THIS IS AN UPDATE OF THE FUND PROFILES printed in 2009 and 2013.

Goal and technique

The fund seeks long-term capital appreciation by investing in a diversified portfolio of very, very small North American corporations.

Aegis believes extra returns might be generated by:

- buying a well-researched portfolio of essentially sound small-cap shares buying and selling at low valuations in periods of stress or neglect, when liquidity is low and investor sentiment is poor,

- holding these investments patiently by way of intervals of short-term worth volatility whereas basic situations normalize, and

- promoting after basic tendencies reverse, as restoration turns into seen and investor sentiment improves, driving valuations increased.

They search for shares which might be “considerably undervalued,” given basic accounting measures together with ebook worth, revenues, or money movement. They outline themselves as “deep worth traders.” Whereas the fund invests predominantly in microcap shares, it does have the authority to put money into an all-cap portfolio if that ever appears prudent.

Adviser

Aegis Monetary Company of McLean, Virginia, is the Fund’s funding advisor. Aegis has been in operation since 1994 and has suggested the fund since its inception in 1998.

Supervisor

Scott L. Barbee, CFA, is portfolio supervisor of the fund and a Managing Director of AFC. He was a founding director and officer of the fund and has been its supervisor since inception. He additionally manages 66 separate fairness account portfolios of different AFC purchasers managed in an funding technique just like the Fund, with a complete worth of roughly $30 million. Mr. Barbee acquired an MBA diploma from the Wharton Faculty on the College of Pennsylvania. He’s supported by 4 different professionals.

Technique capability and closure

Aegis Worth closed to new traders in late 2004, when property within the fund reached $820 million. The supervisor estimates that, below present situations, the technique might accommodate roughly $1.5 billion. That aligns with the scale of its common holding.

Administration’s stake within the fund

As of June 2025, Aegis workers owned greater than $48 million of Fund shares. The overwhelming majority of that funding is held by Mr. Barbee and his household. Two of the fund’s three unbiased administrators, although very modestly compensated, have massive stakes within the fund.

Opening date

Could 15, 1998

Minimal funding

Nominally $10,000 for normal accounts and $5,000 for retirement accounts, however brokerages resembling Schwab require a $1 minimal preliminary funding.

Expense ratio

1.45% on property of $560 million, as of June 2025. The fund has attracted about $100 million in inflows within the first half of 2025. With a administration price of 1.2%, room for extra expense reductions is modest.

Feedback

Small-cap worth investing has lengthy been out of favor as traders feverishly decide themselves on what number of FAANGs or MAGs they’ve managed to amass. Aegis Worth presents the case for double-checking these straightforward impulses. My colleague, Devesh Shah, engaged in an extended dialog with Mr. Barbee in 2023, which resulted within the essay, “In Dialog with Scott Barbee, Portfolio Supervisor at Aegis Worth Fund” (8/2023). Devesh and Scott talked at size about his investable universe and his (since validated) notion of “a uncommon and interesting alternative” which now dominates his portfolio. Given the depth of these discussions, this profile will restrict itself to a few arguments: (1) Aegis is exceptionally profitable, (2) Aegis is distinctive, and (3) the Aegis self-discipline is sensible.

1. Aegis is exceptionally profitable

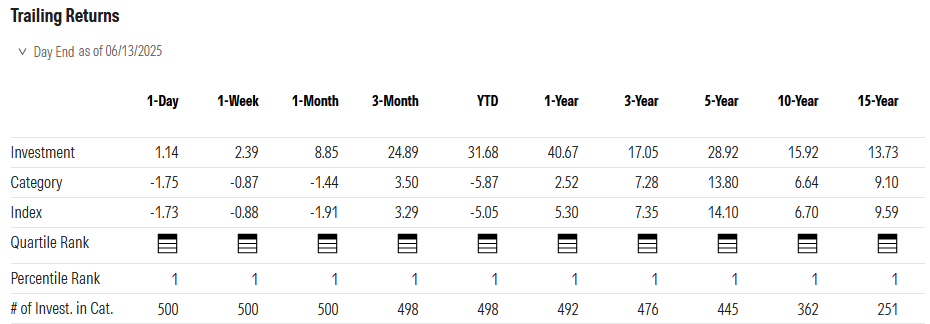

As we composed this profile in mid-June 2025, Morningstar reported the next absolute and relative returns for Aegis Worth. We should always have a look at each the row labeled “Funding” and the one labeled “Percentile Rank.” The primary row signifies annualized returns over quite a lot of trailing intervals; as an illustration, the fund has averaged a return of 13.73% yearly for the previous 15 years. The decrease row reveals how that ranked inside its peer group. The “1” implies that Aegis Worth was within the high 1% of its friends over the previous 15 years.

The highest 1% over the previous 15 years is exceptional. The highest 1% over the previous week, month, quarter, 12 months, three years, 5 years, ten years, and 15 years is just about unprecedented. It’s additionally not a fluke: Lipper gave Aegis a five-star ranking for consistency over the lifetime of the fund, the identical ranking assigned by MFO Premium’s calculation of the fund’s Ferguson Consistency Index: Lifetime.

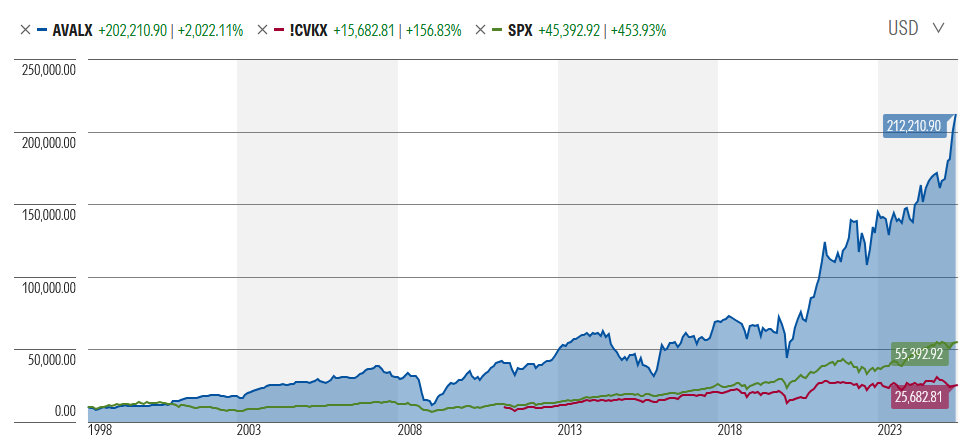

The fund has carried out properly even compared to its antithesis: the large-cap growth-oriented S&P 500. A $10,000 funding in Aegis at inception has grown to $202,000 at present; the identical funding within the S&P 500 has risen by one-fourth as a lot.

2. Aegis is distinctive.

It’s now, because it has often been, a portfolio incomparable to friends or benchmarks. Energetic Share measures the independence of a portfolio from its benchmark; the upper the energetic share, the larger the distinction and the larger the prospect that the returns symbolize a supervisor’s ability quite than his asset class’s successor. Aegis has an Energetic Share of 99.3%, the very best of any fund we monitor. In 2022, we constructed a basket of small-cap worth funds with the very best high quality portfolios (up to date this month in “Extra soiled intercourse and your spanked portfolio: A 3-year evaluate,” 7/2025). Of the 11 funds – energetic and passive – in that basket, Aegis had the bottom correlation to its peer group, to its benchmark, and to the S&P 500.

Concrete markers of that distinction come from a look on the portfolio:

- 92% of the portfolio is in simply two sectors: supplies and vitality. The peer weight is 11%.

- 15% of the portfolio is within the US, in comparison with 97% for friends

- 59% of the portfolio is invested in Canada accounting versus 1% for friends.

- 42% is invested in microcap shares, in comparison with 9% for its friends

- By Morningstar’s metrics, the fund’s common market cap is $655 million, the common holding in its friends is 800% bigger

- The fund at present holds 9% money, in comparison with 1.7% for friends (and 4% two years in the past, when Devesh spoke with Mr. Barbee).

That provides some weight to a remark that Mr. Barbee made to Devesh in 2023: “We’re an odd duck in that we do detailed work on shares as if we had been a hedge fund with out charging the efficiency charges.”

3. The Aegis self-discipline is sensible.

Many managers declare to disregard macroeconomic elements. “We’re not into political economics. We simply purchase the perfect shares accessible” is their mantra. Mr. Barbee appears to have quite extra sympathy for understanding Massive Image points than making an attempt to place Aegis Worth for achievement inside them. There appear to be two large image points on his thoughts. First, the most important US inventory indices are extremely concentrated and wildly overvalued:

Right this moment, speculative fervor continues to dominate the markets. The ratio of property in levered lengthy ETFs to property briefly ETFs hit 11.1 occasions, essentially the most on report in accordance with Bloomberg. Fund Supervisor Survey money allocations are on the lowest since 2001 in accordance with Financial institution of America. Retail sentiment can also be unusually sturdy with Households all-in on equities. Ned Davis Analysis just lately reported that shares as a proportion of whole family monetary property hit 36.1 p.c, the very best family allocation to equities since 1952. NYSE margin debt can also be on the rise, climbing almost 50 p.c within the final two years to ranges close to $900 billion at present. US equities at present are top-heavy, fully-valued, and susceptible to say no. The market capitalization of the top-10 shares within the S&P 500 Index at year-end constituted almost 40 p.c of the general index, with the most important market-cap inventory at a report valuation 750 occasions as massive because the seventy fifth percentile inventory within the Index, a focus degree not seen because the Nineteen Thirties, in accordance with Goldman Sachs. (Shareholder Letter, 1/27/2025)

