My technique entails taking a look at what’s trending in line with my ranking system, and shopping for what matches into my portfolio if I can construct a storyline behind it. My ranking system of practically a thousand funds is primarily based on information from Mutual Fund Observer to mirror my evaluation of quick and intermediate-term tendencies. I chosen the funds utilizing MFO Household scores, property underneath administration, danger, and risk-adjusted efficiency, and availability with out hundreds and transaction charges by way of Constancy and Vanguard.

From the S&P 500 PE Ratio – 90 12 months Historic Chart by Macrotrends, I estimate that the price-to-earnings ratio as we speak is on the highest 94% since 1929 and is extremely valued. My concern is that prime deficits, rising nationwide debt, tariffs, falling greenback, sudden cuts to Federal employment and spending, and uncertainty could create shocks to the economic system over the approaching years. My ranking system is tilted towards fairness worth and bond high quality.

Scores for fairness, bonds, combined property, and “different” are calculated individually and mixed right into a single ranking system with 100 being the very best and 0 being the bottom. All 4 groupings embody three-year efficiency (return and risk-adjusted return), short-term momentum (YTD returns, shifting averages, and fund move), and danger (drawdown, Ulcer Index, and draw back deviation). As well as, fairness consists of valuation (price-to-earnings, price-to-book), bonds embody high quality (bond ranking, efficient period), and yield (together with risk-adjusted yield), and mixed-asset consists of each valuation, high quality, and yield.

The funds chosen for this text have a ranking of 90 or increased. The checklist was pared down to 1 or two per Lipper Class. This text focuses on particular person funds, whereas earlier articles targeted on finest best-performing Lipper Classes as an entire.

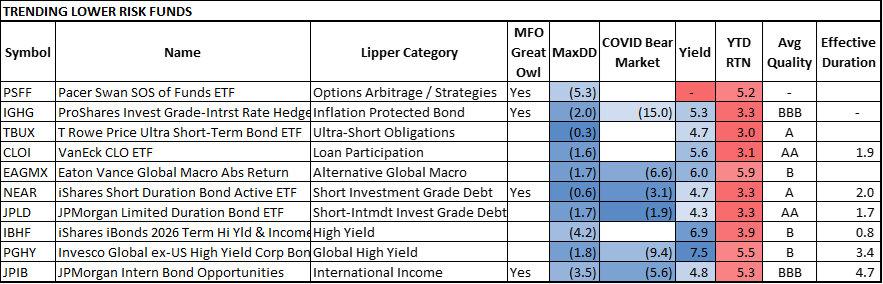

Decrease Danger Funds

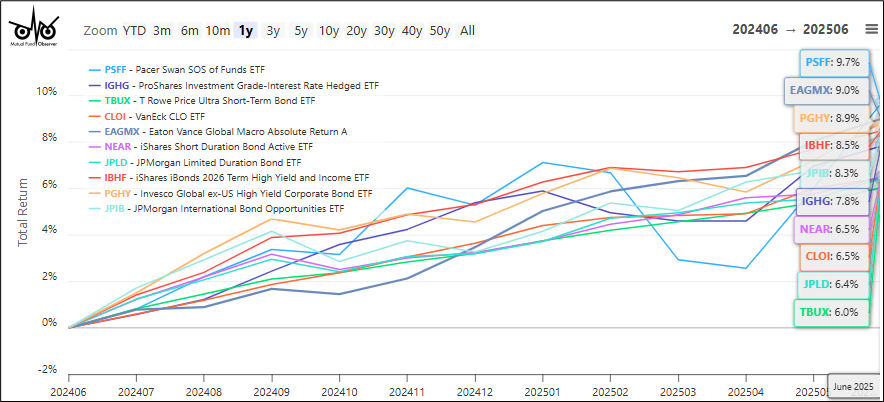

The best rated decrease danger funds are principally within the short-term bond Lipper classes with increased high quality, together with inflation-protected bonds. I personal iShares Brief Period Bond ETF (NEAR) for its security. About 7% of my bond portfolio is invested in inflation-protected bonds, though I don’t personal IGHG. I plan to take a position extra in inflation-protected bond ETFs with goal maturities so as to add to rungs in bond ladders.

Desk #1: Trending Decrease Danger Funds

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset; Morningstar for year-to-date returns as of July twenty fourth.

