f you’re making use of for an SBA 7(a), SBA 504, or Financial Harm Catastrophe Mortgage (EIDL) mortgage, you have to take out hazard insurance coverage on the property you supply as collateral, like actual property, gear, and automobiles.

On this article, you’ll be taught what hazard insurance coverage is, precisely what it covers, why the SBA wants you to have it, and the way to organize the fitting coverage to your SBA mortgage or line of credit score.

What’s hazard insurance coverage for an SBA mortgage?

Hazard insurance coverage is a kind of insurance coverage coverage you need to take out on property and property you present as collateral on an SBA mortgage or line of credit score. The coverage protects the worth of your property in case an occasion like hearth, vandalism, extreme climate, or an earthquake damages or destroys them.

Mortgage lenders and business landlords typically require tenants to take out the sort of protection, too.

Whenever you’re buying round for hazard insurance coverage, you’ll most likely see insurers consult with it as “business property insurance coverage,” which is the broader business time period that encompasses safety in opposition to varied threats together with hearth, theft, vandalism, and pure disasters that would injury or destroy your corporation property and gear. Use that time period once you converse with brokers or search on-line to search out the fitting kind of protection quicker, because it’s the usual terminology that insurance coverage professionals use and can enable you to entry extra complete coverage choices and aggressive quotes.

The SBA’s guidelines for small enterprise hazard insurance coverage

To be legitimate, hazard insurance coverage for SBA loans and contours of credit score should test the next containers:

- Substitute-cost restrict: The protection should be to the worth of what it could price to purchase every asset new at the moment, however, failing that, the utmost quantity insurers will go to.

- Ten-day cancellation clause: Your insurer should notify the lender at the very least ten days earlier than the quilt ends.

For enterprise actual property you pledge as an asset, your coverage should include a mortgagee clause. For private property, you’ll want its equal: a Lender’s Loss Payable clause.

These clauses defend your lender when you’re making use of for a 7(a) mortgage or the SBA or CDC (a nonprofit group that helps organize SBA loans) on a 504 mortgage.

In essence, they make sure that if one thing occurs to your property, cash can nonetheless be collected from the insurance coverage firm, even when you by chance did one thing that might usually cancel your protection.

