As a middle-aged man, I’m a sucker for the true property part in The Wall Road Journal.

That they had a narrative this previous week in regards to the sale of Paul Newman and Joanne Woodward’s Central Park residence in Manhattan. Good view if you may get it:

The place was listed for simply shy of $10 million however bought for 40% over asking at $14 million.

This a part of the story caught my finance eye:

“Should you had been nice with having a incredible one bed room, you had been by no means going to discover a higher one than this,” he stated. “What was loopy to us was how deep that market was.”

The irony, he stated, was that the week the showings came about, the climate in New York was horrible. “It was raining each single day, similar to monsoons,” he stated. “It was the worst time to ever launch one thing like this. It simply exhibits that none of it issues.”

Right here’s a realtor who sells homes to uber-rich folks in Manhattan and even he was shocked by what number of uber-rich folks there have been lining as much as purchase this residence.

That is an excessive instance however everybody has an financial anecdote lately about spending or prices being uncontrolled.

They paid how a lot for that home?!

$25 for beers at that live performance?!

Did you see their Instagram? They went on trip to the Amalfi Coast…once more?

It now prices how a lot for a brand new automobile?!

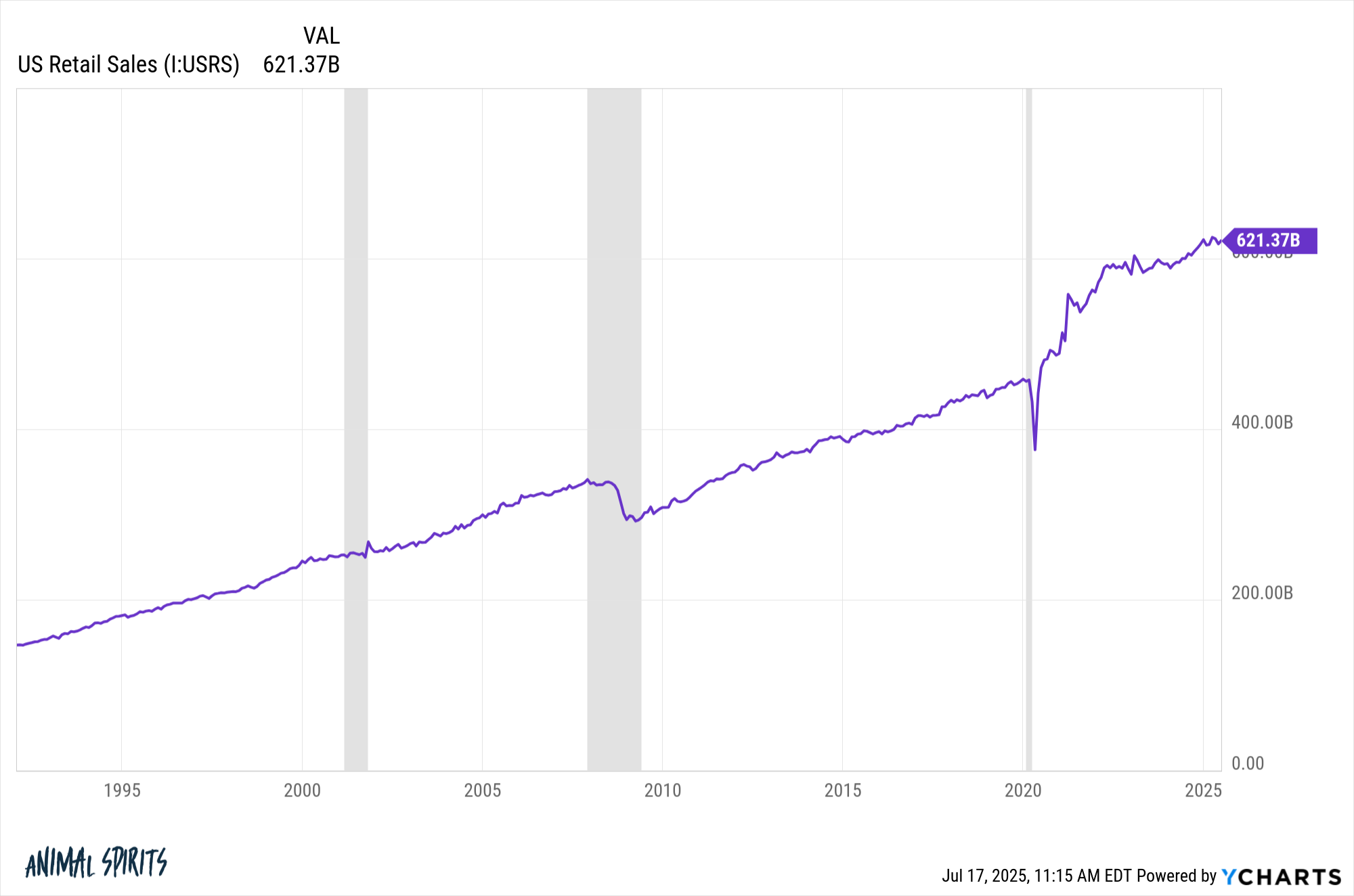

The price of the whole lot retains going up but shoppers hold consuming:

We hold listening to tales about how confused individuals are about cash however it doesn’t appear to matter. Individuals simply hold spending regardless of the whole lot.

