To guard your private property and construct a robust monetary profile on your firm, you have to perceive the excellence between enterprise credit score vs. private credit score. Enterprise credit score is the capital your organization borrows for development, whereas private credit score is the capital you borrow as a person.

On this article, we’ll present you why it is best to construct a strong standalone enterprise credit score profile and the way it unlocks entry to versatile capital that may transfer your corporation ahead.

Advantages of constructing sturdy enterprise credit score

Many firms begin off counting on their house owners’ private financial savings to cowl enterprise bills. That strategy isn’t sustainable for getting your corporation prepared for vital development.

A robust enterprise credit score profile means that you can safe funding primarily based on your corporation’s future potential and never the worth of your private property. To place it in perspective, your private credit score would possibly get you $50K, however your corporation credit score might qualify you for $10M.

There are three different main benefits a robust enterprise credit score profile presents:

- Larger credit score limits: Entry to extra capital means you’ll be able to fund transformative initiatives like buying a smaller competitor, automating your manufacturing line, or opening a brand new nationwide distribution middle.

- Decrease financing prices: A robust enterprise credit score profile means you’re extra prone to pay curiosity at decrease charges. Each greenback you borrow works tougher for you, bettering your web margins and flowing again to your backside line.

- Larger flexibility: You possibly can transfer quicker to make the most of alternatives once they seem, like shopping for stock in bulk at a deep low cost. Lenders and suppliers see you as a reputable, low-risk accomplice, in order that they’re capable of flip round purposes quicker and give you nice phrases.

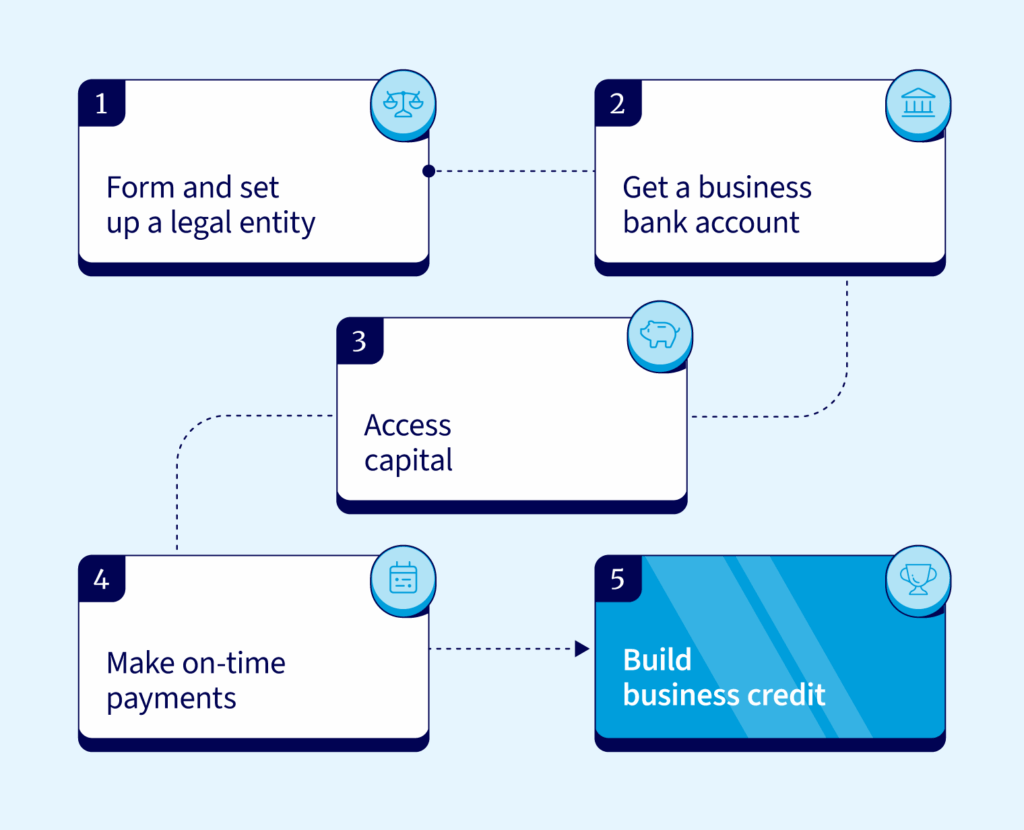

construct sturdy enterprise credit score

To safe the funding you have to energy firm development, take the next 5 steps to construct a robust enterprise credit score profile:

- Set up a separate authorized entity: Registering as an LLC or an S-Company differentiates you from your corporation. This enables the corporate to construct its personal credit score historical past.

- Arrange a D&B file: D&B is a major supply of information for business lenders. Apply for a free D-U-N-S Quantity to open a credit score file and make your corporation seen to extra lenders and suppliers.