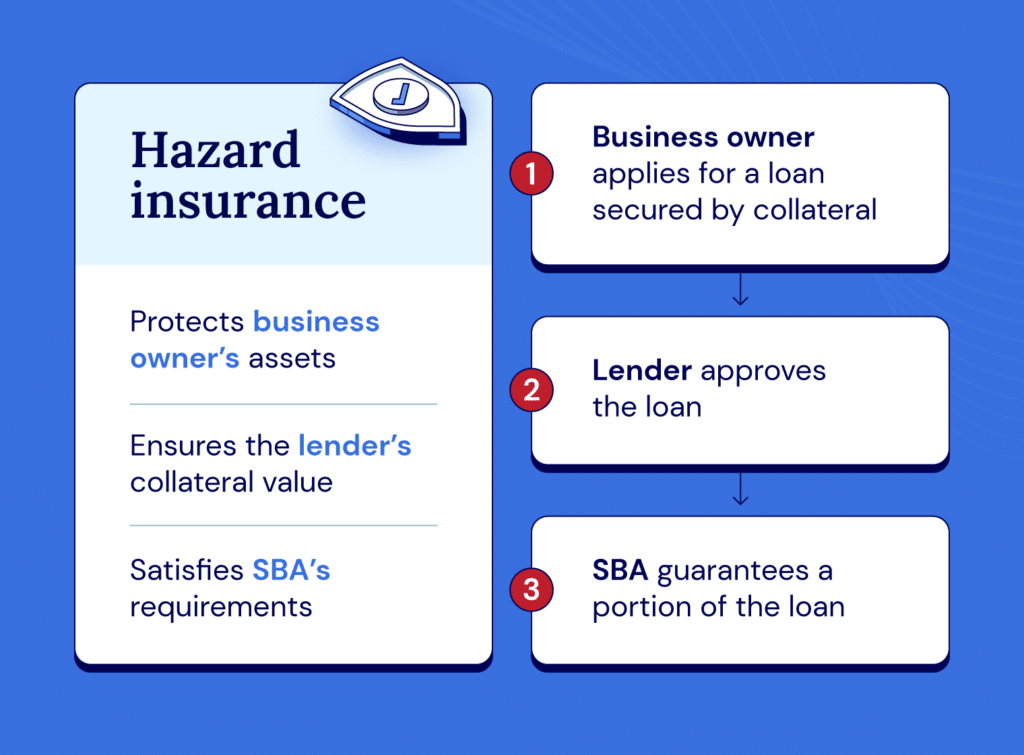

Why does the SBA require insurance coverage?

You want hazard insurance coverage on an SBA mortgage or line of credit score to financially defend the lender and the SBA when you default.

That is the way it works: Whenever you get an SBA mortgage or line of credit score, the funds come from banks or credit score unions that companion with the SBA, not the SBA itself.

If you happen to default, your lender sells your collateral to get better the loss. If the sale doesn’t cowl the steadiness, they arrive to you for the remainder, since you signed a private assure. If you happen to can’t pay, the lender then goes to the SBA to get better a part of the loss.

SBA mortgage hazard insurance coverage protects lenders and the SBA by preserving the worth of your property, even when they’re broken or destroyed. It additionally protects the borrower from owing greater than the asset’s price in these conditions.

What causes of injury does hazard insurance coverage cowl?

Hazard insurance coverage for small companies covers the next kinds of injury and loss, each inside and outdoors your premises:

- Hearth (and the smoke it generates)

- Explosions

- Lightning strikes

- Hail injury

- Wind injury

- Snowstorms and blizzards

- Theft

- Vandalism

- Harm from plane impacts and automobile collisions

- Water injury (together with fire-sprinkler leakage)

- Structural injury and constructing collapse

- Enterprise interruption or misplaced earnings throughout compelled closures

All the time test together with your insurer to substantiate precisely what your hazard coverage covers. Your lender will wish to examine your insurance coverage paperwork as a part of their customary due diligence course of.

When do you want hazard insurance coverage on an SBA mortgage?

The SBA’s hazard insurance coverage necessities differ relying on the kind of SBA mortgage or credit score line you’re making use of for.

SBA 7(a) and SBA 504 loans

All SBA 7(a) and SBA 504 loans require hazard insurance coverage that covers the complete worth of each single asset you pledge as safety in case your mortgage or line of credit score is $50,000 or extra. This new SBA degree changed the outdated breakpoint of $500,000 on Might 31, 2025.

If you happen to get your mortgage by the CDC and let your protection lapse, the CDC can take out insurance coverage for you and cost you for it.

Financial Harm Catastrophe Loans

That you must take out hazard cowl equal to at the very least 80% of the worth of loans higher than $25,000.

In case your mortgage is lower than $200,000, you don’t have to supply your major residence as collateral, supplied you could have different property price at the very least the mortgage quantity.

Microloans

You don’t want hazard insurance coverage for an SBA Microloan.

Flood zone overlay

You’ll additionally want flood insurance coverage to your SBA mortgage for every asset you supply as collateral in a FEMA-designated Particular Flood Hazard Space the place the Nationwide Flood Insurance coverage Program (NFIP) is out there. You don’t want flood insurance coverage for property exterior these flood zones.

The protection for every asset in a flood space should be the decrease of:

- The excellent principal steadiness in your mortgage

- The utmost protection allowed by NFIP

The utmost allowed by the NFIP is $250,000 for constructing protection and $100,000 for contents protection for residential properties housing as much as 4 households.

Your collateral is perhaps private property, like gear or automobiles. If you happen to saved them in a flood-prone constructing that you simply didn’t use as collateral, your lender won’t require flood insurance coverage. If they are saying you don’t want it, ask them to put in writing down why they made this determination – normally as a result of flood insurance coverage wasn’t obtainable or price an excessive amount of.

