Rising a small enterprise requires versatile financing options that may preserve tempo along with your progress ambitions. Whereas conventional lenders usually require in depth collateral and prolonged approval processes, money stream financing presents a quicker, extra versatile possibility. Based on the Nationwide Small Enterprise Affiliation (NSBA), 37% of companies can’t safe the financing they want. Money stream financing presents precisely this sort of agile funding answer.

Money stream financing gives working capital based mostly on your corporation’s income stream relatively than requiring collateral or excellent credit score. You possibly can seize progress alternatives, handle seasonal fluctuations, increase operations, and keep aggressive. On this information, we’ll discover how money stream financing works, what varieties of funding can be found, and what steps you may take to qualify for money stream financing.

What’s money stream financing for small companies?

Small enterprise loans for money stream are an unsecured sort of financing designed for companies in any respect levels of operation. As a substitute of collateral, lenders use your corporation’s income efficiency to find out eligibility.

A lender will consider your earlier money stream, projected future money stream, and different elements to evaluate your creditworthiness. Credit score scores and time in enterprise play much less of a job right here than in asset-based options.

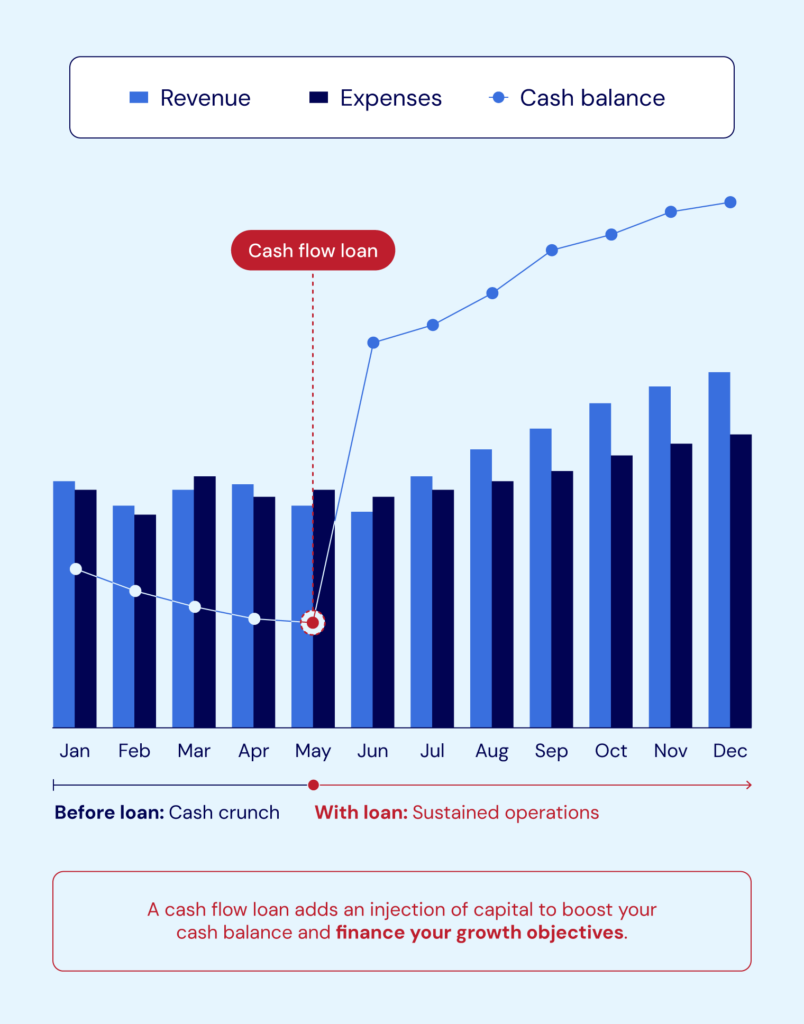

For an thought of how money stream financing works, check out the chart beneath.

Money stream funding quickly boosts a enterprise’s money steadiness, permitting it to benefit from progress alternatives. The short entry to capital makes money stream loans an excellent selection for companies with rapid alternatives. These loans may also be used as a bridge mortgage that can assist you keep on high of bills whilst you safe a extra everlasting financing answer.

How do small enterprise money stream loans work?

Small enterprise money stream loans work by granting your corporation funding based mostly on previous and future money stream. Lenders will plug your money stream projections, seasonal revenue, share of returning prospects, bills, and incoming and outgoing transaction historical past right into a system to find out your most borrowing quantity.

You don’t want collateral, and the lender points funds in a lump sum cost. Compensation is calculated based mostly in your future projected money stream, and funds are sometimes automated.

You should utilize the capital for any enterprise wants, like protecting payroll, making a big capital buy, and bridging seasonal gaps.

Money stream loans vs. asset-based loans: Essential variations

The important thing distinction between money stream loans and asset-based lending is collateral. When making use of for money stream loans, you gained’t be required to supply an asset as collateral; as an alternative, you’ll be evaluated based mostly in your money stream data.

Right here’s a fast overview of among the distinct variations between money stream lending and asset-based financing.

| Money stream loans | Asset-based loans | |

| Kind of mortgage | Unsecured funds | Secured funds |

| Who’s it good for | Companies with sturdy income | Companies with substantial property |

| Widespread collateral | Projected money stream | Gear, autos, and stock |

| Qualification standards | Good credit score rating, substantial money stream | Excessive-value collateral, sturdy credit score |

Kinds of money stream financing for small companies

A number of varieties of small enterprise money stream loans can be found to you. Let’s have a look at among the commonest choices and the way they work.

