A line of credit score is a mortgage that provides you versatile entry to capital on an as-needed foundation. It’s a flexible monetary software that may be both secured or unsecured. So what’s the distinction between unsecured vs. secured line of credit score choices? Merely put, a secured line of credit score is backed by collateral, whereas an unsecured line of credit score just isn’t.

Secured and unsecured strains of credit score are two contrasting approaches to borrowing, every with its personal benefits, necessities, and potential dangers. We’ll lay out the variations, information you thru the method of selecting between the 2, and canopy alternate options, all to empower you to make the only option on your enterprise financing wants.

Key takeaways

- Secured strains of credit score are backed by collateral.

- Unsecured strains of credit score usually are not backed by collateral.

- Secured strains of credit score have decrease rates of interest and bigger borrowing limits, whereas unsecured strains of credit score have fast setups and extra utilization flexibility.

What’s a secured line of credit score?

A secured line of credit score is a versatile borrowing association the place a enterprise can entry funds as much as a sure restrict, backed by collateral in case the mortgage isn’t repaid. For companies, a secured line of credit score depends on collateral similar to actual property, tools, stock, receivables, or different invaluable property to again up the mortgage. If the borrower defaults, the lender can declare the collateral to recuperate their loss.

Lenders choose secured strains of credit score as a result of they carry lowered threat. This leads to decrease rates of interest and bigger borrowing limits for the borrower.

An instance of secured credit score is a development firm utilizing its tools as collateral to safe a line of credit score If the development firm defaults, the lender can then declare the tools to promote and recuperate the excellent debt.

| Secured line of credit score execs | Secured line of credit score cons |

| • Decrease rates of interest because the lender’s threat is lowered • Larger credit score limits and entry to extra funds • Simpler to be authorised, even with a less-than-stellar credit score rating |

• Threat of asset loss if you happen to’re unable to repay the debt • Some have restrictions on how you should use the funds • Setup might be advanced with extra paperwork |

What’s an unsecured line of credit score?

An unsecured line of credit score, then again, doesn’t require any collateral. The lender affords the mortgage primarily based purely on the borrower’s creditworthiness, monetary efficiency, and money stream.

Whereas this eliminates the chance of shedding an asset, unsecured strains of credit score sometimes have a extra stringent eligibility course of and better rates of interest to compensate for the lender’s elevated threat.

Banks not often provide unsecured financing, however non-public credit score lenders do. Non-public credit score allows debtors to entry capital with out collateral protection whereas offering a quicker, relationship-focused course of.

An instance of an unsecured line of credit score is a restaurant that’s authorised primarily based on robust credit score historical past and money stream. The restaurant makes use of the funds to rent extra employees for big particular occasions. There isn’t any collateral concerned.

| Unsecured line of credit score execs | Unsecured line of credit score cons |

| • No collateral required, so that you don’t threat shedding an asset if you happen to can’t repay • Flexibility in how you utilize the funds • Fast setup, as there’s no want to determine collateral possession |

• Larger rates of interest because of larger threat for lenders • Decrease credit score limits/entry to much less capital • Sturdy credit score is required since approval is more durable with out collateral |

What’s the distinction between secured and unsecured credit score?

As you possibly can see, secured and unsecured enterprise strains of credit score differ in collateral necessities, rates of interest, credit score limits, approval issue, and extra. Let’s lay out these variations aspect by aspect:

| Foundation of comparability | Secured line of credit score | Unsecured line of credit score |

| Collateral requirement | Collateral is required as safety towards the credit score line. | No collateral is required. |

| Rates of interest | Charges are normally decrease. | Charges are normally larger. |

| Credit score restrict | Larger borrowing limits are simpler to barter. | Decrease borrowing limits |

| Approval issue | It’s simpler to get authorised when you have an asset of serious worth to make use of as collateral. | It may be more durable to get authorised, particularly for these with weaker credit score. |

| Use of funds | Chances are you’ll be restricted to a particular function (e.g., a line of credit score secured by tools, or you might want to make use of stock for operational bills or asset purchases). | There are typically no restrictions on using funds. |

| Threat to borrower | If the borrower defaults, they threat shedding the asset used as collateral. | Defaulting can result in lawsuits, wage garnishments, and credit score rating injury. |

Now that you recognize the important thing variations, let’s talk about how to decide on the precise choice for your small business.