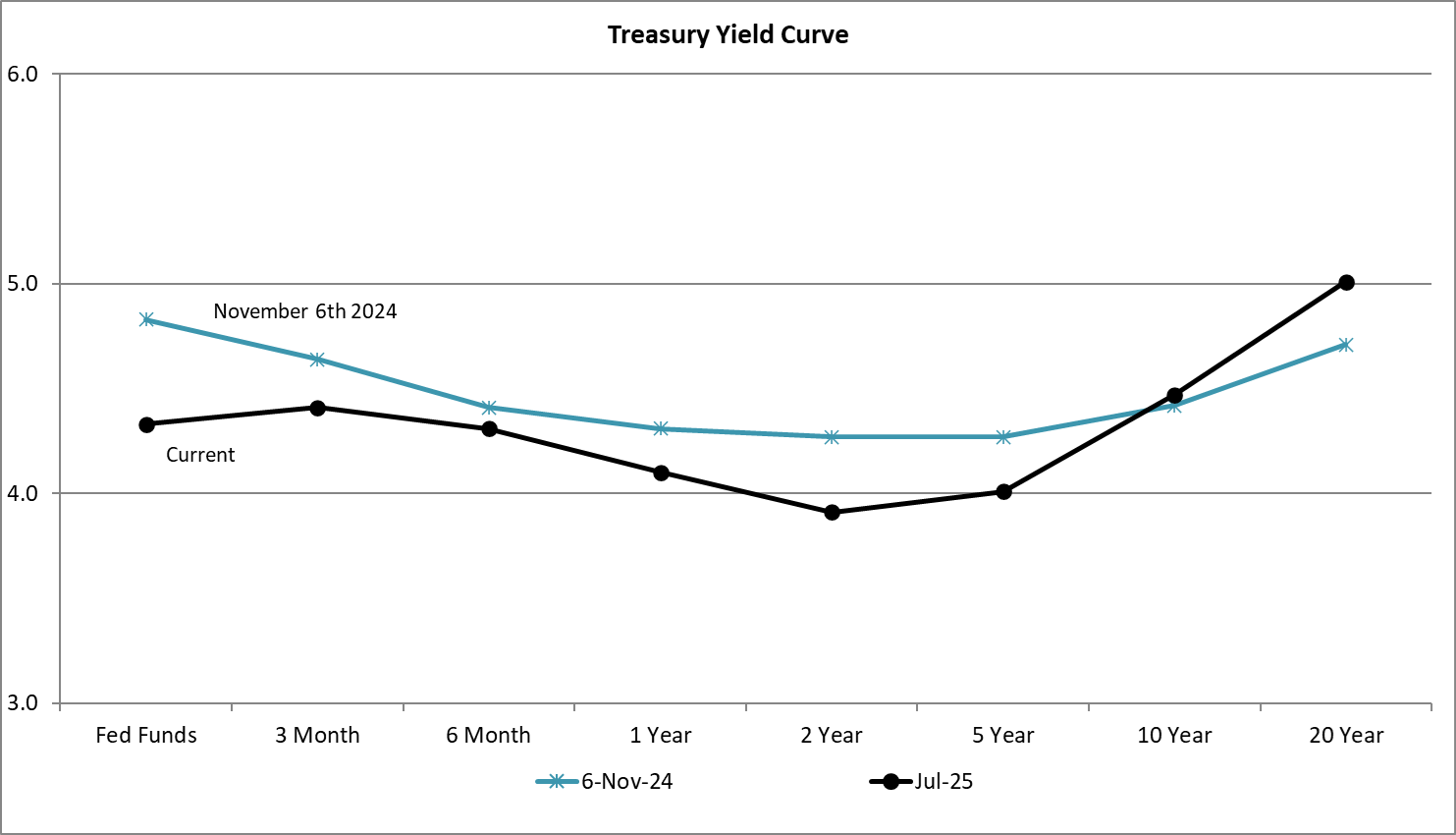

Determine #1 is the yield curve for Treasuries. Lengthy-term charges have risen whereas short- and intermediate-term charges are falling. I interpret this to imply that traders consider the economic system is slowing and charges will fall by the top of the yr, however long-term charges are rising on the expectation that increased charges will probably be required to finance the rising deficit and nationwide debt, together with the potential for increased inflation. I favor bond funds with efficient durations within the one-to-five-year vary.

