A enterprise line of credit score provides corporations versatile entry to funds when development alternatives come up, whether or not that’s buying stock for an enormous order, increasing into new markets, or upgrading heavy equipment. This monetary device helps handle money movement and construct credit score, although you’ll want to satisfy sure credit score necessities to qualify.

On this article, we’ll define these necessities, discover the professionals and cons of a enterprise line of credit score, and clarify decide whether or not one of these funding is best for you.

What’s a enterprise line of credit score?

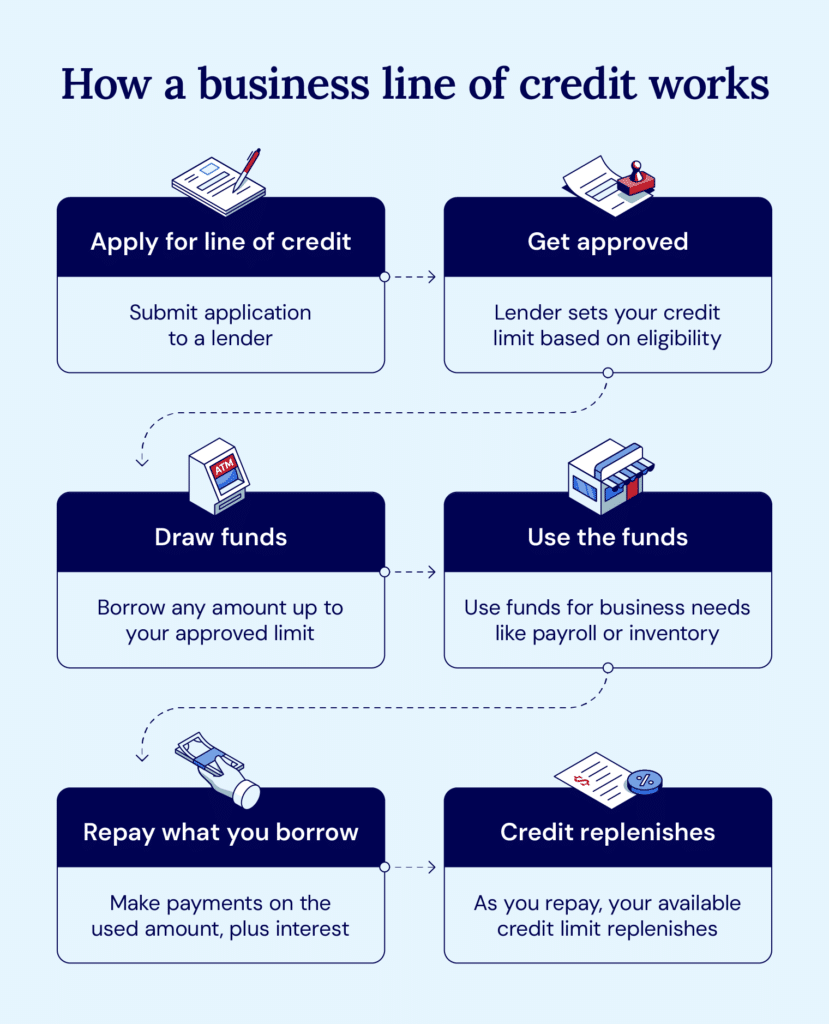

A enterprise line of credit score is a line of credit score that corporations can use to entry funding. It’s a preferred technique as a result of you’ll be able to entry capital as you want it, solely paying curiosity on the quantity you utilize. There’s no penalty for the unused portion.

The road of credit score is commonly revolving, which means you’ll be able to take as a lot (as much as the credit score restrict) or as little as you want. When you pay again the debt, the road of credit score replenishes, and you’ve got entry to the total quantity once more.

What are the necessities for a enterprise line of credit score?

Enterprise line of credit score necessities can differ based mostly on whether or not you utilize a non-public credit score lender or a conventional financial institution. Personal credit score lenders are usually extra lenient and prepared to approve a wider vary of credit score scores.

Typically, listed here are among the tips you’ll want to satisfy.

- Enterprise credit score rating: Most lenders would require a minimal of 700, although collateral may decrease this requirement.

- Private credit score rating: That is additionally a minimal of 700, particularly for those who don’t have well-established enterprise credit score.

- Enterprise financials: You must be capable of present stability sheets, private and enterprise financial institution statements, tax returns, and P&L statements.

- Time in enterprise: Lenders often must see at the least two years of enterprise historical past, however some non-bank lenders will solely require as few as three months.

- Annual income: You’ll doubtless want at the least $120,000 in annual income to qualify for many financing packages. Private loans would possibly assist for those who don’t meet this requirement.

- Debt-to-income: Lenders usually need to see a debt-to-income ratio under 40%, which means your whole month-to-month debt funds shouldn’t exceed 40% of your month-to-month revenue. This reveals you’ll be able to handle extra debt responsibly.

- Business: Some industries are riskier than others. You must be capable of present perception to your lender if they’re well-versed in your goal market.

In the event you don’t meet all of those enterprise strains of credit score phrases, chances are you’ll contemplate looking for a bank card in its place.

Money movement vs. asset-based line of credit score

Each money movement loans and asset-based strains of credit score can enhance a enterprise’s out there capital, however they’ve some key variations.

With money movement loans, lenders have a look at your enterprise’s capability to earn sooner or later. On the flip aspect, asset-based loans are based mostly in your present belongings.

Let’s check out among the key variations between money movement and asset-based lending.

| Money movement lending | Asset-based lending | |

| Description | Based mostly on future incomes potential and talent to repay | Based mostly on collateral and present belongings |

| Greatest for | For corporations with confirmed money movement | For corporations with restricted money movement or poor credit score |

| Credit score necessities | Simpler to qualify | Extra necessities associated to the credit score rating |

| Approval course of time | Quick turnaround | Longer approval as a result of asset appraisal |

Find out how to use a enterprise line of credit score

A enterprise loc can be utilized in some ways to assist get your organization off the bottom or assist it proceed to develop. In the event you meet the necessities we’ve listed above, listed here are some typical methods companies use these kind of loans.

- Brief-term financing: You need to use a line of credit score to satisfy some fast wants with funding you anticipate to pay again rapidly. This may very well be for something from a small constructing renovation to a big advertising and marketing marketing campaign.

- Gear or seasonal financing: You need to use the mortgage that will help you buy new tools or for upcoming stock wants throughout a busy season, akin to November and December in retail.

- Repaying distributors: Whereas not excellent, you can use the road of credit score to repay your money owed to distributors. This needs to be a worst-case situation whenever you’re coping with adverse money movement.

You’ll have many different potential methods to make use of the capital you’ve gained from a line of credit score. The hot button is to be strategic about how you utilize it and make sure to pay it again on time.

Execs and cons of enterprise strains of credit score

A enterprise line of credit score has some components which might be each good and dangerous.

| Execs | Cons |

| • Quick money movement • Builds enterprise credit score • Decrease rates of interest than bank cards • Helps probably improve your enterprise line of credit score restrict • Ongoing entry to funds |

• Straightforward to overspend • Larger rates of interest than conventional loans (if funds are stored excellent for a full time period) • Potential charges • Doable collateral necessities |

The place to get a enterprise line of credit score

In the event you’re seeking to receive a enterprise line of credit score, the excellent news is you may have loads of choices. Let’s check out among the major forms of lenders.

Personal credit score lenders

A personal credit score lender is principally any sort of lender outdoors of banks, credit score unions, and different extra conventional lenders. Funding from these kind of lenders often requires some sort of collateral – usually within the type of enterprise and private belongings or business actual property. This collateral presents safety to the lender in case you’ll be able to’t repay the mortgage.

Financial institution lenders

Financial institution lenders provide extra conventional technique of lending. You’ll want to satisfy a minimal credit score rating requirement, often a minimal of round 700. You must also be ready to offer monetary info like accounts receivable, financial institution statements, revenue and loss statements, tax returns, and proof of annual income.

SBA lenders

Small Enterprise Administration (SBA) lenders present strains of credit score to small enterprise house owners. They provide short-term financing that gives funding to small companies. The SBA mortgage is a enterprise revolving credit score, so that you solely need to take out what you want, and also you’ll solely pay curiosity on the funding you utilize.

