As , rising and strengthening your corporation takes savvy monetary strikes on the proper occasions. Discovering the very best business loans accessible right now may be your ticket to that necessary subsequent progress step.

With so many financing choices accessible, from conventional financial institution loans to non-public credit score, and so many lenders, it may be powerful to know the place to start. Right here’s a breakdown of the 9 finest lenders on the market for business loans, the kinds of business loans to contemplate, and the way to make your best option.

Greatest business loans at a look

Right here’s an outline of the 9 finest business lenders, who they’re finest for, their most mortgage quantities, and extra:

| Lender | Greatest for | Max mortgage quantity | Time period size | Minimal credit score rating |

| Nationwide Enterprise Capital | Advisor-service | $10M | As much as 10 years | 620 |

| U.S. Financial institution | Long term lenghs | $12.375M | As much as 25 years | 700 |

| Financial institution of America | Present clients | $5M | As much as 5 years | 700 |

| Lendio | Evaluating lenders | $2M | As much as 10 years | 650 |

| RCN Capital | Versatile actual property loans | $20M | As much as 25 years | Varies |

| TAB Financial institution | Aggressive rates of interest | $10M | As much as 25 years | 700 |

| Make clear Capital | Quick funding | $5M | As much as 25 years | 640 |

| JPMorgan Chase | Skilled actual property traders | $25M+ | As much as 25 years | Varies |

| U.S. Small Enterprise Administration | Small companies | $5.5M | As much as 25 years | 650 |

The 9 finest business loans

Now we’ll take a deep dive into every lender and break down their execs and cons.

1. Nationwide Enterprise Capital

| Greatest for | Advisor-service |

| Max mortgage quantity | $10M |

| Beginning rate of interest | 12% |

| Time period size | As much as 10 years |

| Minimal credit score rating | 620 |

When your corporation wants strategic financing options by way of money circulate funding, asset-based lending, or one other business mortgage, Nationwide Enterprise Capital’s skilled workforce of enterprise financing advisors leverages their deep business experience to determine and safe the optimum funding technique tailor-made to your distinctive progress goals.

| Professionals | Cons |

| • No tax returns required • Handy on-line software • Group of knowledgeable enterprise advisors • Quick funding • No minimal credit score rating • No collateral required |

• Rates of interest and phrases fluctuate |

2. U.S. Financial institution

| Greatest for | Long term lengths |

| Max mortgage quantity | $12.375M |

| Beginning rate of interest | ~6.99% |

| Time period size | As much as 25 years |

| Minimal credit score rating | 700 |

U.S. Financial institution is a conventional monetary establishment providing varied financing choices, together with traces of credit score, time period loans, asset-based loans, and extra. It provides steerage from a enterprise banker that can assist you discover aggressive charges and versatile phrases suited to your wants.

| Professionals | Cons |

| • SBA Most popular Lender | • Strict qualification necessities |

3. Financial institution of America

| Greatest for | Present clients |

| Max mortgage quantity | $5M |

| Beginning rate of interest | Varies |

| Time period size | As much as 25 years |

| Minimal credit score rating | 700 |

Financial institution of America is a conventional monetary establishment that provides traces of credit score and enterprise loans with aggressive charges and phrases. Nonetheless, they have an inclination to favor present banking relationships and well-established companies with sturdy financials.

| Professionals | Cons |

| • Aggressive rates of interest • Potential for personalised service for present clients |

• Stringent eligibility necessities • Could also be much less versatile than non-public credit score lenders • Longer software course of |

4. Lendio

| Greatest for | Evaluating lenders |

| Max mortgage quantity | $2M |

| Beginning rate of interest | 8.49% |

| Time period size | As much as 10 years |

| Minimal credit score rating | Varies |

Lendio is a web based market connecting small companies with its community of over 75 lenders. They permit companies to match a number of lenders’ provides multi function place and work to match you with the correct lender to your wants, and supply funding in as little as 24 hours.

| Professionals | Cons |

| • Comparability procuring from a number of lenders • Streamlined software course of |

• Rates of interest and phrases fluctuate broadly |

5. RCN Capital

| Greatest for | Versatile actual property investments |

| Max mortgage quantity | $20M |

| Beginning rate of interest | 6.50% |

| Time period size | 30 years |

| Minimal credit score rating | Varies |

RCN Capital is a business actual property lender providing short-term financing for fix-and-flips and building tasks, long-term financing for long-term leases, and brief and long-term financing for multifamily (5+ unit) flats. They lend to builders, small enterprise homeowners, business contractors, and actual property professionals.

| Professionals | Cons |

| • Low beginning charges • Lengthy compensation phrases • No customary upfront charges for approval |