How to decide on between a secured vs. unsecured line of credit score

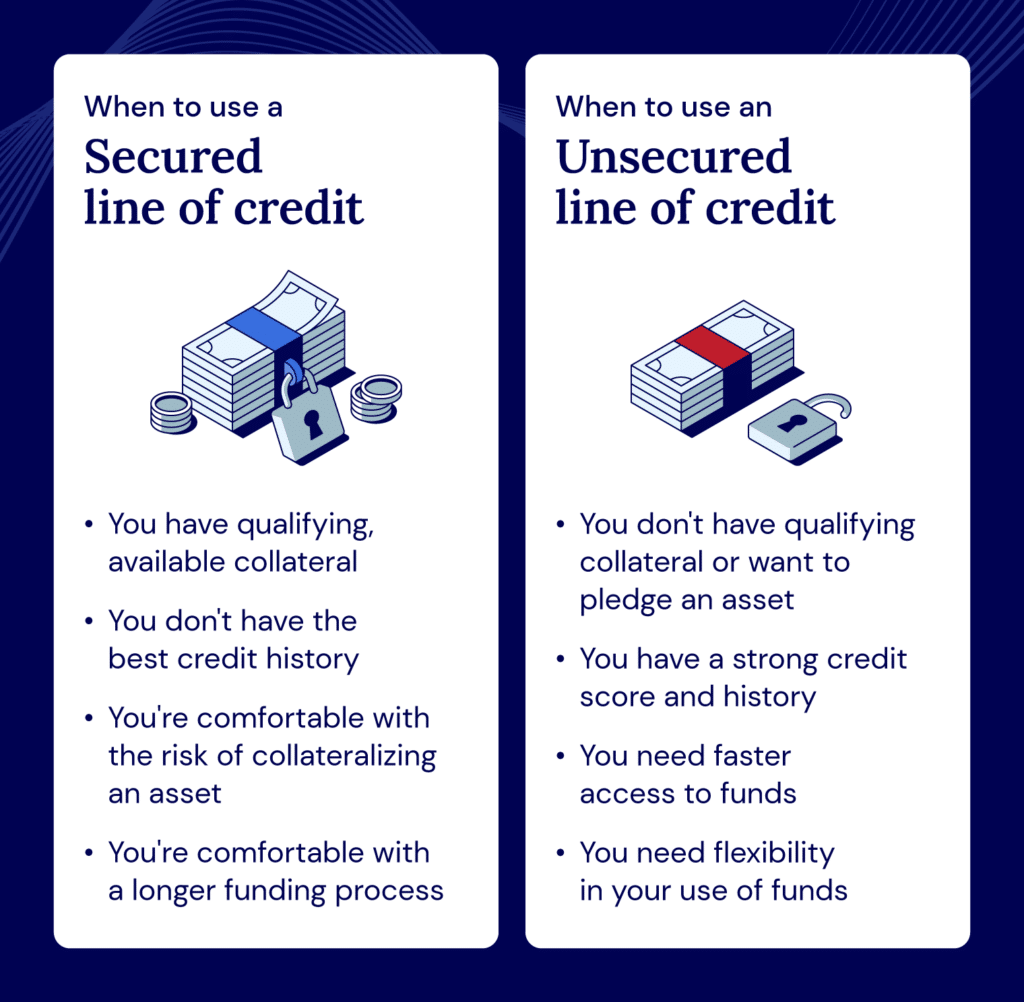

So, which line of credit score kind is correct for your small business? To resolve, you’ll want to think about your capability to offer collateral, your credit score rating, the quantity of capital you’ll want to borrow, the rates of interest on provide, and your timeline wants.

Think about collateral availability and threat tolerance

A secured line of credit score could also be a greater choice for companies which have property to pledge and are keen to threat these property. Unsecured strains of credit score could also be greatest if you happen to don’t have these property or need to threat shedding one.

Word credit score profile and qualification necessities

Lenders could also be extra versatile on credit score rating for a secured line of credit score since they’re backed by collateral. As a result of unsecured strains of credit score are riskier than secured ones, lenders are choosier about who they lend to. Due to this fact, you usually want a powerful credit score historical past to qualify for an unsecured line of credit score.

