I used to be at an institutional investor convention again in 2011.

The inventory market had recovered considerably from the depths of the 2008 monetary disaster however loads of traders had been nonetheless licking their wounds. Nobody was pounding the desk to purchase shares.

Actually, a widely known hedge fund supervisor acquired up in entrance of the gang and advised everybody, “I’ve unhealthy information for you…”

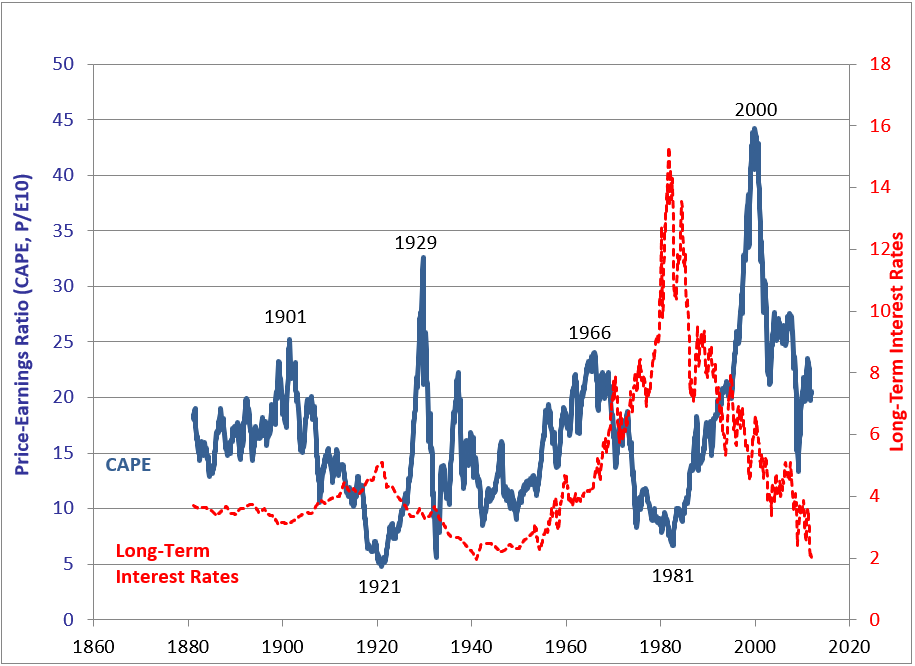

He then went by way of a sequence of charts and historic information that confirmed how overvalued the inventory market was. The CAPE ratio was featured prominently and seemed like this on the time:

I don’t recall the precise figures, however he advised the gang we had been someplace within the 90-something percentile of worst valuations ever. The prospects for ahead returns from these ranges previously spelled bother. Mixed with low bond yields, traders had been taking a look at a decade of low returns.

That was his forecast anyway.

This well-known investor wasn’t alone in setting low expectations for future returns. The CIOs within the crowd largely agreed with him. Nobody anticipated a rip-roaring bull market to final for properly over a decade at that time.

Sam Ro has an incredible piece at TKer that appears at what went mistaken for the predictive energy of the CAPE ratio. Sam pulled some previous quotes from CAPE creator, Robert Shiller:

“I’ve been very cautious about advising folks to tug out of the market despite the fact that my CAPE ratio is at one of many highest ranges ever in historical past,” Shiller advised Bloomberg in April 2015. “One thing humorous is occurring. Historical past is all the time developing with new puzzles.”

Shiller’s been warning folks in opposition to leaning on CAPE for some time.

“Issues can go for 200 years after which change,” he mentioned in a 2012 interview with Cash journal. “I even fear concerning the 10-year P/E — even that relationship might break down.”

That was an excellent little bit of humility on his half. The inventory market didn’t care concerning the earlier 10 years’ price of earnings when tech firms had been about to rewrite the principles of revenue margins and market domination.

Simply because one thing labored previously doesn’t imply it can work sooner or later. Even when one thing does work moderately properly, it’s not assured to work each time. At all times and by no means are two phrases you need to drop out of your vocabulary as an investor.

Peter Bernstein wrote about one thing that labored till it didn’t in his basic e-book Towards the Gods:

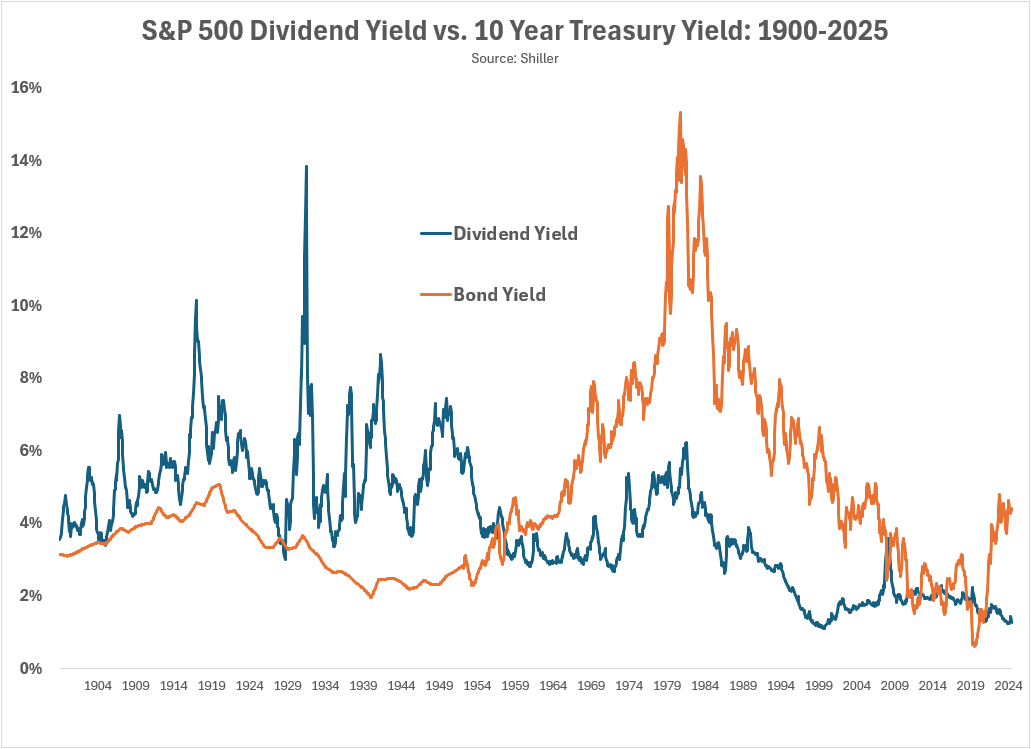

In 1959, precisely thirty years after the Nice Crash, an occasion occurred that made completely no sense within the gentle of historical past. As much as the late Fifties, traders had acquired a better revenue from proudly owning shares than from proudly owning bonds. Each time the yields acquired shut, the dividend yield on frequent shares moved again up over the bond yield. Inventory costs fell, so {that a} greenback invested in shares introduced extra revenue than it had introduced beforehand.

So it’s no surprise that traders purchased shares solely once they yielded a better revenue than bonds. And no surprise that inventory costs fell each time the revenue from shares got here near the revenue from bonds.

Till 1959, that’s. At that time, inventory costs had been hovering and bond costs had been falling. This meant that the ratio of bond curiosity to bond costs was capturing up and the ratio of inventory dividends to inventory costs was declining. The previous relationship between bonds and shares vanished, opening up a spot so enormous that in the end bonds had been yielding greater than shares by a fair higher margin than when shares had yielded greater than bonds.

Have a look:

Bond yields by no means stayed above dividend yields till they did. Then it occurred for 5 many years.

Issues change.

The inverted yield curve was 8-for-8 at predicting previous recessions…till 2022 that’s. Quick-term bonds yields went above long-term bond yields however a recession didn’t comply with. The yield curve has since un-inverted and nonetheless no financial downturn.

That very same yr shares and bonds did one thing that had by no means occurred earlier than — they each crashed. Traders assumed bonds all the time hedged a falling inventory market. Not when bonds trigger shares to fall.

Benoit Mandelbrot as soon as mentioned, “The development has vanished, killed by its personal discovery.”

The onerous half about all of that is that generally traits change endlessly, they usually don’t return. Different instances, there are exceptions to the rule as a result of nothing works on a regular basis.

There’s a fantastic line between self-discipline and an lack of ability to be versatile as an investor.

The answer right here is to keep away from going to extremes. There’s a whole lot of grey space between 0% and 100% certainty.

Unfold your bets.

Robust opinions loosely held.

And go into any funding technique, historic market backtest or financial relationship with an open thoughts.

The market will humble you in the event you don’t strategy it with a way of humility.

Additional Studying:

The Half-Lifetime of Funding Methods