Triveni Turbine Ltd – Augmenting Sustainable Development

Integrated in 1995 and headquartered in Noida, Triveni Turbine Ltd. is likely one of the largest producers of steam turbine merchandise in India and globally. The corporate’s core competency is within the space of business warmth & energy options and decentralized steam-based renewable generators as much as 100 MW dimension. It serves a number of industries comparable to Sugar, Distillery, Metal, Cement, Pulp & Paper, Meals Processing, Palm Oil, Chemical compounds, Petroleum Refineries and many others. With manufacturing amenities in Bengaluru, the corporate has put in 6,000+ steam generators over 20 industries throughout 80+ international locations.

Merchandise and Companies

The merchandise supplied by the corporate contains – 1. Condensing Steam Generators that discover software in biomass, waste to vitality, waste warmth restoration, geothermal, and many others. 2. Again Strain Steam Generators together with American Petroleum Institute (API) compliant steam generators catering to business segments comparable to sugar & distillery, meals processing, pulp & paper, textile, cement and metal, and many others. 3. Aftermarket providers to its personal fleet of generators in addition to generators and different rotating tools comparable to compressors, rotors, and many others. of different makers.

Subsidiaries: As of FY24, the corporate has 6 subsidiaries and 1 three way partnership.

Funding Rationale

- Increasing order e book – Throughout FY25, the corporate recorded its highest-ever annual order reserving of roughly Rs.2,300 crore, marking a 26% enhance over FY24. This progress was pushed by sturdy order finalizations throughout the renewable vitality sector, industrial purchasers, energy producers, and API clients, together with its entry into CO₂ vitality storage options. Key orders have been secured from areas together with the Center East, Europe, North America, Southeast Asia, and Africa, leading to a 23% YoY enhance in export bookings. Moreover, the worldwide enquiry pipeline expanded by round 30%, whereas home enquiries surged by practically 120%, providing strong visibility for future progress.

- New initiatives – The corporate is enjoying a pivotal position in advancing CO₂-based vitality options via cutting-edge applied sciences that enhance vitality effectivity, decrease greenhouse fuel emissions, and help India’s transfer towards sustainable vitality. It just lately secured a Rs.290 crore order from NTPC for the set up of a 160 MWh CO₂-based Vitality Storage System (ESS) on the NTPC’s Kudgi Tremendous Thermal Energy Plant in Karnataka, in partnership with its know-how collaborator, Vitality Dome. This modern battery know-how affords important benefits, together with a lifespan exceeding 25 years, no dependence on crucial minerals like lithium or cobalt, and minimal efficiency degradation over time. Additional increasing its sustainable product portfolio, the corporate has developed transcritical CO₂ warmth pump and chiller techniques, and is contributing to the worldwide vitality transition by growing each supercritical (sCO₂) and subcritical CO₂-based energy blocks. A prototype has already been manufactured and assembled on the firm’s facility, signaling the cusp of commercialization for this promising know-how.

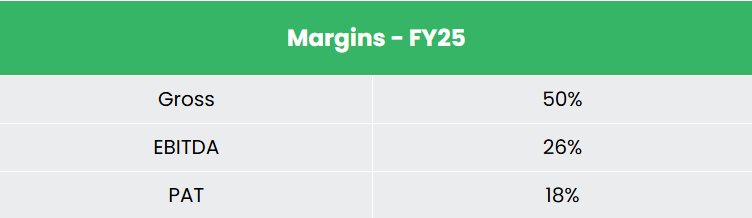

- Q4FY25 – Throughout the quarter, the corporate generated income of Rs.538 crore, a rise of 17% in comparison with the Rs.458 crore of Q4FY24. Working revenue elevated from Rs.107 crore of Q4FY24 to Rs.140 crore of Q4FY25, a progress of 31%. The corporate reported web revenue of Rs.95 crore, a rise by 25% YoY in comparison with Rs.76 crore of the corresponding interval of the earlier 12 months. Working revenue margin improved from 23% to 26% and web revenue margin improved from 17% to 18% throughout the interval.

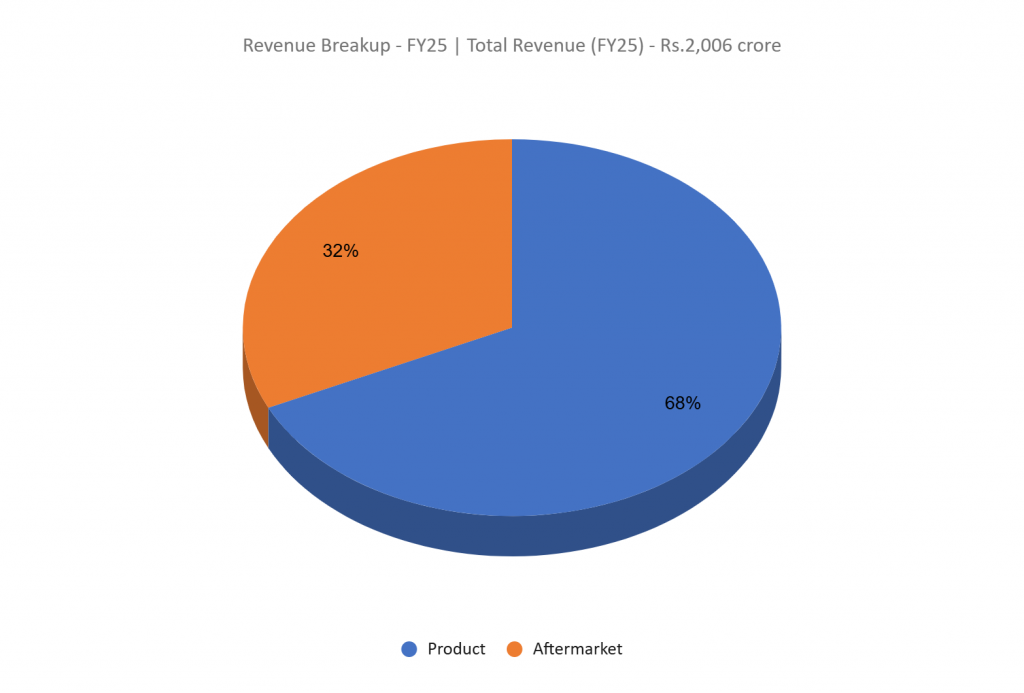

- FY25 – Throughout the FY, the corporate generated income of Rs.2,006 crore, a rise of 21% in comparison with the FY24 income. Working revenue is at Rs.518 crore, up by 36% YoY. The corporate reported web revenue of Rs.359 crore, a rise of 33% YoY.

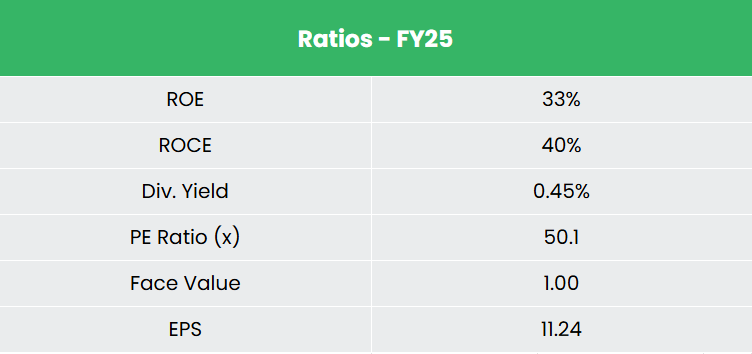

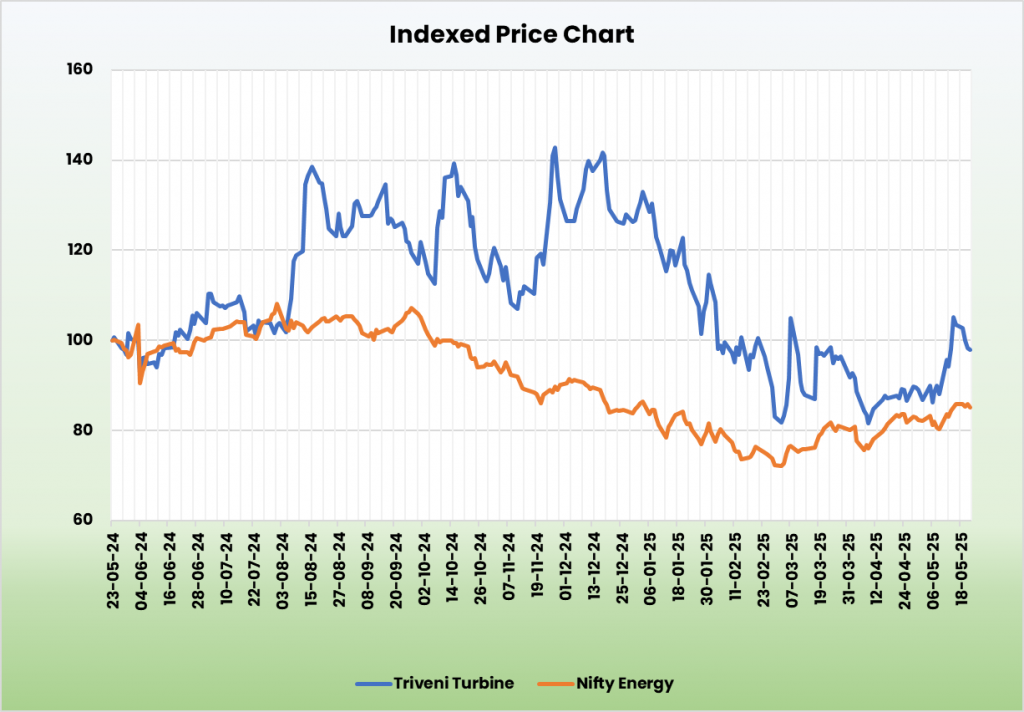

- Monetary Efficiency – The three-year income and web revenue CAGR stands at 33% and 46% respectively between FY23-25. The corporate has a strong capital construction with a debt-to-equity ratio of 0.03. Common 3-year ROE and ROCE is round 28% and 37% for FY23-25 interval.