• Loans should be backed by non-owner-occupied or business properties |

6. TAB Financial institution

| Greatest for | Aggressive rates of interest |

| Max mortgage quantity | $10M |

| Beginning rate of interest | Varies |

| Time period size | As much as 25 years |

| Minimal credit score rating | 700 |

TAB Financial institution is a web based financial institution providing financing for small—to medium-sized companies. It provides all kinds of mortgage choices for industries starting from B2B to B2C and boasts aggressive rates of interest, versatile phrases, and a fast underwriting course of.

| Professionals | Cons |

| • Aggressive rates of interest • Versatile phrases • Number of mortgage choices |

• Strict qualification necessities • Slower software course of |

7. Make clear Capital

| Greatest for | Quick funding |

| Max mortgage quantity | $5M |

| Beginning rate of interest | 6% |

| Time period size | As much as 25 years |

| Minimal credit score rating | 550 |

Make clear Capital provides small enterprise loans, specializing in low charges and same-day approval. After finishing an software, a devoted adviser pairs you with their pool of 75+ lenders to get you the very best charges and loans that you simply’re eligible for.

| Professionals | Cons |

| • Devoted advisor works with you • Low charges • Similar-day approval |

• Rates of interest and phrases fluctuate broadly • Strict minimal necessities |

8. JPMorgan Chase

| Greatest for | Skilled actual property traders |

| Max mortgage quantity | $25M+ |

| Beginning rate of interest | Varies |

| Time period size | As much as 25 years |

| Minimal credit score rating | Varies |

JPMorgan Chase provides varied credit score and financing choices, together with asset-based lending, gear financing, worker inventory possession plans, and syndicated financing. They’re additionally a longtime chief within the business actual property financing business.

| Professionals | Cons |

| • Vast community of sources | • Not accessible in each state |

9. U.S. Small Enterprise Administration

| Greatest for | Small companies |

| Max mortgage quantity | $5.5M |

| Beginning rate of interest | Varies |

| Time period size | As much as 25 years |

| Minimal credit score rating | 650 |

U.S. Small Enterprise Administration (SBA) loans are government-backed loans that help small companies that won’t meet conventional financial institution mortgage necessities. They scale back threat to lenders by way of authorities backing, typically providing aggressive rates of interest and longer compensation phrases. SBA loans may be necessary for a small enterprise’s money circulate and help long-term progress.

| Professionals | Cons |

| • Authorities-backed • Longer compensation phrases • Aggressive rates of interest |

• Prolonged software course of • Typically comes with utilization restrictions |

What are the various kinds of business loans?

There are various kinds of business loans to be accustomed to. These embrace:

- Time period loans: Time period loans present a lump sum that’s repaid over a set time period with curiosity. Companies typically use them for big, one-time expenditures.

- Traces of credit score: Traces of credit score supply companies versatile entry to funds as much as a predetermined restrict, permitting them to borrow and repay as wanted whereas solely paying curiosity on the quantity used.

- Money circulate financing: Money circulate financing offers companies with instant capital primarily based on their accounts receivable or future money flows, serving to bridge timing gaps between bills and incoming income.

- Conventional financial institution loans: Conventional financial institution loans are supplied by a financial institution to an organization.

- SBA 7(a) loans: SBA 7(a) loans are finest for buying or increasing companies, refinancing present debt, and getting working capital. That is the most typical kind of SBA mortgage.

- SBA 504 loans: SBA 504 loans are higher if you wish to buy gear, actual property, different main fastened property, or fund building.

Familiarizing your self with these business mortgage sorts will assist you to choose a lender that provides precisely what you’re in search of.

