Blessed are the forgetful, for they “get the higher” even of their blunders. Friedrich Nietzsche, “Our Virtues,” Past Good and Evil (1886)

Our summer time custom is to replace you on our ruminations and proposals from three (or 5) years in the past. That train serves three functions:

- It offers a actuality verify on whether or not our suggestions for choices to think about bear fruit. (Or are naked of fruit.)

- It offers a reminder of how a lot chaos you’ve already skilled. If we did a pop quiz (fast: the market three years in the past this week was a. crashing, b. flat, c. hovering, d. huh? The very best reply is “d” however the historic sample for 2022 was crash right into a bear in spring, soar right into a bull in summer time, crash once more in fall.)

- It offers focus. For me, largely. Summers are some mixture of lazy, hazy, and loopy. The self-discipline of trying again exactly three years and reassessing our lead story retains me from spending time obsessively cataloging the kinds of bees (no less than eight species, together with two distinct units of bumblebees) swarming the backyard.

In August 2022, we had simply been by means of a shocking market reversal: the S&P 500 fell over 20% coming into June, then jumped 12% in a July-August rally. A second crash and a second rally have been in our speedy future. Our lead characteristic, the Writer’s Letter, began with a query:

What does this imply for buyers?

First, it means you’ve a option to make. It’s essential to resolve to what diploma you consider the optimists – merchants assume the Fed is about finished, FundStrat says “the underside is in” and we’ve bought a 16% upside by yr’s finish, Morningstar declares that shares are buying and selling at traditionally low-cost costs – and to what extent you’re keen to wager your monetary future that they’re proper. In case you’re very assured, it’s risk-on time. In case you’re not, it’s time for warning. (A warning about letting your guard down: Don’t, August 2022)

Our suggestion flowed from two units of analysis.

First, when the market is rising, buyers solely keep in mind rising markets.

We neglect our worst funding errors whereas vividly remembering our successes, with this selective reminiscence being strongest amongst inexperienced buyers who regularly verify inventory costs. This “motivated forgetting” protects our egos however units us as much as repeat the identical expensive errors. (King King Li and Kang Rong, “Actual-life Buyers’ Reminiscence Recall Bias: A Lab-in-the-Discipline Experiment,” Journal of Behavioral and Experimental Finance, 2023)

This rosy-glasses reminiscence bias creates a distorted view of precise efficiency, making us extra prone to repeat dangerous behaviors that after paid off whereas ignoring the hard-learned classes from our errors. (Katrin Gödker, Peiran Jiao, and Paul Smeets. “Investor reminiscence.” The Assessment of Monetary Research 2025)

We persistently keep in mind our wins as greater than they have been. This inflated self-assessment immediately fuels overconfident decision-making in future trades. This reminiscence distortion helps clarify why buyers maintain participating in wealth-destroying behaviors like extreme buying and selling and poor diversification: we actually can’t keep in mind how badly these methods labored earlier than. (Daniel J. Walters and Philip M. Fernbach, “Investor reminiscence of previous efficiency is positively biased and predicts overconfidence,” Proceedings of the Nationwide Academy of Sciences, 2021)

We persistently keep in mind our wins as greater than they have been. This inflated self-assessment immediately fuels overconfident decision-making in future trades. This reminiscence distortion helps clarify why buyers maintain participating in wealth-destroying behaviors like extreme buying and selling and poor diversification: we actually can’t keep in mind how badly these methods labored earlier than. (Daniel J. Walters and Philip M. Fernbach, “Investor reminiscence of previous efficiency is positively biased and predicts overconfidence,” Proceedings of the Nationwide Academy of Sciences, 2021)

This reminiscence downside issues as a result of it blinds us to a vital funding actuality that truly does persist: danger. Therefore …

Second, returns could also be solely skin-deep, however danger goes to the bone. There may be sturdy and dependable educational {and professional} proof that previous volatility predicts future volatility for mutual funds and related investments. That is in sharp distinction to the extensively accepted view that previous returns don’t reliably predict future efficiency.

Educational research present that the usual deviation of a mutual fund’s previous returns (its previous volatility) is a robust predictor of its future volatility. For instance, one large-scale research discovered that previous volatility considerably and positively predicted future volatility for all funds of their pattern—which means that funds with excessive volatility previously have a tendency to stay unstable, and low-volatility funds keep comparatively steady.

The statistical significance of this relationship may be very excessive. In a complete pattern overlaying over 1,800 mutual funds and twenty years of information, the correlation between previous and future volatility was persistently optimistic and extremely vital throughout the board. (see, for instance, Feifei Wang, Xuemin Yan and Lingling Zheng, “Ought to mutual fund buyers time volatility?” Monetary Analysts Journal, 2021).

Wang, et al conclude that it’s way more worthwhile to speculate primarily based on previous volatility than on previous returns.

In 2022, we really useful that you would possibly begin including defensive stars to your due diligence listing. We recommended six funds on your consideration. Particularly, ones run by

people who perceive that the surest path to long-term success is avoiding overconfidence and overexposure to danger. They have an inclination to favor top quality companies bought at a reduction and usually have the flexibility to reduce fairness publicity when issues get frothy.

