The AI story, earlier than DeepSeek

The AI story has been constructing for some time, reflecting the convergence of two forces in expertise – extra computing energy, typically in smaller and smaller packages, and the buildup of information, on expertise platforms and elsewhere. That mentioned, the AI story broke out to the general public on November 30, 2022, when OpenAI launched ChatGPT, and it made its presence felt in houses, colleges and companies virtually instantaneously. It’s that broad presence in our every day lives that laid the foundations for the AI story, the place evangelists offered us on the notion that AI options would make our lives simpler and take away the parts of our work that we discovered most burdensome, and that the companies that offered these options could be price trillions of {dollars}.

Because the variety of potential functions of AI proliferated, thus rising the marketplace for AI services, one other a part of the story was additionally being put into play. AI was framed as being made potential by the wedding of extremely highly effective computer systems and deep troves of information, successfully setting the stage for the winners, losers, and wannabes within the story. The primary set of corporations had been perceived as benefiting from constructing the AI structure, with the advance spending on this structure coming from the businesses that hoped to be gamers within the AI product and repair markets:

- Computing Energy: Within the AI story that was informed, the computer systems that had been wanted had been so highly effective that they wanted personalized chips, extra highly effective and compact than any made earlier than, and one firm (Nvidia), by advantage of its early begin and superior chip design capabilities, stood nicely above the remaining. Not solely did Nvidia have an 80% market share of the AI chip market, as assessed in 2024, the lead and first-mover benefit that the corporate possessed would give it a dominant market share, within the a lot bigger AI chip market of the long run. Alongside the way in which, the the AI story picked up supercomputing corporations, as passengers, once more on the idea that Ai techniques would discover a use for them.

- Energy: Within the AI story, the coupling of highly effective computing and immense knowledge occurs in knowledge facilities which might be energy hogs, requiring immense quantities of power to maintain going. Not surprisingly, a complete host of energy corporations have stepped into the breach, with some rising capability fully to service these knowledge facilities. A few of them had been new entrants (like Constellation Power), whereas others had been extra conventional energy corporations (Siemens Power) who noticed a gap for progress and profitability within the AI house.

- Information: A 3rd beneficiary from the structure a part of the AI story had been the cloud companies, the place the massive knowledge, collected for the AI techniques would get saved. The large tech corporations with cloud arms, notably Microsoft (Azure) and Amazon (AWS) have benefited from that demand, as produce other cloud companies.

Because the corporations concerned in constructing the AI infrastructure are those which might be most tangibly (and instantly) benefiting from the AI growth, they’re additionally the businesses which have seen the most important increase in market cap, because the AI story heated up. Within the graph, I’ve picked on a subset of high-profile corporations that had been a part of the AI market euphoria and appeared on the consequent improve of their market capitalizations:

Utilizing the ChatGPT introduction on November 30, 2022, as the start line for the AI buzz, in public consciousness and markets, the returns in 2023 and 2024 are a composite (albeit a tough) measure of the advantages that AI has generated for these corporations. Word that the most important share winner, a minimum of on this group was Palantir, up 1285% within the final two years, however the largest winner in absolute phrases was Nvidia, which gained virtually $ 3 trillion in worth in 2023 and 2024.

The investments in that AI structure had been being made, with the expectation that corporations that invested within the structure would have the ability to finally revenue from growing and promoting AI services. Because the AI storyline required immense upfront investing in computing energy and entry to massive knowledge, the most important traders in AI structure had been massive tech corporations, with Microsoft and Meta being the most important clients for Nvidia chips in 2024. Within the desk under, I have a look at the Magazine Seven, not inclusive of Nvidia, and study the returns that they’ve made in 2023 and 2024:

As you’ll be able to see, the Magazine Seven carried the market within the two years, every including a trillion (or shut, within the case of Tesla) {dollars} in worth within the final two years, with some portion of that worth attributable to the AI story. With necessities for big funding up entrance appearing as entry obstacles, the expectation was these massive tech corporations would finally not solely have the ability to develop AI services that their clients would need, however cost premium costs (and earn larger margins).

Within the image under, I’ve tried to seize the essence of AI story, with the potential winners and losers at every stage:

There are components to this story the place there’s a lot to be proved, particularly on the AI product and repair half, and whereas traders will be accused of turning into excessively exuberant concerning the story, it’s a believable one. In truth, my most up-to-date (in September 2024) valuation of Nvidia purchased into core components of the story, although I nonetheless discovered it overvalued:

Word that the massive AI story performs out in these inputs in a number of locations:

- AI chip market: My September 2024 estimate for the scale of the AI chip market was $500 billion, which in flip was justifiable solely as a result of the AI product and repair market was anticipated to very large ($3 trillion and past).

- Nvidia market share: In my valuation, I assumed that Nvidia’s lead within the AI chip enterprise would give the corporate a head begin, because the enterprise grew, and to the extent that demand is sticky (i.e., as soon as corporations begin construct knowledge facilities with Nvidia chips, it might be tough for them to change to a competitor), Nvidia would keep a dominant market share (60%) of the expanded AI chip market.

- Nvidia margins: Nvidia has had immense pricing energy, posting nosebleed-level gross and working margins, whereas TSMC (its chip maker) has generated solely a fraction of the advantages, and its largest clients (the massive tech corporations) have been prepared to pay premium costs to get a head begin in constructing their AI structure. Over time, I assumed that Nvidia would see its margins drop, however even with the drop, their goal margin (60%) would resemble these of very profitable, software program corporations, not chip making corporations.

My concern in September 2024, and in reality for the majority of the final two years, was not that I had doubts concerning the core AI story, however that traders had been overpaying for the story. That’s partly why, I’ve shed parts of my holdings in Nvidia, promoting half my holdings in the summertime of 2023 and one other quarter in the summertime of 2024.

The AI Story, after DeepSeek

I train valuation, and have accomplished so for near forty years. One cause I benefit from the class is that you’re by no means fairly accomplished with a valuation, as a result of life retains throwing surprises at you. The primary session of my undergraduate valuation class was final Wednesday (January 22), and in the course of the course of the category, I talked about how a great valuation connects narrative to numbers, and adopted up by noting that even probably the most nicely thought by means of narratives will change over time. I’m not certain how a lot of that message received by means of to my studentls, however the message was delivered rather more successfully by DeepSeek’s entry into the AI story over the weekend, and the market shakeup that adopted when markets opened on Monday (January 27).

A DeepSeek Primer

The DeepSeek story continues to be being informed, and there’s a lot we have no idea. For the second, although, here’s what we all know. In 2010, Liang Wenfeng, a software program engineer, based DeepSeek as a hedge fund in China, with the intent of utilizing synthetic intelligence to earn money. Unable to get traction in that endeavor, and dealing with authorities hostility on speculative buying and selling, he pivoted in 2023 into AI, placing collectively a group to create a Chinese language competitor to OpenAI. Because the intent was to provide you with a product that could possibly be offered at cut price costs, DeepSeek did what disruptors have at all times accomplished, which is search for an alternate path to the identical vacation spot (offering AI merchandise that work). Slightly than put money into costly infrastructure (supercomputers and knowledge facilities), DeepSeek used less expensive, much less highly effective chips, and as an alternative of utilizing immense quantities of information, created an AI prototype that would work with much less knowledge, utilizing rule-based logic to fill within the hole. Whereas there was chatter about DeepSeek for weeks, it grew to become publicly accessible on the finish of final week (ending January 24), and inside hours, was drawing rave evaluations from folks nicely versed in tech, because it matched beat ChatGPT at many duties, and even carried out higher on scientific and math queries.

There are components of this story which might be clearly for public consumption, extra aspect tales than predominant story,, and it’s best to get them out of the way in which, earlier than trying on the DeepSeek impact.

- Price of growth: The notion that DeepSeek was developed for only a few million {dollars} is fantasy, and whereas there might have been a portion of the event that value little, the whole was most likely within the a whole lot of thousands and thousands of {dollars} and required much more sources (together with maybe even Nvidia chips) than the builders are letting on. It doesn’t matter what the true value of growth is lastly revealed to be, will probably be a fraction of the cash spent by the prevailing gamers in constructing their techniques.