As with hazard insurance coverage, your flood insurance coverage coverage should embrace a ten-day cancellation clause. In case your flood protection lapses, you could have 45 days to type it out. If you happen to don’t, the lender or CDC will organize insurance coverage in your behalf and cost you for it.

Find out how to get hazard insurance coverage for SBA loans

Comply with these seven steps to get hazard insurance coverage to your SBA mortgage:

- Get your lender’s guidelines: Get in contact with the mortgage officer at your financial institution or CDC. Ask them for the precise wording of your mortgagee or Lender’s Loss Payable clause. Additionally, ask for the lender’s flood-zone dedication for each tackle you pledge as collateral. This may assist your dealer draft the insurance coverage coverage.

- Checklist each asset: Make an inventory of each constructing, automobile, machine, software, and extra that you simply’re pledging as collateral. Estimate the “buy-new” value for every. Watch out to not underestimate the alternative prices as a result of in case your protection restrict is simply too low, your insurer will solely pay as much as that restrict. You’ll then be personally liable for paying the distinction.

- Test the flood map: Utilizing FEMA’s map view, kind in every tackle and see whether or not it’s in zone A or V. Whether it is, then you definitely’ll have to take out a separate flood coverage on prime of your hazard insurance coverage.

- Store for canopy: Get in contact with an insurance coverage dealer and ask for business property insurance coverage with replacement-cost phrases. Hand over the lender’s wording on the clause, collectively together with your asset record. Ask your dealer so as to add flood cowl as essential on particular person property.

- Test the coverage: Be certain that the protection restrict equals the whole alternative worth prices, the wording matches your mortgagee or Lender’s Loss Payable clause, and there’s a ten-day cancellation notification requirement.

- Signal the settlement: If you happen to want one, test for the flood endorsement attachment, too. If you happen to’re completely satisfied, pay the premium, ask for the Certificates of Insurance coverage, and e-mail it to the lender or CDC.

- Renew yearly: All the time sustain together with your insurance coverage funds and ship your lender or CDC recent certificates yearly. If you wish to promote an asset that secures the mortgage afterward, you’ll want to barter that together with your lender or CDC so to organize an appropriate alternative or pay down the mortgage steadiness accordingly.

