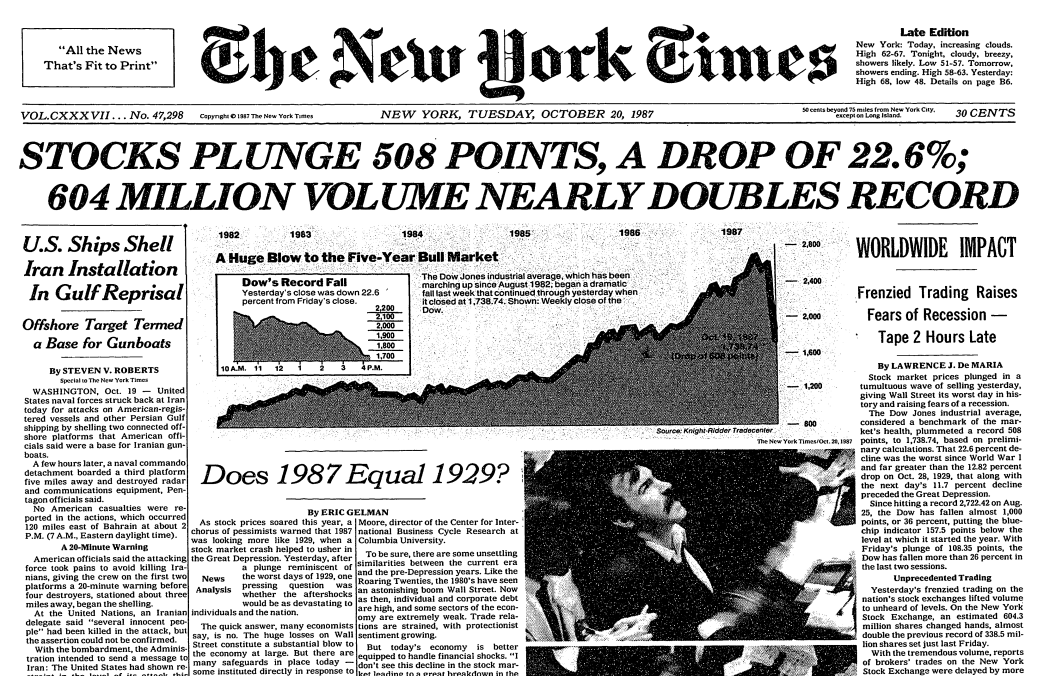

The 1987 Black Monday crash was so swift and extreme that some had been questioning whether or not it was the sign of an oncoming despair:

Most individuals didn’t truly assume 1987 equaled 1929 however the crash was painful sufficient to trigger pundits to at the least contemplate the likelihood that an financial calamity was on the horizon.

The inventory market fell greater than 20% in a single day and almost 35% over the course of per week however the financial influence was…nil.

The subsequent recession within the U.S. didn’t hit till the summer season of 1990. The inventory market completed the yr with a achieve of round 5% in 1987 and was off to the races following the crash.

The inventory market wasn’t huge and highly effective sufficient to trigger an financial downturn. That’s primarily as a result of not that many individuals owned shares again then. In 1987, round 25% of U.S. households owned shares in any kind — particular person shares, mutual funds, and so forth.

