Money runway refers to how lengthy your enterprise can proceed working utilizing its present capital reserves. It’s a strategic window for progress that means that you can make selections based mostly on alternative.

With an extended runway, your organization can pursue its long-term enterprise imaginative and prescient and act from a place of power as an alternative of short-term necessity since you’re not compelled into hasty selections that compromise your values or strategic course. Throughout this era, you and your management group can increase into new markets, purchase a competitor, or spend money on gear to extend your capability since you’re unencumbered by capital-based restrictions.

On this article, we’ll clarify the connection between your money runway and burn price. We’ll additionally present the best way to prolong your money runway whereas focusing on progress, the best way to take management of your money runway, and why burn charges change from month to month.

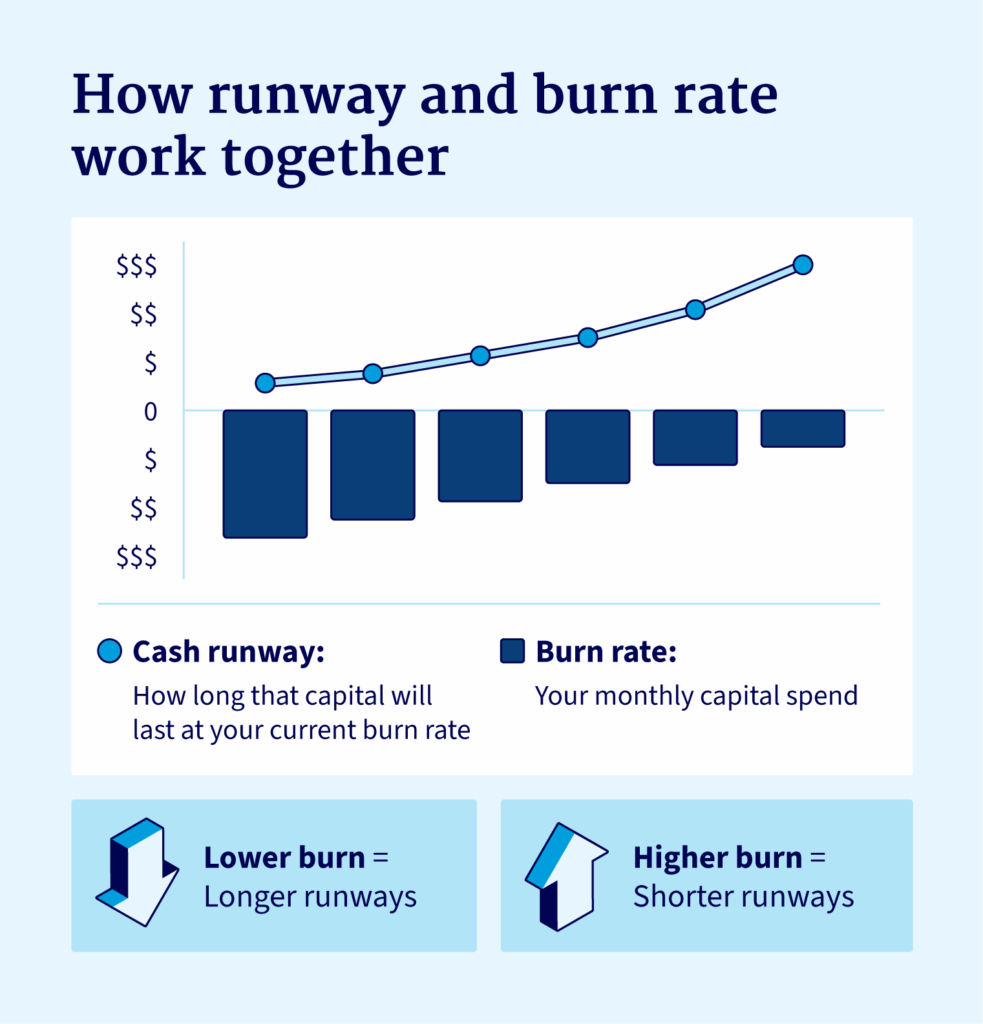

Money runway vs burn price: How they coexist

A money runway is a measure of how lengthy your organization can function with the capital it has accessible. This calculation incorporates a number of key monetary elements:

- Present money reserves (cash in financial institution accounts)

- Accounts receivable (cash owed to you by prospects)

- Different liquid belongings that may be shortly transformed to money, minus your month-to-month burn price (how a lot money you spend every month on operations, salaries, hire, and different bills)

Some companies additionally think about predictable month-to-month income streams when calculating their runway, although this needs to be carried out conservatively to account for potential fluctuations in revenue.

A shorter runway will increase the danger of a setback turning right into a disaster. The excellent news is you could prolong it by enhancing your money stream or implementing a liquidity administration plan.

However, an extended runway means your enterprise can successfully handle challenges it didn’t anticipate, generally turning them into progress alternatives. Nevertheless, an excessively lengthy runway can sign {that a} enterprise is being too conservative with its capital allocation. It may very well be lacking out on invaluable progress investments like product improvement or market enlargement that would speed up income and aggressive positioning.

To offer your self extra time, you might want to perceive how your strategic selections influence your burn price and, by extension, your timeline for sustainable progress.

Burn price is a measure of velocity: how briskly you’re getting via that capital every month, mirrored in internet destructive money stream.

Naturally, money runway and burn charges go hand in hand; he increased your burn price, the shorter your runway. The decrease your burn price, the longer your runway.

Easy methods to calculate money runway and burn price

You may apply two easy formulation to get a transparent view of the place your organization’s monetary place is. First, right here’s the best way to calculate money runway:

| Money runway components = Money stability ÷ money burn price |

|---|

Your “money stability” is the capital you might have accessible now, plus any money equivalents (belongings you possibly can convert to money shortly). Divide it by your month-to-month burn price, and the result’s your money runway measured in months.

For instance, a Texan producer might need $1.2M within the financial institution. If it spends $100k a month on payroll, supplies, and normal working overheads, its runway is 12 months.

On this interval, they will automate their manufacturing to extend output and enhance effectivity or land a bigger distribution contract earlier than they obtain optimistic money stream or want to lift new capital. With 12 months, they’ve time to correctly analysis automation choices, set up gear, and construct distributor relationships – strategic strikes that take months to execute and aren’t attainable with solely a brief runway.

The second components you’ll have to know the best way to calculate is the money burn price:

| Money burn price components = Money acquired – money paid out |

|---|

Burn charges monitor how your money stream adjustments over a set interval, usually a month. A excessive burn price signifies that your operational spending is a big portion of your bills, which isn’t inherently dangerous if it’s tied to progress.

For instance, a wholesale distributor stocking up forward of a really busy season or a development firm onboarding new crews for a significant contract is spending to drive future income.

Conversely, a drop in your burn price isn’t at all times excellent news – it might imply stalled progress or cutbacks.

Monitoring each metrics offers leaders with key insights on when it’s the suitable time to speculate, decelerate, or usher in extra capital earlier than it turns into crucial.