- Open a enterprise checking account: Run all firm earnings and bills by a devoted enterprise account. This creates a transparent monetary path and reveals lenders you handle your funds nicely.

- Apply for credit score: Use a enterprise bank card for normal firm spending and pay it off on time. Do the identical with any suppliers that supply enterprise tradelines and report fee efficiency to the enterprise credit score bureaus. Each kinds of fee exercise assist construct your corporation credit score historical past.

- Pay payments on time: On-time funds are crucial a part of your corporation credit score rating. They show your corporation’s monetary well being and present lenders and suppliers that they will belief you to satisfy your obligations.

Constructing a robust enterprise credit score profile takes time and endurance. You possibly can sometimes set up your preliminary credit score file inside 30-60 days of finishing these steps, however growing a significant credit score historical past requires 6-12 months of constant fee exercise.

The strongest enterprise credit score profiles – those who unlock the most effective financing phrases and highest credit score limits – often take 12-24 months to develop. Beginning early with even small credit score quantities is essential, as lenders and suppliers worth constant fee patterns over time greater than the scale of particular person transactions.

Enterprise credit score vs private credit score: What’s the distinction?

The primary distinction between enterprise credit score and private credit score is:

- Enterprise credit score is capital you utilize to spend money on your organization; for instance, shopping for stock in bulk, funding a serious advertising and marketing marketing campaign, and launching a brand new product line. It’s vital to maintain this separate to construct a robust, impartial credit score profile for your corporation. That is arrange by acquiring bank cards and loans in your corporation’s title and EIN, not your private title.

- Private credit score is capital you spend on your self and your loved ones; for instance, shopping for a household automotive, funding a trip, and paying for a marriage. Mixing this with enterprise bills can jeopardize your private monetary well being. A clear separation is achieved by making certain all private spending makes use of accounts tied solely to your particular person Social Safety Quantity and private credit score historical past.

There are different vital variations, too, beginning with the credit score scoring system.

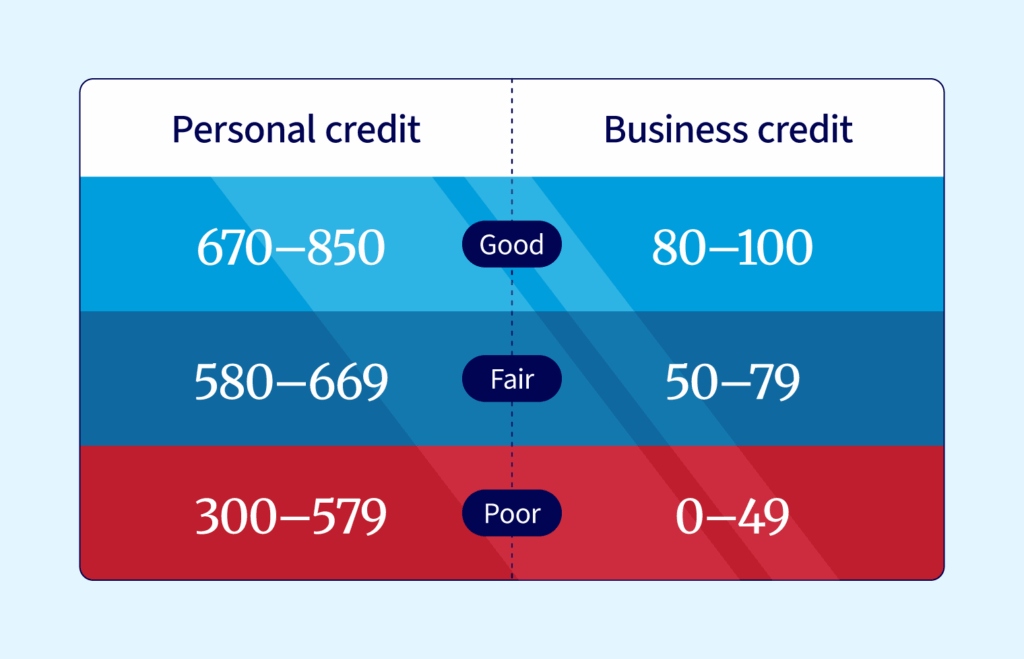

Scoring system

Private FICO® credit score scores vary from 300 to 850. The upper the rating, the stronger your profile is as a borrower.

Enterprise credit score scores charge your organization on a scale of 0 to 100, primarily based in your fee historical past with suppliers, distributors, and lenders.

A robust enterprise rating of 80 or above means you’re seen as a accountable borrower, which makes you extra prone to be accepted for bigger credit score amenities and decrease rates of interest.

Credit score limits

Companies can borrow way over people for one easy cause: companies borrow to take a position whereas individuals borrow to eat.

For instance, an individual would possibly finance an SUV for $50,000. From a monetary viewpoint, the SUV generates no capital and reduces the particular person’s discretionary earnings by month-to-month mortgage repayments.

A New York-based last-mile supply firm, in distinction, would possibly borrow $2M to purchase a fleet of vans. Every car generates income for your corporation, ideally greater than its financing prices. A van with a $1,000 a month fee would possibly generate an additional $3,000 in month-to-month web revenue.

That is the primary cause companies can borrow extra. They use the capital to buy property that pay for themselves and gas future development.

How the credit score is used

You possibly can see how customers and companies use finance in a different way by the several types of loans provided.

These are frequent examples of how customers use private credit score:

| Kind of finance | Typical use case |

|---|---|

| Private bank card | Folks use private bank cards to pay for on a regular basis purchases and handle short-term bills. |

| Auto mortgage | Auto loans finance the acquisition of non-public automobiles. |

| Private mortgage | Customers typically use private loans to cowl the price of one-time bills like house enchancment or a marriage. |

| Pupil mortgage | Pupil loans cowl bills like tuition charges and different prices for larger schooling. |

| Trip mortgage | This gives customers with the funds they should pay for a trip when their private funds received’t stretch to the price. |

As compared, enterprise loans goal a return on funding, like these examples:

| Kind of finance | Typical use case |

|---|---|

| Massive enterprise loans | Companies use massive enterprise loans to spend money on development by assembly the prices of growth or buying a competitor. |

| Enterprise line of credit score | Enterprise traces of credit score present firms with versatile capital for managing day-to-day money move and seizing sudden alternatives. |

| Gear financing | Companies use gear financing to buy particular, income-generating property like equipment or automobiles. |

| Bill factoring | Factoring unlocks working capital tied up in unpaid invoices and may help protect working capital. |

| Stock financing | Stock financing gives firms with the capital they should buy stock with out depleting their operational reserves. |

Reporting companies

Shopper credit score bureaus like Equifax and TransUnion observe your private fee historical past. Enterprise credit score bureaus like Dun & Bradstreet (D&B) observe the funds you make to suppliers, distributors, and lenders.

Obligation

With private credit score, you’re accountable for all money owed registered in your title. In the event you miss fee dates or your account goes into default, your private credit score rating will take a big hit, making it rather a lot tougher to borrow sooner or later.

When your corporation is registered as a separate authorized entity, like an LLC or company, it turns into accountable for its personal money owed.

Nevertheless, due to that separation, lenders typically require you to signal a private assure. That is whenever you conform to repay the excellent steadiness personally on a finance facility your organization takes out.

In some instances, lenders may additionally ask for collateral. Collateral is a selected enterprise asset, similar to gear or stock, that you simply pledge as safety for the financing. In the event you don’t sustain with repayments on the mortgage, the lender can recuperate the asset to assist cowl the excellent debt.

Why it’s vital to separate enterprise and private credit score

Establishing a definite monetary and authorized id is usually the primary strategic step in shifting a enterprise ahead. It lets you transcend utilizing your private bank cards and make the most of enterprise financing options to develop and scale.

4 vital advantages embody:

- Protects private property with a authorized firewall: Utilizing enterprise credit score establishes a transparent, authorized separation. It ensures that enterprise money owed and liabilities stay with the corporate, shielding your private property, like your own home and private financial savings, from business-related lawsuits or vendor disputes. Whereas private ensures could also be required for some loans, this separation limits your publicity and protects every little thing else.

- Builds a robust, impartial enterprise credit score profile: Counting on private credit score for enterprise wants prevents you from establishing a standalone enterprise credit score historical past. Utilizing devoted enterprise credit score merchandise is the one option to construct a robust enterprise credit score rating, which is important for unlocking larger funding limits and higher mortgage phrases primarily based in your firm’s monetary well being, not your private funds.

- Creates transparency for lenders and buyers: Mingling private and enterprise credit score is usually a main crimson flag for banks and buyers. It makes assessing your organization’s true monetary well being practically unimaginable, branding you as high-risk. A separate enterprise credit score historical past gives a transparent, verifiable image of your organization’s efficiency and debt administration, making it considerably simpler to safe funding and entice companions.

- Will increase enterprise worth and sale potential: When it’s time to promote, potential patrons conduct thorough due diligence. A historical past of utilizing enterprise credit score (as an alternative of non-public playing cards or loans) gives a clear, auditable path that proves your organization’s profitability and monetary duty by itself deserves. This standalone monetary story makes your corporation a extra helpful and sellable asset.