Secured vs. unsecured strains of credit score

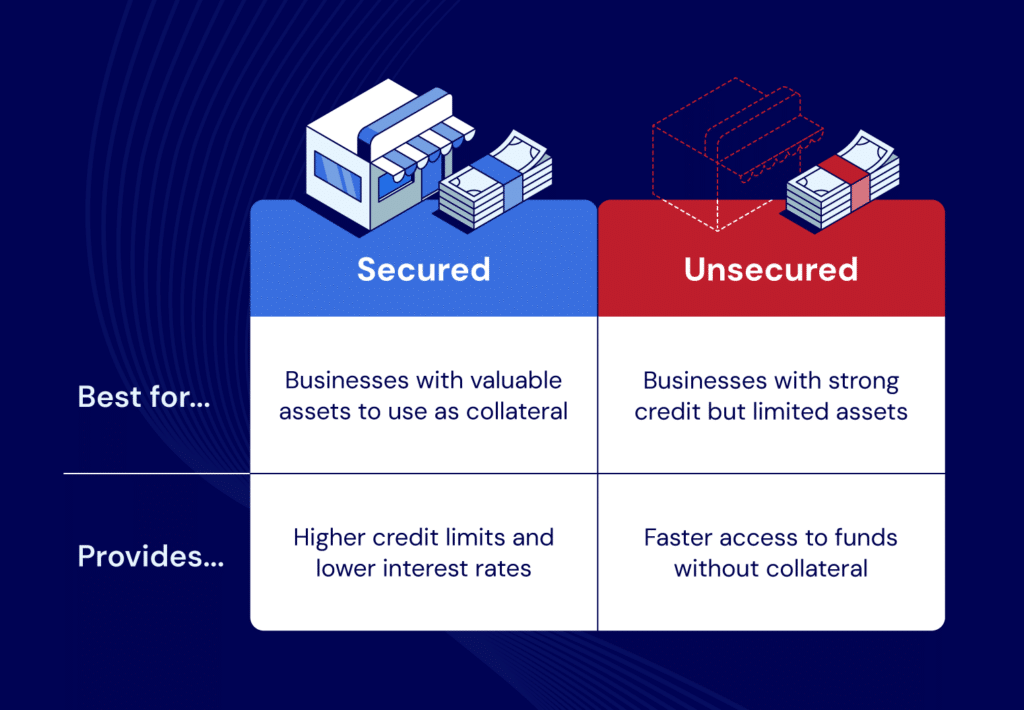

The most important distinction between a secured and unsecured line of credit score is easy: collateral. Secured loans are simply that – loans secured by collateral, which may very well be any sort of enterprise asset like stock, receivables, or actual property. As a result of the mortgage is secured, it usually comes with a decrease rate of interest.

On the flip aspect, unsecured strains of credit score don’t require collateral, which additionally makes the funding course of quicker. For the reason that lender is taking up extra danger with out collateral, credit score necessities for an unsecured line are extra stringent. These loans even have the next common rate of interest than secured loans.

Get a enterprise line of credit score with Nationwide Enterprise Capital

Whereas this text serves as a place to begin that will help you perceive the enterprise line of credit score necessities, you’ll doubtless have extra questions as soon as you start the method of securing a mortgage.

In the event you’re in that place, Nationwide Enterprise Capital has you coated. Our group of skilled enterprise advisors can reply your questions and information you thru the mortgage course of that will help you make the funding choice that works completely for you.

Attain out to us to debate your choices. Or, for those who’re prepared, go forward and get the mortgage course of began with our on-line software.

Regularly requested questions

The everyday minimal credit score rating to qualify for a enterprise line of credit score is round 700.

Sure, identical to some other enterprise, an LLC can get both a secured or unsecured line of credit score.

A $2M line of credit score works like some other line of credit score, nevertheless it clearly simply includes far more funding. You’ll have entry to as much as $2M of capital, however you solely take out what you want – and also you’ll solely pay curiosity on the quantity you utilize.