Equities have been on fairly the curler coaster in 2025. Though the tariff state of affairs has pushed a lot of this volatility, we discover ourselves in the same spot to the place we started the 12 months. Valuations stay excessive, the market continues to be relying on the expansion of the Magnificent 7 (Magazine 7), and analysts proceed to count on above-average development for the following a number of years, regardless of all of the uncertainty.

To know the equities outlook for the second half of the 12 months, let’s first think about how we acquired right here.

A Whirlwind of a First Half

Initially of 2025, analysts had been anticipating shut to fifteen p.c earnings development for the S&P 500. Within the two quarters since, we’ve seen the same story from a elementary perspective—however with some key variations as to why. Every quarter noticed earnings beat expectations by stable margins, however analysts then lowered future development expectations, offsetting a few of that optimistic information.

Within the first quarter, lowered development expectations hit the tech sector and the Magazine 7 notably exhausting. Analysts started to see a deceleration in development projections for corporations whose valuations relied on vital future development projections. Within the second quarter, most of these corporations beat lowered expectations, with funding spending for AI persevering with at a powerful tempo regardless of enterprise considerations over tariffs and the broader economic system.

The long run development expectations for tech and communications companies additionally held up effectively, resulting in a rebound for development corporations dominated by these sectors. Regardless of a majority of cyclical sectors beating their first-quarter development estimates, corporations and analysts had considerations over tariffs and the economic system, resulting in lowered future estimates.

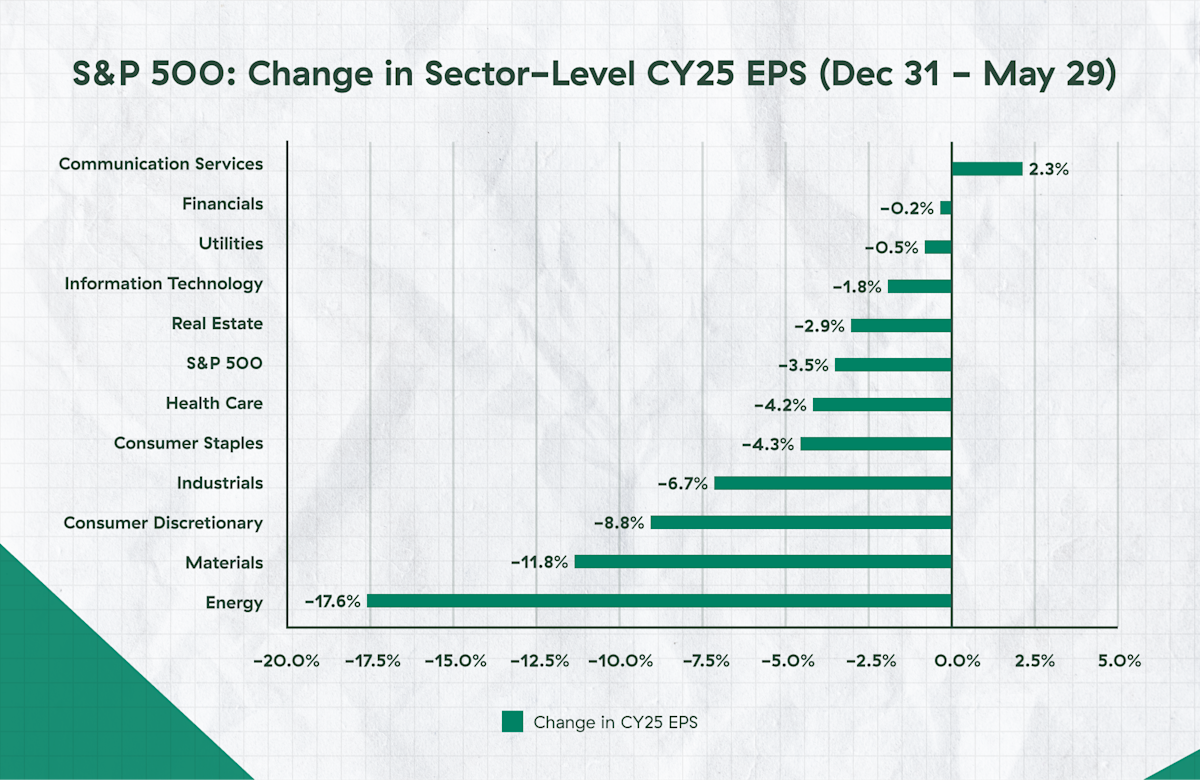

Within the chart under, you may see the complete impression of all of the analyst modifications to estimates because the starting of the 12 months.