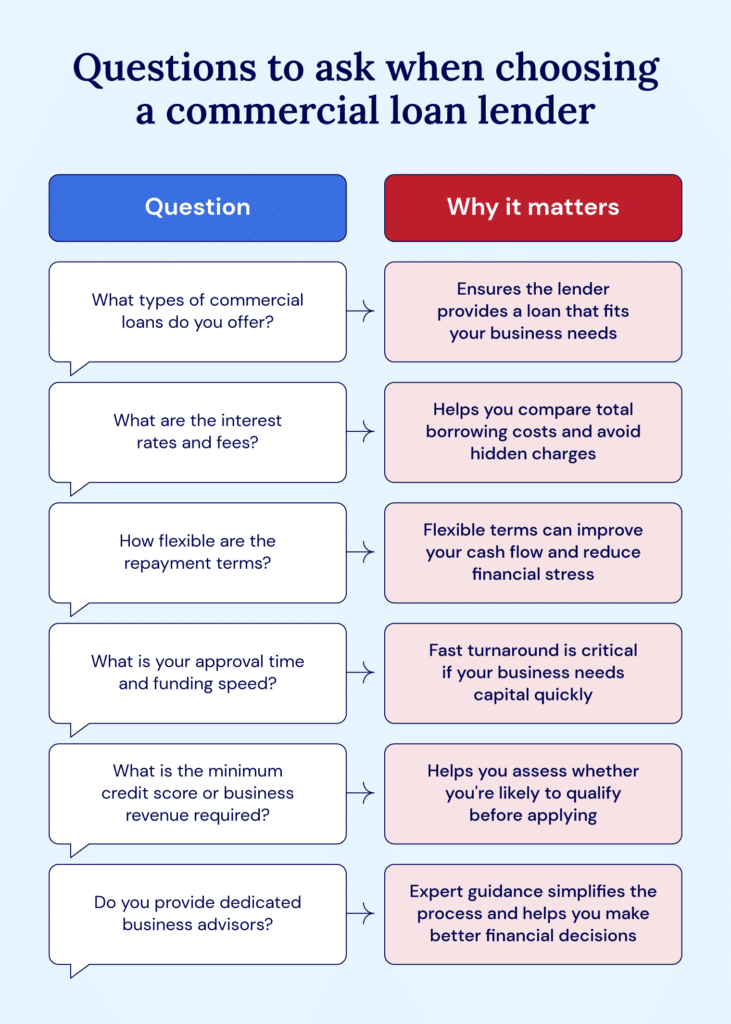

How to decide on the correct business mortgage lender to your wants

Discovering the correct supplier comes with business financing challenges like excessive qualification requirements and sophisticated software processes. Listed here are some steps to get began:

- Weigh your objectives. Decide precisely what you’ll use the mortgage for and the way that can assist you to attain the following section of progress. Do it’s essential acquire new gear or cowl new operational prices? Take into account that some kinds of loans could have longer compensation phrases than others.

- Take into account your funding kind. Determine what lending product suits your wants finest, whether or not it’s a time period mortgage, line of credit score, gear financing, or an actual property mortgage.

- Examine phrases. Examine rates of interest, compensation phrases, and any collateral necessities. Take note of compensation flexibility and catch any hidden charges earlier than you signal.

Be sure to weigh all of your choices or get assist from a monetary knowledgeable earlier than leaping on the primary mortgage alternative you discover.

Business mortgage alternate options

Alternate options to business loans exist for some companies that want extra choices because of components like credit score challenges or progress stage concerns. Listed here are a number of to know:

- Fairness financing: This includes promoting possession stakes within the enterprise to traders in change for capital, however requires giving up partial management and future income to shareholders.

- Fundraising: Fundraising encompasses varied strategies of elevating capital from traders by way of formal campaigns, however may be extraordinarily time-consuming and infrequently leads to rejection from a number of sources earlier than securing funding.

- Crowdsourcing: Additionally known as crowdfunding, this technique permits companies to lift small quantities of cash from many particular person contributors by way of on-line platforms, however success will not be assured, and failed campaigns can injury model fame whereas offering no funding.

- Bill factoring: Bill factoring allows companies to promote their excellent invoices to a 3rd get together for instant money at a reduction, however reduces total income for the reason that factoring firm takes a proportion of the bill worth as its charge.

It’s necessary to know that these alternate options typically require both giving up possession or management, accepting diminished income, or going through important uncertainty about efficiently acquiring the wanted funding. Know your various choices, however perceive the dangers as properly.

Safe a business mortgage with Nationwide Enterprise Capital

Now that you simply’ve reviewed the very best business loans above, you’ve obtained your ticket to progress in hand. Whether or not it’s essential buy gear, rent new workers, or increase your operations, now could be the time to make a sensible financing determination to gas your success.

Particularly for first-time candidates, having a trusted knowledgeable at your facet is necessary that can assist you take advantage of knowledgeable selection. For personalised recommendation and to discover particular financing choices, contact our Nationwide Enterprise Capital consultants. We’ll clarify how your organization suits into capital markets, advise you on the choices your corporation qualifies for, and advocate for essentially the most aggressive contract inside our lender community.

Apply now to get began and put your corporation on the quick monitor to progress.

Steadily requested questions

A business mortgage is a mortgage made to a enterprise by a financial institution or different monetary establishment. It’s typically used to fund operational prices, buy gear or property, and extra. What you are promoting’s {qualifications} decide the rates of interest and compensation phrases. Most function fastened month-to-month funds over a set time-frame. Typically, business loans are secured by collateral.

One of the best business mortgage lenders will fluctuate primarily based on your corporation wants. Nationwide Enterprise Capital is a direct lender with no intermediary. Our workforce of enterprise advisors can work with you to discover a personalised answer to your business mortgage wants.

Business actual property loans are finest for business property. These embrace conventional financial institution loans, non-public lender financing, SBA 504 and SBA 7(a) loans, and extra. They could be secured by the property and supply longer compensation phrases.