You’ve obtained three progress plans prepared: a bulk order to lock in discounted provider pricing, a putting seasonal advertising and marketing marketing campaign, and also you need to open a pop-up in an incredible location. You verify your enterprise line of credit score charges and uncover that your lender’s taking such an enormous lower that they’ll make extra of your concepts than you’ll. That’s when you recognize it’s time to discover a higher deal.

Learn on to seek out out what enterprise line of credit score charge lenders at the moment cost, how they determine on their charge, and the way to get a greater deal for your corporation.

What’s the common rate of interest of a enterprise line of credit score?

Enterprise line of credit score charges fluctuate relying in your lender. At conventional monetary establishments, charges can fluctuate – banks historically give charges at prime plus 2–3% – however the present charges are:

- Variable rates of interest: 8.6% at metropolitan banks and eight.3% at regional banks

- Mounted charges: 7.4% at metropolitan banks and eight.4% at regional banks

Different and personal credit score lenders cost anyplace from 7% to 25%, which might rise to 60% for companies with a unfavorable credit ratings ranking.

Common charge for enterprise strains of credit score by lender sort

The kind of lender you employ for your corporation line of credit score partly determines the speed you pay.

Right here’s how enterprise line of credit score charges common out throughout lender sorts:

| Sort of financing | Rate of interest |

|---|---|

| Banks | 7.4%-8.6% |

| Non-bank | 7%-25%, larger for unfavorable credit ratings |

Keep in mind that the common charge is simply the place to begin. Mortgage charges, closing prices, and upkeep prices enhance the price of credit score.

Present enterprise line of credit score charges comparability

Along with lender sort, elements like your enterprise credit score rating, monetary efficiency, facility measurement, and {industry} instantly influence your corporation line of credit score charge.

One option to see that in motion is by evaluating beginning charges throughout completely different lenders. Every one tends to concentrate on a specific sort of enterprise or funding want:

| Lender | Greatest use case | Beginning charge |

|---|---|---|

| Nationwide Enterprise Capital | Massive credit score strains | 1% per thirty days |

| Lendio | Low-credit-score firms | 0.64% per thirty days |

| Wells Fargo | Sub-$500,000 income companies | 0.77% per thirty days |

| OnDeck | Sub-$100,000 credit score strains | 3.85% per thirty days |

| TD Financial institution | Curiosity-only repayments | 0.69% per thirty days |

| Financial institution of America | Normal SMBs | 0.77% per thirty days (unsecured), 0.71% per thirty days (secured) |

| Fast Finance | Excessive-risk companies | Not publicly obtainable |

Some issues to bear in mind:

- The desk exhibits beginning charges as month-to-month curiosity percentages.

- Wells Fargo and TD Financial institution prices rely upon the Federal Reserve charge. For this text, we’ve set that at 7.50%.

- You pay curiosity on the excellent principal and never the complete credit score restrict.

Deep dive: Greatest enterprise line of credit score lenders

Under, discover a checklist of seven of the highest lenders, together with who they work with, how shortly they fund, and the professionals and cons of every service.

1. Nationwide Enterprise Capital: Greatest for giant credit score strains

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $100K to $10M | 1% per thirty days |

Nationwide Enterprise Capital makes a speciality of high-limit credit score strains between $100,000 and $10M. You’ll be able to select between weekly or month-to-month funds and repay your facility early with no penalty.

Restricted legal responsibility firms (LLCs), companies, and partnerships can all apply to borrow as much as the worth of their collateral on secured strains and their income on unsecured strains.

“Ours is a quick and straightforward course of that we attempt to make as stress-free as attainable,” says Matt Presta, monetary advisor at Nationwide Enterprise Capital.

He continues, “Our relationship managers transfer shortly to show funding round, however we additionally take time to know every shopper’s long-term objectives. We’re right here to assist firms by each stage of progress – not simply provide a one-time facility.”

Strains of credit score are only the start for many Nationwide Enterprise Capital shoppers. As they transfer by completely different phases of improvement, they return to their Enterprise Advisor for time period loans, money circulation financing, tools financing, and different packages.

Professionals:

- Aggressive charges on secured and unsecured credit score strains

- Rates of interest begin at 6%

- Straightforward software course of

Cons:

- Rates of interest and phrases fluctuate

- Not designed for startups

This funding can go towards tasks like fueling their growth, competitor acquisitions, and different long-term progress tasks.

2. Lendio: Greatest for companies with a low credit score rating

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $1,000 to $250,000 | 0.64% per thirty days |

Lendio connects companies with secured and unsecured credit score strains from $1,000 to $250,000. Most lenders on the platform settle for credit score scores beginning round 600. Some suppliers launch funds inside two enterprise days. Rates of interest fluctuate extensively, beginning at 8% and stretching as much as 60%.

Association charges might be as much as 5%. The corporate works with firms in enterprise for six months or longer with a minimal month-to-month income of $8,000.

Professionals:

- Secured and unsecured credit score strains

- Decrease credit score scores accepted

- Restricted buying and selling historical past accepted

Cons:

- As much as 60% curiosity, far larger than bank cards

- $250,000 max is limiting

- 5% association charge could also be charged

3. Wells Fargo: Greatest for firms with sub-$500,000 income

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $5,000 – $150,000 | 0.77% per thirty days |

Two of Wells Fargo’s BusinessLine and Small Enterprise Benefit merchandise, neither of which requires collateral, goal smaller companies, an underserved market. Charges begin at prime plus 1.75% and the utmost restrict is $150,000. Its different product, the Prime Line of Credit score, provides secured services of as much as $500,000 on a three-year time period or $1M on a one-year time period.

The minimal credit score rating is 680, and functions can take as much as two weeks to course of. Bigger services require extra documentation and collateral, and companies in search of a restrict of $100,000 or extra should meet with a relationship supervisor.

Professionals:

- Unsecured credit score strains for brand spanking new companies

- Linked Mastercard to entry funds

- Rewards program obtainable

Cons:

- $90-$175 account charge

- 0.5% opening charge

- Advance charges on OTC and wire transfers

4. OnDeck: Greatest for sub-$100,000 credit score strains

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $6,000-$100,000 | 3.85% per thirty days (common) |

OnDeck provides enterprise credit score strains between $6,000 and $100,000 on 12, 18, or 24-month phrases, aimed toward companies in search of short-term liquidity. Annual share charges begin at 29.9% and attain as much as 65.9%, with the common buyer paying 52.6%.

A $20 month-to-month upkeep charge applies. OnDeck sometimes requires a private credit score rating of 625, no less than $100,000 in annual income, and a minimal of two years in enterprise. Credit score strains are usually not obtainable in North Dakota or in sure restricted industries.

Professionals:

- 24/7 entry to capital

- Tender credit score verify solely

- Construct up your credit standing

Cons:

- Common APR 50%+

- $20 month-to-month upkeep charge

- Private assure required

5. TD Financial institution: Greatest for interest-only repayments

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $25,000 – $500,000 | 0.69% per thirty days |

TD Financial institution provides enterprise strains of credit score starting from $25,000 to $500,000, with charges beginning at prime +0.74% yearly. It provides an interest-only reimbursement possibility to cut back shoppers’ minimal month-to-month reimbursement; nevertheless, repayments won’t influence the account’s principal stability.

Prospects should renew the ability yearly and pay an annual charge on limits over $100,000. The financial institution requires a private credit score rating within the excessive 600s and can take accounts receivable as collateral on secured strains. For credit score strains above $250,000, you will need to apply in particular person at a neighborhood department. TD at the moment operates in 15 states and Washington, D.C.

Professionals:

- Curiosity-only repayments obtainable

- Free waived on smaller credit score strains

- 600-700 credit score rating candidates thought of

Cons:

- 12-month renewal

- Restricted geographical protection

- Apply in particular person for $250,000+ strains

6. Financial institution of America: Greatest for SMBs

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $10,000 (unsecured) and $25,000 (secured) – higher restrict not marketed | 9.25 % APR (unsecured), 8.50 % APR (secured) |

Financial institution of America’s Enterprise Benefit Credit score Line is for established SMBs with predictable income and house owners with a private FICO rating of 700 or larger. Unsecured strains provide a $10,000 minimal, and to qualify, companies want no less than two years of buying and selling historical past and $100,000+ in annual income.

Secured strains provide a minimal $25,000 at a barely decrease rate of interest however require $250,000+ in annual income. Secured clients could use a blanket lien or a Financial institution of America CD as collateral. Candidates may want a BoA enterprise checking account to qualify.

Pros:

- $100,000 annual income minimal for unsecured

- $250,000 annual income minimal for secured

- Reward program reduces rates of interest

Cons:

- Excessive credit standing required

- Annual account critiques

- Blanket lien for collateral

7. Fast Finance: Greatest for high-risk companies

| Line of credit score quantities | Beginning rate of interest |

|---|---|

| $5,001-$250,000 | Varies – curiosity or fastened charge (not publicly disclosed) |

Fast Finance supplies revolving credit score strains from $5,001 to $250,000 to newer firms and ones with weaker credit score studies. Time period ranges from as little as three months to a extra manageable 18 months. Companies can switch funds to their enterprise checking account by ACH or a Fast Entry Card linked to the borrower’s account.

Each day, weekly, or month-to-month funds can be found. The lender performs a delicate credit score verify throughout prequalification and a full verify when a buyer applies for enterprise financing. Secured strains could require a blanket lien over enterprise belongings.

Professionals:

- Prompt drawdown of accredited funds

- Quick software course of

- Select every day, weekly, or month-to-month repayments

Cons:

