A reader asks:

I not too long ago offered my apartment for $400k and need to make investments the cash within the inventory market. Nonetheless, it seems the market is at an all time excessive. Ought to I make investments elsewhere or look forward to a market correction?

Wonderful query.

Let’s begin with the mathematics first after which work our strategy to the psychological ramifications.

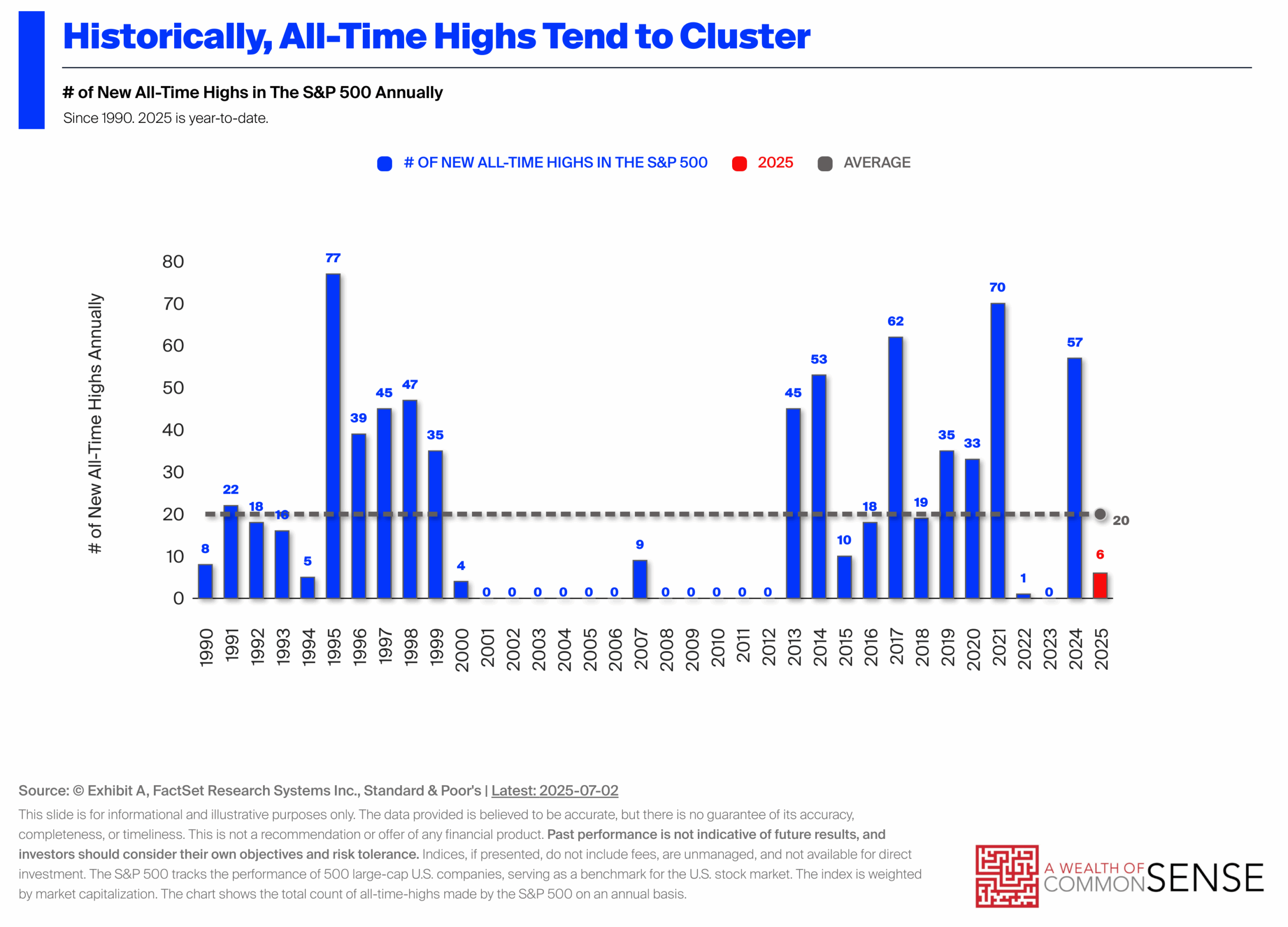

Listed below are some charts from Exhibit A on the historical past of all-time highs:

The excellent news is that new all-time highs are completely regular. On common they occur 20 instances a 12 months since 1990.