Easy methods to speed up your runway with out slowing progress

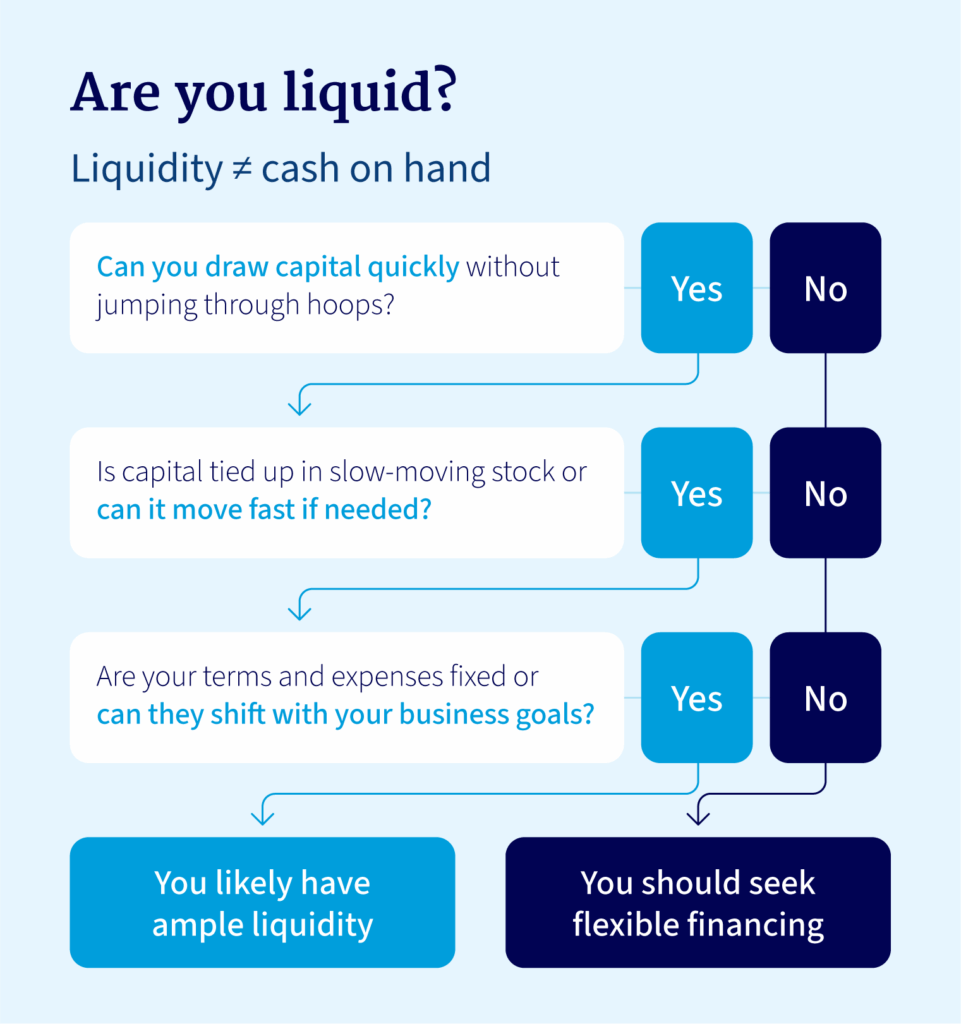

To increase your runway with out slowing progress, you possibly can handle your money stream tightly whereas additionally in search of outdoors funding. This offers you the monetary flexibility to pursue progress alternatives with out worrying about masking your primary working prices.

These are three benefits this method delivers:

Safe capital earlier than you want it

Ready till simply earlier than you want capital limits your choices and may drive you to compromise on phrases you in any other case wouldn’t have. It’s essential to safe entry to capital when your monetary place is powerful, not when you might want to cowl a shortfall.

With a non-public credit score lender like Nationwide Enterprise Capital, you apply for versatile funding choices, like enterprise traces of credit score. We are able to give you the monetary headroom to say “sure” to new contracts, spend money on new gear, or increase operations with out ready for money stream to catch up.

Search for insights behind the numbers

Many companies miss straightforward methods to release money by fixing inefficiencies.

Your cash is likely to be tied up in stock that’s not promoting, gear you’re not utilizing, or work you’ve completed however haven’t billed but. Discovering these issues can put extra cash again in your enterprise.

For instance, a development firm might ask suppliers for longer cost phrases. As a substitute of paying for supplies in 30 days, they may get 60 days, which provides them extra respiration room with their money.

On this case, investing in stock administration software program might additionally assist by enhancing materials stream, decreasing holding prices, and accelerating the money conversion cycle.

Professional Tip: Bill financing can assist release funds when purchasers are late on funds. A factoring firm offers upfront cost on your receivables, serving to you to bridge money stream gaps and turning future income into rapid money stream.

Capitalize on clever timing

Burn charges continually change, which creates home windows of alternative when you possibly can apply for funding from a place of power – earlier than you really want it.

For instance, a development firm spends probably the most throughout heavy construct phases for crews and supplies, whereas a wholesaler ties up money filling warehouses earlier than the busy season. The secret’s securing capital entry throughout your slower durations, so that you’re prepared when these high-spend phases arrive.

Versatile non-public credit score adapts to the tempo of your enterprise, letting you capitalize on alternatives throughout momentary money crunches. Many firms safe bridge loans forward of time to cowl predictable bills, like massive materials orders, with out ready for shopper funds to clear.

Gaining management of your money runway

Runway posture refers to how a lot monetary respiration room your enterprise has to make selections. Once you’re working from a place of power with ample time and capital, your runway posture is more healthy and you’ve got higher liquidity to spend money on progress.

Understanding what your runway posture says about your enterprise typically comes right down to following the 30/90/180 rule of thumb:

- 30-day runway: With a month of working capital left, you might have minimal buffer towards drops in income or expenditure spikes, so you might want to give attention to optimizing money stream or securing new capital quick.

- 90-day runway: You will have extra room for maneuver and may take up minor challenges, however there are business deserves to inspecting your expenditure and rising income technology to increase your runway.

- 180-day runway: A six-month monetary runway is sort of prolonged. It might point out overcautious administration, not making capital work onerous sufficient for progress.

When you constantly monitor and alter your capital degree, a powerful runway posture exhibits how prepared you’re for brand new alternatives or market turbulence.

Why burn price adjustments from month to month (and the best way to regular it)

You’ll discover that your burn price varies; it’s by no means a flat, predictable line. Burn charges rise and subside attributable to elements like seasonality, stock loading, progress funding selections, and late buyer funds.

Fluctuating burn charges are normal in these industries:

- Manufacturing: Burn charges typically speed up in Q2 to construct stock for sturdy This autumn gross sales, making a interval of money compression (when capital is deliberately tied up in non-liquid belongings).

- Building: Contractors might even see seasonal, weather-influenced slowdowns and ramp-ups for main initiatives. This variability requires strategic planning to match capital and funding with project-related expense cycles, like mobilization prices.

- Wholesale and distribution: Companies on this business regularly front-load purchases earlier than main vacation seasons. That is liquidity pull-forward, the place companies search capital earlier so that they’re prepared for high-demand durations.

Understanding what your burn price is and why it varies helps you management capital higher and time whenever you search enterprise financing.

Look to Nationwide Enterprise Capital to assist increase your runway

Many founders and CFOs be taught this common reality the onerous method: Development virtually at all times prices extra and takes longer than you intend for.

Mastering your burn price places you in management and allows you to drive enterprise progress with out your financial institution stability and capital ranges dictating your technique. That is key to extending your runway, preserving capital, and securing funding earlier than your choices are restricted.

At Nationwide Enterprise Capital, our advisors look past the numbers to search out the suitable financing on your distinctive enterprise wants. Apply at this time to see how we can assist you discover a resolution that extends your runway and fuels your subsequent progress part.

Often requested questions

Your money runway is how lengthy your enterprise can function on its present capital and money equivalents. Your burn price is the velocity at which you’re spending capital each month. Increased burn charges imply a shorter runway and vice versa.

Money runways differ between industries, progress levels, and strategic objectives of every enterprise. A wholesome money runway offers leaders the time to spend money on their enterprise’s progress with out having to give attention to short-term monetary necessities.

Calculate your money runway by dividing your present money stability (accessible capital plus money equivalents) by your month-to-month money burn price.

To handle burn price throughout seasonal shifts, anticipate increased prices throughout busier occasions, and safe versatile funding beforehand.