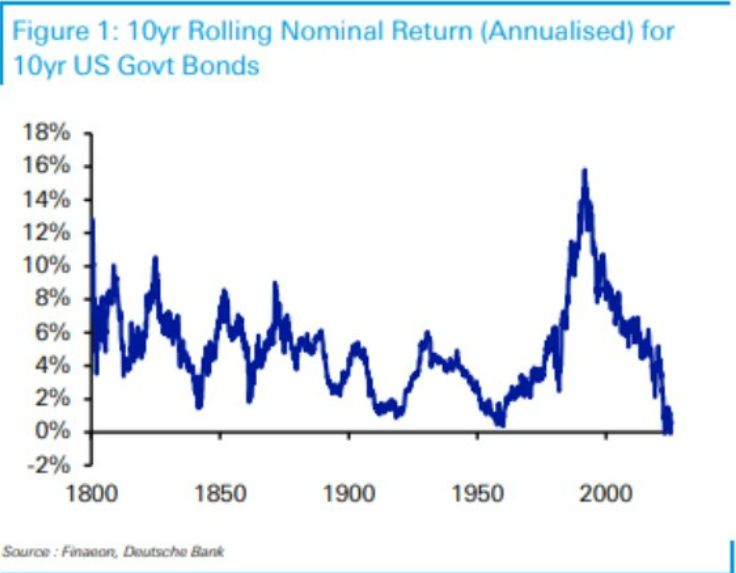

Deutsche Financial institution has a chart that exhibits we’re trying on the worst 10 yr interval ever for U.S. authorities bonds:

That doesn’t appear good.

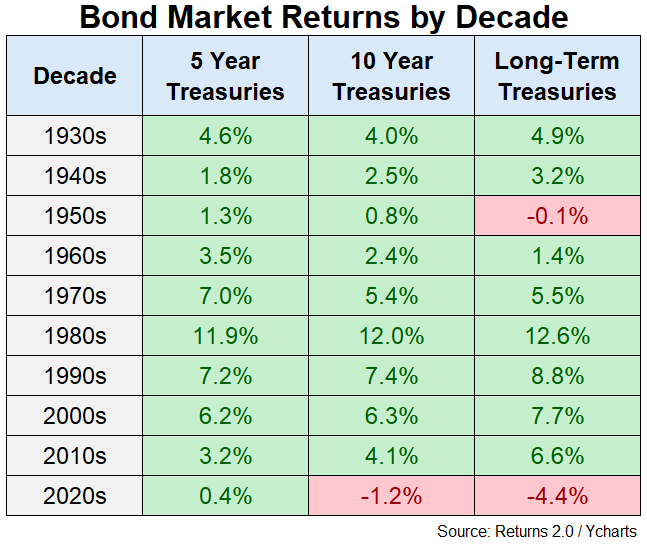

Being a market returns geek I made a decision to take this a step additional by trying on the returns by decade for varied maturities in authorities bonds to see how the 2020s stack up traditionally.

Right here’s the info for five yr, 10 yr and long-term (20+ years) U.S. Treasuries by decade going again to the Thirties:

A little bit greater than midway via the 2020s we’re on tempo for the worst decade in fashionable financial instances.

Not nice.

Going from generationally low bond yields to 9% inflation and a large spike in charges in a brief time period didn’t assist.

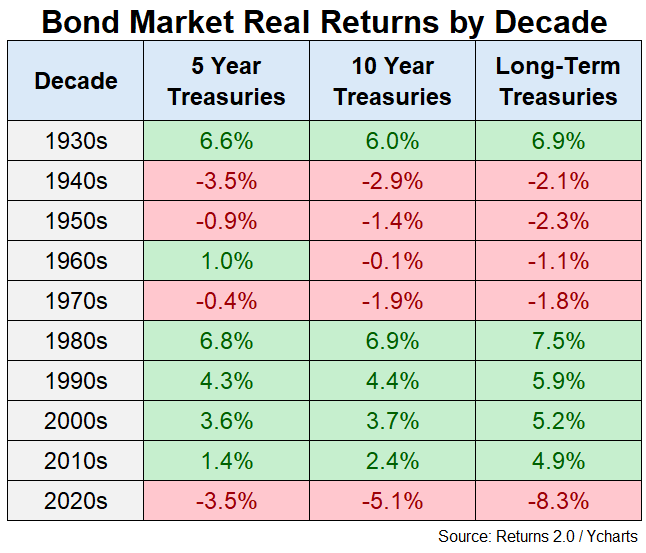

But it surely’s really worse than it seems.

These are nominal returns. The largest danger for bonds is inflation as a result of they pay you a hard and fast quantity of earnings over time. It’s good to take a look at the inflation-adjusted returns to essentially perceive how issues evaluate over time.

