I had a joke within the 2010s that went like this:

I’m a contrarian.

-Everybody

It was cool to be contrarian popping out of the Nice Monetary Disaster.

All of us learn The Large Brief.

Everybody wished to be the following Steve Eisman, Michael Burry or Meredith Whitney.

Like most issues within the markets, the contrarianism went too far. Everybody thought going towards the grain was the best way to make cash.

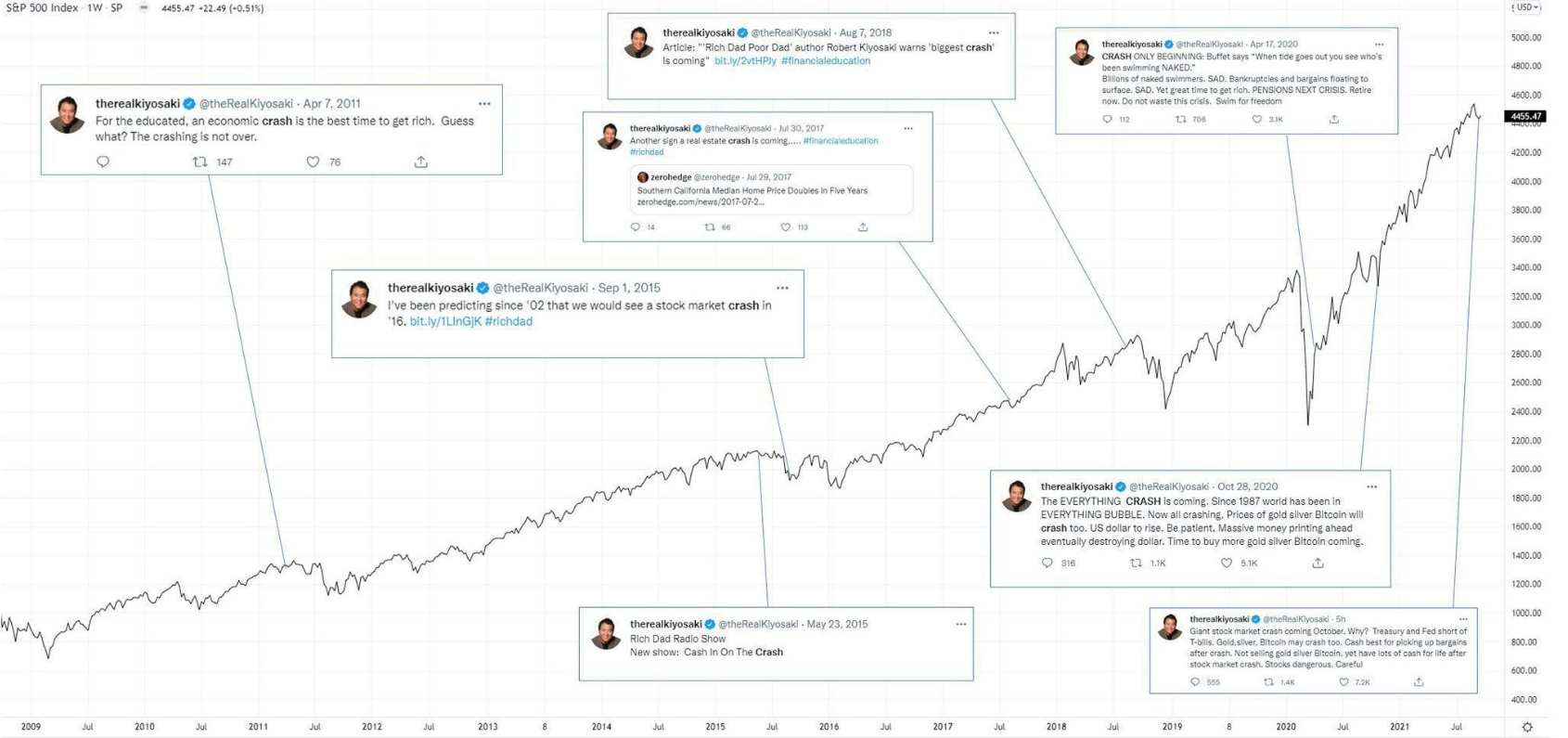

Zero Hedge constructed a cult following of permabears throughout one of many nice bull markets of all-time!

The funding workplace I labored for invested in a hedge fund that owned a bit of John Paulson’s fund that shorted subprime mortgages. Sadly it was a fund-of-funds so the allocation wasn’t massive sufficient to make up for losses elsewhere. There was some remorse that they didn’t go greater.

The recency bias kicked in large time so within the aftermath of the disaster they created a brand new fund to take a position completely within the subsequent Large Brief. Traders have been excited in regards to the alternative on the time, however they tried shorting Japanese authorities bonds and another esoteric trades that by no means labored.