The unhealthy information is that there might be dry spells as these new highs are inclined to cluster. Right here’s one other means of this:

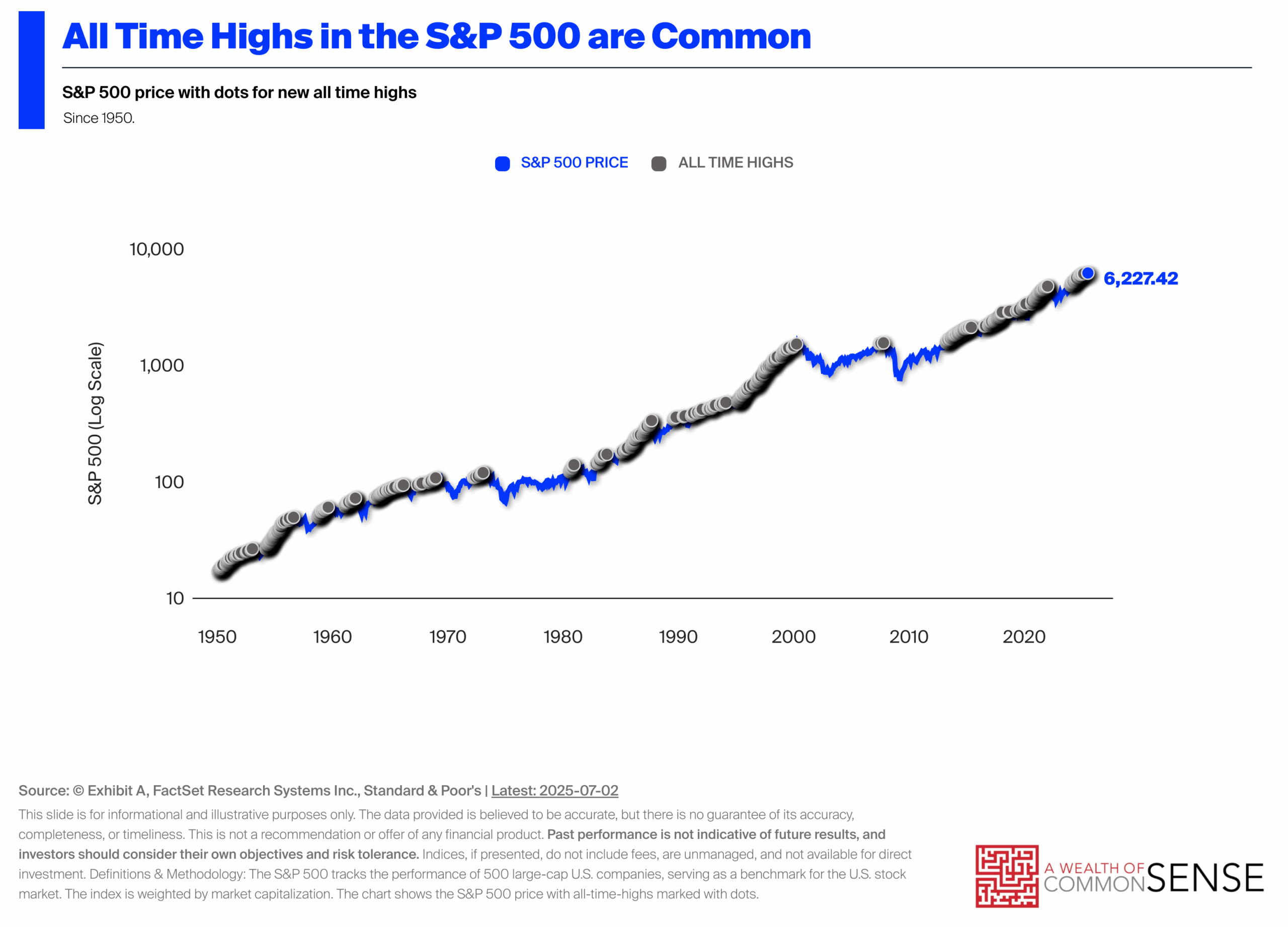

Clearly, the all-time highs cluster round bull markets whereas the droughts are attributable to bear markets and misplaced a long time.

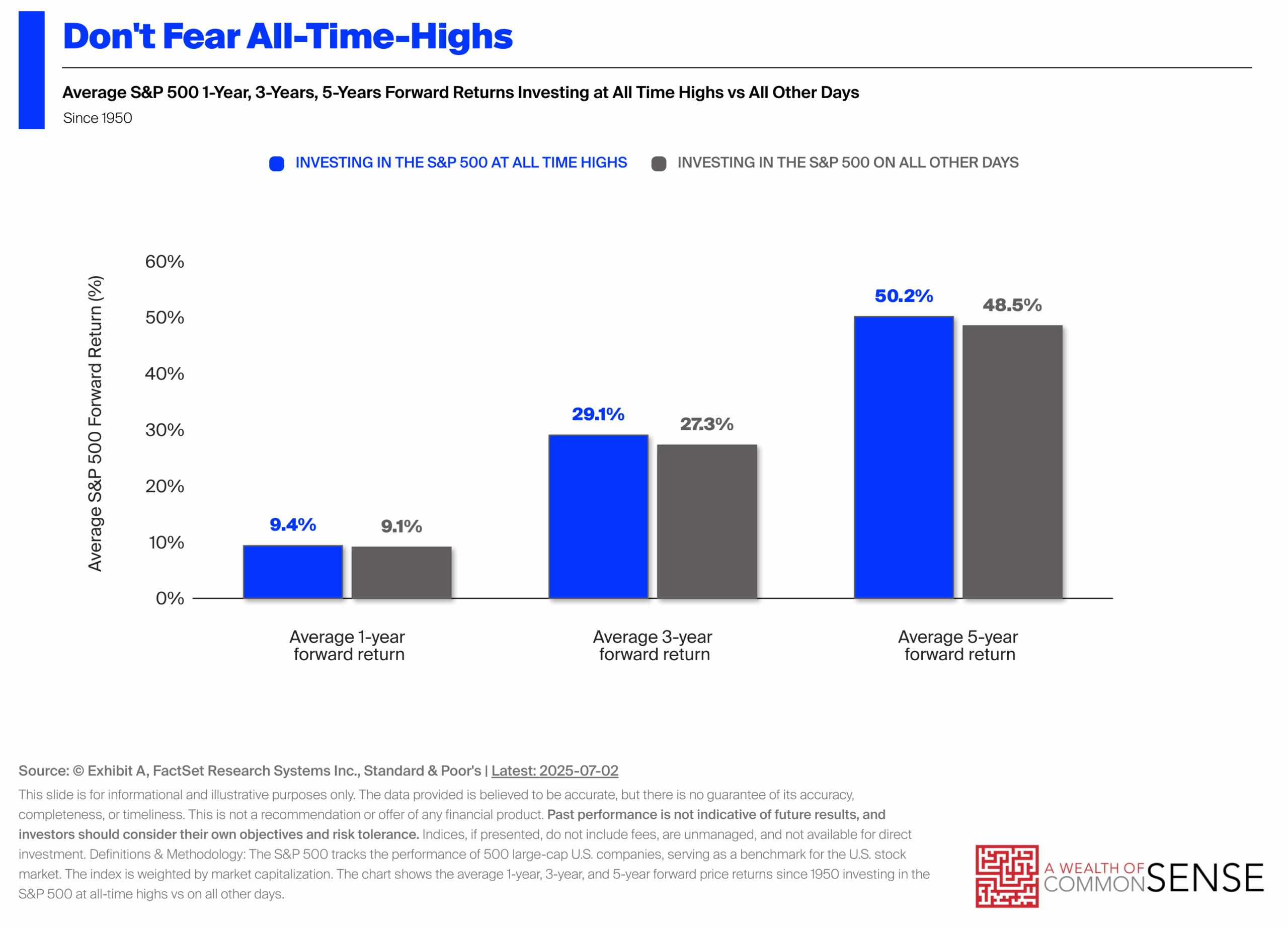

Let’s do some extra excellent news since I prefer to be constructive:

Not solely are new all-time highs completely regular, your returns are literally higher while you make investments at these ranges than placing your cash to work on all different days over 1, 3 and 5 12 months home windows.

For those who’re this strictly from a cost-benefit perspective, you don’t should be scared off by new highs within the inventory market. They occur extra usually than you assume.

Lengthy-term buyers have to change into accustomed to purchasing and holding at new heights.

Individuals have been making an attempt to name THE high of this bull market because the backside in 2009.

The factor is one in every of these all-time highs might be THE peak that happens earlier than a nasty market crash. There might be a painful bear market and we received’t see new highs for a number of years.1

That is the arduous half when pondering via a lump sum funding like this.

The mathematics tells you the inventory market is up three out of each 4 years, on common, and investing at all-time highs presents barely above common outcomes. These are fairly good odds.

However the psychology tells you losses deliver way more ache than the pleasure you obtain from good points.

For this reason many individuals are extra snug greenback value averaging into the market, even when it’s a sub-optimal method from a spreadsheet perspective.

Remorse minimization is vital when working via these selections.

Some individuals would remorse lacking out on additional good points in the event that they greenback value averaged into shares and the market retains transferring increased. Most individuals would really feel extra remorse in the event that they put that lump sum to work and the market instantly rolled over.

You shouldn’t at all times permit behavioral psychology to information your actions however it’s important to weigh the professionals and cons of each the mathematics and human nature when making huge funding selections like this.

You additionally don’t need to put all of this cash into shares. You might create a extra balanced portfolio of shares, bonds, money and different investments if that makes it simpler to be absolutely invested sooner.

An all-or-nothing method tends to ask extra alternatives for remorse.

Michael and I talked about investing at all-time highs and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Lump Sum vs. Greenback Value Averaging Choice

Now right here’s what I’ve been studying these days:

Books:

1It’s value noting we went two years or so with no new highs from the 2022 bear market.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.