These are the actual returns:

Loads of the inexperienced from the nominal chart turns pink on an actual foundation.

Essentially the most obtrusive instance is the Nineteen Seventies the place you had fairly good nominal returns as a result of yields had been comparatively excessive however terrible actual returns as a result of inflation was so excessive (which is why charges had been excessive within the first place).

In actual fact, actual returns had been damaging from mainly World Struggle II right through the inflationary Nineteen Seventies as charges and inflation wreaked havoc on mounted earnings buyers.

The 2020s look unhealthy on a nominal and actual foundation. This actually is the worst decade (up to now) ever for presidency bonds.

How unhealthy is it Ben?!

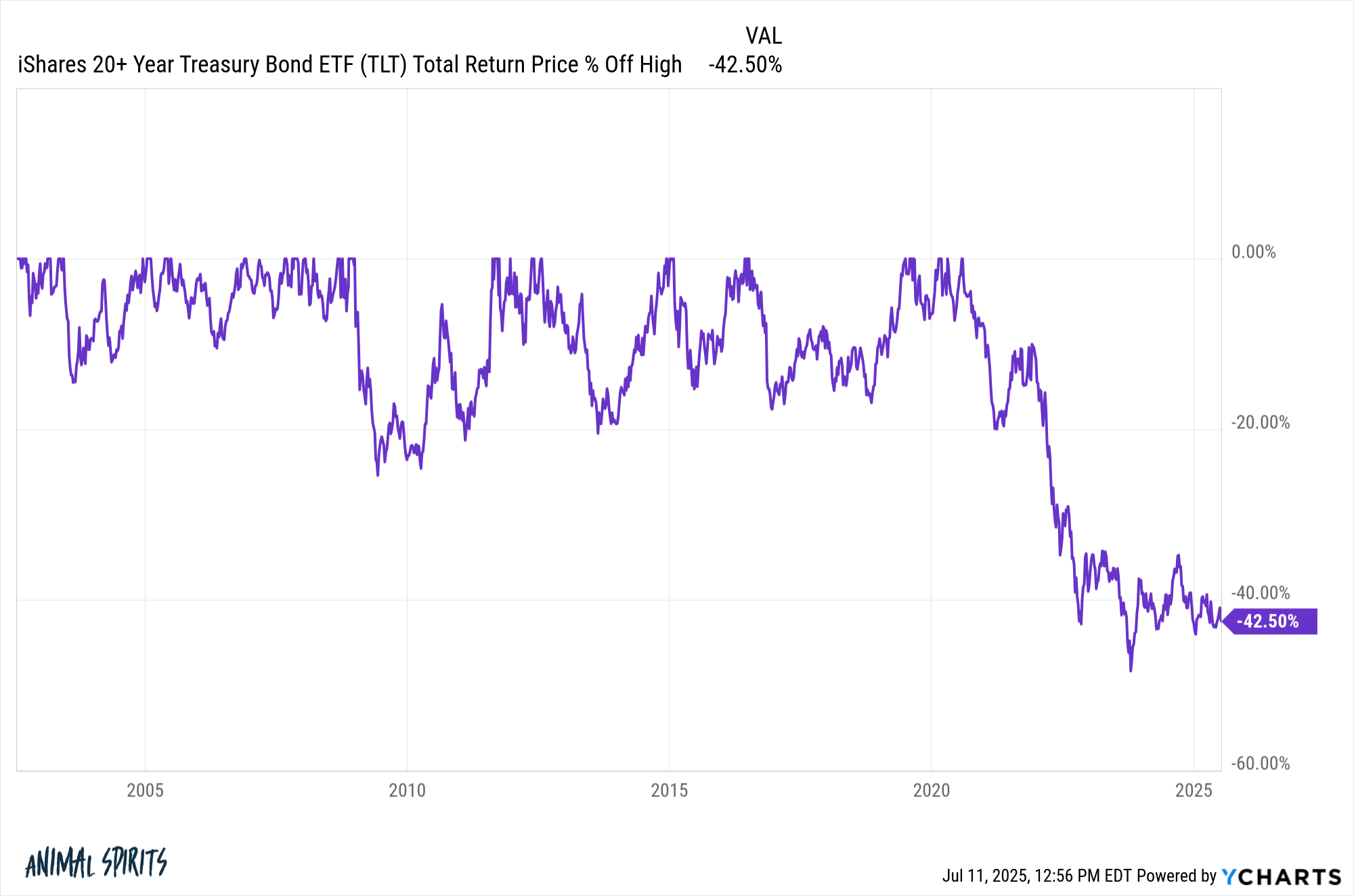

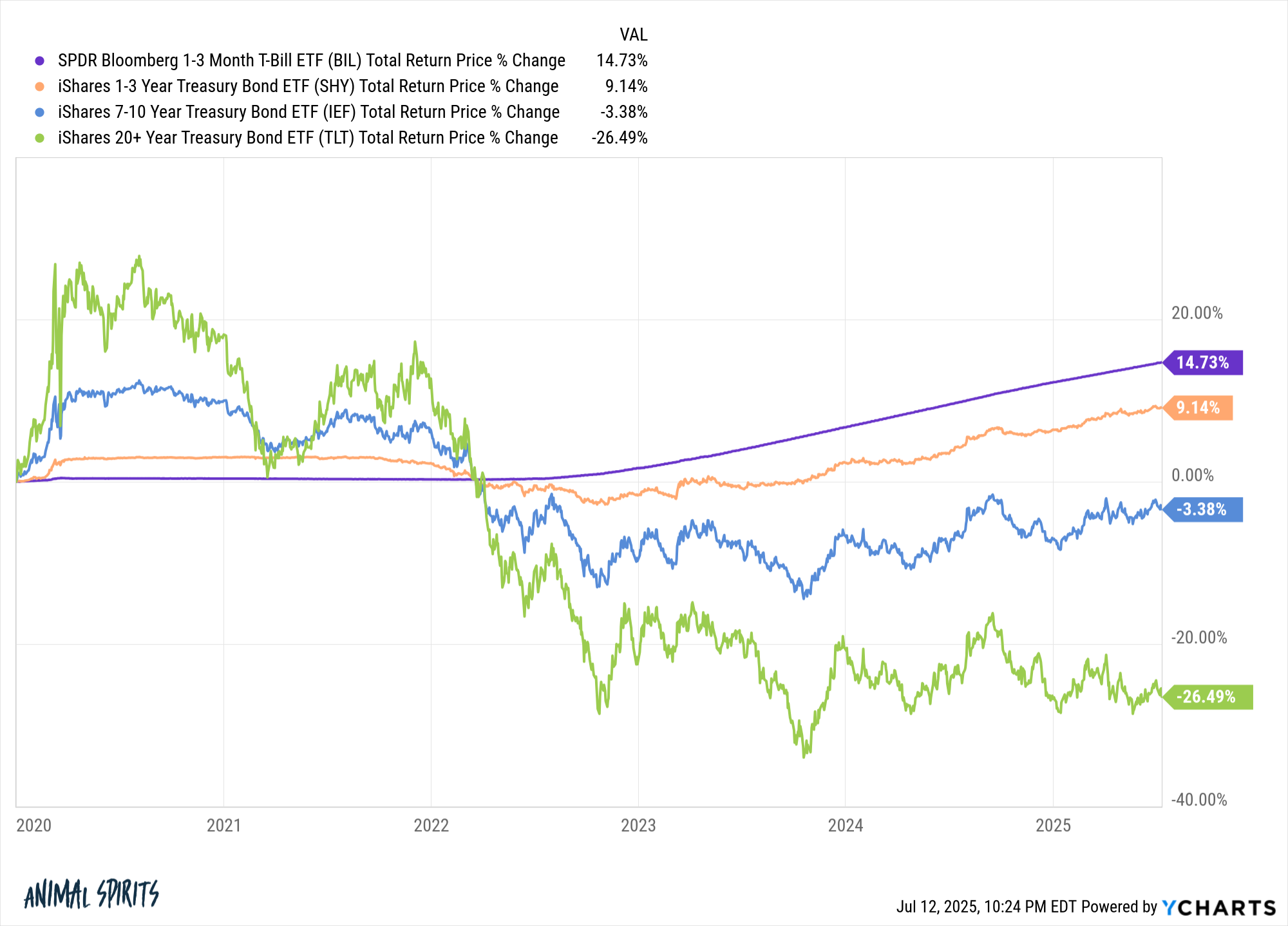

Lengthy-term Treasuries are nonetheless within the midst of a 40% drawdown even after accounting for the earnings paid out:

They’ve been in a 40% drawdown since 2022!

Why aren’t extra buyers freaking out about this?

Are you able to think about if the inventory market received minimize in half and didn’t make any critical progress for 3 years? It will be a every day story within the monetary press. Traders can be dropping their minds. It will be a full-fledged disaster.

You don’t ever actually hear something about carnage within the bond market.

I suppose that is partly due to the best way bonds are structured. You’ll be able to maintain to maturity and be made entire (on a nominal foundation).