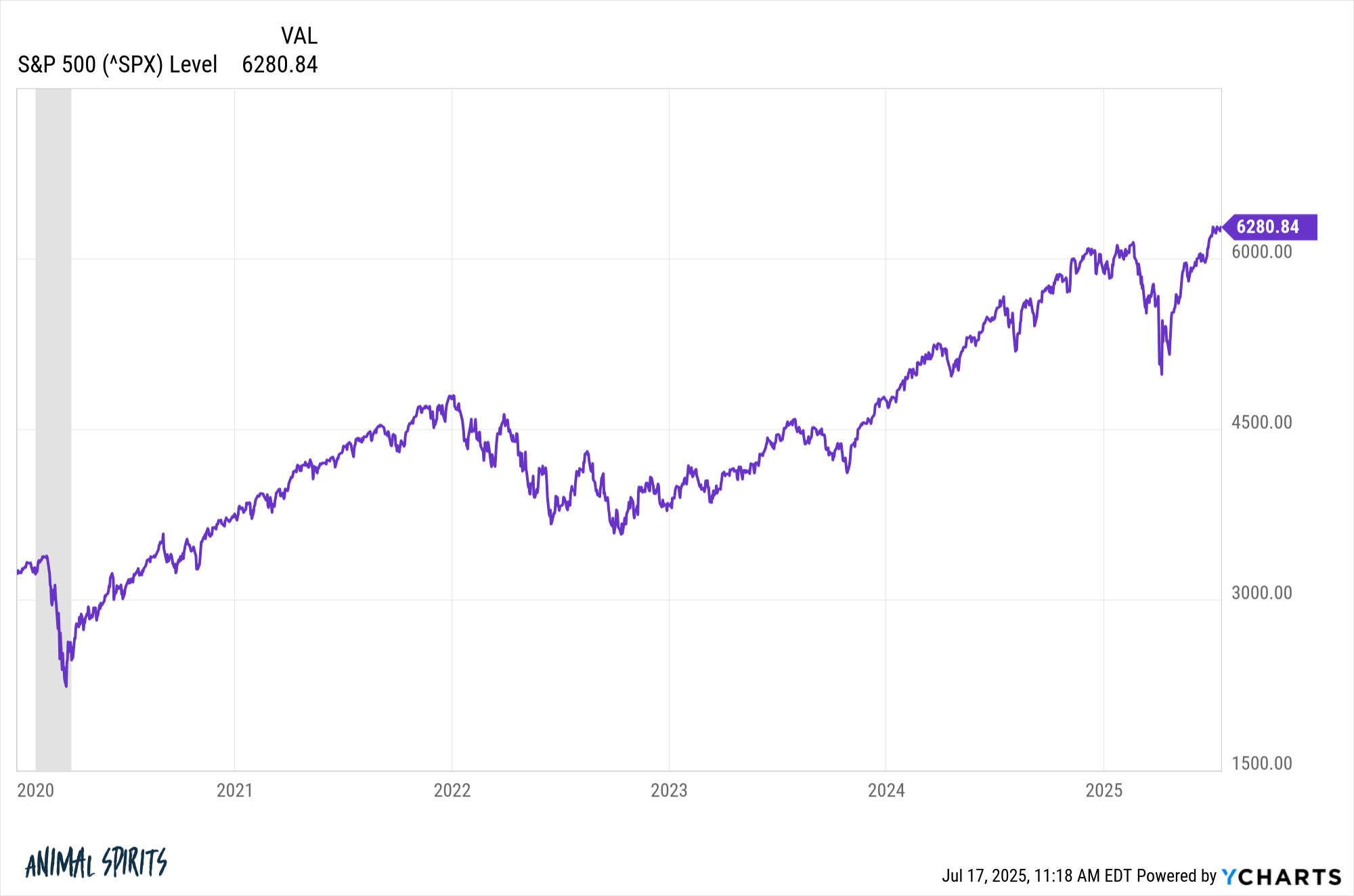

The inventory market is simply as resilient as the patron:

There have been loads of downturns this decade, however the market simply retains coming again with a vengeance.

