There’s little doubt that business actual property could be risky when it comes to provide and demand, and few industries have needed to cope with these ups and downs like building corporations. Development financing is a useful technique for these corporations to resist that unpredictability and guarantee dependable development and suppleness, regardless of the market circumstances.

Development funding helps corporations preserve money movement steady and may also assist corporations increase, attain new markets, and in the end construct a profitable long-term enterprise. On this article, we’ll take a look at the ins and outs of this kind of financing, the potential advantages of a building mortgage, and the way it might assist your building enterprise survive and thrive.

Key takeaways

- Development financing offers versatile funding for tools, supplies, and operational prices.

- Down funds usually vary from 20-30%.

- Choices obtainable embrace traces of credit score and tools financing.

What’s building financing?

Development financing is a straightforward technique for building corporations to accumulate wanted funding. Some makes use of may embrace:

- Increasing contract labor

- Buying wanted permits

- Shopping for tools

- Constructing supplies

That is only a brief listing of how you might reap the benefits of building financing. Like some other sort of financing possibility, you’ll want to satisfy sure necessities to qualify for a building mortgage.

How does building financing work?

Let’s say your building enterprise has an enormous job developing subsequent yr. You’ve accomplished this kind of job earlier than, however this explicit mission is on a special scale. You want extra tools, and plenty of it. In that sort of scenario, you may strongly think about getting short-term financing for the brand new tools.

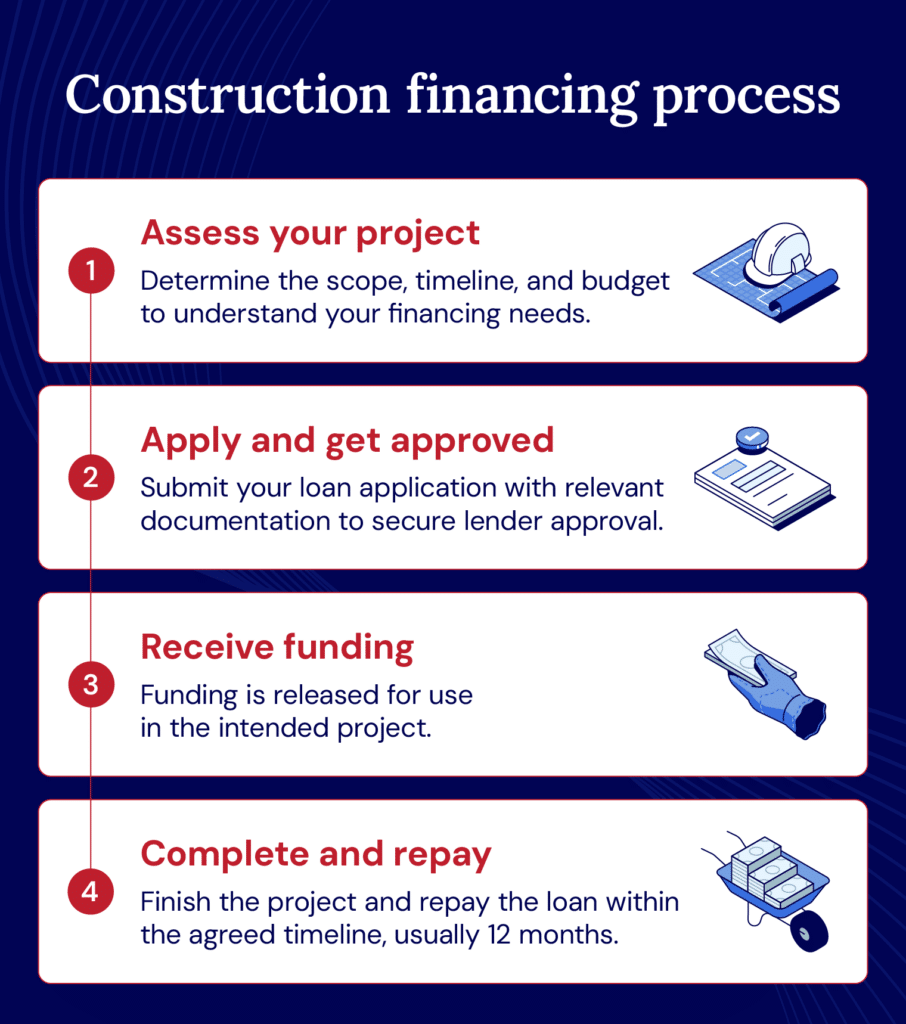

The subsequent piece is studying easy methods to get funding for a building firm, and that begins by merely getting accepted. As soon as your small business receives building financing, you’ll have till your time period is as much as end the constructing course of and repay the mortgage. The lender will need detailed details about the mission with the intention to assure funding.

To qualify, you’ll have to be a licensed and skilled building enterprise with an excellent credit score historical past and monetary monitor file. That is primarily as a result of banks view a majority of these loans as riskier due to the quantity of capital concerned and the potential for building tasks to go unfinished, leaving the financial institution with no collateral.

How do contractors qualify for building financing?

As we talked about, financing for building corporations requires the enterprise to offer detailed data. Some examples embrace:

- Constructive monetary file: Lenders tackle danger when providing building loans and different financing choices. Your credit score helps offset that. You’ll want a powerful credit score rating of at the least 680 and proof of sufficient earnings to justify the mortgage.

- Accomplished building plan: The lender will need detailed data on the plan earlier than it releases financing.

- Proof of licensing and expertise: Most lenders will solely cope with licensed contractors who’ve expertise making income and repaying loans.

Be sure you ask your lender about all the development financing necessities you’ll want to satisfy earlier than making use of. They could additionally have the ability to provide less complicated building financing course of alternate options.

Sorts of building financing for contractors

Contractors have a variety of choices on the subject of building financing. Some might make extra sense for your small business than others, so analysis to seek out one of the best mortgage possibility. Listed here are some frequent examples.

Money movement financing

That is often a short-term mortgage that gives fast funding with out collateral. Money movement financing could be utilized in pressing conditions, resembling the necessity to meet payroll. Due to the shortage of collateral, this financing possibility comes with larger rates of interest.

Enterprise line of credit score

A building line of credit score is like some other enterprise line of credit score. It affords flexibility because it lets you draw funds solely when wanted. The higher your credit score, the extra funds you’ll have entry to. This financing possibility is a revolving line of credit score, which suggests you’ll be able to repay the loans after which borrow once more. You’ll must pay curiosity on the capital you truly borrow.

Tools financing

Tools financing is a superb possibility for funding the acquisition of building tools, resembling equipment, autos, or different tangible property wanted for enterprise operations. It’s designed for use solely for this function, and often, the tools itself serves as collateral.

Discover building financing choices that fit your wants

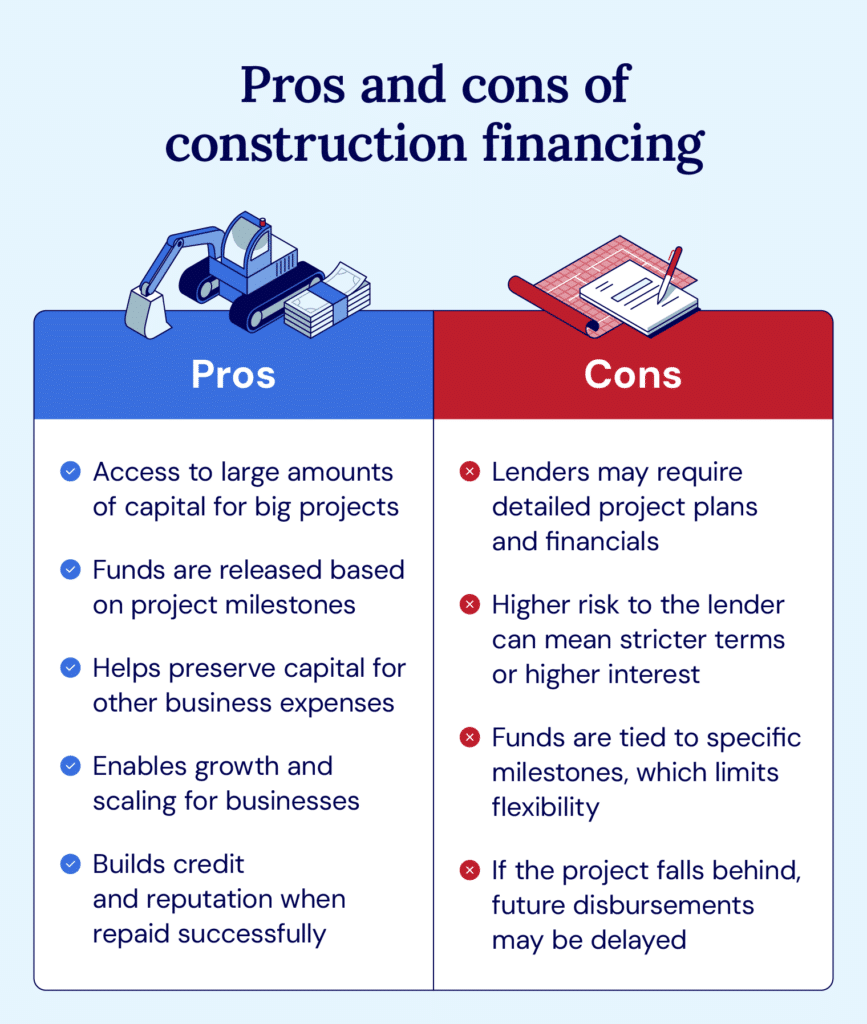

Contractors and building corporations are like some other enterprise that depends on money movement, ongoing revenue, and regular enterprise to develop and thrive. Development financing will help these companies take higher management of money movement administration, bridge a short-term hole, and construct for the longer term.

In the event you’re not fairly certain whether or not building financing is a match for your small business, Nationwide Enterprise Capital can information you thru the whole course of, from a fast starting session to finishing a financing utility. Be happy to attain out to us right now.

Often requested questions

Rates of interest for building financing range relying on elements such because the contractor’s creditworthiness, market circumstances, and mortgage sort. Typically, they vary from 4% to 12%.

For building financing, collateral usually contains the development mission itself or different actual property property. Lenders may think about tools, enterprise property, or private property of the enterprise proprietor.

Compensation phrases for building financing often vary from short-term (12-24 months) for smaller tasks to longer phrases for bigger tasks. Funds may cowl curiosity solely throughout building, with principal due upon completion.

Companies may use building financing to pay for land, building labor, constructing tools and supplies, and wanted permits.