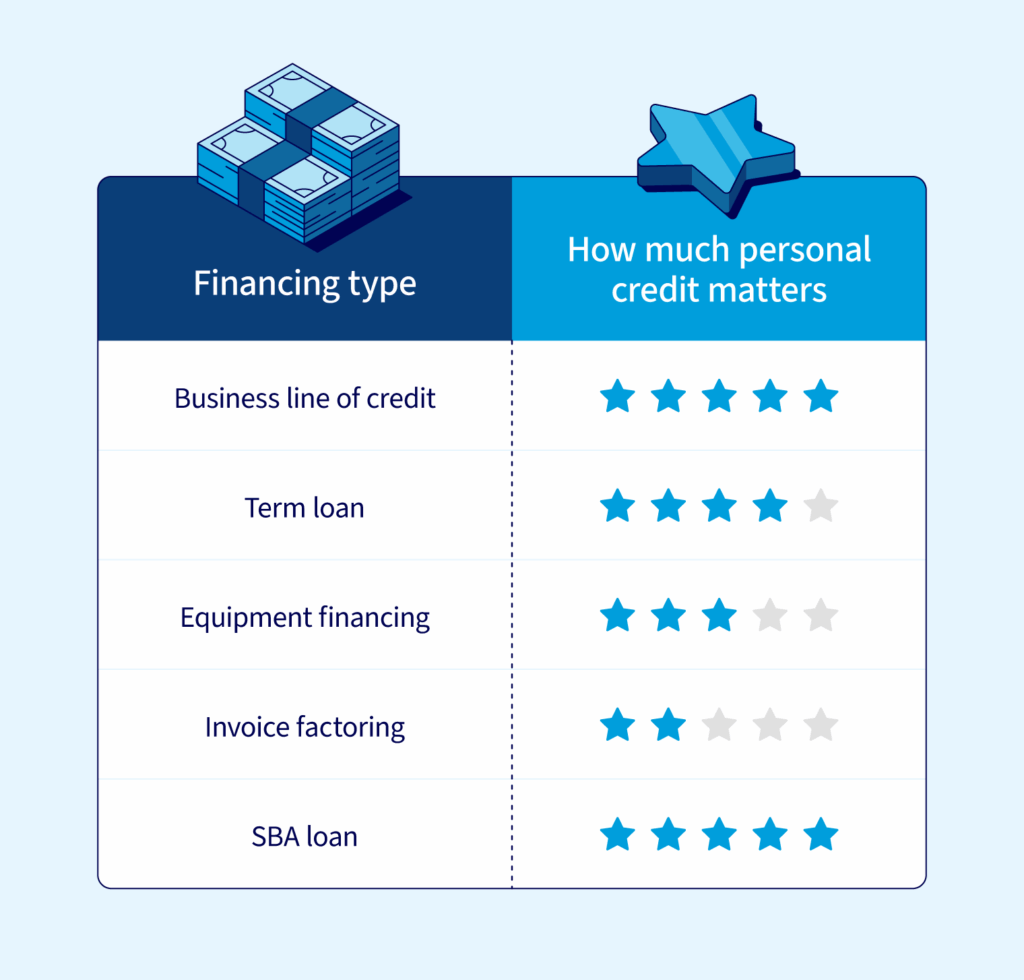

How private credit score impacts enterprise financing

Though your corporation credit score rating is extra vital, your private credit score rating nonetheless counts. That’s very true for youthful companies with restricted credit score histories. In these instances, lenders typically use your private rating to evaluate how financially disciplined you’re.

How a lot your private credit score issues is dependent upon the kind of funding you apply for, as you’ll be able to see from this desk:

Discover financing that helps your corporation objectives

Separating private funds from enterprise funds is a crucial step each enterprise has to take to develop. Understanding the enterprise credit score vs. private credit score distinction is step one to constructing an impartial monetary id on your firm. A robust impartial enterprise credit score profile opens the door to the versatile financing you have to gas your development. Nationwide Enterprise Capital’s skilled advisors provide help to discover the correct funding choice to maneuver your corporation ahead, from time period loans that fund your subsequent growth venture to buy order financing so you’ll be able to fulfill massive buyer orders with out affecting your working capital. Apply at the moment to seek out out what’s obtainable to you.

Ceaselessly requested questions

You want each, particularly within the early days. In the long run, your precedence ought to be constructing your corporation credit score rating. Whereas a robust private rating reveals you’re accountable with capital, a robust enterprise rating is what helps your organization qualify for development funding.

Lenders look first at your corporation credit score rating from bureaus like Dun and Bradstreet to evaluate the monetary well being of your corporation. If your corporation has a restricted credit score historical past, lenders may additionally evaluate your private FICO® rating as a key indicator of your monetary self-discipline.

Enterprise loans can have an effect on your private credit score. First, should you apply for a enterprise mortgage, many lenders carry out a tough private credit score verify, which might trigger a dip in your rating.

Second, should you signal a private assure, you make your self personally chargeable for the debt. If the enterprise then defaults on that mortgage, the lender can report the default in your private credit score historical past due to the assure. That reported default can severely impression your private credit score rating.