Determine #1: Treasury Yield Curve

Eaton Vance World Macro Absolute Return is actually price looking at. Throughout its eighteen-year life, it has had a 3.8% return with a most drawdown of seven.2%. It has an MFO Danger Ranking of “2” for conservative and an MFO Ranking of “5” for being within the highest quintile for risk-adjusted return for the class.

Likewise, JPMorgan Worldwide Bond Alternatives (JPIB) additionally has an MFO Danger Ranking of “2” for conservative and an MFO Ranking of “5”. I’ve diversified world portfolios managed partially by Constancy and Vanguard, which personal worldwide bond funds. I’m within the preliminary stage of figuring out if I wish to purchase worldwide bond funds in self-managed portfolios.

Determine #2: Trending Decrease Danger Funds

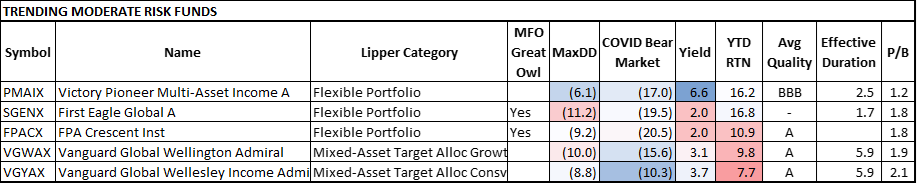

Average Danger Funds

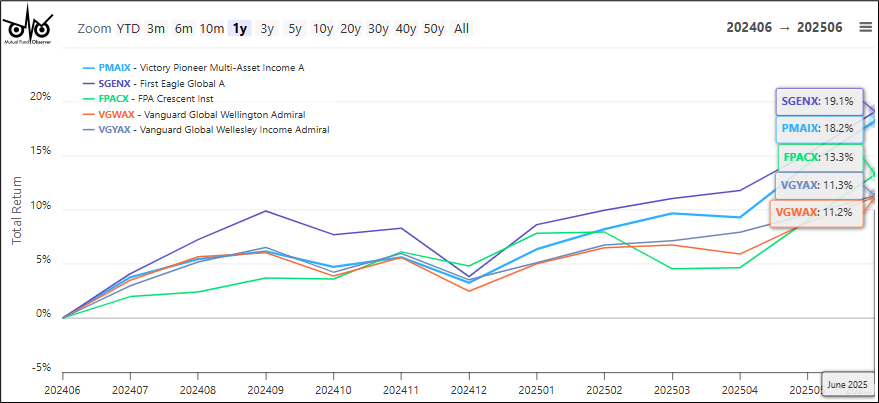

I wrote Investing Internationally for the Timid Investor within the June MFO e-newsletter about Vanguard World Wellesley Earnings Fund (VGWIX), which I personal. I’ve some dry powder in a Bucket #3 long-term account and am contemplating the extra aggressive Vanguard World Wellington Admiral (VGWAX) to enhance Vanguard World Wellesley Earnings Fund. All three versatile portfolios in Desk #2 have related efficiency over the previous seven years, with Victory Pioneer Multi-Asset Earnings (PMAIX) and First Eagle World (SGENX) outperforming VGWAX year-to-date. SGENX is probably the most tax-efficient of the three.

Desk #2: Trending Average Danger Funds

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset; Morningstar for year-to-date returns as of July twenty fourth.

