Each profitable enterprise proprietor understands that progress requires strategic monetary planning and the correct instruments to grab alternatives after they come up. Whether or not you’re increasing operations, investing in new gear, or profiting from market alternatives, having robust enterprise credit score opens doorways to prospects.

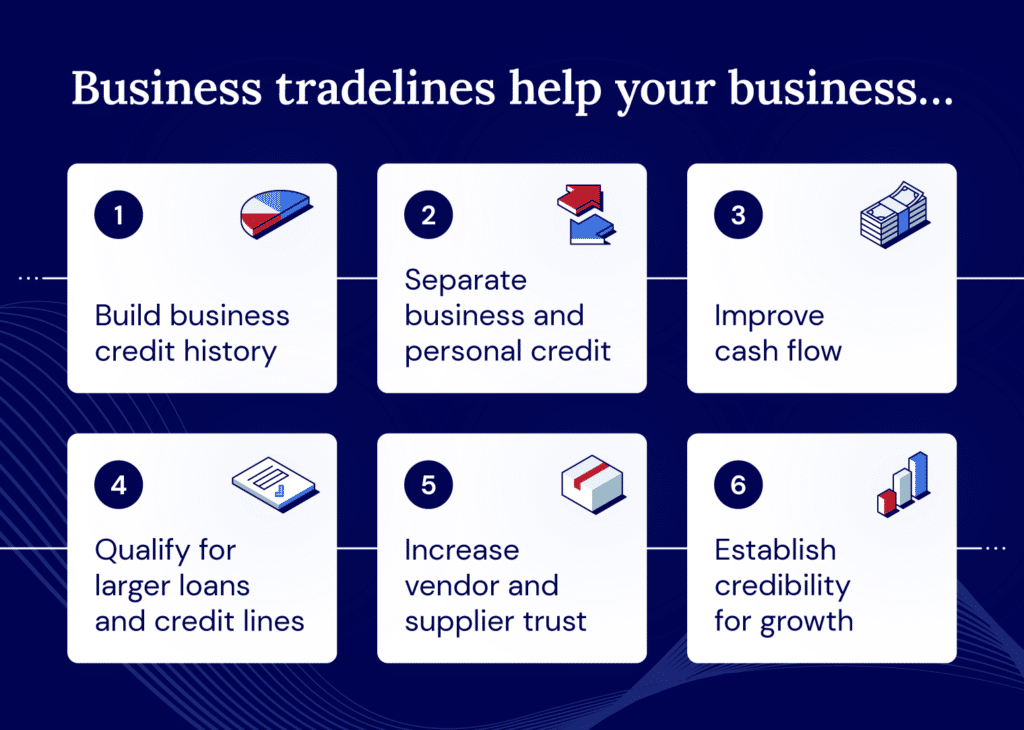

Enterprise tradelines supply enhanced money move and sustainable progress. With established commerce credit score, companies achieve entry to higher financing phrases and the monetary basis wanted to scale confidently. A tradeline serves as each a progress accelerator and a security internet, making certain you’re ready for no matter alternatives or challenges come your manner. We’ll discover how they work and in the event that they fit your progress objectives.

What are enterprise tradelines?

A enterprise tradeline is a credit score account that what you are promoting establishes with a vendor that studies again to a serious credit score bureau. The same account, however not all the time the identical, is a net-30, which is an account with a vendor that’s restricted to a 30-day compensation interval.

For the reason that tradelines are a type of credit score, they’re reported to the principle credit score bureaus, like Experian and Equifax. Not solely does the tradeline assist what you are promoting construct credit score, however it additionally helps the corporate get hold of quick money move funding. Do not forget that a enterprise line of credit score will mirror your organization’s creditworthiness and historical past, and is unrelated to your individual private credit score profile.

Why are enterprise tradelines essential?

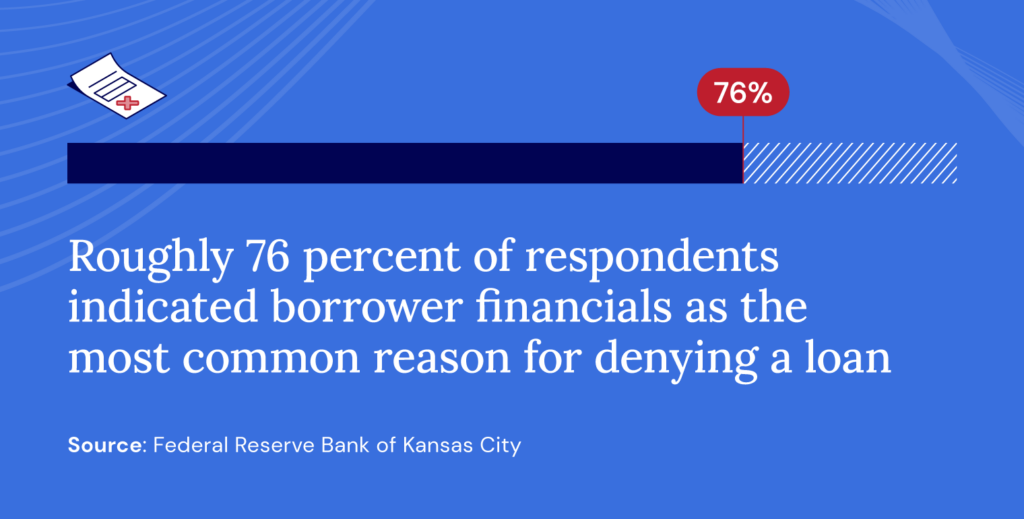

Enterprise tradelines are essential as a result of they supply firms with quick entry to items and providers with out requiring upfront money funds, considerably bettering money move administration and operational flexibility. These established commerce accounts with suppliers and distributors enable companies to buy stock, gear, or supplies on favorable fee phrases, liberating up working capital for different essential growth-focused investments like advertising, hiring, or growth.