Seems once-in-a-lifetime trades don’t come round that always. Who knew?

For sure, this fund was closed in brief order for the reason that monetary world doesn’t come aside on the seams each single 12 months.

By the top of the 2010s the contrarian mindset began to shift. The bull market had gone on lengthy sufficient to snuff out the entire crash calls. It died within the 2020s as first-level considering beat the pants off of second-level considering. Everybody got here to appreciate that making predictions is less complicated than earning money in terms of being a perma-contrarian.

I assume you possibly can say the brand new purchase the dip mentality is contrarian in some respects. However within the early-2010s everybody thought the market was going to rollover once more. Now everybody thinks it does nothing however go up. The large quick has morphed into the massive lengthy.

You might have individuals who made life-changing portfolio features, not from betting towards the herd however investing alongside of it. Why would you ever promote Nvidia, Bitcoin, Tesla, Fb, index funds, and so forth.? Every part that falls instantly goes again up. Don’t battle the pattern. Up and to the appropriate.

Permabears have mainly been rounded up and thrown in pundit jail.

Nobody listens to those individuals anymore as a result of they’ve been fallacious for 15 years straight. Any time these individuals spout off individuals dunk on them relentlessly with the entire situations the place they referred to as for a systemwide crash up to now and have been useless fallacious.

There’s additionally an enormous distinction between official contrarians and permabear charlatans who prey in your worst monetary fears.

We’re beginning to see some rumblings from some respected contrarians who’re fearful the present surroundings has gone too far.

Howard Marks wrote a brand new memo about AI, elevated valuations and why he’s fearful:

The existence of overvaluation can by no means be proved, and there’s no cause to assume the situations mentioned above suggest there’ll be a correction anytime quickly. However, taken collectively, they inform me the inventory market has moved from “elevated” to “worrisome.”

Burton Malkiel wrote an op-ed for the New York Occasions with a headline that reads:

Right here’s a passage:

Nobody can know for positive the place the inventory market will go subsequent. However there are worrisome indicators that investor optimism might have gotten out of hand. The latest exuberance of buyers raises the query of whether or not they’re making the identical errors they made up to now — errors that would show very expensive down the road. If historical past is repeating itself, what can we do to guard our monetary futures?

OK, positive. Folks have been saying we’re within the ninth inning since like 2017. What does this imply for buyers? What do you have to do?

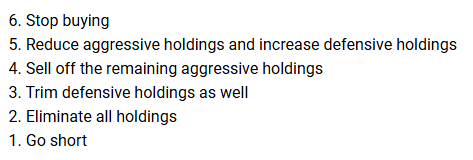

Marks affords up some choices for people who find themselves nervous:

And right here’s his prescription:

As a result of “overvaluation” isn’t synonymous with “positive to go down quickly,” it’s hardly ever sensible to go to these extremes. I do know I by no means have. However I’ve no drawback considering it’s time for INVESTCON 5. And for those who loosen up on issues that seem traditionally costly and swap into issues that seem safer, there could also be comparatively little to lose from the market persevering with to grind increased for some time . . . or anyway not sufficient to lose sleep over.

That appears cheap for people who find themselves fearful in regards to the potential for an AI bubble bursting.

Malkiel gave comparable recommendation:

Market timing can destroy a nicely thought out funding plan. Simply because the market is bipolar doesn’t imply you need to be too.

There are actions buyers ought to take. In case you are retired, and want cash quickly, it is best to make investments it in secure short-term bonds. Suppose you’re in your late 50s, and your retirement fund is nicely balanced, for instance, at 60 p.c shares and 40 p.c bonds. Test to see if the latest rise in inventory costs has elevated your fairness place, maybe to round 75 p.c. If that’s the case, promote sufficient inventory to get again to the popular 60/40 allocation appropriate to your age and threat tolerance. Periodic rebalancing is all the time smart and provides you the perfect probability to purchase low and promote excessive.

The onerous half about making an attempt to foretell overvalued markets is that nobody is aware of whether or not you’re in 1996 or 1999 while you’re in it. Everybody is aware of while you’re in a monetary disaster whereas it’s occurring. Bubbles are solely recognized with the advantage of hindsight.

I do not know what inning we’re in. There’s speculative habits and the AI spending binge is otherworldly. However individuals have been calling this market overvalued for nicely over a decade. The market can look irrational for lots longer than you assume.

Contrarians will make a comeback sooner or later.

The present surroundings can’t final perpetually.

However more often than not contrarians are fallacious.

The pattern is often your buddy…till it ends.

Michael and I talked about contrarians, overvalued markets and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Contrarians Are Normally Mistaken

Now right here’s what I’ve been studying recently:

Books: