You’re getting extra shoppers signing up for greater offers than ever earlier than. Proper now, your online business has actual momentum. Nevertheless, funds take a while to come back in, so that you’re continuously looking for capital to spend on scaling the enterprise and overlaying operational bills.

In conditions like this, a working capital mortgage can present the respiration room it’s good to proceed rising the enterprise with out slowing down whereas nonetheless settling your payments on time.

Learn on to seek out out what a working capital mortgage is, the several types of working capital loans, and how you can enhance your possibilities of getting authorised quick.

What’s a working capital mortgage?

Working capital loans are a kind of financing that offers companies the funds they should meet their short-term enterprise bills and, in lots of instances, tackle alternatives they’d in any other case should go up.

Brief-term gaps in funding occur for a lot of causes, like late buyer funds, an sudden expense like pressing tools repairs, or a short lived dip in gross sales. Working capital loans assist bridge these gaps so you’ll be able to pay employees, cowl hire, settle your provider invoices, and equipment up for the following wave of rising your online business.

Compensation of enterprise working capital loans is swift, various from a couple of weeks to 18 months. When deciding how a lot you need to borrow, begin with what it’s good to cowl your working capital shortfall.

When funding a short-term mission, calculate the required financing by first pricing in the associated fee plus a contingency. This helps keep away from encountering the identical monetary hurdles.

| Use case: Your organization is launching a model new product. Orders pile in, however you don’t take fee till dispatch. The mortgage lets you ramp up manufacturing to fulfill 100% of the demand whereas conserving sufficient within the financial institution to pay for every day operations. With out this type of short-term manufacturing financing, you couldn’t produce at scale, so that you’d miss out on producing vital income. |

|---|

Forms of working capital funding

The perfect working capital loans give you the funding you want, a compensation schedule that doesn’t impression your money movement, and aggressive rates of interest that received’t eat away at your margins.

Listed below are 5 common financing choices that can assist you meet your short-term enterprise wants, along with examples of how companies use them:

Money movement financing

Money movement financing supplies a lump sum fee upfront to companies. Repayments align along with your money movement, so throughout busy seasons, you pay extra and in quieter intervals, much less.

| Use case: Retailers use money movement financing to fill up on stock forward of peak season. The decrease repayments they make when it’s quieter protect their money movement. Then, when income picks up, their repayments improve, that means they clear the excellent stability quicker. |

|---|

Time period loans

Time period loans additionally present a lump sum of capital upfront. Mortgage phrases typically take between three and 18 months to clear. You make weekly or month-to-month repayments over the time period till you compromise the stability.

| Use case: Producers usually use this sort of small enterprise mortgage to buy uncooked supplies in bulk, locking in reductions. For instance, a furnishings producer buys six months’ value of hardwood in a single go, in order that they pay a cheaper price. Their merchandise are flying out the door as quick as they will make them. The mortgage provides them the capital to purchase the uncooked supplies in bulk to fulfill 100% of buyer demand. Gross sales cowl the repayments, so by the point they repay the mortgage, their working capital is more healthy and their margins are intact. |

|---|

Enterprise traces of credit score

A enterprise line of credit score provides you versatile entry to capital whenever you want it. Like with a enterprise bank card, you get a restrict (the utmost you’ll be able to borrow) and a stability (the quantity you’ve really borrowed after any repayments). You possibly can overpay or clear the stability with out penalty.

Understand that you must settle the account in full in some unspecified time in the future, usually three to 24 months after you open the ability, except the ability is revolving.

| Use case: A building agency makes use of this short-term funding choice to inject working capital whereas they’re ready for staggered funds to come back in from a shopper. They borrow $100,000 to pay subcontractors and purchase materials to maintain the work going, repaying it when the shopper’s bill clears. |

|---|

Bill factoring

Flip your unpaid invoices right into a working capital line with bill factoring. Lenders purchase your unpaid invoices and ahead you as much as 95% of their worth on the identical day or the following day. You get the stability, minus the factoring payment, when the shopper makes the ultimate fee.

| Use case: Staffing companies use factoring firms to offer short-term financing to cowl their payroll. A temp agency with $250,000 in excellent invoices would possibly issue them as a result of fee shouldn’t be due for 45 days, they usually should pay the employees on the finish of the month. |

|---|

SBA loans

You should utilize SBA 7(a) and Microloans for working capital, however the common turnaround time on an SBA mortgage utility is 90 days.

| Observe: Want new tools? Inform considered one of our advisors what you need, they usually’ll advise you on tools financing time period lengths and month-to-month fee estimates. We are able to prepare normal tools financing in addition to SBA-backed loans for tools buy. |

|---|

What can I take advantage of a working capital mortgage for?