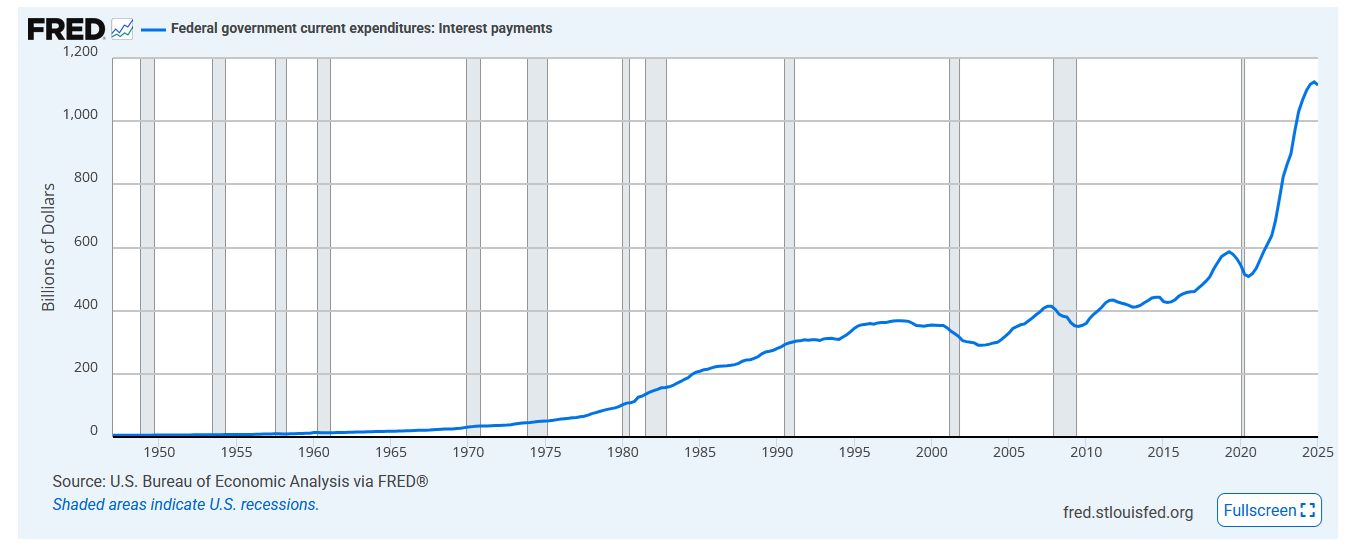

Second, the federal authorities’s incapacity to align its revenue with its bills dangers resulting in a debasement of the greenback. The federal authorities’s standing because the world’s most secure funding and strongest haven is being known as into query by a debt that’s so massive that curiosity funds on it exceed $1 trillion a 12 months.

Supply: St. Louis Fed, 5/29/2025

Debt funds are the third-largest, and the fastest-growing, class of federal outlay. The mix of big deficits and diffidence from worldwide traders creates the prospect for actual and sustained inflation. As DoubleLine founder and hedge fund supervisor Jeff Gundlach warned in June: “a reckoning is coming.”

Mr. Barbee believes that he has positioned the portfolio intelligently in gentle of each of these elements.

We imagine our angular portfolio, with a powerful give attention to supplies and vitality, is properly positioned given at present’s surroundings We’re at present sustaining a portfolio that’s unusually angular, with excessive focus amongst a lot of deeply undervalued small-cap vitality and supplies shares from the worth universe, together with a considerable variety of Canadian shares and some different international equities. Many of those Fund positions have been performing properly regardless of the numerous headwinds of a quickly strengthening greenback. Nevertheless, with the greenback hitting new highs, sentiment in the direction of securities buying and selling outdoors the US has deteriorated markedly. Resultingly, considerably decrease valuations stay accessible on international securities. With the robust greenback now trying fairly prolonged, and with US know-how equities at present within the highlight, we imagine it’s a nice time to be opportunistically positioned in worldwide, commodity-producing shares, notably on condition that commodities are sometimes priced in {dollars}. Ought to the greenback roll-over, whether or not pushed by a brand new Washington political consensus or in any other case, the latest greenback headwinds confronted by worldwide shares and commodity producers might quickly shift to tailwinds. Because the S&P 500 has soared in the previous few years, US small caps have additionally been underperforming, with many managers showing to be falling by the wayside. Fund supervisor positioning towards small-cap shares was just lately reported by Financial institution of America to be on the lowest degree in information going again to 2015. (Shareholder Letter, 1/27/2025)

The portfolio is positioned to profit from declines within the US greenback, and lots of of its holdings are thought of conventional inflation hedges.

Backside Line

Aegis Worth is a deep-value fund that has historically discovered among the most compelling values within the small- to microcap house. Mr. Barbee is likely one of the discipline’s longest tenured managers, and Aegis sports activities one among its longest information. Each testify to the truth that steadfast traders right here have had their endurance greater than adequately rewarded. You need to contemplate it.

Fund web site

Aegis Worth fund. We’d principally commend the wealth of shareholder letters to you.