Union Financial institution

April is Monetary Literacy Month, a fantastic reminder to deal with bettering your understanding of private finance. At Union Financial institution, we consider that information is energy, particularly in terms of your cash. This month, we’re highlighting the significance of investing and the way Investing may also help you obtain your monetary targets.

Investing is all about placing your cash to work with the aim of rising your wealth over time. It might probably appear intimidating at first, however understanding some primary ideas could make an enormous distinction:

4 Fundamental Ideas for Investing That Can Assist You Begin

- START SMALL: You don’t want some huge cash to start investing. Investing means that you can begin with a small quantity and progressively improve your investments as you turn out to be extra comfy. Even small quantities, invested constantly, can develop considerably over time. Consider it like this: Would you slightly put $20 per week right into a financial savings account, or use that cash to purchase a small piece of an organization you consider in?

- DIVERSIFICATION: Don’t put all of your eggs in a single basket. Diversifying your investments throughout totally different asset lessons (like shares and bonds) and sectors may also help scale back danger. Think about proudly owning inventory in only one firm. If that firm struggles, your total funding is in danger. However in case you personal inventory in ten totally different firms throughout totally different industries, the danger is unfold out.

- RISK TOLERANCE: Everybody has a distinct stage of consolation with danger. Understanding your danger tolerance will enable you to select investments that align together with your targets and

persona. Keep in mind, the upper the potential reward, the upper the potential danger. Are you comfy with the potential of your investments shedding worth within the brief time period if it means they’ve the potential to develop extra in the long run? Or do you favor slower, steadier development with much less danger? - COMPOUNDING INTEREST: That is the magic of investing! Compounding permits your returns to earn returns, accelerating your wealth development over time. Consider it like a snowball rolling downhill: it begins small, however because it rolls, it picks up extra snow and will get larger and greater.

Make Investing Easy

- RECURRING DEPOSITS: Arrange computerized recurring deposits into your funding account. This “set it and neglect it” strategy makes investing a constant behavior. Permitting you begin small however nonetheless reap the benefits of the compounding curiosity impact.

- MULTIPLE PORTFOLIO OPTIONS: Select from a wide range of funding portfolios to match your pursuits and targets. You’re in management!

- GUIDED PORTFOLIOS: Professionally managed portfolios for a hands-off strategy.

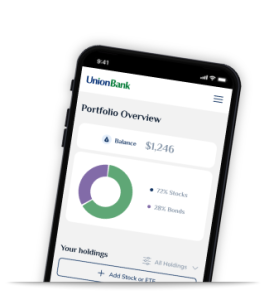

- SELF-DIRECTED INVESTING: Construct your personal portfolio with particular person shares and ETFs.

- HYBRID INVESTING: Mix guided and self-directed for a private strategy.

Take the Subsequent Step with Investing

Discover Investing

Log in to your UB2Go on-line banking account and navigate to the Investing platform to be taught extra.

Get Began Right now

Don’t wait! Start your investing journey now and make this Monetary Literacy Month a turning level to your monetary well-being.

Make this Monetary Literacy Month the time you begin constructing a brighter monetary future with Investing!