- Efficiency checks: The checks of DeepSeek versus OpenAI (or Claude and Gemini) means that DeepSeek not solely holds it personal in opposition to the institution, however even outperforms them on some duties. That’s spectacular, however the leap that some are making to concede your entire AI product and repair market to DeepSeek is unwarranted. There are clearly facets of the AI merchandise and repair enterprise, the place the DeepSeek method (of utilizing much less highly effective computing and knowledge) will probably be ok, however there will probably be different facets of the AI enterprise, the place the previous paradigm of tremendous computing energy and huge knowledge will nonetheless maintain.

- A Chinese language firm: The truth that DeepSeek was developed in China throws a political twist into the story that may undoubtedly play a job in the way it develops, however the genie is out of the bottle, even when different governments attempt to cease its adoption. Including to the noise is the choice by the corporate to make DeepSeek open-source, successfully permitting others to adapt and construct their very own variations.

- Honest or foul: Lastly, there was some information on the authorized entrance, the place OpenAI has argued that DeepSeek unlawfully used knowledge that was generated by OpenAI in constructing their providing, and whereas a part of that lawsuit could be showboating, it’s potential that parts of the story are true and that authorized penalties will observe.

Whereas we are able to debate the what’s and why’s on this story, the market response this week to the story has been swift and decisive. I graph the efficiency of the 5 AI shares highlighted within the earlier part, throwing within the Meta and Microsoft for good measure, each day in 2025.

As you’ll be able to see on this chart, Nvidia Broadcom, Constellation and Vistra have had horrible weeks, dropping greater than 10% within the final week, however only for perspective, additionally be aware that Constellation and Vistra are nonetheless up strongly for the yr. Meta and Microsoft had been unaffected, and so was Palantir, Clearly, the DeepSeek story is enjoying out in a different way for various corporations within the AI house, however its general market impression has been substantial, and for probably the most half, damaging.

What’s it that makes the DeepSeek story so compelling? First, is the technological facet of developing with a product, with far much less in sources that the institution, and I’ve nothing however admiration for the DeepSeek creators, however the a part of the story that stands out is that the they selected to not go along with the prevailing narrative (the one the place Nvidia chips and large knowledge bases are a necessity) and as an alternative requested the query of what the tip services would seem like, and whether or not there was a better, faster and cheaper approach of getting there. In hindsight, there are most likely others who’re DeepSeek and questioning why they didn’t select the identical path, and the reply is that it takes braveness to go in opposition to the standard knowledge, particularly when, as AI did during the last two years, it sweeps everybody (from tech titans to particular person traders) together with its drive.

The reality is that even when DeepSeek is stopped by means of authorized or authorities motion or fails to ship on its guarantees, what its entry has accomplished to the AI story can’t be undone, because it has damaged the prevailing narrative. I’d not be shocked if there are a dozen different start-ups, proper now, utilizing the DeepSeek playbook to provide you with their very own lower-cost opponents to prevailing gamers. Put merely, the AI story’s weakest hyperlinks have been uncovered, and if this had been the story concerning the Emperor’s new garments, the AI emperor is, if not bare, is having a wardrobe malfunction, for all to see.

The Story Impact

On this first week, as is to be anticipated, the response has been something however reasoned. In case you are a voracious reader of monetary information (I’m not), you will have most likely seen dozens of “thought items” from each expertise and market specialists claiming to predict the long run, and even among the many few that I’ve learn, the views vary the spectrum on how DeepSeek adjustments the AI story.

In my writings on narrative and numbers, the place I discuss how each valuation tells a narrative, I additionally discuss how tales are dynamic, with a narrative break representing radical change (the place an ideal story can crash and burn or a small story can get away to turn into an enormous one), a narrative change is usually a vital narrative alteration (the place a narrative provides or loses a dimension with massive worth results) or a narrative shift (the place the core story stays unchanged, however the parameters can change). Utilizing the pre-DeepSeek story as a place to begin, you’ll be able to classify the narratives on what’s approaching the story break/story change/story shift continuum:

|

With all of the caveats, together with the truth that I’m an AI novice, with a deeper understanding of potato chips than pc chips, and that it’s early within the sport, I’m going to take a stand on the place on this continuum I see the DeepSeek impact falling. I consider that DeepSeek does change the AI story, by creating two pathways to the AI product and repair endgame. On one path that may result in what I’ll time period the “low depth” AI market, it has opened the door to decrease value alternate options, by way of investments in computing energy and knowledge, and opponents will flock in. That mentioned, there’ll stay a section of the AI market, the place the previous story will prevail, and the trail of large investments in pc chips and knowledge facilities resulting in premium AI services would be the one which must be taken.