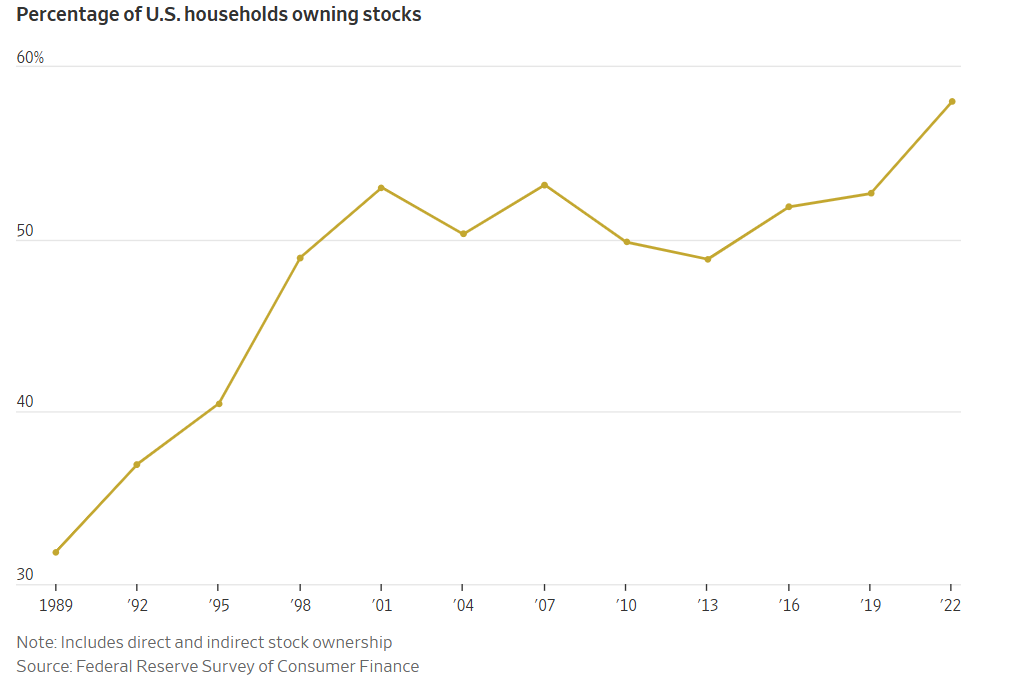

You possibly can see that inventory market possession didn’t actually take off in a significant approach till the Nineteen Nineties:

This chart is a few years outdated. Right this moment the quantity is 62% of households that personal shares. This enhance in possession means the inventory market is way extra essential to extra individuals than it was in 1987 (duh).

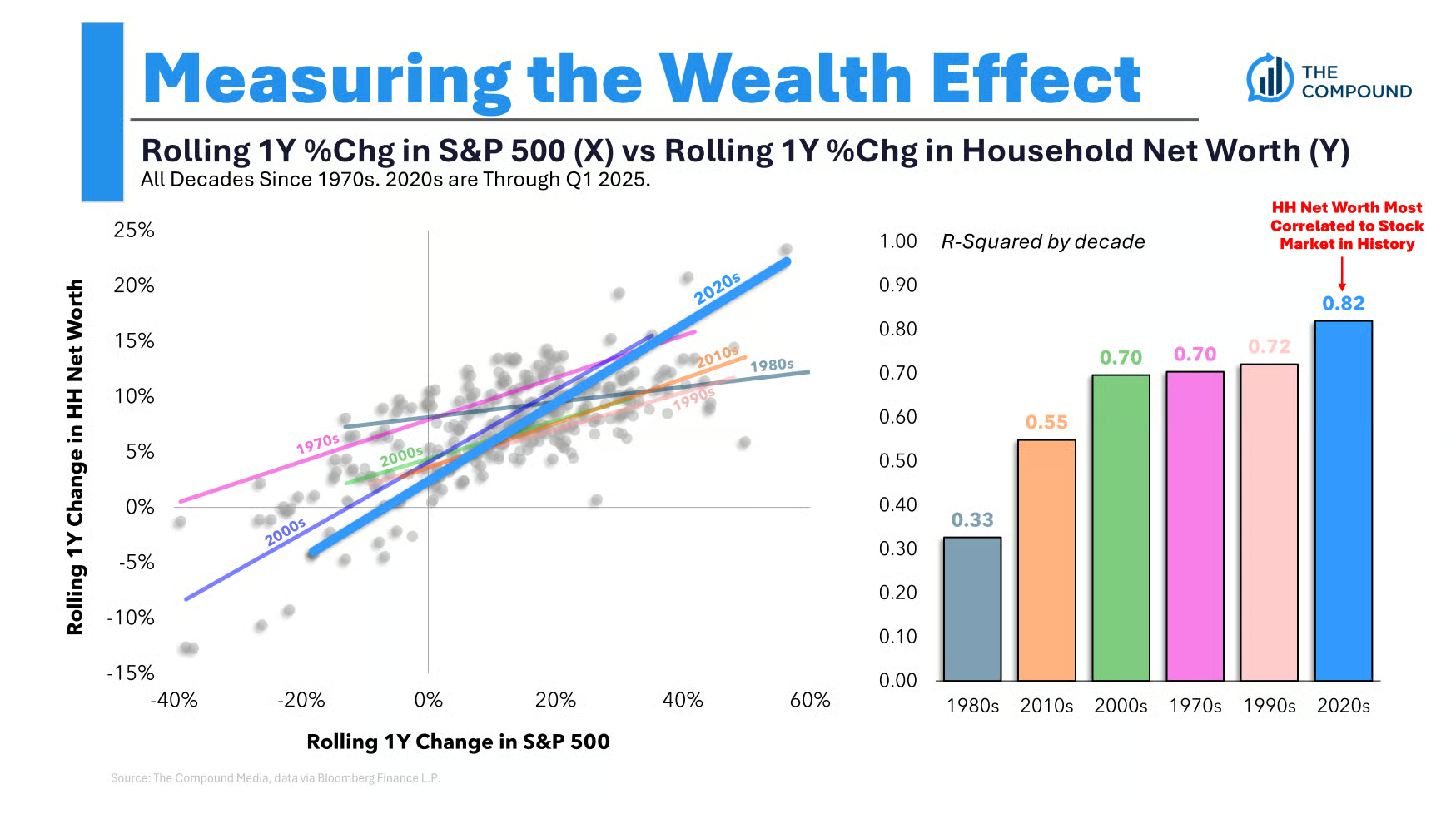

Chart Child Matt has a superb chart that exhibits how web price has by no means been extra intertwined with the inventory market:

You possibly can see the large leap this relationship has taken because the Nineteen Eighties.

Right here’s a superb stat from The Wall Road Journal that cements this concept:

Shares as a share of family monetary property surged to 36% within the first quarter, the best degree in information going again to the Fifties, in line with Ed Clissold, chief U.S. strategist at Ned Davis Analysis.

Now some individuals have a look at this information as a trigger for concern. A rising inventory market could possibly be inflicting extra households to spend cash extra loosely.

If the market rolls over, that would trigger households to chop again on consumption. Nobody is aware of if this wealth impact will present up for certain however it’s actually price contemplating.

A rising inventory market can be doubtless driving up spending for the wealthiest subset of the inhabitants. The highest 10% personal almost 90% of the inventory market.

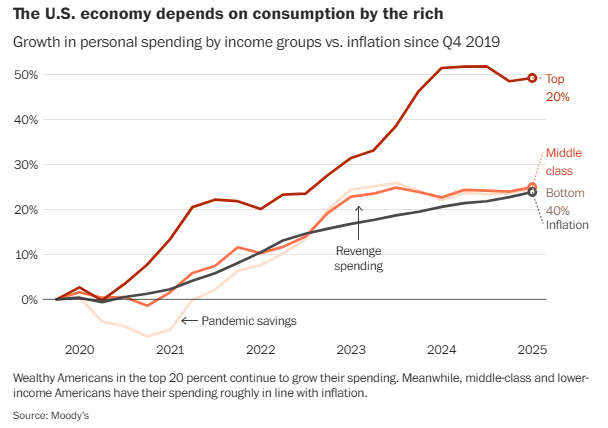

In response to The Washington Submit they’re additionally driving many of the spending:

“Within the close to time period, the whole lot rests on what that prime 10 % decides to do or to not do. The remainder of the earnings distribution is absolutely not consequential from a macroeconomic perspective,” Mark Zandi, chief economist at Moody’s, advised me.

Zandi finds that the highest 20 % of households proceed to develop their spending, although they’ve pulled again considerably amid a lot uncertainty. In the meantime, the underside 80 % of households are mainly simply retaining their spending development consistent with inflation. This can be a notable shift from the “revenge spending” period from 2022 to 2024, when individuals of all earnings ranges had been splurging considerably after the tip of pandemic lockdowns.

This chart says lots:

This isn’t all of the inventory market after all. This group additionally makes more cash.

Primarily this can be a chicken-or-the-egg concern — will a slowing financial system trigger the inventory market to fall or will a falling inventory market trigger individuals to rein of their spending?

It’s exhausting to say which one comes first.

The rising significance of the inventory market on the financial system is nice information. Having extra individuals investing in shares is an indication of progress. I hope it continues.

However will probably be fascinating to see if this rising significance ultimately has an influence on the financial system.

Can the inventory market trigger a recession?

The chance is larger in the present day than it’s ever been.

Michael and I talked concerning the rising significance of the inventory market on the financial system and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Prime 10%

Now right here’s what I’ve been studying this week:

Books:

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.