Money stream financing

Money stream financing makes use of enterprise efficiency to supply entry to rapid capital. Lenders consider your money stream statements, income tendencies, and profitability.

If your corporation offers with cyclical or seasonal exercise, you’ll profit from this sort of financing, as it will possibly enable you to bridge the sluggish season and put together for the busy time of 12 months.

Enterprise line of credit score

Enterprise traces of credit score are one of the versatile financing choices obtainable. They’re revolving credit score traces you may draw on everytime you want capital for your corporation bills. As you repay what you’ve borrowed, you may draw on the identical funds once more, permitting you to remain proactive in tackling future challenges.

You should utilize funds from a enterprise line of credit score for nearly any enterprise goal, like serving to you repay bills, hiring new workers, or launching a advertising and marketing initiative.

Brief-term money stream loans

A brief-term money stream mortgage is your corporation’s best money stream financing possibility. This kind of financing is right for small companies which have wholesome, dependable money stream and want versatile entry to capital.

Mortgage quantities are typically small, reimbursement durations quick, and rates of interest excessive, however eligibility standards are low. Youthful companies might be able to qualify with a historical past of constant, sturdy money stream.

Subordinated debt

Subordinated debt, or sub debt, is funding on the subordinated or secondary place. Because of this this lender takes a again seat to different lenders or lienholders within the capital stack. If your corporation have been to fold up store, your different lenders would gather first, and any funds left would go to paying off your subordinated debt.

Briefly, subordinated debt is a money stream answer companies can leverage for extra capital after they have current (senior) financing in place.

Execs and cons of small enterprise money stream loans

Whether or not a money stream mortgage is an effective selection for your corporation will rely in your distinctive enterprise wants. Right here’s a fast assessment of the professionals and cons of a money stream mortgage.

| Execs | Cons |

| Doesn’t require collateralQuick funding typeSmooth software course of | Rates of interest will be highLow mortgage values |

Money stream loans could be a nice useful resource for small companies. Nonetheless, it’s necessary to steadiness the advantages of a money stream mortgage with the challenges.

Tricks to qualify for a money stream mortgage

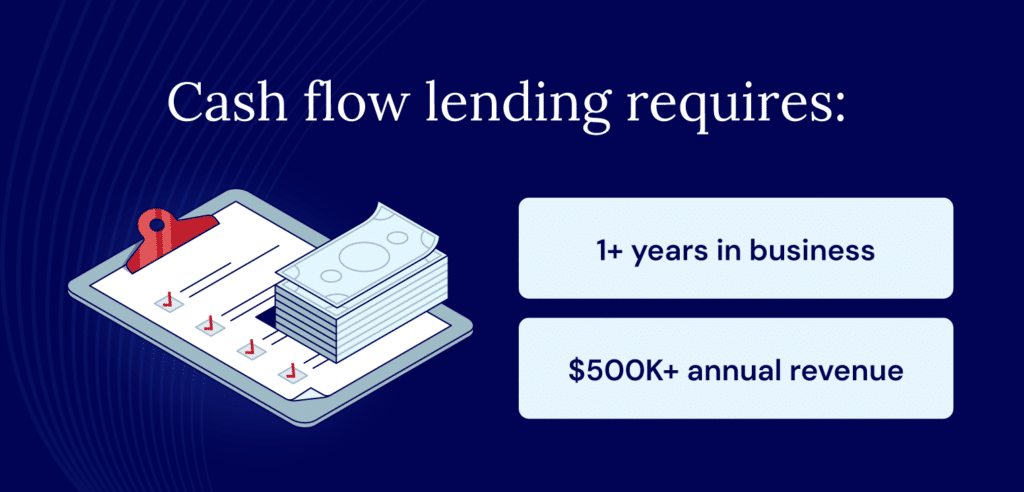

Qualifying for a money stream mortgage is way simpler than most asset-backed options. You don’t want collateral, however you will want a strong income historical past. For reference, listed here are Nationwide Enterprise Capital’s minimal {qualifications}:

- 1+ 12 months in enterprise

- $500,000 in annual income

When you qualify, full our digital software to start out the method. A enterprise finance advisor will attain out to be taught extra about your corporation financing wants.

When you don’t qualify for money stream financing proper now, you may attempt ready till you’ve been in enterprise longer, work on enhancing your credit score rating, and minimize down your bills.

Discover money stream financing with Nationwide Enterprise Capital

Money stream loans for small companies will help cowl the prices of each day bills, new gear, facility expansions, and extra. With no collateral wanted and quick funding, money stream financing allows you to get a enterprise mortgage with much less trouble.

Nationwide Enterprise Capital helps varied money stream financing choices, together with short-term money stream loans, enterprise traces of credit score, and bill factoring. Working with one among our enterprise advisors, you may get personalised recommendation on which financing answer is greatest to your scenario. Apply immediately and take step one to getting funded.

Incessantly requested questions

Money stream loans can rapidly inject liquidity into your each day operations. When you uncover a possibility to develop your corporation, you may leverage a money stream mortgage with out placing an excessive amount of strain in your money stream.

Mortgage funds can improve your buying energy, streamline money stream throughout a busy or sluggish season, cowl working prices, and extra.

Money stream loans require much less documentation than asset-backed options, however it is best to anticipate to supply some primary data that tells the lender a bit about you, your corporation, and the way it’s trending. This may embrace: financial institution statements, steadiness sheets, money stream statements, tax returns, licenses, and extra.

Money stream loans usually carry shorter reimbursement phrases and infrequently lengthen previous 18 months. Because the reimbursement is on the shorter aspect, each day and weekly funds are frequent, though month-to-month cost choices are additionally obtainable.