Sooner or later, your enterprise will possible want monetary assist to scale to the subsequent degree. You could be getting ready to capitalize on a market alternative, increasing your staff to fulfill rising demand, investing in new tools or know-how, or launching a brand new product line that requires upfront capital.

Regardless of the case, most lenders are greater than prepared to work along with your small enterprise to supply funding. However though you’ve bought loads of decisions, that doesn’t imply they’re the fitting possibility to your firm. This information will take a look at a few of the greatest small enterprise lenders and the way they might help your enterprise develop and broaden.

Prime small enterprise lenders at a look

Right here’s an summary of the seven greatest small enterprise lenders, who they’re greatest for, their most mortgage quantities, and extra:

| Lender | Max mortgage quantity | Minimal credit score rating | Time period size | Finest for |

|---|---|---|---|---|

| Nationwide Enterprise Capital | $10M | 620 | As much as 2 years | Advisor-service & flexibility |

| Bluevine | $500K | 625 | As much as 2 years | Bigger mortgage quantities |

| Fora Monetary | $1.5M | 570 | As much as 1.5 years | Low credit score scores |

| Speedy Finance | $1M | Undisclosed | As much as 5 years | Quick funding |

| Wells Fargo | $3M | 680 | As much as 3 years | Strains of credit score |

| TD Financial institution | $1M | Undisclosed | As much as 5 years | On-line purposes |

| AltLINE | $5M | None | Undisclosed | Finest for startups |

Nationwide Enterprise Capital

Finest for advisor-service & flexibility

- Max mortgage quantity: $10M

- Minimal credit score rating: 620

- Time period size: As much as 2 years

Nationwide Enterprise Capital is understood to supply a few of the greatest small enterprise loans primarily based on its high quality advisor service and mortgage flexibility. The corporate affords excessive lending quantities as much as $10M with a variety of secured, unsecured, and cash-flow funding choices. With 17 years in enterprise, NBC is a longtime lender that has offered greater than $2.5B in funding since 2007.

| Professionals | Cons |

|---|---|

| • Nicely-trained advisors • Excessive mortgage quantities |

• Shorter mortgage phrases • Increased income necessities |

Bluevine

Finest for giant mortgage quantities

- Max mortgage quantity: $500K

- Minimal credit score rating: 625

- Time period size: As much as 2 years

Bluevine has a big community of lenders who assist present loans to small companies. With ten years of expertise within the business, you’ll be able to anticipate a variety of lenders that provide completely different funding quantities with completely different credit score rating necessities.

| Professionals | Cons |

|---|---|

| • Excessive mortgage quantities out there by lending companions • Decrease credit score rating necessities |

• Loans not supplied by Bluevine • Phrases and necessities can range extensively primarily based on the lending associate |

Fora Monetary

Finest for low credit score scores

- Max mortgage quantity: $1.5M

- Minimal credit score rating: 570

- Time period size: As much as 1.5 years

Fora Monetary has offered billions in funding to companies since 2008. The lender is prepared to work with dangerous debtors with credit score scores as little as 570. Its larger most funding quantity of $1.5M is countered by shorter time period lengths of as much as 1.5 years.

| Professionals | Cons |

|---|---|

| • Superb for companies with poor credit score • Approval inside 4 hours |

• Brief mortgage phrases • Solely two mortgage choices |

Speedy Finance

Finest for quick funding

- Max mortgage quantity: $1M

- Minimal credit score rating: Undisclosed

- Time period size: As much as 5 years

Speedy Finance affords loans with time period limits from three months to 5 years. The corporate doesn’t disclose its credit score necessities, but when a enterprise meets them, it is going to present funding as much as $1M.

| Professionals | Cons |

|---|---|

| • Similar-day funding • Many mortgage choices |

• Doesn’t disclose credit score rating necessities • Web site offers restricted data |

Wells Fargo

Finest for enterprise strains of credit score

- Max mortgage quantity: $3M

- Minimal credit score rating: 680

- Time period size: As much as 3 years

Wells Fargo’s lending choices embrace a secured and unsecured enterprise line of credit score, however it doesn’t provide time period loans. The big banking lender offers a spread of potential mortgage quantities – between $5K and $150K for unsecured loans and $100K to $3M on secured loans.

| Professionals | Cons |

|---|---|

| • Excessive mortgage quantities out there • Consists of rewards program |

• No time period mortgage choices • Excessive credit score rating necessities |

TD Financial institution

Finest for East Coast companies

- Max mortgage quantity: $1M

- Minimal credit score rating: Undisclosed

- Time period size: As much as 5 years

TD Financial institution operates in 15 states on the East Coast and Washington, D.C. The lender affords an internet software course of with versatile phrases of 1 to 5 years and most mortgage quantities of $1M. Notice that TD Financial institution will present a most funding quantity of $250K for on-line purposes.

| Professionals | Cons |

|---|---|

| • Quick on-line purposes • A number of mortgage choices |

• Loans greater than $250K have to be utilized for in particular person • Lack of transparency on credit score rating necessities |

AltLINE

Finest for startups

- Max mortgage quantity: $5M

- Minimal credit score rating: None

- Time period size: Undisclosed

Altline is an internet lender that focuses on serving to new companies and startups purchase funding to get off their toes and develop. The lender offers excessive mortgage quantities – as a lot as $5M – and doesn’t require a minimal credit score rating.

| Professionals | Cons |

|---|---|

| • No credit score rating minimal • Funding inside two days |

• Time period lengths not disclosed • Fees origination charge |

Forms of small enterprise mortgage lenders

Relating to the forms of lenders who provide small enterprise loans, your decisions come right down to just some choices.

- Non-public credit score lenders: Non-public enterprise lenders work outdoors the normal financial institution setting and may present funds to companies with extra favorable and versatile phrases. This doubtlessly contains lengthier time period limits, decrease credit score {qualifications}, and fewer annual income.

- Conventional banks and credit score unions: Conventional banks and credit score unions may also present small enterprise loans and assist with refinancing a mortgage. Nonetheless, their mortgage phrases and {qualifications} are typicallyn’t as versatile as these of personal lenders, which can make them much less interesting, particularly to newer companies.

- Authorities small enterprise lenders: Authorities-backed loans, sometimes referred to as Small Enterprise Administration (SBA) loans, present ensures to lenders who, in flip, provide extra favorable phrases to small companies.

Now that the forms of lenders, let’s look at how to decide on one of the best one for your enterprise.

How to decide on one of the best small enterprise lender

Deciding on a lender will contain a mixture of elements, and your process is to resolve which of those elements is most essential to you.

| What’s most essential to you? | Which lender do you have to select? |

|---|---|

| Funding velocity | As a result of they’ve fewer lending necessities, personal credit score lenders can present quicker funding – sometimes inside a number of hours up to some days. |

| Value of capital | Sometimes, conventional banks provide decrease rates of interest than personal credit score lenders. Nonetheless, these decrease charges often include stricter {qualifications}. |

| Versatile phrases | Non-public credit score lenders may also provide extra versatile phrases as much as a number of years which can be customizable and extra useful to small companies. |

| Experience and transparency | Whereas newer to the lending business than conventional banks, personal credit score lenders sometimes have been working because the early 2000s. They’re typically extra upfront about phrases and necessities. |

Matthew Auletta, Enterprise Finance Advisor with Nationwide Capital, notes that small companies can profit from knowledgeable steerage when matching with one of the best lender.

“Many SMB homeowners are so used to long-term financing like automobile notes or mortgages that after they take a look at the shorter turnaround of enterprise lending, it might trigger them to hesitate and never put money into their enterprise.”

That’s the place Nationwide Enterprise Capital’s advisors’ experience comes into play. Our knowledgeable staff might help you perceive one of the best financing choices that will help you meet your growth targets.

Alternate options to small enterprise lenders

If you happen to’re searching for options to small enterprise lenders, you do produce other choices. Some examples embrace:

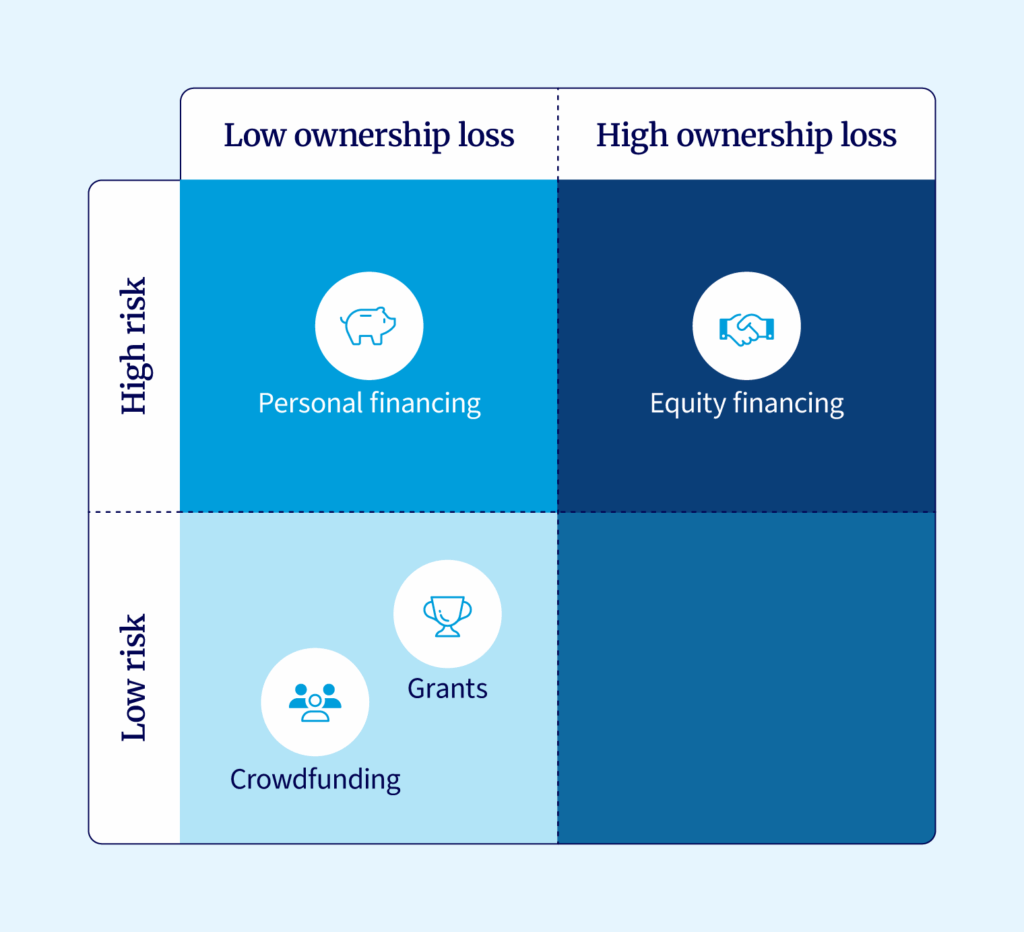

- Small enterprise grants: A technique of buying a debt-free financing possibility, however the software course of could be prolonged.

- Fairness financing: Offered by angel traders or enterprise capitalists, although it comes with the chance of giving up an excessive amount of management of your enterprise.

- Private financing: Funding by your individual private or retirement financial savings is one other risk, although definitely much less fascinating as a result of it may well threat your future monetary well-being.

Crowdfunding: A useful risk if you have already got a good buyer base and a supportive group of family and friends.

Every affords completely different advantages, notably for startups that don’t qualify for conventional or personal credit score lending.

| Fast tip: Earlier than pursuing another, ask your self: Are you comfy sacrificing possession? Do you’ve got time for advanced purposes? Is your concept “crowdfundable?” The most effective various matches each your fast wants and your long-term targets. |

|---|

Select a versatile small enterprise lender like Nationwide Enterprise Capital

The lending business is saturated with choices, and the alternatives could be a bit overwhelming. That’s why it’s important to search out one of the best small enterprise lenders, to search out the lender that isn’t simply versatile and has your greatest pursuits in thoughts.

Nationwide Enterprise Capital is understood for offering versatile phrases whereas offering you entry to knowledgeable advisors who’re more than pleased that will help you get a enterprise mortgage or different kinds of funding. If you happen to’re able to take the subsequent step towards a small enterprise mortgage, apply at the moment, and we’ll be in contact.

Incessantly requested questions

Credit score rating necessities will range by lender. Primarily based on the lenders featured on this article, scores can vary between 570 and 680. Some lenders would require scores of 700 and above.

Relying on the lender, small enterprise funding can take a number of hours up to some days, if not longer.

Secured enterprise loans are backed by collateral, akin to tools, actual property, stock, and so on. Unsecured loans don’t require collateral however have stricter {qualifications}, and approval is predicated on elements like credit score scores, financials, and annual income.

![Finest small enterprise lenders for versatile financing [2025] Finest small enterprise lenders for versatile financing [2025]](https://i0.wp.com/www.nationalbusinesscapital.com/wp-content/uploads/2025/08/best-small-business-lenders-hero-1024x603.jpg?w=696&resize=696,0&ssl=1)