The variety of insanely massive companies continues to develop as nicely.

Nvidia not too long ago hit a $4 trillion market cap. There are 8 different corporations in the USA with a trillion greenback valuation: Microsoft ($3.8 trillion), Apple ($3.1 trillion), Amazon ($2.4 trillion), Google ($2.2 trillion), Fb ($1.8 trillion), Broadcom ($1.4 trillion), Tesla ($1.0 trillion) and Berkshire Hathaway ($1.0 trillion).

The large ones hold getting greater.

Authorities debt isn’t slowing down anytime quickly both:

For my whole grownup life I’ve been instructed taxes have nowhere to go however up due to all the federal government spending and deficits. But tax charges simply hold taking place and we simply handed one other large tax lower.

So the large query is: What stops this prepare?

What causes wealthy folks to rein of their spending?

What causes shoppers to cease touring, consuming out and paying for Doordash?

What causes the inventory market to expertise a correction that lasts longer than a film preview?

What causes buyers to tug again on speculative conduct?

What causes the U.S. authorities to gradual its spending?

What causes the U.S. to expertise its first true recession in additional than 15 years?

That is going to sound like a cop-out Grand Rapids hedge reply however I truthfully don’t know. It may very well be a Black Swan occasion nobody sees coming. It may very well be an AI bubble that pops. Perhaps it’s a coverage mistake by the Fed or the White Home.

The most certainly reply is human nature will get us in some unspecified time in the future.

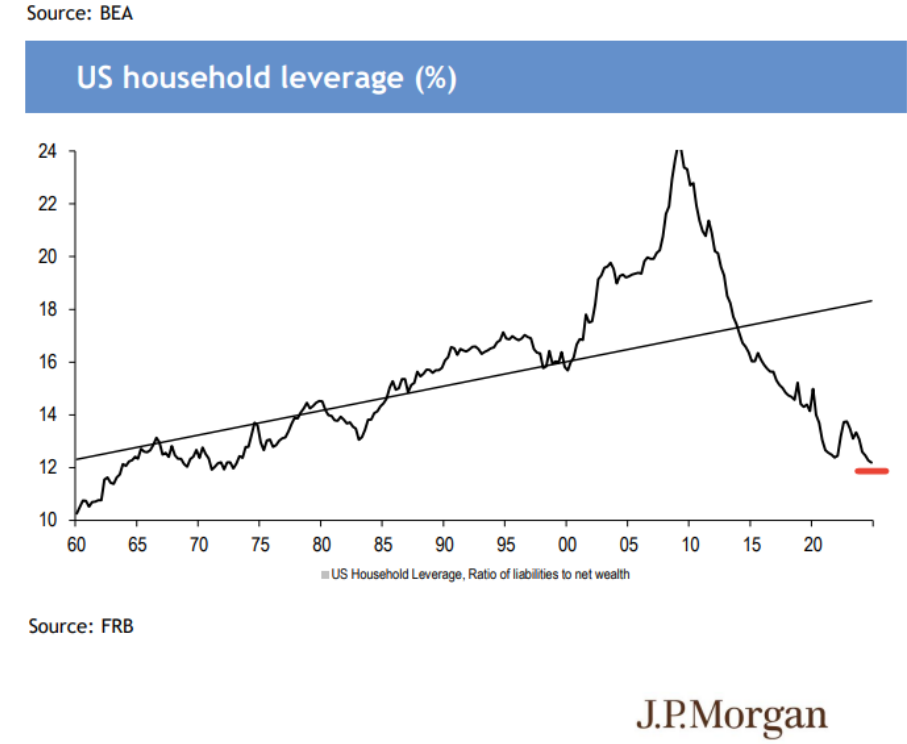

Excesses will construct as households and companies turn into increasingly more comfy making dangerous bets. Leverage will enhance. Folks will turn into complacent. An excessive amount of stability will result in instability.

Good luck guessing when that can occur.

I vividly keep in mind the market lastly reaching new all-time highs in 2013 for the primary time for the reason that Nice Monetary Disaster. A sure pundit was pounding the desk that This market REEKS of euphoria!

Ah nicely.

The one factor I do know is that cycles don’t final eternally. They at all times really feel like they are going to hold going when you’re in them however they by no means do.

The unusual factor is family stability sheets are in such fine condition that when an actual downturn lastly occurs there may be loads of dry powder accessible to lever up:

Sorry, even when contemplating the potential dangers that exist I’ve to look on the intense facet of issues.

Michael and I talked about an extreme quantity of wealthy folks, what stops this prepare and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

I Don’t Really feel Wealthy

Now right here’s what I’ve been studying this week:

Books: