As a pure section of rising, your small business will seemingly want extra capital to shortly capitalize on profitable alternatives like a brand new product line or a bodily location in a brand new state. A enterprise mortgage in all probability is sensible, however what are the perfect small enterprise loans out there? And what kinds of {qualifications} will you want?

On this article, we’ll provide you with an summary of a small enterprise mortgage comparability between a number of the extra in style lenders. These elements will embody time period lengths, credit score {qualifications}, funding quantities, and extra.

Finest small enterprise loans at a look

The market has numerous choices with many banks and lenders prepared to supply enterprise financing. However, as with every different trade, not all are created equal. Let’s have a look at 9 of the highest small enterprise lenders and the kinds of phrases and {qualifications} they provide.

| Lender | Max mortgage quantity | Minimal credit score rating | Time period size | Finest for |

| Nationwide Enterprise Capital | $10M | 620 | As much as 2 years | Advisor-service & flexibility |

| Bluevine | $500K | 625 | As much as 2 years | Bigger loans |

| Financial institution of America | $250K (secured) | 700 | As much as 5 years | Lengthy-term loans |

| QuickBridge | $500K | Undisclosed | As much as 1.5 years | Brief-term loans |

| U.S. Financial institution | $250K | Undisclosed | As much as 7 years | Quick funding |

| Wells Fargo | $3M | 680 | As much as 3 years | Traces of credit score |

| Kapitus | $5M | 650 | As much as 2 years | A number of financing choices |

| OnDeck | $250K | 625 | As much as 2 years | Decrease credit score scores |

| PayPal | $100K | Undisclosed | As much as 1 12 months | Low income companies |

Nationwide Enterprise Capital

Finest for advisor-service & flexibility

- Max mortgage quantity: $10M

- Minimal credit score rating: 620

- Time period size: As much as 2 years

Nationwide Enterprise Capital is named among the finest small enterprise lenders primarily based on its high quality advisor service and mortgage flexibility. The lender additionally affords a number of the highest funding quantities out there – as much as $10M.

With 17 years in enterprise and having supplied greater than $2.5B in funding, Nationwide Enterprise Capital is a longtime lender that provides unsecured, cash-flow funding, and asset-based choices.

| Execs | Cons |

| • Nicely-trained advisors • Excessive mortgage quantities |

• Shorter mortgage phrases • Greater income necessities |

Bluevine

Finest for bigger loans

- Max mortgage quantity: $500K

- Minimal credit score rating: 625

- Time period size: As much as 2 years

Bluevine makes use of a community of lenders to assist present loans to small companies. As a result of Bluevine acts as a market connecting debtors with a number of third-party lenders relatively than funding loans immediately, you’ll be able to count on a variety of funding quantities and credit score rating necessities that modify primarily based on every particular person lender’s standards and underwriting requirements.

| Execs | Cons |

| • Excessive mortgage quantities out there by means of lending companions • Decrease credit score rating necessities |

• Loans not supplied by means of Bluevine • Phrases and necessities can fluctuate broadly primarily based on the lending associate |

Financial institution of America

Finest for long-term loans

- Max mortgage quantity: $250K

- Minimal credit score rating: 700

- Time period size: As much as 5 years

Financial institution of America (BOA) is likely one of the largest banks in the USA. BOA has extra strict credit score and enterprise historical past necessities than its opponents, however they provide longer phrases and a variety of mortgage quantities – between $10K and $250K.

| Execs | Cons |

| • Time period loans as much as 5 years • Small mortgage quantities out there |

• Greater credit score rating necessities • Want a number of years in enterprise to qualify |

QuickBridge

Finest for short-term loans

- Max mortgage quantity: $500K

- Minimal credit score rating: Not disclosed

- Time period size: As much as 1.5 years

QuickBridge supplies small enterprise mortgage choices with excessive quantities over pretty brief phrases – as much as 18 months. The lender additionally works with its shoppers to create personalized mortgage and reimbursement plans to suit their particular wants.

| Execs | Cons |

| • Wide selection of loans out there • Customizable loans |

• Credit score rating phrases not disclosed • $250K in annual gross sales required |

U.S. Financial institution

Finest for quick funding

- Max mortgage quantity: $250K

- Minimal credit score rating: Undisclosed

- Time period size: As much as 7 years

As one of many largest business lenders within the nation, U.S. Financial institution has years of expertise serving to small companies with funding. Whereas the financial institution sometimes requires sturdy credit score profiles and established enterprise financials for approval, it affords cheap mortgage quantities – $5K to $250K – over longer phrases as much as seven years. The lender additionally includes a “fast mortgage” possibility that may doubtlessly present funding inside minutes for well-qualified candidates.

| Execs | Cons |

| • Approval and funding inside minutes • Mortgage choices as little as $5K |

• Doesn’t share credit score rating necessities • Rates of interest and income necessities aren’t disclosed |

Wells Fargo

Finest for strains of credit score

- Max mortgage quantity: $3M

- Minimal credit score rating: 680

- Time period size: As much as 3 years

Wells Fargo doesn’t provide time period loans however supplies a enterprise line of credit score – each secured and unsecured. It does have stricter credit score necessities, however they supply a variety of potential mortgage quantities – between $5K and $150K for unsecured loans and $100K to $3M on secured loans.

| Execs | Cons |

| • Excessive mortgage quantities out there • Features a rewards program |

• No time period mortgage choices • Excessive credit score rating necessities |

Kapitus

Finest for a number of financing choices

- Max mortgage quantity: $5M

- Minimal credit score rating: 650

- Time period size: As much as 2 years

Kapitus has supplied numerous funding options, together with six potential small enterprise mortgage affords: commonplace enterprise loans, gear financing, strains of credit score, revenue-based financing, bill factoring, and SBA loans. Due to the upper funding quantities, Kapitus requires annual revenues of not less than $250K and a minimal of two years in enterprise.

| Execs | Cons |

| • Six potential funding choices with every mortgage • Day by day, weekly, and month-to-month cost choices |

• Excessive annual income necessities • Brief-term loans solely |

OnDeck

Finest for decrease credit score scores

- Max mortgage quantity: $250K

- Minimal credit score rating: 625

- Time period size: As much as 2 years

OnDeck could be best for much less established companies due to its extra relaxed necessities associated to years in enterprise, annual income, and credit score rating. Time period loans have a variety of potential quantities – between $5K to $250K.

| Execs | Cons |

| • Potential same-day funding • Low income and credit score rating necessities |

• No mortgage choices past 2 years • Tough to seek out rates of interest on-line |

PayPal

Finest for low-revenue companies

- Max mortgage quantity: $100K

- Minimal credit score rating: Undisclosed

- Time period size: As much as 1 12 months

PayPal has designed a mortgage program best for low-revenue and startup companies. Necessities embody solely 9 months in enterprise and a minimal annual income of $33K. PayPal supplies quick funding instances however does require a PayPal enterprise account in an effort to entry its loans.

| Execs | Cons |

| • Relaxed income necessities • Low time period limits and mortgage quantities out there |

• PayPal enterprise account required • Unclear credit score rating necessities |

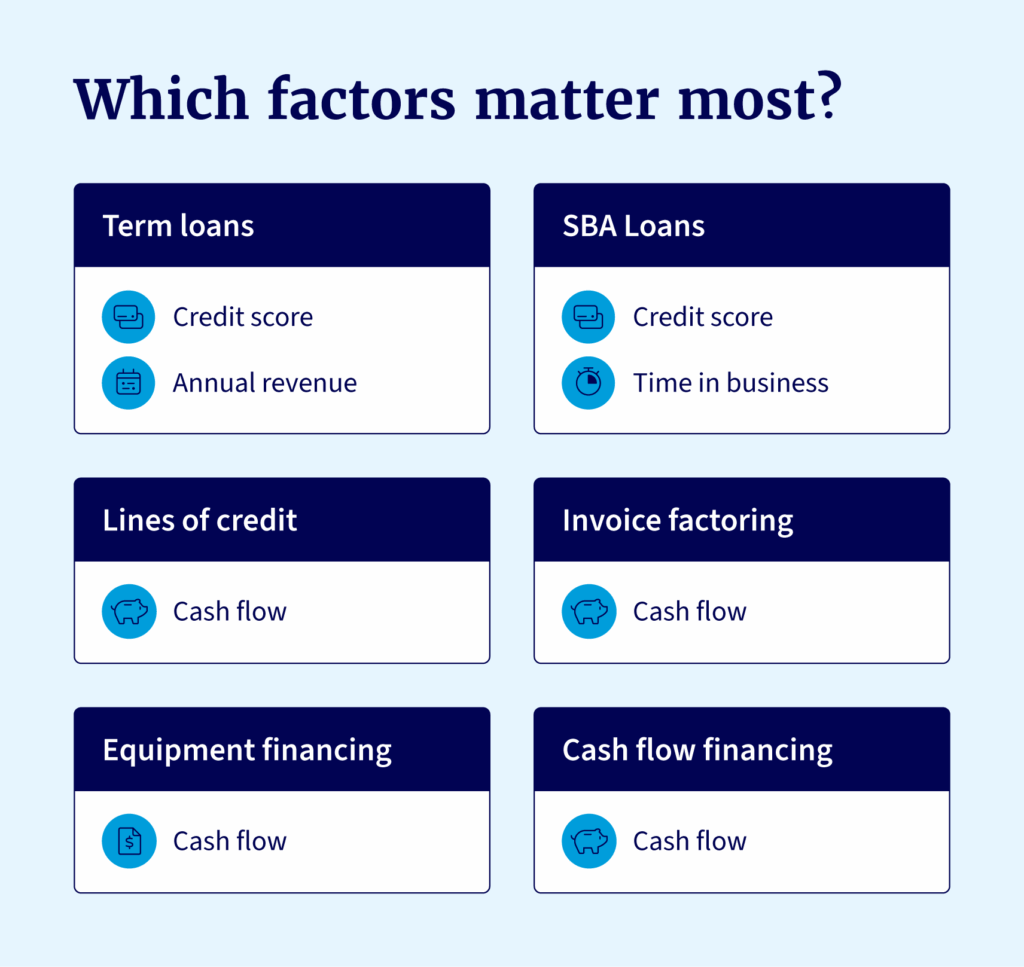

Varieties of small enterprise loans

Small enterprise loans are available all sizes and shapes. You’ll have many choices when in search of the perfect loans for small companies. Listed here are the most typical kinds of small enterprise loans.

| Mortgage sort | Description |

| Enterprise strains of credit score | Permits a enterprise to borrow as wanted (as much as a selected most) whereas solely paying curiosity on the full quantity borrowed |

| Money movement financing | Gives financing to a enterprise with quantities primarily based on the enterprise’s previous and projected money movement tendencies |

| Enterprise time period loans | Gives a certain quantity of financing to a enterprise anticipated to be repaid over a set period of time – sometimes between one and 7 years |

| Tools financing | Gives a mortgage or lease to a enterprise to amass gear, together with automobiles, workplace furnishings, manufacturing and medical gear, manufacturing loans, and extra |

| SBA loans | Offered to companies with financing that the U.S. authorities backs. These loans provide extra favorable situations to corporations, like longer phrases and fewer stringent credit score necessities |

Ideas for selecting the perfect small enterprise mortgage

Selecting the perfect small enterprise mortgage is pretty easy as soon as you understand every lender’s standards. Do your analysis to seek out the mortgage that’s most favorable to you.

- Confirm credit score rating standards: Credit score rating necessities can fluctuate from 600 to 700. Although a decrease credit score rating may harm your potential to amass a small enterprise mortgage, some lenders will present extra relaxed necessities.

- Assess month-to-month income minimums: Lenders will certainly think about your small business’s annual and month-to-month income as a part of their approval course of. Income necessities can vary from $33K to $500K.

- Affirm time in enterprise necessities: The longer you’ve been in enterprise, the higher your likelihood of securing a enterprise mortgage. Typical necessities are round two years in enterprise, although some lenders might present loans to companies in operation for as little as 9 months.

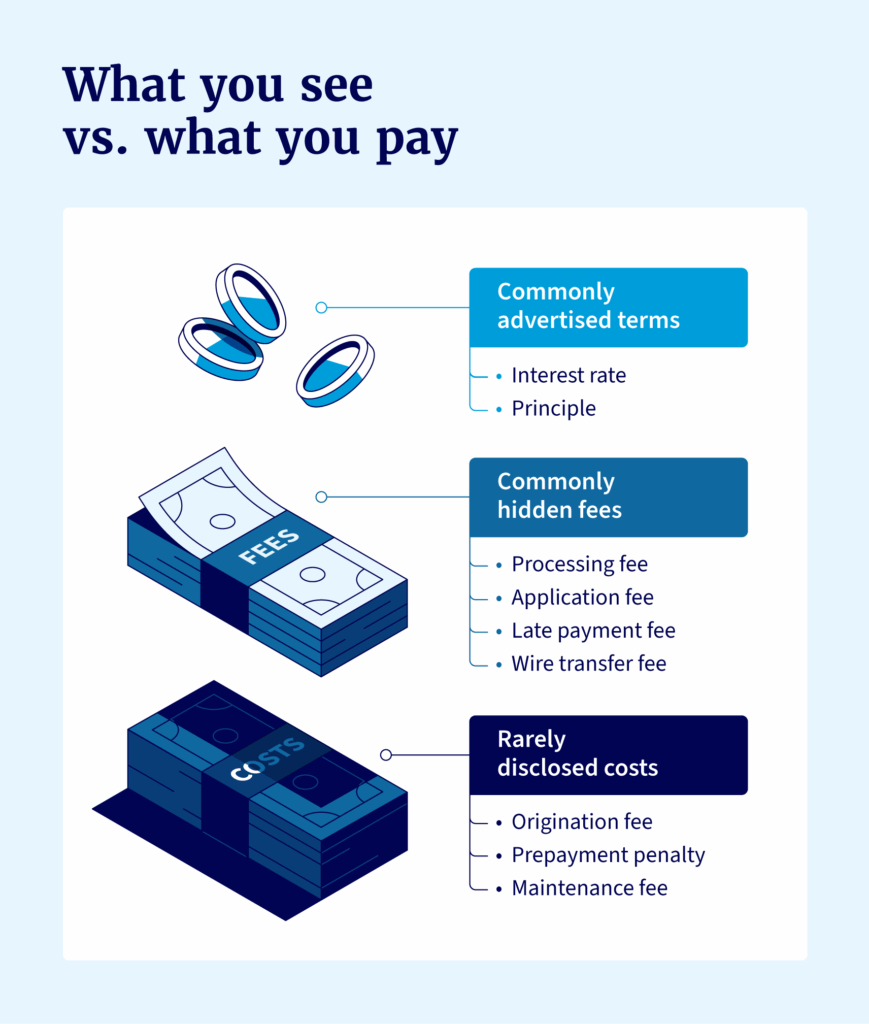

- Consider annual proportion charges (APR): Annual proportion charges will vastly have an effect on how a lot curiosity you pay all through the mortgage. Learn the high-quality print to study the kinds of APR ranges and perceive the lenders that present the perfect small enterprise mortgage charges.

- Search for any hidden fees: Not each lender has hidden charges, however some will attempt to sneak in a number of fees. Some of these fees are sometimes prepayment penalties, late cost penalties, and origination and underwriting charges.

- Analyze reimbursement phrases: With conventional enterprise loans, time period lengths can vary from a number of months to seven years. When you want longer phrases, think about an SBA mortgage backed by the federal government.

Know the time to funding: Some lenders present quick funding choices – from inside minutes to the identical day. Others may take just a little longer to course of funds in your account, so know what you want and when earlier than making use of with lenders.

Now that you just perceive how to decide on the perfect small enterprise loans, let’s look at how you can get such a mortgage and the method.

get a small enterprise mortgage

The world of small enterprise loans can typically be complicated with all of the choices out there. That stated, understanding the steps of making use of for one helps simplify the method.

Verify your eligibility

Lots of elements go into being eligible for a mortgage. Your credit score rating, time in enterprise, annual income, and general monetary profile. Some lenders will give weight to sure elements over others.

Among the finest features of a lender will likely be their willingness to know your scenario and supply confirmed recommendation primarily based on what you want, and that’s the place you’ll be able to belief Nationwide Enterprise Capital and its workforce of skilled enterprise advisors to shine.

Analysis and evaluate lenders

The mortgage course of will be difficult; some lenders will level you to an utility and allow you to go. Nationwide Enterprise Capital pairs you with an skilled enterprise advisor who can assist you higher perceive the choices you’ve gotten out there and the way every will match into your long-term enterprise targets.

Collect documentation, apply, and obtain funds

Get collectively as a lot documentation as you’ll be able to earlier than you apply. These will likely be objects equivalent to:

- Steadiness sheets

- Tax returns

- Financial institution statements

- Credit score experiences

- Money movement projections

- Driver’s license

That’s simply an instance of a number of the documentation you may want. After getting the suitable info, apply to your small enterprise mortgage – holding in thoughts that lenders who’re extra versatile and supply sooner funding will make it easier to attain your targets sooner.

Discover versatile small enterprise funding choices with Nationwide Enterprise Capital

Nationwide Enterprise Capital isn’t going to hold you out to dry throughout the mortgage course of. We provide a number of the trade’s most versatile, greatest small enterprise loans. We’ll present you how you can get a enterprise mortgage and supply an advisor to work with you all through the method. We might love to debate our versatile funding choices should you’re able to learn how Nationwide Enterprise Capital can assist you attain your small business targets. Apply as we speak to get began and put your small business on the quick observe to progress.

Often requested questions

The perfect mortgage for a small enterprise depends upon the enterprise’s general monetary scenario – together with annual income, time in enterprise, credit score rating, and so forth.

The longer you’ve been in enterprise and the higher your monetary profile, the much less dangerous your small business will seem to lenders.

The simplest small enterprise loans to qualify for sometimes come from non-public credit score lenders, different lenders, or SBA loans backed by the U.S. authorities.

A number of the quickest loans to amass will come from non-public credit score lenders, who course of instantly and may present funds inside the similar day.

Sure. LLCs can get a small enterprise mortgage, identical to every other firm.

![Finest small enterprise loans + how you can apply for one [2025] Finest small enterprise loans + how you can apply for one [2025]](https://i0.wp.com/www.nationalbusinesscapital.com/wp-content/uploads/2025/08/best-small-business-loans-hero-1024x603.jpg?w=696&resize=696,0&ssl=1)