- No revealed charges

- Account critiques as little as each three months

- $250,000 is just too small for a lot of SMBs

Enterprise line of credit score charges

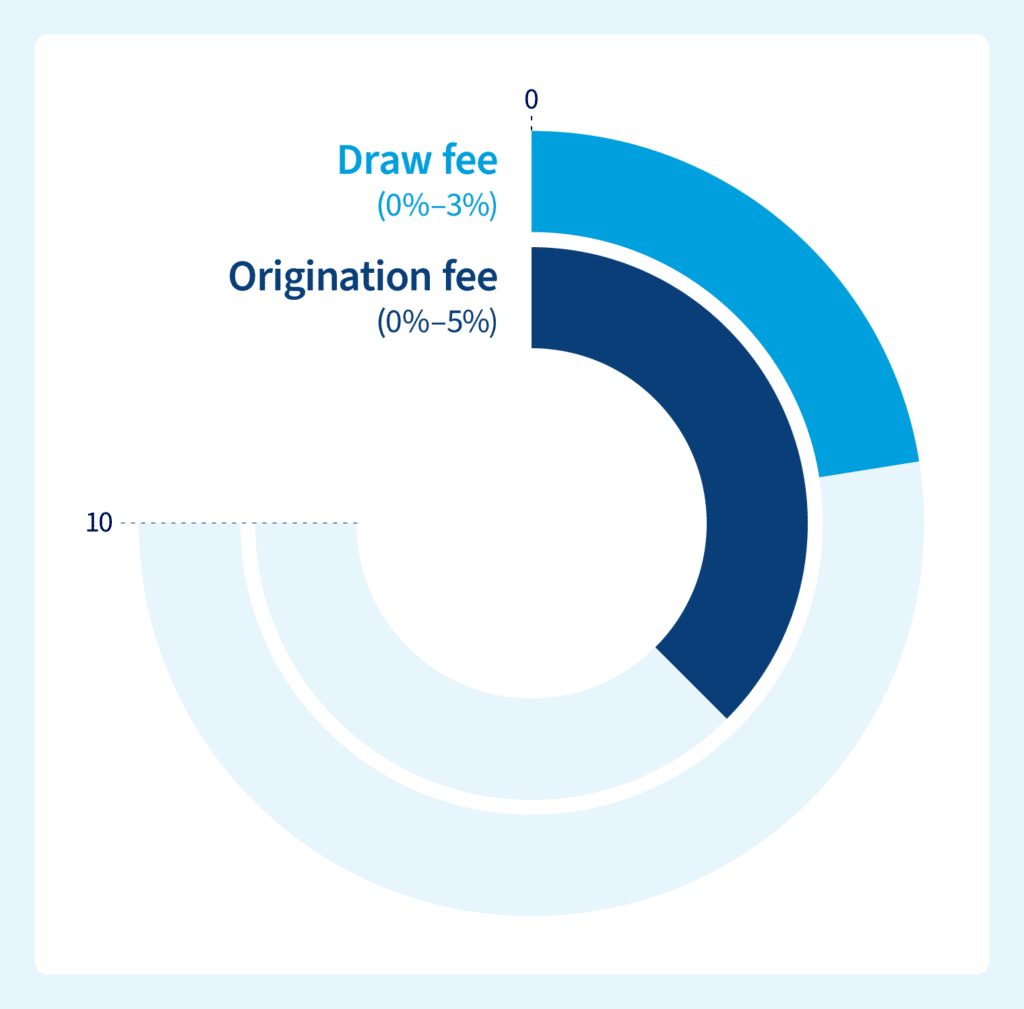

Curiosity isn’t the one price you’ll pay on a enterprise line of credit score, so a low charge doesn’t at all times imply you get the most effective deal. Listed below are different charges to look out for:

Right here’s what every of those charges consists of:

| Annual charge | Some lenders cost a yearly charge to maintain the credit score line open, like Wells Fargo’s $90-$175 charge, even in the event you by no means use it. |

|---|---|

| Draw charge | Some lenders apply a percentage-based charge every time you draw down funds. |

| Upkeep charge | Month-to-month charges cowl account servicing and reporting, like OnDeck’s $20 per thirty days cost. |

| Origination charge | This one-off charge covers setup prices and different bills, like Wells Fargo’s 0.5% cost primarily based on account restrict. |

Enterprise line of credit score options

Enterprise strains of credit score work very properly when enterprise house owners must plug a niche in money circulation or spend money on a short-term venture to spice up their income or capability.

Different varieties of finance that may assist embrace:

- Money circulation financing: Lenders consider your corporation’s money circulation observe document to find out funding eligibility, reasonably than counting on bodily belongings as collateral. You repay it weekly or month-to-month. Repayments fluctuate together with your income, so that you don’t fall behind throughout slower months.

- Time period loans: You obtain a lump sum cost upfront with time period loans. You then make common repayments over a hard and fast time period till you clear the excellent stability. Enterprise mortgage rates of interest are often decrease than line of credit score charges.

- Gear financing: Lenders fund the acquisition of autos, equipment, or specialist instruments, utilizing the asset as collateral. As a result of the lender has safety, they could provide a decrease rate of interest and the next credit score restrict.

- Bill factoring: Promote your excellent invoices to a factoring firm, and so they pay you as much as 95% of their worth inside 24 hours. When your clients pay, you get the stability minus your factorer’s charge. This may also help unlock working capital tied up in unpaid receivables.

Communicate to a Nationwide Enterprise Capital enterprise finance advisor to find out the fitting possibility in your firm. Name us or contact us by way of our contact web page.

How lenders set charges for enterprise strains of credit score

Lenders value all merchandise, together with long-term enterprise loans and enterprise strains of credit score, primarily based on how seemingly they assume a borrower pays every thing again on time and in full, together with curiosity and different prices.

Let’s take a look at the 5 principal elements lenders take into account when setting an rate of interest:

- Safety: Collateral like actual property, autos, or unpaid invoices reduces lender threat by offering belongings to promote if debtors default, permitting lenders to supply decrease rates of interest on secured loans. For unsecured options, lenders view the shortage of collateral as the next threat since they don’t have any assured restoration technique. This elevated threat publicity results in larger rates of interest to compensate for potential losses.

- Account measurement: Bigger mortgage quantities, like $1M+, create higher absolute loss publicity for lenders in comparison with smaller $50,000 services, prompting them to cost larger charges to offset this elevated threat. The substantial capital at stake requires lenders to cost extra conservatively. Increased mortgage quantities due to this fact sometimes command premium rates of interest.

- Reimbursement interval: Longer reimbursement phrases cut back month-to-month cost stress on debtors’ working capital, reducing default chance and permitting lenders to supply extra aggressive charges. Prolonged timeframes like 25-year business mortgages versus two-year phrases exhibit this precept. Lenders reward debtors with decrease charges when reimbursement schedules are extra manageable.

- Credit score profile: Robust private and enterprise credit score scores exhibit dependable cost historical past, enabling lenders to supply decrease charges as a result of diminished default threat. Debtors with marginal credit score face larger charges as lenders require extra documentation and cost premiums for elevated uncertainty. Credit score energy instantly correlates with the rate of interest lenders are keen to increase.

- Line of enterprise: Industries with secure income streams and dependable cost histories like skilled companies obtain preferential charges as a result of predictable money flows. Riskier sectors equivalent to development, transport, or meals service face larger charges due to unstable revenue patterns and elevated default possibilities. Lenders alter pricing primarily based on industry-specific threat profiles.

Add all of these elements collectively, and that’s how lenders determine whether or not to approve your software and what to cost you. Within the subsequent part, we’ll take a look at the way to tip the chances in your favor.

The way to get the most effective enterprise line of credit score charge

Give lenders each purpose attainable to believe in your skill to make all repayments on time. credit score rating is a superb begin, however preserve your current financial institution statements and monetary forecasts prepared. In the event that they ask what the capital is for, clarify the way you’ll use it to allow them to see your function and plan.

Providing collateral and signing a private assure can be a very good transfer. That exhibits you place confidence in your self and helps cut back the lender’s threat by taking a few of it on your self.

Fulfill your progress potential with a versatile line of credit score

A enterprise line of credit score boosts your working capital in the intervening time you want it, whether or not you’re funding a brand new contract, launching a advertising and marketing marketing campaign, or managing money circulation whereas ready for patrons to pay their invoices. Choosing the proper facility with the restrict you want and aggressive rates of interest offers you the capital to maneuver your corporation ahead with out draining your reserves.

Nationwide Enterprise Capital is right here for each stage of your corporation journey, from arranging strains of credit score immediately to tools financing when you should construct your new, expanded premises.

We’ve secured over $2.5B+ in funding, with credit score strains starting from $100K to $10M+. Select us as your accomplice for enterprise progress at each stage of your journey.Full our digital software kind and let’s get you funded.

Continuously requested questions

Charges for $1M credit score strains often begin at 1% per thirty days with non-public lenders, or prime + 0.50% at conventional lenders in the event you provide collateral. The precise charge you’ll pay is determined by your credit score rating, the {industry} you use in, your current financials, and whether or not you provide safety.

charge for credit score strains over $500K is something between 0.75% and 1.25% per thirty days – decrease if secured. If a lender asks you to pay a charge over 2% a month, this could set off a assessment or comparability in opposition to different lender choices.

It may be straightforward to get a $2M enterprise line of credit score and another sort of business financing in the event you tick the next containers: good credit score, a powerful buying and selling historical past, a secure enterprise sector, and also you provide collateral. The less of these containers you tick, the tougher and time-consuming the method turns into.