By extending fee cycles and creating predictable money outflows, tradelines enable companies to higher align their bills with income cycles and keep optimum money reserves. This enhanced liquidity administration means firms can reply extra rapidly to sudden alternatives or challenges with out depleting their money reserves or searching for emergency financing.

For rising companies, tradelines create a monetary buffer that allows strategic decision-making quite than reactive scrambling, permitting firms to benefit from market alternatives, handle seasonal fluctuations, and keep regular operations even throughout momentary money move challenges.

Key details about enterprise tradelines

Like another sort of financing, comparable to a line of credit score, enterprise tradelines don’t come with out some sort of danger. You should know what you’re getting into earlier than deciding on getting a tradeline on your firm.

Listed here are among the professionals and cons to think about:

Professionals

- Fast manner to enhance money move

- Simpler to qualify for than a conventional small enterprise mortgage

- Decrease rates of interest

- A straightforward solution to construct a credit score historical past and rating

Cons

- Small credit score limits to begin

- Mortgage charges are a part of the deal

- Brief compensation phrases

- Can result in a steady cycle of debt with out proactive compensation

How do you get a enterprise tradeline?

If you happen to’ve weighed the professionals and cons of tradelines for enterprise credit score and determined it’s best for you, right here’s what you’ll must get one.

- Open a credit score account with at the least one firm that studies to a serious credit score bureau.

- Ensure you meet the corporate’s credit score necessities, which can more than likely contain your credit score rating, credit score historical past, and size of time in enterprise.

- Be ready to supply pertinent data comparable to your worker identification quantity (EIN), enterprise checking account, enterprise registration, and licensing.

When you’ve established one revolving enterprise line of credit score, you must have a better time getting the subsequent one.

What number of tradelines ought to you’ve?

If you wish to construct your credit score rating in a shorter period of time, it’s not a foul concept to have at the least two vendor tradelines, if no more. Retaining these accounts energetic and utilizing them on a semi-regular foundation will assist set up your credit score. The extra of these kinds of transactions you’ve in your report, your rating will slowly enhance, and lenders will likely be extra prepared to supply new enterprise tradelines sooner or later.

| Essential to recollect: |

| Sustaining a number of open tradelines requires cautious administration. Overextending throughout too many credit score accounts can pressure your skill to fulfill fee obligations and harm relationships with key suppliers.

Moreover, juggling quite a few tradeline funds can create money move complexity and enhance the chance of missed funds, which may lead to lowered credit score limits, much less favorable phrases, and even account closures that harm what you are promoting. |

The right way to construct enterprise tradeline exercise

When you’ve bought a base of enterprise credit score tradelines, you can begin constructing your exercise and bettering your credit score. Ensure you’re managing your accounts in a wise manner so that you’ll keep in good standing together with your lenders and credit score bureaus.

One of the best methods to do that embrace maintaining your balances low, making funds on time, maintaining common exercise (like straightforward, small purchases), and being sensible about what different types of credit score you employ. If you happen to open too many accounts without delay, this is usually a purple flag to collectors.

One straightforward solution to keep on prime of your credit score is thru a credit score monitoring service. These providers will replace you often about your credit score rating, monitor your credit score exercise, and warn you about actions which may have an effect on your rating or total profile. These providers are very reasonably priced and remove quite a lot of the stress related to monitoring your credit score by yourself.

Safe a credit score line with Nationwide Enterprise Capital

Advancing your credit score profile, constructing capital, and progressing towards your progress plans are all key benefits of enterprise tradelines. If you happen to suppose enterprise credit score is an effective answer for you, Nationwide Enterprise Capital has skilled enterprise advisors who may help you perceive your choices.

If you happen to nonetheless have questions, we are able to stroll you thru the applying course of so you’re feeling comfy earlier than you make a closing choice.

Steadily requested questions

Sure, enterprise tradelines are authorized. Some extra controversial strategies of shopping for and promoting tradelines – whereas not unlawful – are often frowned upon within the credit score trade.

Sure, you should buy enterprise tradelines, however it’s usually discouraged by credit score bureaus. This includes paying a 3rd social gathering so as to add you to a credit score account, primarily permitting you to “piggyback” off their good credit score to assist construct your individual. Bureaus imagine shopping for a tradeline is an try to misrepresent your credit score historical past, and a few prohibit promoting tradelines altogether.

To get a tradeline on what you are promoting credit score report, you merely want to ascertain a credit score account with one other enterprise or vendor that studies again to one of many main credit score bureaus. Repaying a line of credit score on time can even assist construct your credit score and assist you to achieve entry to extra capital sooner or later.