Right here’s an summary of how qualification necessities could differ:

| Secured line of credit score | Unsecured line of credit score |

| Evaluation of property: Lenders will assess the worth of your property that can be utilized as collateral. | Credit score rating verify: Lenders will completely verify your credit score rating, which frequently must be good or wonderful. |

| Credit score historical past overview: Lenders will overview your credit score historical past, though they could be extra versatile on credit score rating since they’re backed by collateral. | Earnings verification: To show which you could repay the mortgage, you will need to present proof of earnings (ex., pay stubs, tax returns, or financial institution statements). |

| Monetary overview: The lender will overview your monetary statements (together with a overview of earnings, present money owed, and general monetary well being) to evaluate your capability to repay the mortgage. | Evaluation of economic well being: Lenders will overview your present money owed, monetary standing, and typically a marketing strategy. |

| Approval and phrases: If authorised, the lender will set up phrases for the road of credit score, together with the credit score restrict, rate of interest, and compensation schedule. | Approval and phrases: If authorised, the lender will offer you the phrases of the credit score line, together with the credit score restrict, rate of interest, and compensation schedule. |

Understand that the qualification course of for each secured and unsecured strains of credit score largely relies on the lender’s necessities.

Assess your funding quantity and timeline wants

An unsecured line of credit score could also be higher for companies that want fast entry to funding however not as massive a credit score restrict, and are keen to pay larger curiosity charges.

Then again, a secured line of credit score could also be greatest if you’ll want to borrow extra. It additionally normally has longer compensation phrases.

To summarize, a secured line of credit score could be extra appropriate if you happen to can present collateral and require a bigger mortgage with decrease rates of interest. When you’ve got a powerful credit score rating, want funds shortly, and don’t need to threat an asset, an unsecured line of credit score could also be extra acceptable.

Options to enterprise strains of credit score

As a enterprise proprietor, it’s vital to think about all of your financing choices. Listed here are some alternate options to enterprise strains of credit score to think about:

- Money stream financing: Money stream financing is a sort of short-term financing that entails a mortgage backed by your small business’s anticipated money stream.

- Time period loans: With a time period mortgage, you borrow a lump sum upfront with an agreed compensation schedule and particular borrowing phrases.

- Bill factoring: Bill factoring is a sort of accounts receivable financing wherein you promote your excellent invoices to a 3rd social gathering. This permits your small business to lift capital up entrance.

- Gear financing: Gear financing lets companies buy tools with out paying the complete value upfront. You should utilize it to purchase tools like equipment, automobiles, and workplace furnishings.

- SBA funding: An SBA mortgage is assured by the Small Enterprise Administration. You should utilize any such mortgage for varied objectives, like shopping for tools and increasing.

Doing in-depth analysis on all of your choices will assist you to take advantage of educated alternative in relation to your particular monetary scenario and enterprise wants.

Discover the versatile funding you want with Nationwide Enterprise Capital

Weighing secured vs. unsecured strains of credit score relies upon closely in your particular person enterprise. Whereas secured strains of credit score usually have decrease rates of interest and better borrowing limits, they do carry the chance of shedding the collateral you’ve pledged in case of default. Then again, unsecured strains of credit score could also be quicker to acquire and don’t require collateral, however sometimes include larger rates of interest and extra stringent credit score necessities.

If choosing the proper financing choice nonetheless feels overwhelming, we at Nationwide Enterprise Capital might help. Our skilled enterprise advisors are right here to reply your questions and information you thru every thing you’ll want to discover the most effective financing choices for your small business.

Whether or not you want stock financing or one other financing choice, we’re right here to propel your small business ahead. We provide varied strains of credit score choices to assist your organization take that subsequent vital step. Fill out your on-line utility to get began.

Continuously requested questions

The draw interval is when a enterprise can entry funds from its line of credit score. As soon as it’s over, the corporate has to start out repaying the excellent stability and may now not draw extra funds.

The compensation phrases inform you precisely when and the way you’ll want to repay the borrowed funds. They could dictate the compensation interval, the minimal fee required, and extra.

There are dangers related to each secured and unsecured strains of credit score if you happen to default.

With a secured line of credit score, the first threat is that you would lose the asset you’ve pledged as collateral if you happen to’re unable to repay the borrowed quantity. This could possibly be a property, tools, or different invaluable property.

For an unsecured line of credit score, the chance lies within the potential for injury to your credit score rating if you happen to fail to make repayments. This could make it tougher to safe credit score sooner or later. Moreover, lenders could take authorized motion if you happen to fail to repay.

Actual property, tools, enterprise stock, or different high-value property are generally used as collateral for a secured line of credit score. The kind of property accepted as collateral could differ relying on the lender’s insurance policies.

In case you default on a secured line of credit score, the lender has the precise to grab the asset you’ve used as collateral to recuperate the debt. Within the case of an unsecured line of credit score, the lender could report the default to credit score bureaus, negatively affecting your credit score rating. They could additionally sue you to recuperate their funds.