Working capital loans are greatest for benefiting from short-term alternatives and overlaying bills, like month-to-month payments and debt funds. They’re not for purchasing costly new tools, increasing your premises, or buying a competitor.

Companies use this sort of quick funding for:

- Bridging seasonal gaps: Have sufficient within the financial institution to fulfill your monetary obligations when capital goes out quicker than it’s coming in.

- Managing payroll: To guard staff morale and keep capability, hold your employees completely satisfied by paying them on time and in full.

- Rent further employees: Cowl recruiter charges and the primary few paychecks for brand new staff members earlier than they begin bringing in a return.

- Replenish on stock: Purchase common traces to outperform your opponents and lock in provider reductions to enhance your margin on every sale.

- Run well-timed advertising pushes: Take advantage of surges in demand and vacation seasons by reserving promoting to draw new curiosity and generate extra income.

- Staying operational: Use quieter occasions to restore and improve your tools so that you’re prepared to maneuver quick when demand picks up.

Working capital financing is nice at stabilizing funds and powering development initiatives at totally different elements of the shopping for cycle. They’re not ideally suited for refinancing a mortgage or for long-term investments like shopping for main tools, increasing your location, or buying one other enterprise.

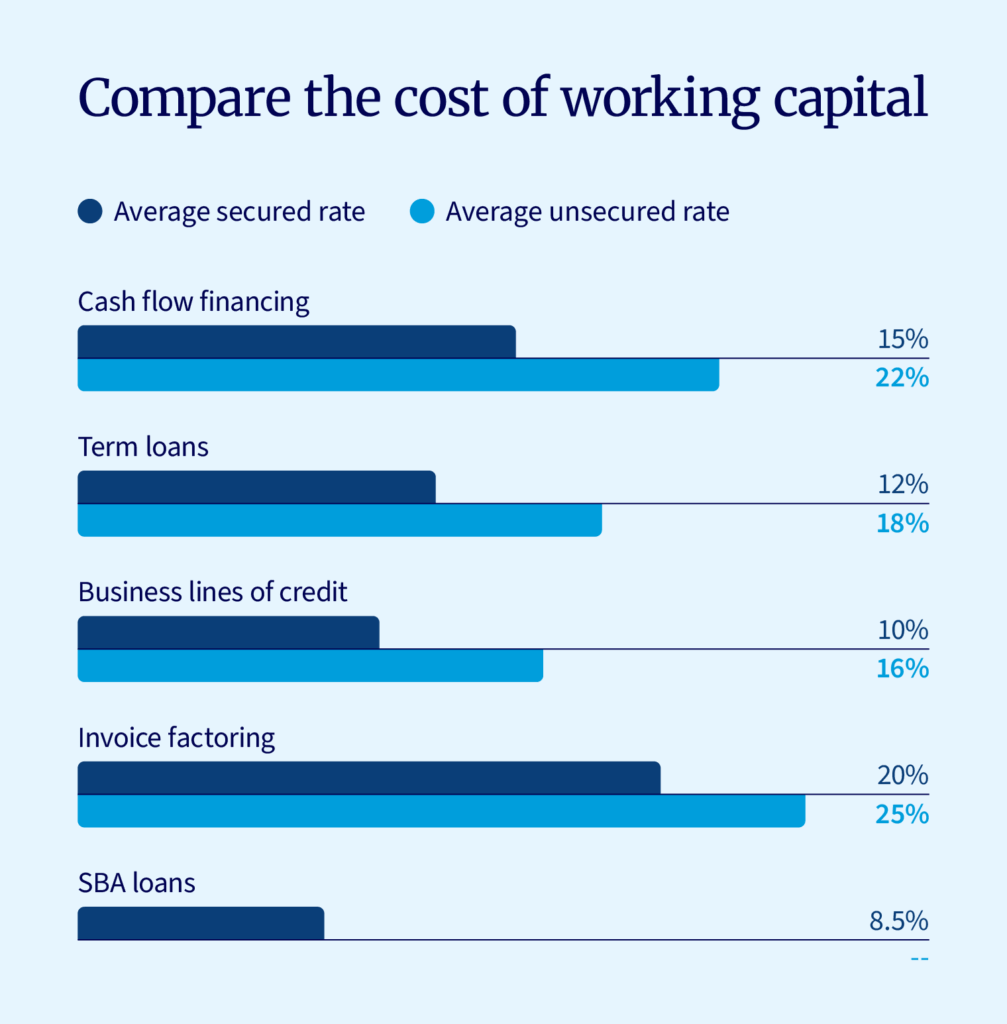

Will I want to supply collateral for a working capital mortgage?

Think about providing collateral in your working capital mortgage to entry decrease rates of interest and the next most mortgage quantity. Doing so can improve your mortgage phrases and enhance your monetary standing. With out collateral, it’s possible you’ll face barely increased prices and stricter eligibility standards, however this method ensures you safe the funds you want on favorable phrases.

In case your lender suggests a private assure (PG), it’s necessary to know the implications. A PG signifies that in case of default, your private property, similar to financial savings or property, could possibly be pursued for compensation. It’s a major dedication, so it’s sensible to fastidiously consider the phrases and search skilled recommendation if wanted.

Managing your working capital mortgage

Handle your working capital mortgage properly to get the monetary respiration room to maneuver your online business ahead whereas defending your money movement. Listed below are three constructive approaches you’ll be able to take:

- Keep on with the plan: Deal with the capital from the mortgage as a mission finances and don’t spend it on something apart from what you have been planning. Each further greenback you spend on advertising, enterprise apps, and extra will increase the chance of a capital crunch coming if the income you’re relying on arrives late.

- Observe your money movement: Ask why capital has been tight. Undergo each expense, together with employees, and ask whether or not they price greater than they bring about in. Have a look at credit score management. Are invoices going out quick sufficient? Are you chasing funds correctly? Lastly, try your opponents to see if there’s an opportunity you’re underpricing. Repair any points now to keep away from a repeat sooner or later.

- Keep on with your compensation schedule: Most lenders and lots of suppliers that offer you commerce credit score report your fee historical past to the credit score bureaus. Each late fee knocks your credit score rating and makes it more durable to safe funding sooner or later.

Execs and cons of working capital financing

Each industrial and private finance bundle has its benefits and drawbacks. Under, discover 5 upsides and 4 downsides of working capital loans:

| Execs | Cons |

|---|---|

| Fast entry to funds: Get the capital you want whenever you want it. Versatile use of funds: Spend the capital the place you see match, like paying employees, shopping for inventory, overlaying overheads, or working short-term campaigns. Unsecured mortgage availability: Lenders may match with you in case you don’t need to pledge any safety. Improved money movement: Get respiration room to fulfill your payments with out affecting your working capital. Brief-term compensation interval: Clear your repayments quicker to unencumber money movement for future development. |

Increased price of capital: Working capital loans have increased rates of interest than normal time period loans. Brief compensation phrases: The slim window to repay your stability can stress your money movement. Collateral necessities: Some loans require you to pledge property you would possibly lose in case you default on funds. Not at all times, although; Nationwide Enterprise Capital doesn’t require collateral for working capital. Credit score rating impression: Lacking a fee can knock down your credit score rating. |

Tips on how to apply for a working capital mortgage

Getting a working capital mortgage for a small enterprise isn’t laborious. Nevertheless, it’s good to put together to seek out the fitting mortgage in your firm.

Listed below are our tricks to discover the fitting enterprise financing accomplice and get by the approval course of quick:

- Know why you want the capital: Have a determine in thoughts and a function for each greenback you’ll spend. Should you’re overlaying money movement, whole up each price you must meet. If you wish to, for instance, run an advert marketing campaign to usher in further income, know beforehand precisely the place you’ll promote, how a lot you’ll spend on every channel, and the place your returns will come from.

- Select a reliable lending accomplice: Look by each lender’s T&Cs fastidiously for hidden fees. Try their on-line buyer opinions to ensure they’re professional, dependable, and have expertise with companies in your sector.

- Communicate to an skilled monetary advisor: Clarify your plan to an knowledgeable at your chosen lending accomplice. Ask which is the fitting monetary product in your wants and why. Request a abstract of the entire mortgage prices and any further charges you must pay.

- Get your paperwork prepared: Lenders that supply same-day funding or payout in as little as three enterprise days usually require greater than your financial institution statements. For lenders with extra advanced utility procedures, collect these paperwork collectively: financials (P&L, stability sheet, and tax returns), debt schedules, and authorized paperwork like leases and franchise agreements. Should you’re going for a secured mortgage, you’ll want proof of possession of the property.

- Verify your key numbers: Verify your private and enterprise credit score scores. Keep present on all funds so your credit score rating stays excessive when the lender runs a full search on you.

- Apply and agree on phrases: As soon as all the things’s in place, apply to your lender and be prepared to reply to their questions and requests for documentation shortly. Once you’re accepted, evaluate each time period fastidiously, particularly rates of interest, compensation schedules, and early fee penalties. Should you’re completely satisfied to proceed, full the paperwork and the lender will switch the capital to your account.

Bridge funding gaps with versatile choices from Nationwide Enterprise Capital

Working capital loans assist firms benefit from enterprise alternatives and efficiently handle their money movement constraints. They’re a part of an arsenal of monetary merchandise obtainable to assist companies at each stage of their journey by Nationwide Enterprise Capital.

Nationwide Enterprise Capital is a market chief in funding $100K to $5M+ transactions. We’ve funded $2.5B+ for firms throughout America. From enterprise traces of credit score to tools financing, 1000’s of companies belief us to seek out them the fitting funding deal at each stage of their development journey.Begin your utility in the present day with Nationwide Enterprise Capital and let’s get you funded.

Continuously requested questions

Many small enterprise house owners provide collateral, like their tools or receivables, to safe decrease rates of interest and better borrowing ranges on a working capital mortgage.

Nevertheless, many lenders provide unsecured choices with a barely increased annual share charge, making repayments barely dearer.

Eligibility standards for working capital loans fluctuate from lender to lender. Most need not less than 6-12 months in enterprise, regular month-to-month income, and a wholesome credit score profile. Some may additionally need to evaluate your present financials, private credit score rating, and firm debt.

Some non-public credit score lenders can fund working capital loans on the identical day, whereas others could require between 24 and 72 hours. The extra full your utility is whenever you submit it, the quicker you’ll get a solution and your capital.

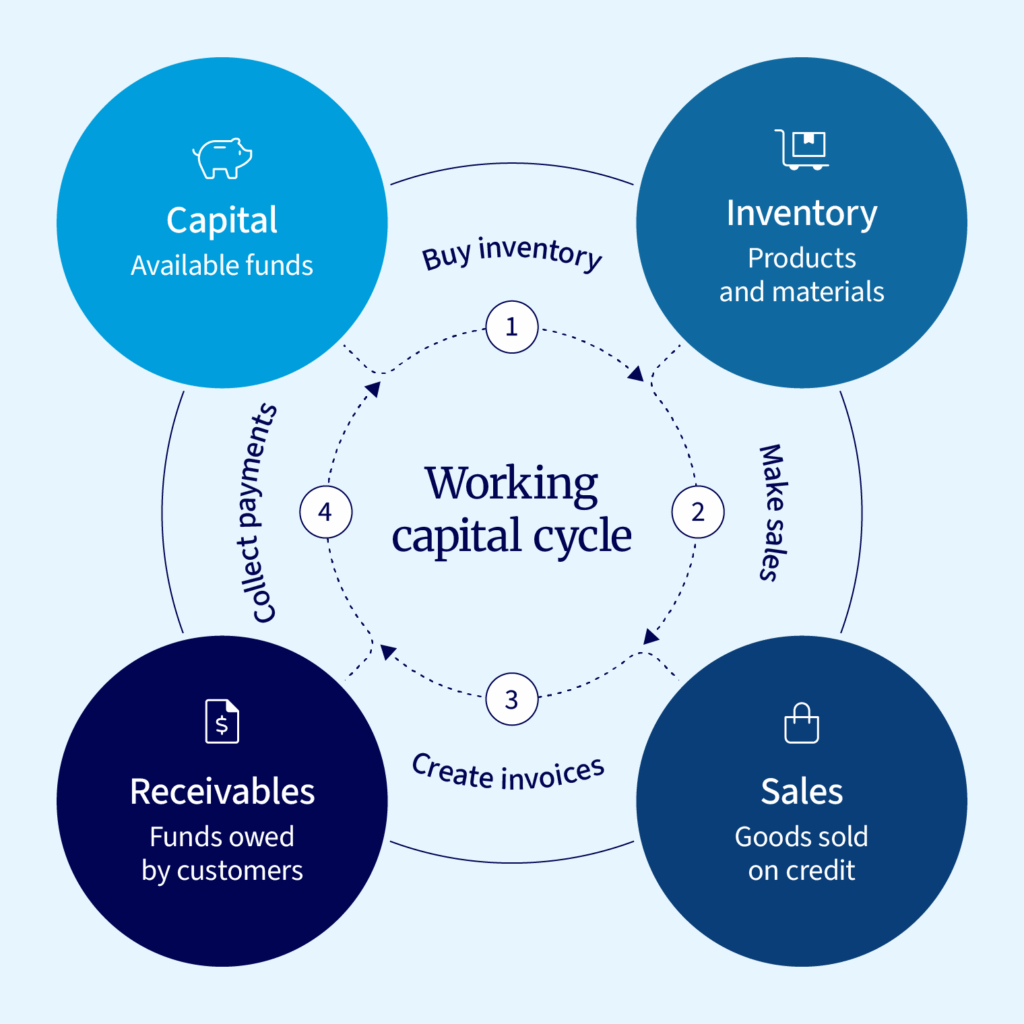

To calculate working capital, subtract your present liabilities out of your present property.

Your present enterprise property embrace capital, stock, and accounts receivable. They’re liquid investments like bonds and shares that you could promote shortly. Your present liabilities are your money owed and bills, like accounts payable, repayments on loans for the 12 months, and mortgage repayments due inside 12 months, and excellent obligations like worker wages and tax.

Working capital is essential to your online business’s short-term monetary well being and operational flexibility.