The Indian Finance Minister has tabled immediately, the Union Basic Finances 2025-26 within the Parliament. From the Evaluation 12 months 2021-22, a tax assessee has been supplied with an choice to pick out both new tax charges or previous charges.

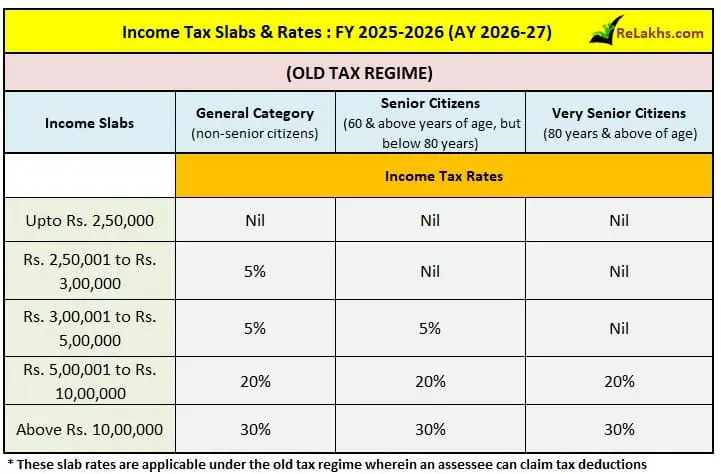

As per the Finances 2025, there was no adjustments made to non-public Revenue tax construction underneath previous tax regime. Nonetheless, a major revision to the earnings tax slab construction has been proposed underneath the brand new tax regime, with efficient from the Monetary 12 months 2025-26 (AY 2026-27).

Newest Revenue Tax Slab Charges for FY 2025-26 / AY 2026-27

Efficient from FY 2020-21, the person tax assessee has an choice to go for brand new Tax Slab Charges by forgoing the a lot of the Revenue Tax Deductions and Exemptions, like HRA, Part 80C, Residence mortgage tax advantages and many others.,

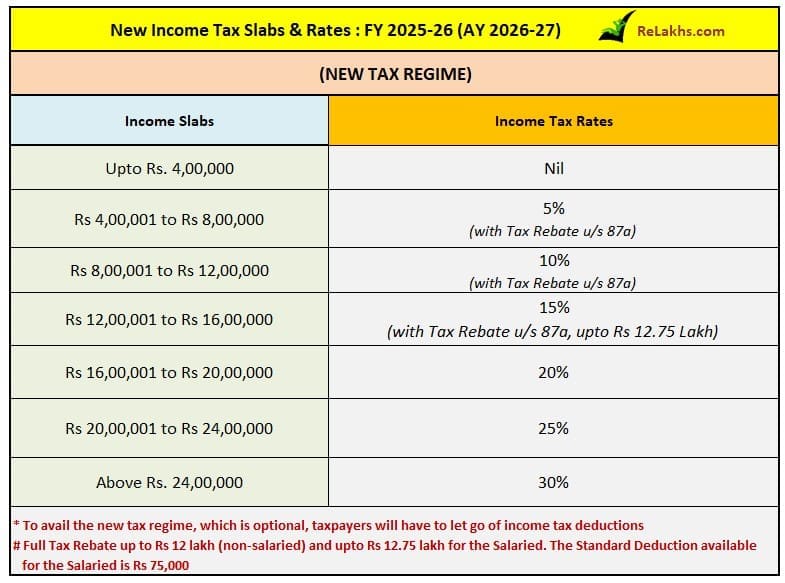

As per the Finances 2025, no earnings tax might be payable on earnings as much as Rs 12 lakh has been proposed. Under is the brand new tax slab construction underneath the brand new tax regime

What’s Tax Rebate? Tax rebate is a refund on taxes when the legal responsibility on tax is lower than the tax paid or liable to pay, by the person is known as Revenue Tax Rebate.

Part 87A permits people to assert the rebate on earnings tax legal responsibility that arises for every earnings slab. This rebate is now obtainable for all of the tax assessees with earnings as much as Rs 12 lakh.

The salaried people eligible for the customary deduction advantage of Rs 75,000 is not going to be required to pay any taxes if their gross taxable earnings doesn’t exceed Rs 12.75 lakh.

“Resident people with a internet taxable earnings as much as Rs 12 lakh will now pay no earnings tax. For salaried people who avail of the usual deduction advantage of Rs 75,000 underneath the brand new tax regime, the tax-free threshold will increase to Rs 12.75 lakh. It is a vital improve from the earlier Rs 7 lakh earnings restrict underneath the brand new tax regime.”

I consider that earnings from Capital Positive aspects just isn’t a part of this Rs 12 lakh bracket. The tax rebate doesn’t apply to particular earnings like capital positive aspects, which is taxed at separate charges.

In case, you want to declare your IT deductions and exemptions then your earnings might be topic to tax as per the under earnings tax slabs and charges;

Proceed studying :

Kindly observe that this text might be up to date/edited as and when extra data is on the market.

(Put up first printed on : 01-February-2025)