4 of the six went on to submit each greater alpha (i.e., extra positive aspects) and decrease beta (muted losses) than their friends. One largely excelled in loss administration, and one foundered after dropping its founding supervisor. Right here’s the snapshot:

| Type notes | 3-year Efficiency | MFO’s take | |

| Ariel International AGLOX | International giant worth, supervisor deeply skeptical of “a market on opioids” | Decrease alpha, decrease beta, decrease Sharpe ratio, much less upside seize, much less draw back seize | Founding supervisor Rupal Bhansali left Ariel in 2023 and based Double Obligation Cash Administration |

| FPA Crescent FPACX | Unconstrained multi-asset portfolio whose supervisor has been getting it proper for 30 years | Larger alpha, decrease beta, greater Sharpe, extra upside seize, much less draw back seize | MFO Nice Owl, outperforming its friends by practically 6% yearly. |

| SmartETFs Dividend Builder DIVS | Previously an energetic mutual fund, Guinness Atkinson Dividend Builder, which screens for firms with low debt and persistently rising dividends | Larger alpha, decrease beta, greater Sharpe ratio, decrease upside seize, a lot decrease draw back seize | Categorized as a worldwide fairness earnings fund, DIVS has crushed its friends by 2.7% yearly |

| Leuthold Core LCORX | Multi-asset portfolio pushed by rigorous quantitative screens. | Larger alpha, decrease beta, greater Sharpe, extra upside seize, much less draw back seize | Has outperformed its friends, with decrease volatility, in each longer-term trailing interval, 0.79% |

| Osterweis Strategic Revenue OSTIX | Multi-asset earnings fund from a famously independently store, basically unconstrained within the seek for the most-attractive risk-adjusted alternatives | Decrease alpha, decrease beta, greater Sharpe ratio, much less upside seize, destructive draw back seize | MFO Nice Owl for persistently high tier danger adjusted returns over all our measurement friends, with a 3.6% annual outperformance towards its multisector earnings friends. |

| Palm Valley Capital PVCMX | Small worth, two absolute worth buyers with 50 years of expertise between them, nonetheless caustic about present valuations | Larger alpha, decrease beta, decrease Sharpe ratio, very low upside seize, even decrease draw back seize | MFO Nice Owl, regardless of trailing friends by 5.4% yearly. |

Aside from Ariel and Palm Valley, Morningstar charges all of them as both four- or five-star funds (as of seven/30/2025). We can’t advocate Ariel simply now. Palm Valley Capital, nominally a small-value fairness fund, would possibly finest be assigned to the extra speculative wing of your fixed-income portfolio, together with international or high-yield bonds. The managers are extremely disciplined and gifted; the issue is that the market has not fallen to valuations that enable them to seek out many shares that meet their worth + high quality standards. So 70-80% of the portfolio has been invested in short-term bonds and money, making it a type of bond fund with a possible upside punch.

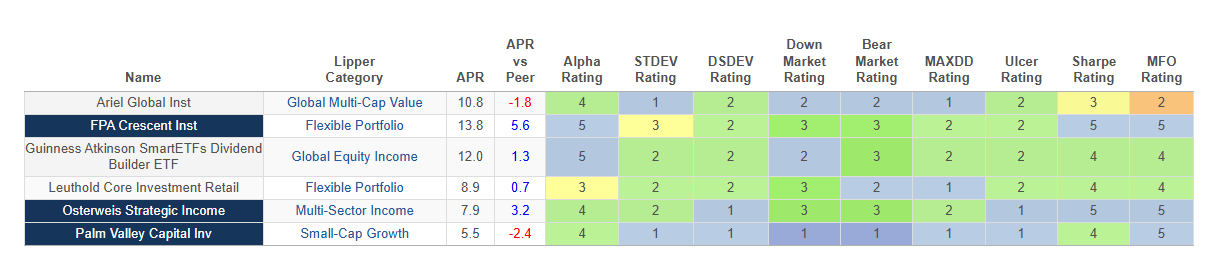

For visible learners, right here’s the identical three-year knowledge, color-coded. In all situations, keep in mind “blue is finest, inexperienced is sweet.”

How do you learn the desk? APR is the annual share return over the previous three years; the following column compares these returns to its Lipper friends, adopted by its Alpha (extra returns) score, the place a blue field means “high 20% of its peer group for this era.” Since danger is necessary, we offer a snapshot of 5 volatility measures (customary deviation, draw back or “dangerous” deviation, volatility in down markets and bear markets, then the depth of the fund’s worst decline). Lastly, we mix returns and volatility into three risk-return measures: the fund’s Ulcer Index (which seems at how far a fund falls plus how lengthy it stays down), Sharpe ratio (essentially the most extensively used of all risk-return metrics) and the fund’s MFO score which locations higher weight on danger aversion than does the Sharpe score.

Returns / dangers / risk-return steadiness. Acquired it?

Good!

Rather more full info – extra time durations, extra metrics, and 10,000 extra investments – is on the market at our sister web site, MFO Premium. Of us contributing $120 or extra to assist help MFO get a yr’s entry to MFO Premium.

Backside line

The US inventory market hovers at or close to document valuations. It may be that we’ve really achieved the “completely excessive plateau” that Yale economist Irving Fisher foresaw for shares … in his feedback round October 15, 1929.

Or we would have achieved the identical state that the market was really in on October 15, 1929.

I don’t know. Do you? If not, then the recommendation stands: search excellent danger managers who’ve demonstrated, over time, their willingness and talent to guard you even when it means “leaving cash on the desk” when markets are excessive.