Alan Greenspan’s notorious irrational exuberance speech is a basic instance of how loopy markets can all the time get crazier.

This was the precise textual content from his speech at a coverage dinner in December of 1996:

Clearly, sustained low inflation implies much less uncertainty in regards to the future, and decrease threat premiums suggest increased costs of shares and different incomes belongings. We will see that within the inverse relationship exhibited by value/earnings ratios and the speed of inflation up to now. However how do we all know when irrational exuberance has unduly escalated asset values, which then turn into topic to surprising and extended contractions as they’ve in Japan over the previous decade? And the way can we issue that evaluation into financial coverage? We as central bankers needn’t be involved if a collapsing monetary asset bubble doesn’t threaten to impair the actual financial system, its manufacturing, jobs, and value stability. Certainly, the sharp inventory market break of 1987 had few unfavorable penalties for the financial system. However we should always not underestimate or turn into complacent in regards to the complexity of the interactions of asset markets and the financial system. Thus, evaluating shifts in steadiness sheets typically, and in asset costs notably, should be an integral a part of the event of financial coverage.

The previous Fed chair wasn’t pounding the desk that the inventory market was a bubble however he was definitely implying one thing was afoot.

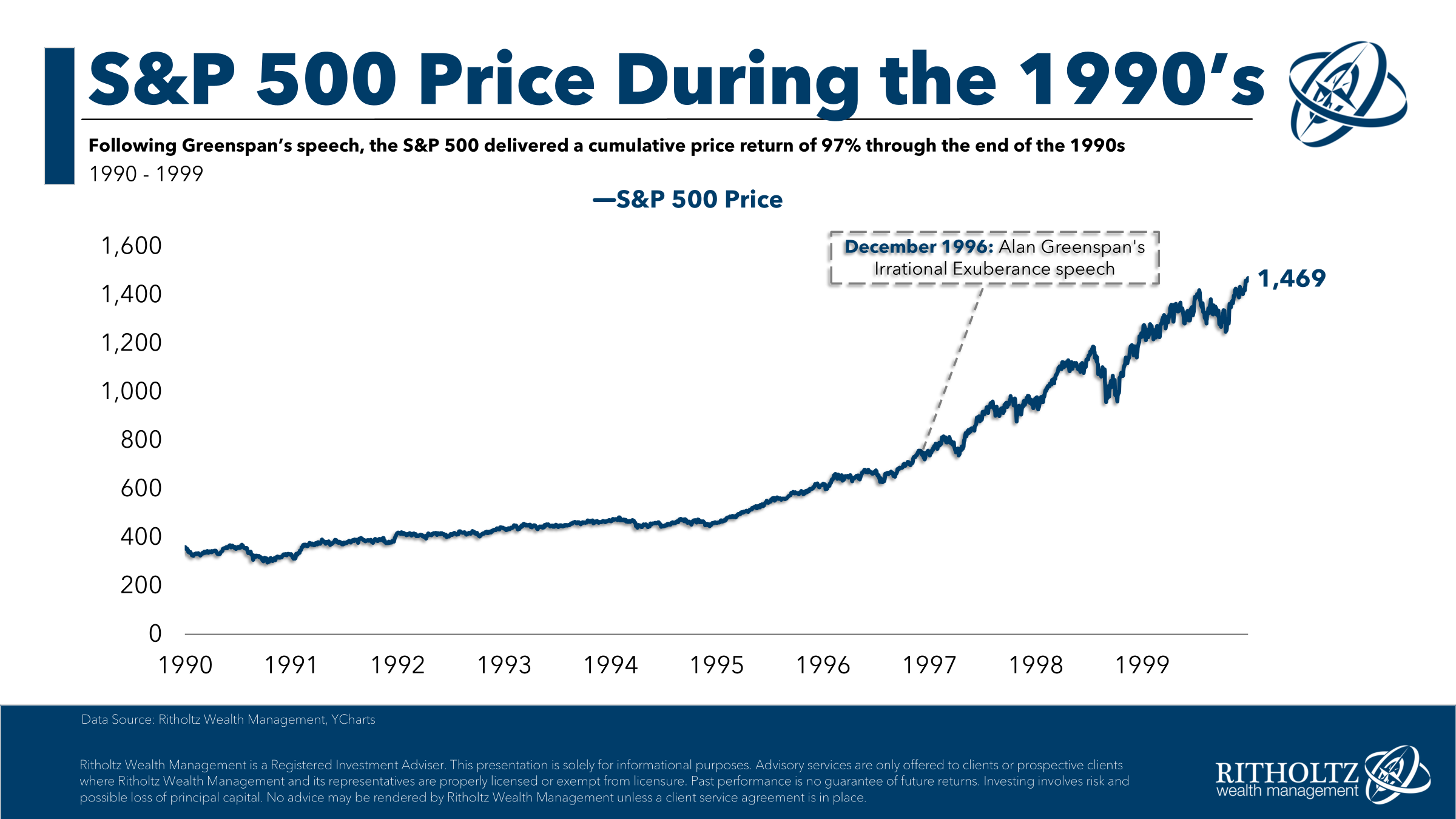

From 1980 via Greenspan’s speech on the tail finish of 1996, the S&P 500 was up greater than 1,200% in complete or a blistering 16.5% return on an annual foundation. Valuations had been up, up and away. The Netscape IPO occurred a yr earlier. Issues felt very toppy.

That didn’t matter. The market took off like a rocket ship following Greenspan’s speech:

From the time of Greenspan’s speech via the remainder of the last decade the S&P would greater than double, adequate for an annualized return of almost 26% via the tip of 1999. The market was up 33% in 1997, 28% in 1998 and one other 21% in 1999.1

The dot-com bubble lastly burst within the spring of 2000, chopping the S&P 500 in half together with a drawdown of greater than 80% within the Nasdaq.

Some individuals are beginning to marvel if we’re in an analogous scenario now.