Supply: FactSet as of 5/30/2025

A Story of Two Markets

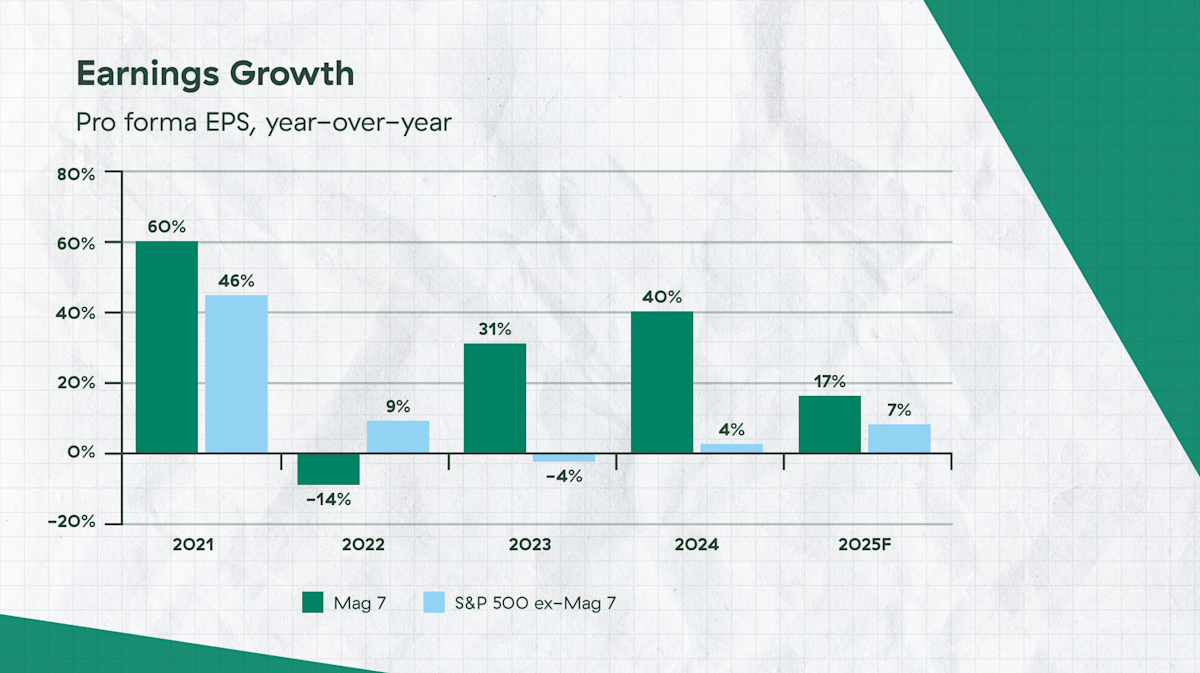

There are numerous methods to categorize the markets: large-caps versus small-caps, U.S. versus worldwide, and worth versus development. However the greatest divide for the previous few years? The Magazine 7 versus everybody else.

The recurring story over the previous 12 months and a half has been the expansion of the highest corporations declining towards the remainder of the S&P 500 however regularly managing to beat these expectations. Magazine 7 valuations stay effectively above the remainder of the S&P 500, however they’re nonetheless anticipated to see 17 p.c earnings development for 2025 versus 7 p.c for the remainder of the index.

Supply: FactSet, Commonplace & Poor’s, J.P. Morgan Asset Administration. Magnificent 7 consists of AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA, and TSLA. Earnings estimates for 2025 are forecasts primarily based on consensus analyst expectations. Information to the Markets – U.S. Knowledge as of June 6, 2025.