Determine #3: Trending Average Danger Funds

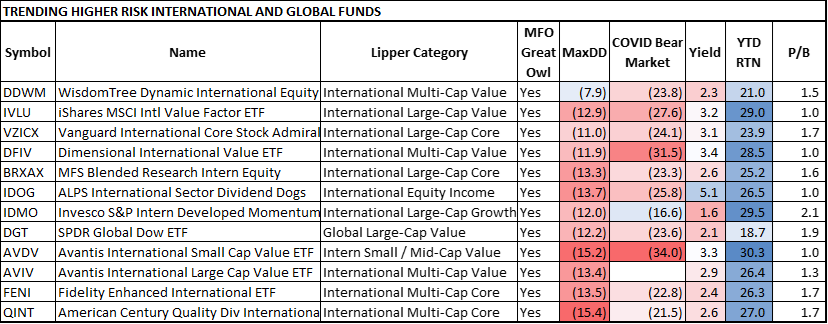

Larger Danger Funds

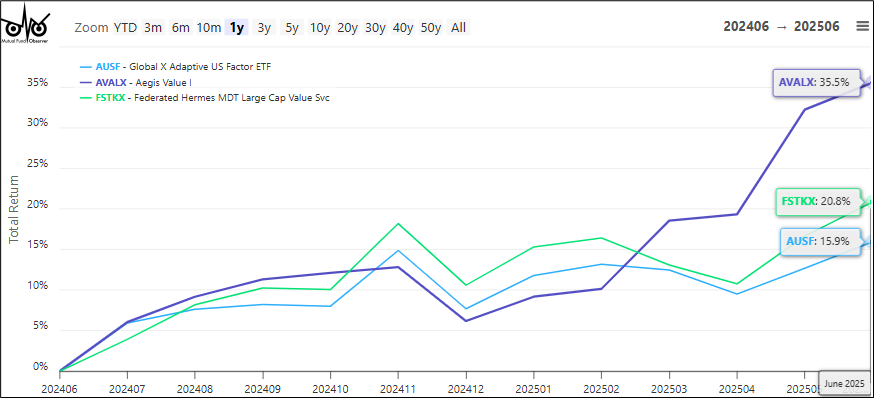

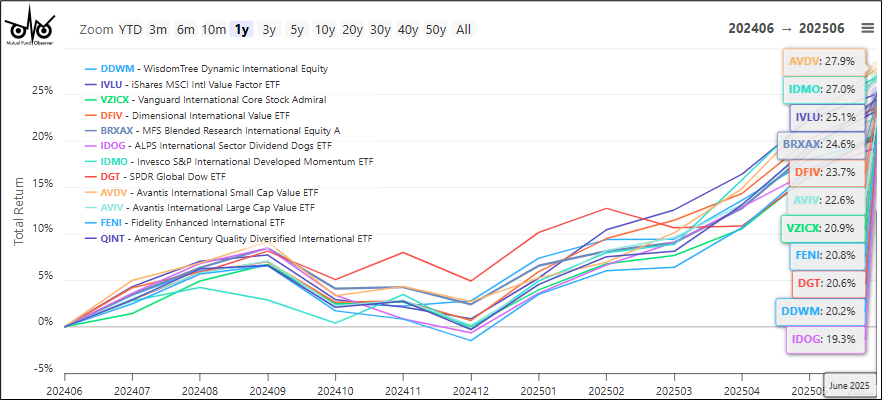

Worldwide and world fairness funds have finished extraordinarily properly this yr, partially due to their decrease valuations in comparison with the extremely valued home market. I contemplate my allocation to shares to be applicable, and I’m not wanting so as to add any extra. The one fairness fund that I bought just lately is Aegis Worth (AVALX), and I anticipate so as to add to that place over the approaching years.

Desk #3: Trending Home Larger Danger Funds

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset; Morningstar for year-to-date returns as of July twenty fourth.

David Snowball wrote about Aegis Worth (AVALX) within the MFO July E-newsletter, Aegis Worth Fund (AVALX), and I bought some for my youthful self. I ended shopping for particular person securities many years in the past, though I at all times favored small-cap worth shares. It’s listed as a Small-Cap Worth Lipper Class, however solely has 26% invested in the US and 50% invested in Canada. I purchased AVALX as a long-term holding and will add to it over the subsequent yr or two.

Determine #4: Trending Home Larger Danger Funds

With the steerage of Constancy and Vanguard, I used to be well-positioned with world and worldwide fairness funds at first of the yr. My last checklist of highest rated world and worldwide fairness funds is proven in Desk #4.

Desk #4: Trending World and Worldwide Larger Danger Funds

Supply: Creator Utilizing MFO Premium fund screener and Lipper world dataset; Morningstar for year-to-date returns as of July twenty fourth.

Determine #5: Trending World and Worldwide Larger Danger Funds

Closing

I analyze tendencies month-to-month, searching for alternatives to promote what shouldn’t be working to be able to purchase what’s trending. I make small adjustments when applicable. I take note of the adjustments that Constancy is making in my managed accounts. Lately, they’ve made some small defensive adjustments, together with reductions of each home and worldwide inventory funds, and added bond and different funds. This offers me a way of consolation.