In typical cycles, the playbook is simpler to learn. Increase-and-bust cycles supply a form of readability. In a increase, momentum can reward fast motion. If it’s missed, one other alternative normally follows. In a downturn, wait-and-hold is commonly what’s applicable. Buffering for disruption is a time-proven play.

However 2025 hasn’t given us both.

It’s given us fog — uncertainty, volatility.

Alternative doesn’t disappear in fog, it simply will get tougher to identify.

For 2025, the companies taking daring initiatives aren’t hovering over headlines. They’re responding to moments distinctive to their circumstance. Moments when, with vigilance, they will see simply sufficient to hit tougher on the gasoline and go.

For advisors and companions working with these companies, it’s much less about fueling urgency and extra about serving to shoppers interpret foggy imprints with readability and care.

Contained in the mid-market mindset…

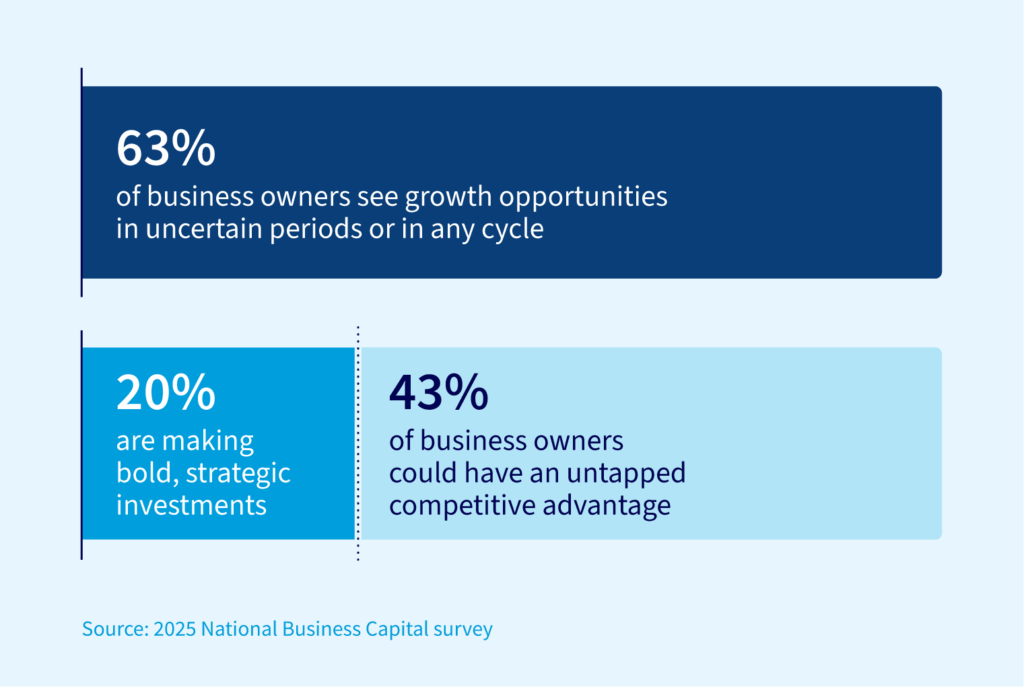

In Could 2025, we requested over 500 enterprise homeowners, from development to training, from manufacturing to retail to transportation: how they understand the present financial system and the way that notion shapes conduct.

The outcomes present a putting however unsurprising hole:

- 63% of enterprise homeowners consider development is feasible, even in risky or unsure circumstances.

- However solely 20% are literally making daring, strategic strikes to pursue that development.

That is greater than a hesitation hole. It’s a 43-point alternative hole tucked between perception and motion.

Strategic vulnerability veiled in fog, the place perception is held however visibility is just not.

Many of those enterprise homeowners nonetheless consider within the potentialities of development however lack the visibility to say sure with confidence. With out readability on ROI home windows, or certainty round development eventualities, execution stalls technique. Perception stays current, however motion can’t translate into initiatives, investments, or operational enlargement.

Alternatives might name. Need for development could also be honest. However with out foundational relationships of groups, advisors, companions, and even distributors, it turns into tougher for any enterprise chief to discern which dangers will repay with enlargement… and what would possibly misfire.

When motion wants orientation, not simply confidence…

Whereas many companies are ready for information headlines to forecast the “all clear,” a smaller—and extremely strategic—group is already responding to particular alternatives that require decisive capital deployment.

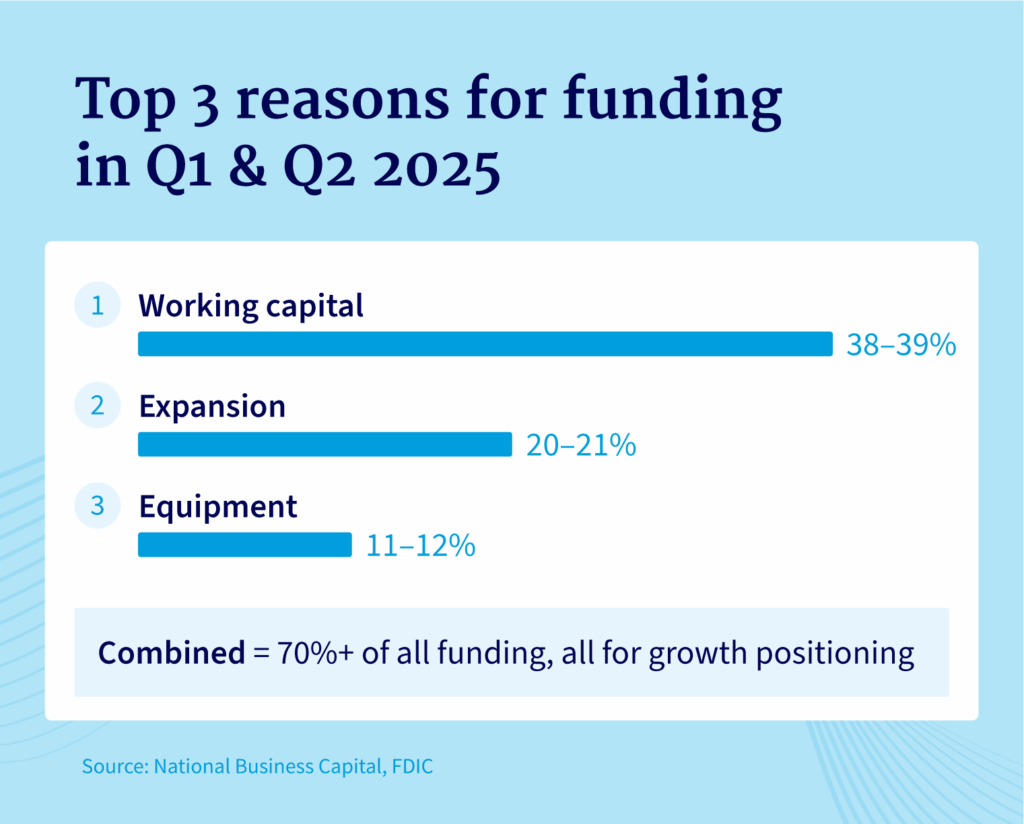

Nationwide’s personal Q1 – Q2 2025 funding knowledge backs this up.

In Q1 2025, we noticed:

- Funding demand rose 94.5% YoY

- Common mortgage dimension requests surged 114.8% YoY

- High 3 use circumstances: working capital, enlargement, and tools accounted for over 70% of whole capital deployed

These aren’t defensive strikes, both. They’re focused development initiatives made with exact actions, clear forecast ROI window, and contingency plans.

Q2 2025 introduced geopolitical tensions, rising tariffs, and worldwide coverage shifts that triggered a market dip. However even with that backdrop, momentum on Major Road didn’t stall. In comparison with our Q2 of 2024 knowledge, funding demand rose one other 40%.

A deceleration from Q1, sure, however no reversal.

This sample tells us one thing vital: Companies are doing extra than simply making ready for what’s subsequent. They’re constructing into the long run, even when the trail isn’t completely seen.

As our CEO, Joe Camberato, places it:

“Throughout Major Road, momentum is constructing. Enterprise homeowners are leaning into development—making strikes with readability, velocity, and confidence.”

That is particularly clear in higher-value fundings. Amongst transactions above $650,000, the dominant use circumstances have been all expansion-related—not emergency money, however capital for brand new areas, capability will increase, or long-term tools purchases.

The place development is taking root whilst market hesitation persists.

Whereas our knowledge displays Major Road (i.e. mid-market industrial companies that don’t report their earnings), the Q2 2025 S&P Earnings Perception Report (FactSet, July 18) confirmed small indicators of development. Take away the ‘Magnificent 7’ and the report exhibits how erratically totally different sectors are experiencing the present financial system.

Amongst a few of the companies we serve—industrial, logistics, development, and manufacturing—the expansion patterns are too quiet for headlines, however are robust and simple to learn for mid-market pulse.

Key Sector Knowledge

On our funding steadiness sheet, Development leads with a 40% YoY enhance in funding quantity requests.

In the meantime, on Wall Road, Industrial firms posted a median internet revenue margin of 10.6%, up from a 5-year common of 8.6%.

→ But solely 44% of Industrials expanded their margins this quarter; 54% skilled compression.

The distinction? Usually, strategic capital deployment.

Some companies are utilizing capital to scale and place for long-term benefit.

Others, dealing with the identical uncertainty, are holding nonetheless and feeling the margin squeeze.

Whereas industries like healthcare, vitality, and client staples are flashing crimson with continued margin compression, the companies we work with are quietly outperforming.

On Wall Road, whereas tech and finance make headlines with highlights and lowlights, our shoppers maintain constructing. They don’t dominate the information cycle. They simply maintain the parcels delivered, the frames welded, and the orders crammed. The financial fog might linger at some point of H2, or it could elevate within the months forward. Both approach, enterprise isn’t slowing down. Our shoppers and companions are shifting ahead with plans for development, and so are we.

*Knowledge based mostly on funding functions made by way of Nationwide Enterprise Capital between 1/1/2025 and 6/30/2025 in comparison with the earlier time interval one yr in the past.

Methodology: The survey was carried out by way of SurveyMonkey Viewers by a third-party on behalf of Nationwide Enterprise Capital on Could 27, 2025. The outcomes are based mostly on 503 accomplished surveys. With a purpose to qualify, respondents have been census-balanced for gender and age, and screened to be residents of the US, over 18 years of age, and to personal or handle a small- to medium-sized enterprise (as much as 500 staff). Knowledge is unweighted, and the margin of error is roughly +/-4.46% for the general pattern with a 95% confidence stage.