You’ve constructed a powerful meals truck operation; Demand is rising, and foot visitors is choosing up week by week. A fantastic new location has come up ten blocks away, and also you need it, however proper now, money circulate’s a bit tight. If this sounds acquainted, meals truck financing gives you the capital it is advisable to seize the chance whereas defending your working capital.

Beneath, learn the way different operators use meals truck financing and what steps you must take to decide on the precise funding choice on your firm.

What are some great benefits of financing a meals truck?

Meals truck financing offers you entry to capital on the proper time, when it may make an actual distinction to your enterprise’s future. The objective is that can assist you attain your potential quicker, with decrease stress and extra management over your capital.

Additionally, understand that lenders know meals vans could be nice companies – that’s why they’re able to again them. Skip the bank cards and discover a lender who sees your potential and needs that can assist you develop with out placing your personal financial savings on the road.

Right here’s how meals truck companies use financing to develop quicker, enhance profitability, and keep forward of rivals:

Frees you to behave on alternatives

Let’s say you need an additional truck. Ready 12 months to avoid wasting up $60,000 to purchase it’s a false financial system. If that delay means you miss out on $10,000 to $20,000 in income a month, you’ve misplaced out on potential revenue and missed the possibility to construct your visibility.

Prepares you to take motion

Locals and vacationers flock to Meals Truck Saturdays at Amelia Earhart Park in Miami, in search of the town’s greatest meals. When a possibility to safe your spot at an analogous occasion in your space seems otherwise you discover a pitch with severe footfall, financing means that you can transfer quick and declare the spot earlier than another person does.

Permits for profitable gear upgrades

Upgrading your fryer, fridge, or POS system cuts your prep time so you’ll be able to serve extra clients each shift. If which means you promote to 6 extra clients at $10 a time throughout lunch hour, that’s $15,000 in further income a 12 months. Plus, clients return to you extra since you don’t preserve them ready.

Unlocks higher pricing

Wholesalers reward meals truck companies that place greater orders with reductions. Use stock financing to purchase key elements, disposables, and cooking oil in quantity and make larger margins on each sale. Increase your margins with out elevating menu costs.

What can I exploit meals truck financing for?

Once you’re able to develop, the precise funding offers you the capital to again your enterprise instincts and make it occur.

Right here’s how profitable operators use meals trailer financing to provide themselves a bonus:

- Increasing your fleet: Add one other truck to launch a brand new route or safe a everlasting pitch you’ve lined up. Financing helps you purchase the truck, match it with gear, wrap it in your model, rent your crew, and earn it on the street.

- Getting higher prep and space for storing: Transfer right into a commissary or kitchen facility with sufficient room to prep, retailer, and restock for a number of vans. Give your crew the house to work correctly and deal with the rising demand.

- Shopping for higher kitchen gear: Give your crew the instruments to work constantly, prep quicker, and roll out improved menus. Don’t get held up by defective equipment, delays between shifts, or gear that’s now not match for objective.

- Leaping on time-sensitive pitches: Cowl bid charges when an excellent spot opens up and have funding able to pay for permits, provides, and staffing. You’ll have every little thing in place to start out buying and selling right away.

- Investing in advertising: Refresh your model with a brand new wrap, branded packaging, and on-location advertising to drive footfall at present pitches and construct momentum at new ones. That further visibility helps folks acknowledge your model and select you after they’re deciding what to eat.

- Hiring forward of peak seasons: Usher in full new crews, together with line cooks and shift managers, and practice them so that they’re able to go from day one. Use funding to cowl the preliminary wages, recruiter charges, and onboarding prices with room to spare.

- Including extra cooking gear: Set up a smoker, pizza oven, or second fryer to increase your menu and deal with larger volumes. These setups actually repay at non-public occasions, state gala’s, and trailer items with the house to run full-scale service.

- Paying for permits in bulk: Once you’re increasing, don’t overlook to price range for permits throughout new vans, service areas, and employees. Type out the paperwork now so each new unit can begin incomes on day one.

- Providing door supply: Arrange on-line ordering, connect with supply platforms, take pre-bookings so clients can acquire with out ready in line, or launch your personal drop-off service. That manner, you’re benefiting from each hour, not simply breakfast, lunch, or the post-work rush.

You’ll be able to take out a mortgage with multiple objective in thoughts. Essentially the most profitable operators aren’t simply in search of a enterprise mortgage for a meals truck. They need capital for the truck, the fit-out, the wrapping and branding, hiring and coaching employees, the permits, and an promoting price range to create a neighborhood buzz earlier than launch.

Discuss to Nationwide Enterprise Capital to fund your total rollout, not simply a part of it.

How a lot do it is advisable to put money into a meals truck?

You want round $50,000 to put money into a meals truck, with round $30,000 at least for the truck and $20,000 to cowl your first six months up and working.

We’ve averaged the numbers on these web sites – Postron, Shopify, and CloudKitchens – to estimate the prices of launching and working a meals truck.

Right here’s how the three commonest methods to get a truck evaluate.

| Buy methodology | Price vary | Key advantages |

|---|---|---|

| Purchase New | $50,000-$175,000 | • Totally fitted with new home equipment (usually beneath guarantee) • Minimal upkeep early on |

| Purchase Used | $30,000-$100,000 | • Decrease entry price • Sooner availability |

| Customized Construct (from scratch) | $50,000 + the price of the car | • Totally tailor-made structure and spec • Ideally suited for area of interest ideas |

Used vans minimize your prices and allow you to begin on a tighter price range whereas customized vans provide the spec you wish to stand out at premium pitches. Financing enables you to select the precise choice for the chance, not simply the one you’ll be able to afford upfront.

How worthwhile is a meals truck enterprise?

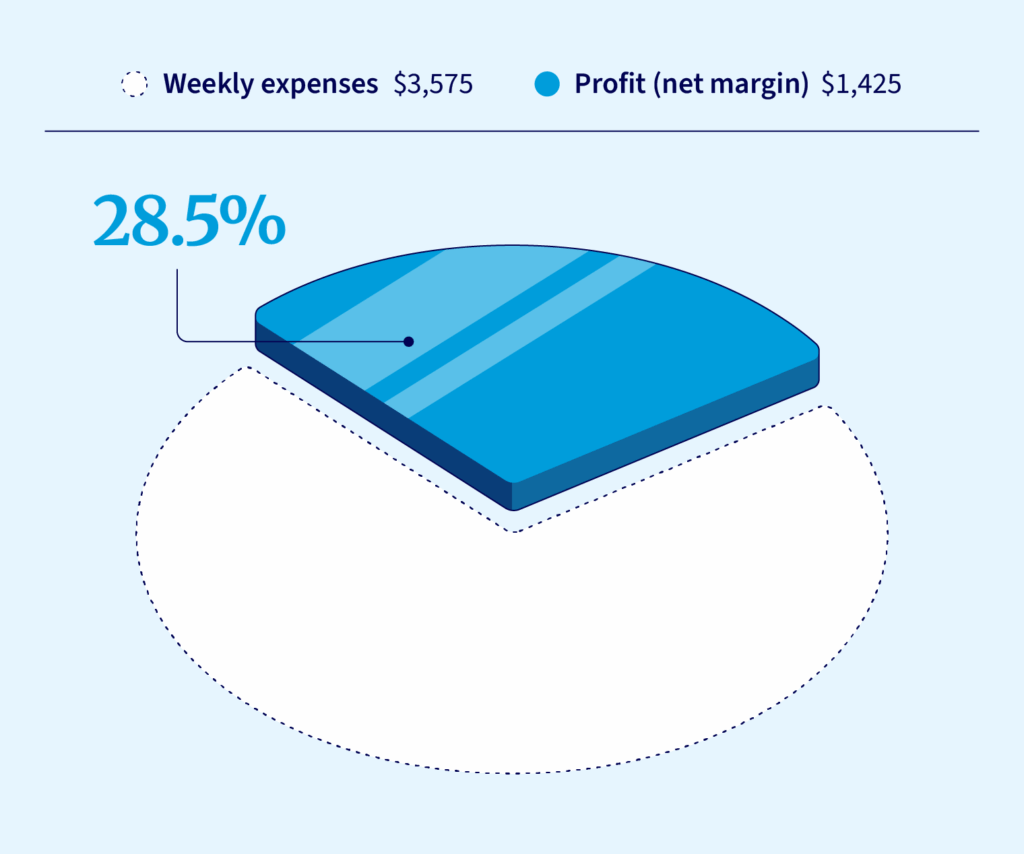

A meals truck enterprise can ship a really wholesome margin of 28.5% web margin earlier than mortgage repayments and upkeep prices. Add in occasion bookings or non-public catering, and plenty of vans push that margin even larger, particularly when you’ve paid off the preliminary truck prices.