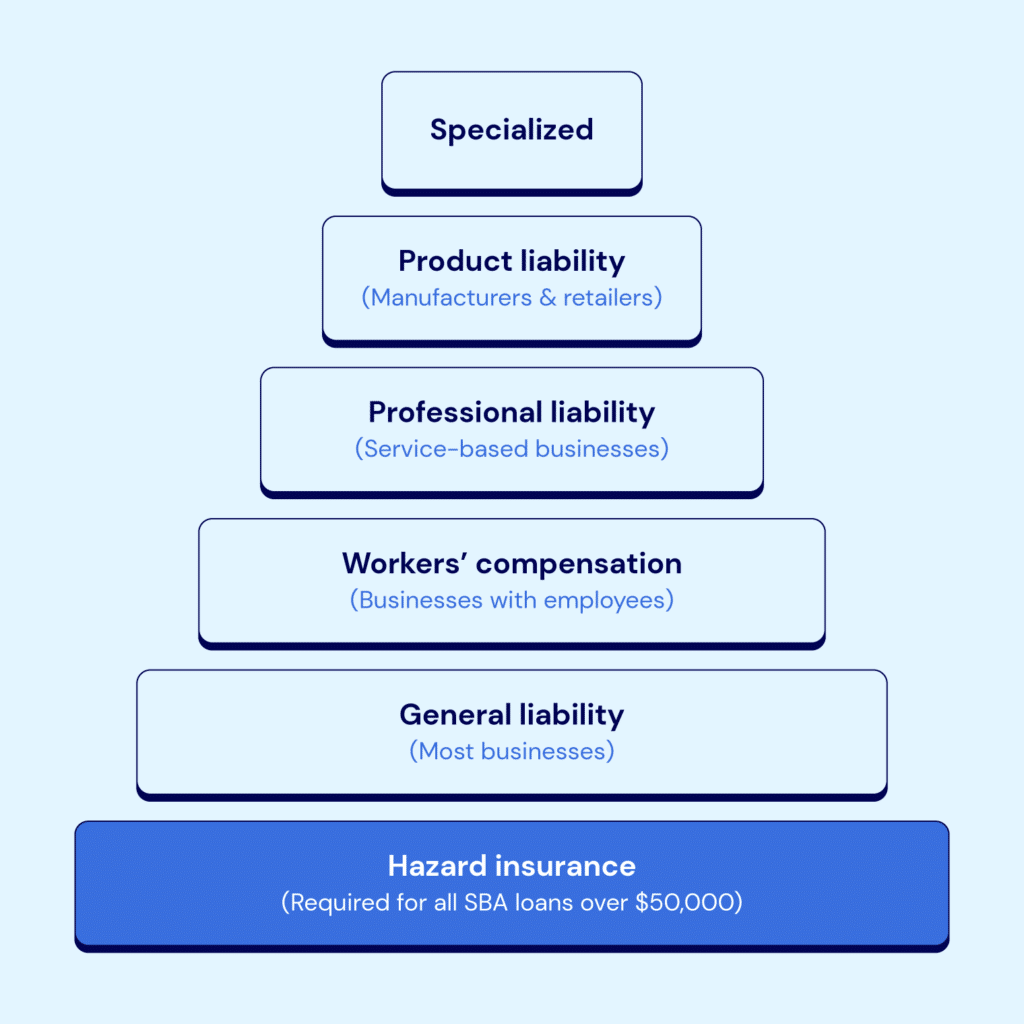

Different SBA insurance coverage necessities you have to find out about

Some states could require you to take out further insurance coverage protection to guard in opposition to pure hazards like earthquakes, hail, and wind. You might also want a number of of the next insurance policies:

- Normal legal responsibility: Protection if somebody claims you brought on them damage or broken their property.

- Skilled legal responsibility: Safety if somebody sues you for negligence, unhealthy recommendation, or misrepresentation.

- Product legal responsibility: Pays your authorized prices, compensation, and recall bills in case your product causes injury or private damage.

- Liquor legal responsibility/dram‐store: Protection for any damage or injury an intoxicated buyer causes after leaving your premises.

- Employees’ compensation: Funds medical payments, misplaced wages, and incapacity advantages.

- Life insurance coverage on key homeowners: Typical when a enterprise depends on one or two principals to run it profitably.

- Builders danger coverage: Protects supplies and work‑in‑progress on development or renovation tasks. You’ll want this when you’re getting an SBA mortgage to finance the development or vital renovation of a constructing.

- Tools floater: Covers cellular instruments and equipment that transfer between websites in case of theft or injury.

- Marine (vessel) insurance coverage: If you happen to pledge a ship as collateral, your coverage should embrace air pollution protection, breach of guarantee, indemnity, and safety.

SBA mortgage options

On common, there’s a 90-day turnaround on an SBA mortgage. Nationwide Enterprise Capital’s common turnaround time is 45 days, so that you get funded in half the time by working with our crew.

We are able to present different kinds of enterprise loans a lot quicker when you want the capital now. For instance, we will organize funding of as much as $250,000 inside a couple of hours when you make a digital utility to us and fasten your six most up-to-date financial institution statements. Funding of as much as $5M is feasible inside seven days.

If that’s you, contemplate one of many following enterprise financing choices:

Money movement financing

With money movement financing, the quantity you repay to your lender varies in keeping with your income. The extra you promote, the upper your compensation. In case your gross sales take a short lived dip, your repayments go down, making it simpler to handle your money movement.