The most important potential driver for continued S&P 500 development stays the flexibility of corporations closely concerned within the AI revolution to beat development projections. Given the optimistic outlook from the Magazine 7 of their Q1 earnings calls and lots of of these of their provide chain, we see stable development persevering with within the second half of the 12 months.

Right here, it’s essential to needless to say markets are forward-looking. As we proceed via the 12 months, the main threat to the outlook is that markets begin to see the tip of above-average development, which might convey valuations down. As we noticed in 2022’s “tech wreck” because of rising charges, the drop might be fast and vital. Equally, when analysts lowered future expectations earlier this 12 months, we noticed the Magazine 7 decline considerably. Nonetheless, the expansion of those corporations has produced actual income that may’t be ignored—however traders could must mood expectations given the excessive valuations.

What About Every part Else?

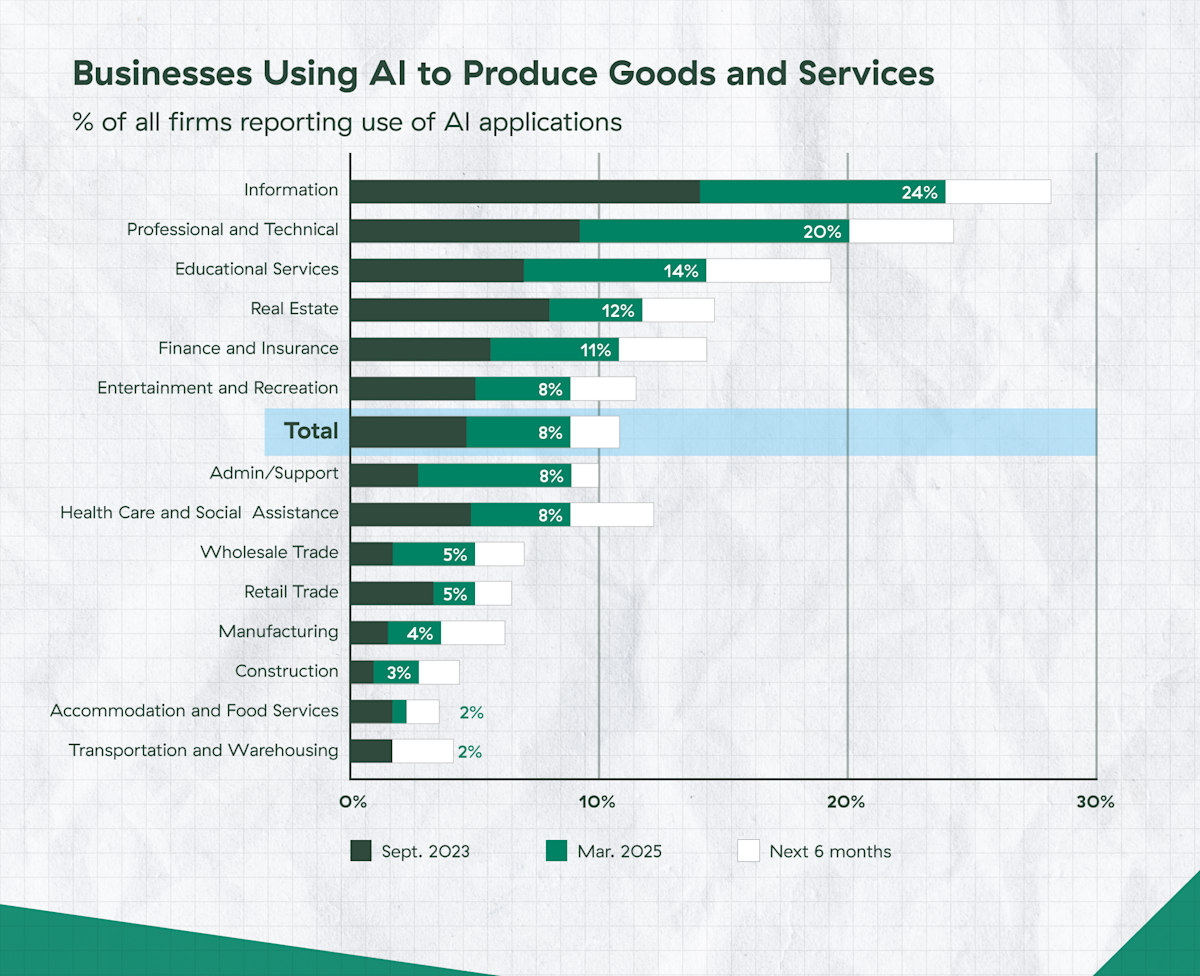

AI’s potential to assist enhance productiveness in a still-tight labor market will likely be key to sustaining the Magazine 7’s excessive revenue margins, but additionally the revenue margins of many different corporations. To assist the expansion of the Magazine 7, it should additionally seemingly be needed for AI to have a serious impression on different corporations.

Supply: J.P. Morgan Asset Administration; BEA. Information to the Markets-U.S. Knowledge as of June 6, 2025.

The power to adapt and use AI is definitely prevalent in tech, but it surely has a number of purposes in different industries. This might assist result in rising development elsewhere (see chart under).

Supply: Census Enterprise Developments and Outlook Survey (AI Complement). Information to the Markets-U.S. Knowledge as of June 6, 2025.

2025 earnings development expectations for worth corporations are solely 5 p.c, in comparison with 14 p.c for development corporations. Nonetheless, they’re buying and selling at a 40 p.c low cost on a ahead P/E foundation. This leaves much more room for error if these corporations can’t reside as much as expectations. On condition that analyst estimates have been lowered because of the uncertainty over continued tariffs, there’s nonetheless house for enchancment if the extent of the introduced tariffs continues to say no.

At present, mid-cap corporations have the identical earnings development expectations as large-caps with decrease valuations, whereas small-caps have considerably greater development expectations. Previously two years, small-caps haven’t come near assembly excessive expectations, resulting in underperformance. But when projections are according to analyst estimates for 30 p.c development, there’s vital potential there.