Utilizing the identical sources, right here’s how we labored out that determine, assuming meals truck income of $5,000 per week:

| Class | Weekly expense | % of income | Typical prices |

|---|---|---|---|

| Components | $1,500 | 30% | Uncooked supplies and elements |

| Labor | $1,000 | 20% | Two employees at round $15/hr every |

| Gasoline & Propane | $150 | 3% | Cooking and driving gas prices |

| Provides | $200 | 4% | Takeout containers, napkins, utensils |

| Parking & Commissary | $375 | 7.5% | Based mostly on $1,500/month parking ($375/week) |

| Insurance coverage & Permits | $100 | 2% | Professional-rated annual insurance coverage and allowing |

| Advertising | $250 | 5% | Native advertisements, truck wraps, promos |

| Whole Bills | $3,575 | 71.5% | |

| Internet Weekly Revenue | $1,425 | 28.5% |

It’s no shock that, with margins that robust, enterprise analysis firm Skyquest believes the market will increase from $1.4B in 2023 to $2.29B in 2032. A few of these prices, particularly meals and parking/commissary charges, could also be decrease for operations with fewer vans exterior city or metropolis middle places.

What paperwork do I would like to use for meals truck financing?

With most lenders, it is advisable to present a good quantity of documentation to use for meals truck financing. Count on to be requested for:

- Monetary statements: You’ll want financial institution statements, enterprise tax paperwork, steadiness sheets, money circulate statements, revenue and loss statements, debt schedules, and accounts receivable and payable. This helps lenders perceive how a lot you’ll be able to borrow, the way you’ll repay it, and how briskly you’re rising.

- Authorized and possession paperwork: This consists of proof of possession for any collateral you supply beneath the mortgage phrases, your enterprise insurance coverage coverage, licenses, permits, articles of incorporation, and registration certificates.

- Enterprise and private info: Be able to share private tax returns, a abstract of your private monetary place and a marketing strategy that outlines your concept intimately with advertising plans, employees, administration, monetary forecasts, and extra.

At Nationwide Enterprise Capital, you’ll be able to apply with simply six months of enterprise financial institution statements. If we’d like the rest, we’ll let .

What are one of the best meals truck loans?

The perfect meals truck mortgage isn’t about discovering the bottom charge – it’s about matching the funding to the job. Which may imply short-term funding to cowl seasonal hires or permits or a longer-term facility to fund growth, refit a truck, or open a prep kitchen.

In the event you’re evaluating gives, search for choices that align together with your income cycle, offer you entry to the complete quantity you want, and depart room to develop. The perfect lenders will allow you to weigh the trade-offs between price, pace, and adaptability so you’ll be able to select based mostly on what you’re making an attempt to attain, not simply what you’ll be able to qualify for.

Why is meals truck financing vital for progress?

Meals vans are worthwhile, however it’s a aggressive sector, so that you want capital on the proper time. In the event you don’t, you’ll spend months, if not years, saving as much as open a brand new pitch or improve your gear. In that point, another person can take the slot, declare the situation, and construct the shopper base you have been aiming for.

When the chance is there, funding enables you to:

- Carry extra capital: Pay for big-ticket objects like vans and kitchen gear whereas having the capital to fulfill your working prices.

- Purchase higher and quicker: Order in quantity out of your suppliers, they usually’ll offer you a reduction. Do it usually, and also you’ll lock in higher pricing, precedence supply, and extra favorable provide phrases.

- Take a look at out concepts: Attempt new menu objects, seasonal occasions, or short-term routes with out taking capital away out of your day-to-day operations.

- Declare tax benefits: In lots of instances, you’ll be able to write off curiosity or gear depreciation to scale back your tax invoice.

Each enterprise makes use of debt. Essentially the most profitable ones use it as leverage to scale and develop their corporations. It’s the identical within the meals trucking sector.

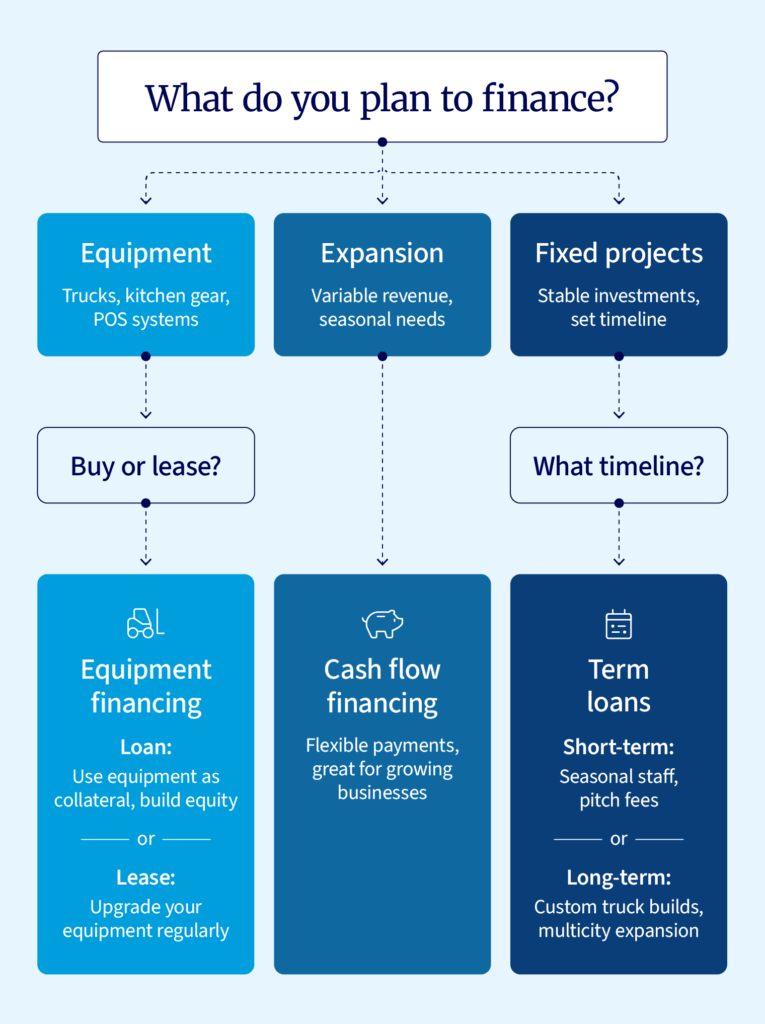

Varieties of loans to finance a meals truck

The appropriate mortgage is completely different for each meals truck. The one which works for your enterprise is dependent upon what you wish to do with the capital, how briskly you want it, and the way lengthy it takes to see a return in your funding.

Right here’s how you can finance a meals truck:

Tools financing

Tools financing may be very in style with meals truck operators. You’ll be able to take out a mortgage to purchase the gear you need or lease what you need and improve once more later. Right here’s how the 2 choices work:

- Tools mortgage: Put down a deposit of 10-20%. The gear is your collateral.

- Tools lease: Leasing has a decrease upfront price, however the lender owns the gear. On the finish of the lease, they acquire it or, in case you conform to this initially, allow you to purchase it outright for a price. Alternatively, begin a brand new lease with the newest gear.

Each choices allow you to maintain on to your working capital and don’t intervene with every other finance association you’ve gotten. You get the gear it is advisable to push your enterprise ahead.

Money circulate financing

Get upfront capital based mostly in your money circulate, not your property. The lender assesses how properly your meals truck enterprise performs to resolve how a lot you’ll be able to borrow. Repayments are weekly or month-to-month.

Money circulate financing is a good selection for rising operators who wish to preserve momentum. The funding can be utilized to cowl growth prices, tackle bigger catering contracts, and lock in new pitches with out touching your financial savings.

The perfect half is that funds flex together with your income. If the occasion you booked didn’t go forward, foot visitors dropped resulting from unhealthy climate, or one in every of your vans was out for restore, your repayments alter so you’ve gotten further room to cowl your prices and preserve buying and selling with out stress.

Enterprise time period loans

With a time period mortgage, you borrow a set quantity and repay it in equal installments over a set interval. Time period loans are versatile; you should use them for absolutely anything, from hiring employees and increasing right into a commissary to paying off older, costlier debt.

Varieties of time period loans embrace:

- Quick-term mortgage (six to 18 months): These are greatest for investments that’ll return capital quicker like investing in seasonal employees or pitch charges.

- Intermediate time period mortgage (one to 3 years): Go mid-term on gear upgrades, the deposit on and kitting out of a commissary kitchen, or refurbishing an present truck. Your repayments are decrease, however you received’t be paying out after you’ve gotten the complete worth out of the funding.

- Lengthy-term mortgage (three to 10 years): Unfold the prices out so long as doable on large expenditures like customized truck builds, shopping for your personal prep house, or increasing into completely different cities. Decrease repayments take the strain off your money circulate.

How to decide on the precise meals truck mortgage for your enterprise

The appropriate mortgage isn’t the one with the bottom charge. It’s the one which helps you get the job accomplished and doesn’t lock you into repayments lengthy after you’ve seen the worth.

Operators are likely to favor these financing choices:

- Shopping for gear: In the event you’re shopping for a truck, a grill, or a freezer, go for gear financing. On daily basis, you employ your property, and the income you make out of your meals takes care of the cost. Select leasing for the newest gear and loans for property that maintain their worth over time. Each choices preserve your working capital free to run the enterprise.

- Feeding progress: In the event you’re rising your enterprise, money circulate financing is greatest. Funds flex together with your income, so that you hold onto extra of your capital in quieter weeks. That flexibility makes it splendid for operators in vacationer locations or places the place your greatest weeks are festivals, markets, and native occasions.

- Lengthy-term funding: Time period loans make sense while you’re constructing lasting worth in your enterprise, like scaling into a number of cities. They are often helpful, however provided that the mission delivers excessive returns over time. Stress-test your numbers to examine that your mission earns sufficient to justify the complete price of the mortgage.

Lending standards for meals truck financing

Nationwide Enterprise Capital works with established operators with not less than one present restaurant location. You’ll have to have been in enterprise for not less than one 12 months and produce $500K+ in annual income. In addition to meals truck financing, discover out about our restaurant financing choices.

What makes us completely different is the long-term partnerships we construct with established and rising corporations. We’re right here to help you with knowledgeable recommendation by way of your growth and in any market. We’ve constructed our firm round working with enterprise homeowners who depend on us to search out the precise funding resolution as they increase, add places, or tackle greater contracts.

Discover choices to finance your meals truck with Nationwide Enterprise Capital

Whether or not you’re increasing your fleet, upgrading your kitchen gear, or locking in a worthwhile new pitch, the precise mortgage construction makes the distinction. Apply securely for meals trucking enterprise loans with Nationwide Enterprise Capital, and develop your meals truck enterprise to greatness with our help.

Nationwide Enterprise Capital is a market chief in funding $100K-$5M+ transactions. We’ve secured over $2.5B in financing for enterprise homeowners, and one in every of our specialist areas is hospitality financing. In the event you’re undecided which choice matches greatest, communicate to our knowledgeable enterprise advisors, who know the meals truck sector and may tailor a plan to your targets. Apply now to get began as we speak.

Steadily requested questions

Most lenders ask for tax returns, financial institution statements, a marketing strategy, and proof of licenses, permits, and possession. You might also want to supply a revenue and loss assertion, steadiness sheet, or proof of collateral. Nationwide Enterprise Capital solely wants a accomplished utility and 6 months of financial institution statements to get began.

Sure, you should use private property like actual property as collateral, however you don’t must. Many meals truck lenders supply unsecured loans based mostly in your income, not your house or financial savings. Contact Nationwide Enterprise Capital to search out lenders that may fund your enterprise with out requiring collateral.

You want a credit score rating of not less than 550 to finance a meals truck. Each lender is completely different, however most require a better rating. Companies with stronger credit score can entry higher charges, extra reasonably priced compensation phrases, and better borrowing limits. Nationwide Enterprise Capital requires a minimal rating of 700 for meals truck financing.

In case your credit score rating is beneath 600, it’s useful to indicate robust money circulate and energetic contracts or convey on a co-signer with glorious credit score. Search for lenders open to funding candidates with combined or restricted credit score histories.

To purchase a meals truck with no funds, you first want a plan to find out how a lot it is advisable to launch your enterprise. Upon getting a agency price range, take into account approaching the next sources:

- Family and friends: Ensure you agree on compensation phrases upfront. In the event you supply fairness, everybody ought to perceive their share and what rights they’re entitled to.

- Bank cards: Some playing cards supply 0% APR for the primary 12–18 months. Nonetheless, when the 0% charge ends, you’ll pay a lot larger rates of interest than on normal industrial financing like a time period mortgage.

- Renting a meals truck: You could possibly lease a completely fitted truck with no down cost. However most rental corporations received’t allow you to purchase the car later, so that you’ll at all times be paying for one thing you don’t personal.