Money movement financing is Nationwide Enterprise Capital’s most requested product due to its versatile cost phrases.

Purchasers put money movement financing to a variety of makes use of like opening pop-up areas to check new markets, taking stands at high-profile commerce exhibits to draw new sales-ready prospects, and paying for further uncooked supplies and employees extra time to ramp up manufacturing to fulfill rising demand.

Enterprise time period loans

Time period loans pay a lump sum into your corporation checking account up entrance. You then make common funds (weekly, bi-weekly, or month-to-month) over an agreed interval till you clear the steadiness.

The 2 fundamental kinds of enterprise time period loans are:

- Brief-term loans: Paid again over a interval of six months to 3 years, short-term loans are glorious for bridging gaps in money movement, benefiting from last-minute alternatives, and dealing with surprising payments with out having to faucet into your capital reserves.

- Lengthy-term loans: Paid again over a interval of three to 25 years, long-term loans are perfect for buying rivals or consolidating higher-cost debt into one manageable month-to-month cost.

Enterprise line of credit score

With a enterprise line of credit score, you may borrow as much as a predetermined most restrict, like with a bank card.

You solely pay curiosity on the steadiness, not on the restrict, which may make a line of credit score less expensive than an ordinary time period mortgage. Each time you make a compensation, your steadiness goes down and you’ll borrow what you’ve simply paid again once more immediately, so long as you don’t go over the utmost.

Traces of credit score typically supply a lot increased spending limits than bank cards. Most lenders anticipate you to clear the steadiness in full inside one to 3 years.

Enterprise homeowners use traces of credit score for a wide range of causes, together with paying for seasonal advertising and marketing campaigns, shopping for stock in bulk to safe a reduction, and hiring further employees so as to add capability throughout peak intervals.

Getting access to a reserve of capital helps companies keep agile and scale up.

Tools financing

Tools financing permits you to purchase or lease important equipment, instruments, and expertise with out depleting your capital. Which means you could have extra headroom to fulfill your day by day working bills.

There are two fundamental methods to fund new gear:

- Tools leases: Leases are perfect for gear that shortly turns into out of date and doesn’t retain its worth over time, like pc networks, software program techniques, and workplace expertise. You’ll be able to improve to newer gear on the finish of the lease and keep away from the effort of promoting outdated gear on the finish of the time period.

- Tools purchases: Buying works finest for gear that continues to be helpful and holds its worth over time, like heavy equipment, business automobiles, and production-line gear. You personal the asset outright on the finish of the time period, strengthening your steadiness sheet and including lasting worth to your corporation.

Select Nationwide Enterprise Capital for your corporation financing wants

SBA loans are well-liked with enterprise homeowners as a result of they provide aggressive rates of interest, and you’ll repay over a interval of as much as 25 years. Apply for an SBA mortgage by Nationwide Enterprise Capital and get funded in a median of 45 days in contrast with the business common of 90 days. Discover out extra about our SBA mortgage service for companies.Nationwide Enterprise Capital has funded over $2.5B for our purchasers, incomes us the title of market chief in $100,000 to $5M+ transactions. Communicate to one in every of our finance consultants at the moment, inform us about your organization and your plans for the longer term, and we’ll present you precisely how we may also help. Apply right here and let’s get you funded.

Regularly requested questions

Hazard insurance coverage prices between $60 and $80 per 30 days for the typical U.S. enterprise. What determines the precise price you pay is the worth of the constructing you use from, how a lot your gear is price, and the dangers related to your corporation location, similar to storms, theft, or vandalism.

Hazard insurance coverage helps companies defend their property within the case of an occasion like a hearth or different pure catastrophe. The insurance coverage will cowl the repairs and assist to protect the worth of the property that secures your mortgage.

You could insure all collateral you supply to your lender or CDC for its full alternative price. You additionally want to incorporate a mortgagee or lender’s loss payable clause in favor of the lender and take out a coverage that warns the lender at the very least ten days earlier than protection ends.