Business

The engineering and capital items sector play a significant strategic position in India’s economic system as a consequence of its sturdy hyperlinks with the manufacturing and infrastructure industries. India holds a aggressive edge in manufacturing prices, technological capabilities, market experience, and innovation throughout a number of engineering sub-sectors. Engineering items exports are projected to achieve US$ 200 billion by 2030. Recognizing the crucial position of dependable energy provide in financial improvement, India is actively working to boost its energy infrastructure. Authorities-led initiatives geared toward increasing energy era capability are anticipated to drive elevated demand for electrical equipment. The Indian electrical tools market is anticipated to develop from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, reflecting a strong compound annual progress charge (CAGR) of 11.68%.

Development Drivers

- The federal government has de-licensed the engineering sector with 100% FDI permitted.

- The ‘Make in India’ initiative, together with the federal government’s emphasis on bettering the convenience of doing enterprise, is predicted to create quite a few alternatives within the engineering and capital items sectors within the coming years.

- Rising inhabitants together with growing electrification and per-capita utilization.

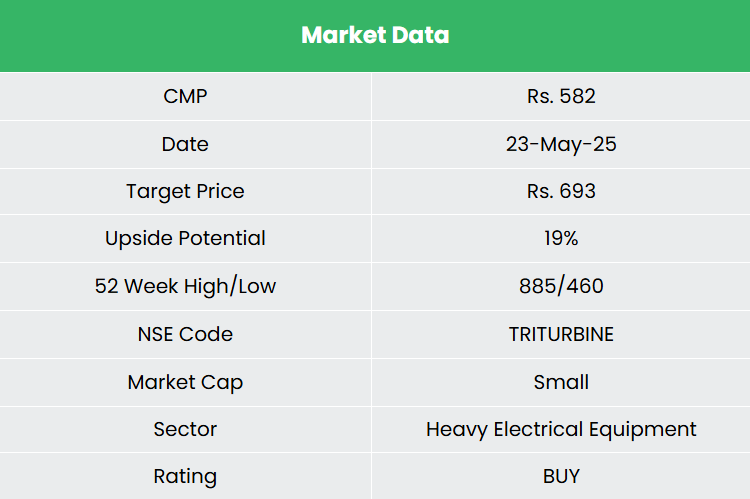

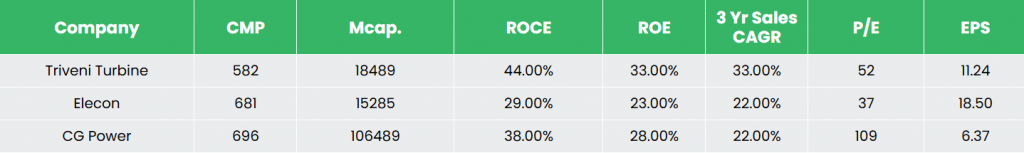

Peer Evaluation

Rivals: Elecon Engineering Firm Ltd, CG Energy & Industrial Options Ltd, and many others.

Among the many above rivals, the corporate stands out with regular income progress, superior return ratios, and powerful earnings potential, reflecting the corporate’s monetary stability and its capacity to effectively generate revenue and returns on invested capital.

Outlook

For FY26, the administration has outlined a capital expenditure plan of roughly Rs.165 crore. The product portfolio is predicted to develop considerably, supported by the corporate’s ongoing investments in analysis and improvement. As of March 31, 2024, the corporate had filed a complete of 374 world Mental Property Rights (IPR), with a good portion registered in India. Development in aftermarket providers and export gross sales is anticipated to contribute positively to margin enchancment. Deliberate investments additionally embody the growth of worldwide subsidiaries, additional R&D and testing enhancements, and the addition of a brand new manufacturing bay on the Sompura facility. A robust closing order e book supplies strong medium-term visibility, positioning the corporate for sustained progress.

Valuation

We imagine the corporate has strong progress potential given its give attention to bettering the product choices and geographical growth. We suggest a BUY ranking within the inventory with the goal value (TP) of Rs.693, 47x FY27E EPS.

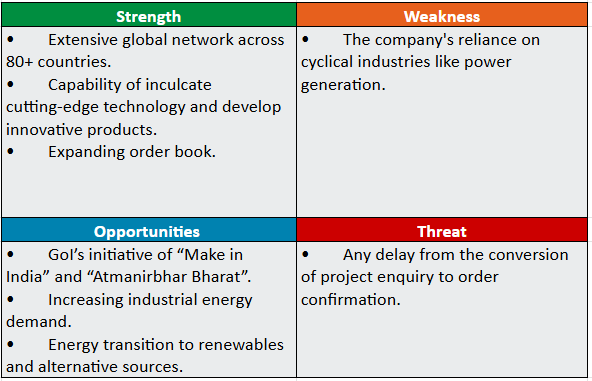

SWOT Evaluation

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles chances are you’ll like

Put up Views:

3,246