There have been additionally completely good alternate options for many who didn’t wish to settle for length danger from longer-term bonds when yields had been on the ground:

Brief-term Treasuries and T-bills have been a no brainer different with greater yields and much much less volatility.1

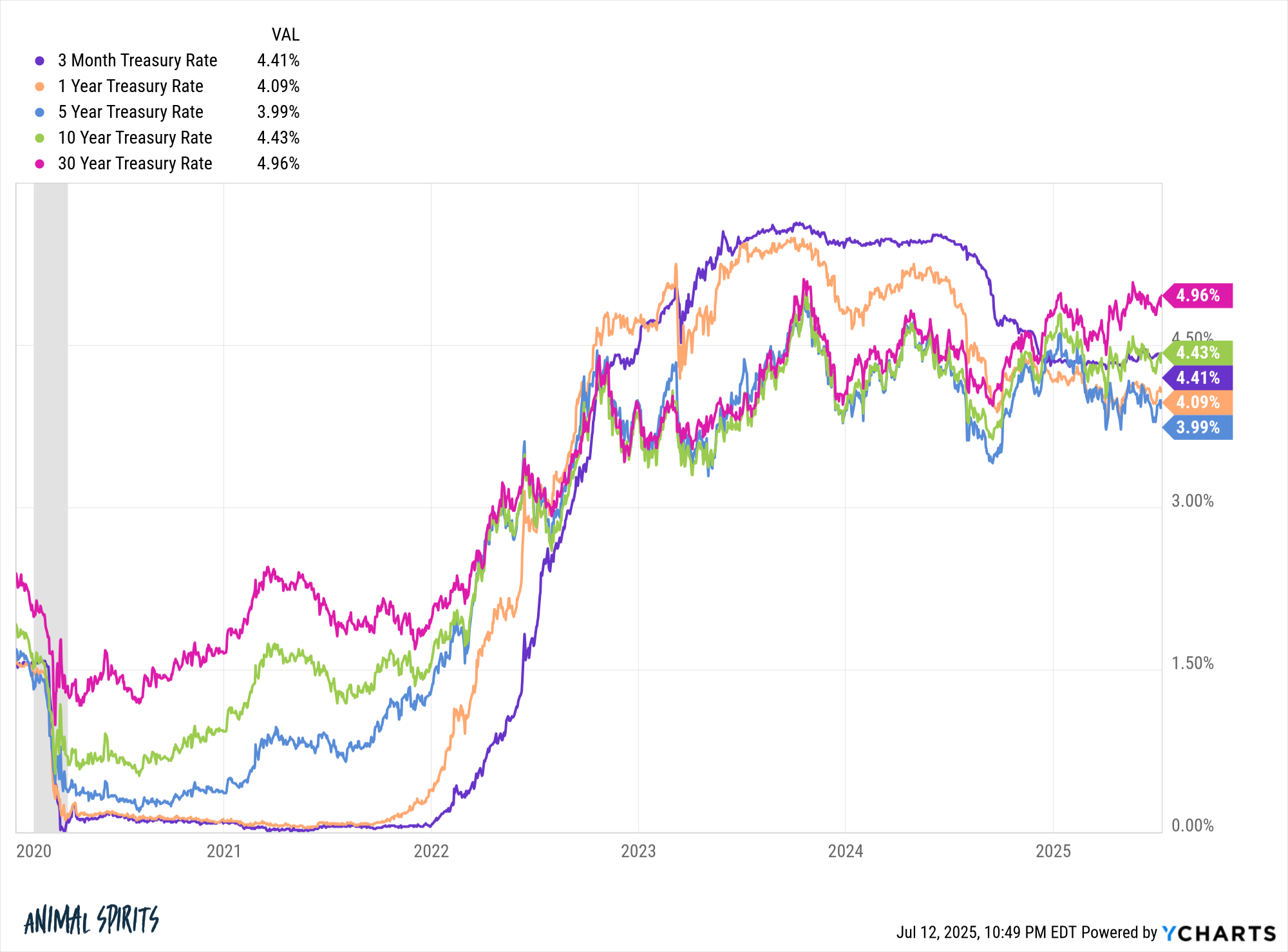

One more reason bond buyers aren’t freaking out is as a result of yields are a lot greater now than they had been when this entire mess started again within the pandemic:

Bonds aren’t a screaming purchase by any means however yields within the 4% to five% vary are significantly better than they had been all through a lot of the 2010s and early-2020s.

The primary half of this decade confirmed a few of the worst returns we’ve ever seen in bonds. Now that we’ve lived via that disagreeable interval, anticipated returns are greater.

Positive, charges might proceed their ascent and inflation might come roaring again. That may ding bonds once more.

However beginning yields at the moment are significantly better than they had been in 2020 so the rest of the last decade ought to see significantly better returns from right here.2

Additional Studying:

Is It Time to Lock in 5% Yields?

1Plus, most buyers in long-term Treasuries are pensions, insurance coverage corporations and yield speculators.

2Let’s say annual returns for the ten yr are 4.5% for the rest of the last decade, which is near the present yield. In that case everything of the 2020s can be an annual return of round 1% per yr.

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here might be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.