise financing

Nonbank credit score choices for small enterprise lending are rising in recognition. Based on the Federal Reserve, 43% of companies sought various lenders in 2024. Whereas that is turning into commonplace, it’s necessary to weigh the advantages together with the challenges.

| Different financing professionals | Different financing cons |

| Versatile financing optionsQuick fundingLess restrictive eligibility necessities | Larger curiosity ratesLower borrowing amountsIncreased potential for hidden charges |

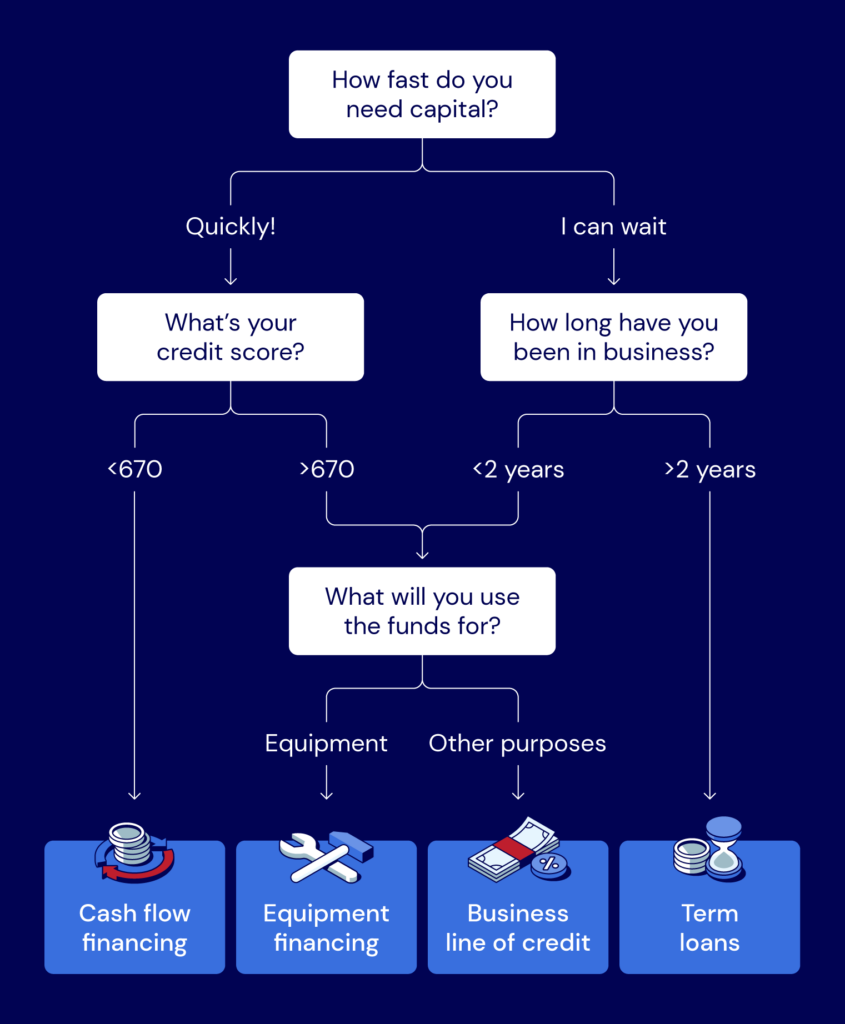

know if various lending is true for your enterprise

Each enterprise is completely different, every with distinctive traits that may make one kind of funding extra engaging. When researching your funding choices, it’s necessary to think about a wide range of components, equivalent to:

Funding instances

The applying-to-funding-in-hand pace is without doubt one of the most necessary issues to think about. Banks and credit score unions are likely to have longer funding, usually taking weeks and even months to finish the applying and funding course of.

Alternatively, various lenders supply same-day approvals in lots of circumstances, with funding instances as quick as 24 hours. This makes various enterprise lending a greater possibility for many who want capital quick.

Rates of interest

As mentioned beforehand, banks and credit score unions have a tendency to supply decrease rates of interest in comparison with various lending organizations. Your corporation’s monetary background determines rates of interest, your time in enterprise, and the lender. Procuring round is the one manner to make sure you’re getting the very best charge.

Out there lending choices

In comparison with financial institution loans and financing, various enterprise lending choices are extra accessible. Different lenders can supply conventional choices like loans and features of credit score, money circulate financing, buy order financing, and different versatile funding choices.

These are just some of a very powerful components to discover. Contemplate different components, equivalent to your long-term monetary targets, firm repute, and financing preferences.

get another enterprise mortgage

Looking for another lender is as straightforward as typing “various enterprise loans” into your search bar. The onerous half, nonetheless, is selecting the best one in your particular scenario. You’ll must analysis every possibility rigorously, noting eligibility necessities, mortgage quantities, and funding instances.

You can begin filling out purposes upon getting a couple of high decisions. Whereas each group has a special software process, most various leaders comply with this five-step course of:

- Fill out the lending software

- Join with a Enterprise Advisor to overview and evaluate mortgage presents

- Choose the most effective match, settle for the supply, and finalize agreements

- Obtain funds rapidly

With various lenders, this course of can usually be completed in as little as 24 hours, and also you gained’t have as many documentation necessities as you’d with a standard lender.

Discover higher financing choices with Nationwide Enterprise Capital

Discovering the most effective various enterprise loans begins with assessing your wants. What are your enterprise targets, and the way can financing enable you to obtain them?

Nationwide Enterprise Capital can assist discover funding that aligns along with your targets and expectations. Our enterprise advisors can information you in choosing the right mortgage possibility. Whether or not you want a fast inflow of capital or have an in depth growth plan, our on-line software is step one in getting you the financing you want.

Incessantly requested questions

You’ll want to supply primary enterprise and private data like: financial institution statements, tax returns, and licenses. Relying on the kind of mortgage and the worth, the choice lender could require further paperwork like a marketing strategy, invoices, stock checklist, and so on. Usually talking, a mortgage from another lender can have fewer documentation necessities.

Whereas it will depend on the mortgage quantity, kind, and lender, another enterprise mortgage could be permitted and funded in as little as 24 hours. Brief-term loans and features of credit score are normally funded sooner, whereas high-value loans or SBA loans can take a number of days to a number of weeks.

Compensation durations fluctuate, however the commonest size for short-term loans is 24 months. Money circulate financing could have a shorter compensation interval of lower than a yr. Alternatively, bigger loans could include a compensation time period of 10+ years.