Word that the entry traits for the 2 paths may even decide the profitability and payoffs from their respective AI product and repair markets (that may finally exist). The “low entry value” pathway is extra prone to result in commoditization, with numerous opponents and low pricing energy, whereas the “excessive entry value” path with its necessities for big upfront funding and entry to knowledge will create a extra restrictive market, with larger priced and extra worthwhile AI services. This story leaves me with a judgment name to make concerning the relative sizes of the markets for the 2 pathways. I’m generalizing, however a lot of what shoppers have seen as far as AI choices fall into the low value pathway and I’d not be shocked, if that continues to be true for probably the most half. The DeepSeek entry has now made it extra seemingly that you just and I (as shoppers) will see extra AI services provided to us, at low value and even without cost. There’s one other section of the AI services market, although, with companies (or governments) as clients, the place vital investments made and refinements will result in AI services, with a lot larger worth factors. On this market, I’d not be shocked to see networking advantages manifest, the place the most important gamers purchase benefits, resulting in winner-take-all markets.

In telling this story, I perceive that not solely am I going to be flawed, maybe decisively, but additionally that it may unravel in report time. I make this leap, not out of vanity or a misplaced need to vary the way you assume, however as a result of I personal a slice of Nvidia (one quarter of the holding that I had two years in the past, however nonetheless massive sufficient to make a distinction in my portfolio), and I can not worth the corporate with out an AI story in place. That mentioned, the suggestions loop stays open, and I’ll hear not solely to alternate opinions but additionally observe actual world developments, within the pursuits of telling a greater story.

The Worth Impact

Now that my AI story is within the open, I’ll use it to revisit my valuation of Nvidia, and incorporate my new AI story in that valuation. Even with out working by means of the numbers, it is rather tough to see a situation the place the entry of DeepSeek makes Nvidia a extra beneficial firm, with the most important change being within the anticipated measurement of the AI chip market:

| In September 2024 (pre DeepSeek) | In January 2025 (publish DeepSeek) | |

|---|---|---|

| AI chip market measurement in 2035 | $500 billion | $300 billion |

| Nvidia’s market share | 60% | 60% |

| Nvidia’s working margin | 60% | 60% |

| Nvidia’s threat (value of capital) | 10.52% _> 8.49% | 11.79% -> 8.50% (Increased riskfree charge + larger ERP) |

With the adjustments made, and updating the financials to mirror a further quarter of information, you’ll be able to see my Nvidia valuation within the image under:

There are two (unsurprising) outcomes on this valuation. The worth per share that I estimate for Nvidia dropped from $87 in September 2024 to $78 in January 2025, a lot of that change pushed by the smaller AI chip market that comes out of the DeepSeek disruption (with the remainder of the decline arising for larger riskfree charges and the fairness threat premiums). The opposite is that the inventory is overvalued, at its present worth of $123 per share, even after the markdown this week. Since I discovered Nvidia overvalued in September 2024, when the massive AI story was nonetheless in place, and Nvidia was buying and selling at $109, $14 decrease than todays worth, estimating a decrease worth and evaluating to the next worth makes it much more over valued..

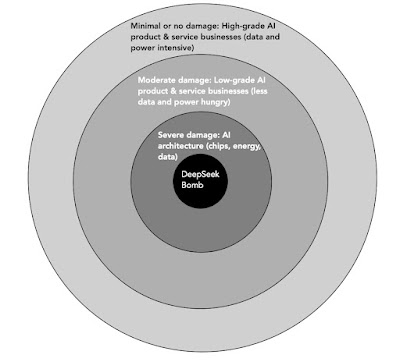

Extra usually, the worth impact of the DeepSeek disruption will probably be disparate, extra damaging for some corporations within the AI house than others, and even perhaps optimistic for a couple of and I’ve tried to seize these results within the image under, evaluating DeepSeek to a bomb, and searching on the harm zones from the blast:

In my opinion, the harm, within the close to and long run, from DeepSeek will probably be to the companies which were the lead gamers in constructing the AI structure. Along with Nvidia (and its AI chip enterprise), this contains the power and fuel companies which have benefited from the tens of billions spent on constructing AI knowledge facilities. It’s not that they’ll at the moment contracts, however that it’s seemingly that you will note a slowing down of commitments to spend cash on AI, as corporations study whether or not they want them. Extra corporations are subsequently prone to observe Apple’s path of cautious entry than Meta and Microsoft’s headfirst dive into the AI companies. As for the companies which might be aiming for the AI services market, the impact will rely upon how a lot these services want knowledge and computing energy. If the proposed AI services are low-grade, i.e., they’re extra rule-based and mechanical and fewer depending on incorporating instinct and human conduct, the impact of DeepSeek will probably be vital, with decrease prices to entry and a commoditized market, with decrease margins and intense competitors, If then again, the AI services are excessive grade, i.e,, making an attempt to mimic human resolution making within the face of uncertainty, the consequences of the DeepSeek entry are prone to be minimal and even perhaps non-existent. Thus, I’d count on a enterprise that’s engaged on an AI product for monetary accounting to search out its enterprise panorama modified greater than Palantir, engaged on complicated AI merchandise for the protection division or business companies. There’s a grouping of corporations, primarily massive tech corporations with massive platforms, like Meta and Microsoft, the place there could also be purchaser’s regret about cash already spent on AI (shopping for Nvidia chips and constructing knowledge facilities) however the DeepSea disruption might make it simpler to develop low-cost, low-tech AI services that they will supply their platform customers (both without cost or at low prices) to maintain them of their ecosystems.

When confronted with a growth that would change the way in which we dwell and work, it’s pure, particularly within the early phases, to present that growth a catchy title, and use it as a rationale for investing massive quantities (in case you are a enterprise) or pushing up what you’ll pay for the companies within the house (in case you are an investor). In my early piece on AI, I talked about 4 developments in my lifetime that I’d classify as revolutionary – private computer systems within the Eighties, the web within the Nineties, the smartphone within the first decade of the twenty first century and social media within the final decade, and the way every of those began as catchall buzzwords, earlier than traders and companies realized to discriminate. Cisco, AOL and Amazon had been all born within the web period, however they’d very totally different enterprise fashions, and because the web matured, confronted very totally different finish video games. I hope that the DeepSeek entry into the AI narrative, and its disparate results on totally different companies on this house, will lead us to be extra centered in our AI conversations. Thus, fairly than describe an organization as an AI firm or describe the AI market as “big”, we must be extra express about what a part of the AI enterprise an organization matches into (structure, software program, knowledge or merchandise/providers) and apply the identical diploma of discrimination when speaking about AI markets. In the event you additionally purchase into my reasoning, it’s possible you’ll wish to observe up by asking whether or not the AI providing is extra prone to fall into the premium or commoditized grouping.

The Backside Line

My early entry into Nvidia and my holdings of lots of the different Magazine Seven shares have allowed me to experience the AI growth, I’ve remained a skeptic concerning the product and repair aspect of AI, for a lot of the final two years. I can attribute that wariness partly to my age, since I can not consider a single AI providing that has been made to me within the final two years that I’d pay a big extra quantity for. I see AI icons on virtually every little thing that I take advantage of, from Zoom to Microsoft Phrase/Powerpoint/Excel to Apple mail. I need to admit that they do neat issues, together with reword emails to not solely clear up for errors however change the tone, however I can dwell with out these neat add-ons. Since I work in valuation and company finance, not a day goes by with out somebody contacting me a few new AI services or products within the house. Having tried a couple of out, my response to many of those services is that, a minimum of for me, they don’t do sufficient for me to hassle. In some ways, DeepSeek confirms a long-standing suspicion on my half that almost all AI services that we are going to see, as shoppers and whilst companies, fall into the “that’s cute” or “how neat” class, fairly than into the “that might change my life”, If that’s the case, it has additionally struck me as overkill to expend tens of billions of {dollars} constructing knowledge facilities to develop these merchandise, akin to utilizing a sledgehammer to faucet a nail into the wall. Each main innovation of the previous couple of many years, has had its actuality verify, and has emerged the stronger for it, and this may occasionally the primary of many such actuality checks for AI.

YouTube Video

Nvidia Valuations