Worldwide equities have been the largest story outdoors of the Magazine 7 thus far this 12 months. The MSCI AC World ex U.S. Index has outperformed the S&P 500 by simply over 13 p.c (year-to-date via June 6, 2025). Nonetheless, after almost a decade and a half of underperformance, these corporations are buying and selling at a big low cost relative to their 20-year historical past. Given the continued optimistic financial surprises taking place internationally, together with still-subdued valuations relative to the U.S., worldwide outperformance may proceed within the second half of the 12 months.

Lengthy-Time period Performs for Portfolios

Trying towards the again half of 2025, a number of believable tales may unfold. Markets could rise considerably on the again of elevated AI development, with the remainder of the market seeing stable development and valuations persevering with to construct on elevated pleasure. Or the Magazine 7 could have a reset in valuations, whereas the remainder of the market manages to outperform expectations and markets stay flat. Then there’s the likelihood that financial development may sluggish considerably, hurting each the largest and smallest names.

The underside line is that this: fairness traders are paid to take dangers. They have to decide what the almost certainly situation is and the way a lot threat they will afford. Having publicity to the largest names within the index can nonetheless make sense given their profitability and development prospects. However with the valuation disconnect, worldwide equities and, to a lesser extent, small- and mid-cap names could also be enticing in the long run as the advantages from AI develop past the Magazine 7.

Do not miss tomorrow’s publish, which can function a particular Midyear Outlook version of the Market Observatory.

Sure sections of this commentary comprise forward-looking statements which might be primarily based on our cheap expectations, estimates, projections, and assumptions. Ahead-looking statements should not ensures of future efficiency and contain sure dangers and uncertainties, that are tough to foretell. Previous efficiency just isn’t indicative of future outcomes. Diversification doesn’t guarantee a revenue or defend in opposition to loss in declining markets.

The ahead price-to-earnings (P/E) ratio divides the present share worth of the index by its estimated future earnings.[JH1]

The Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) are a bunch of seven corporations generally acknowledged for his or her market dominance, their technological impression, and their modifications to shopper conduct and financial developments.

The MSCI ACWI ex USA is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed and rising markets. It doesn’t embody the US.