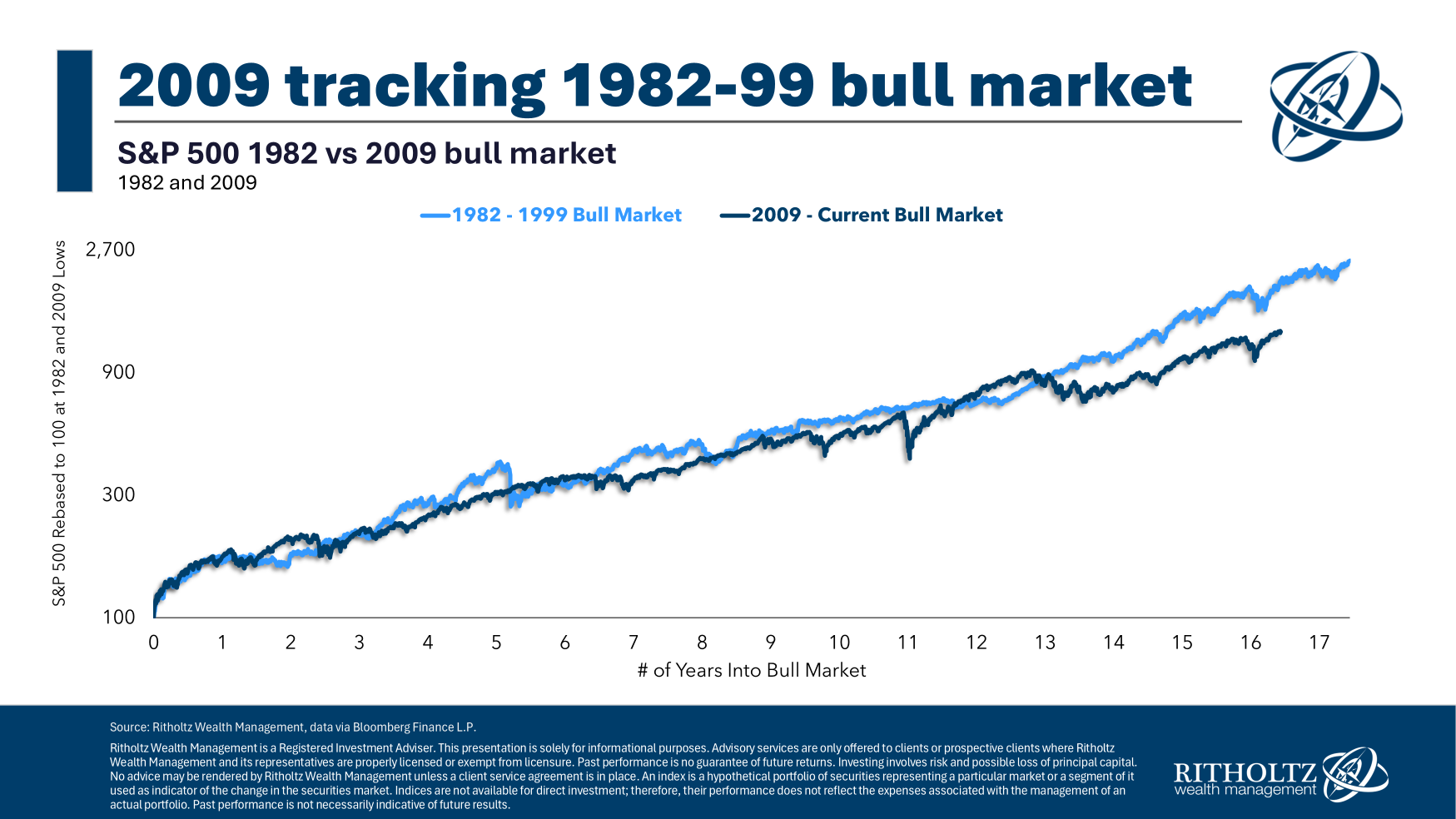

No two markets are ever the identical. The businesses within the dot-com bubble didn’t make any cash. They didn’t have the ridiculous revenue margins tech shares have as we speak. However there are some similarities.

The AI capex spending binge is eerily much like the telecomm buildout that occurred within the Nineties.

Speculative exercise is in all places too — SPACs, meme shares, IPOs, leverage, story shares, excessive valuations, deregulation, and many others.

And the 2 bull markets have taken on an analogous trajectory over time:

Many individuals are attempting to determine whether or not that is the early phases of a bubble or the tip of the highway.

Investing could be rather a lot simpler if there have been a easy option to predict these kind of markets. Sadly, there’s not. Nobody can predict when human nature will take issues too far or when it’s going to cease on a dime. The pendulum all the time swings; we simply don’t know the way far in both route.

Forecasting the market within the brief run is unattainable.

Investing for the long term is the very best treatment for the uncertainties of the brief run.

For those who had invested within the S&P 500 following Greenspan’s speech in December of 1996 and held on till as we speak, you’ll be up simply shy of 10% per yr. You’d have needed to stay via two 50% crashes within the subsequent dozen years or so, 9/11, a number of wars, oil going to $150/barrel then unfavorable, the pandemic, 40-year excessive inflation, the 2022 bear market and a few dozen different run-of-the-mill corrections.

However even in any case that unhealthy stuff you continue to would have kind of gotten the market’s long-term annual return.

That’s not unhealthy.

For those who had invested on the peak of the market simply earlier than the dot-com bubble burst on the finish of 1999, you’ll be up just a little greater than 8% per yr. That’s not a horrible final result contemplating all the unhealthy stuff you’ll have needed to stay via plus that was the costliest valuations the U.S. inventory market has ever seen.

Clearly, nobody really invests like that (besides Bob). Individuals don’t put all of their cash to work suddenly.

Most individuals spend money on 1996, 1999, 2007, 2009, 2020 and every part in-between. Among the best options of greenback value averaging into the market over time is that it permits you diversify throughout time, valuation degree and market surroundings.

For those who’re averaging into the market over time it is best to welcome volatility.

For those who’re absolutely invested, you should be keen to simply accept volatility or diversify your belongings to dampen no matter ache it could trigger.

These items are far simpler and extra useful than attempting to foretell the start or finish of a monetary asset bubble.

Additional Studying:

An Epic Bull Market

1And that was following +37% in 1995 and +23% in 1996. Simply an insane run.